The Bear Market Wash-Cycle

Dear Bankless Nation,

The collapse of the Terra ecosystem left wakes of fear throughout the entire industry.

The rapid destruction of such a massive amount of capital will leave scars visible for a decade.

As we assess the damage from the fallout, investor appetite has already shifted away from high-growth plays and into risk-off positions.

We can see change both inside the crypto industry as people flee up the market-cap stack, as well as in traditional markets where bonds have become attractive once again.

The sharp market drawdowns have forced investors to reevaluate their financial positions, in order to conserve for the bear. Investments that once were promising growth opportunities have turned into liabilities, as the foundations of the market have shifted from pricing in growth to pricing in fundamentals.

Until the beatings from the Fed rate hikes end, the markets will continue to rotate into conservative long-term positions.

Welcome, Bankless Nation, to the phase of the market where fundamentals matter.

ETH vs BTC

Ethereum has made strong improvements to its fundamentals during this last bull market.

ETH captured $4.7b of transaction fee revenue since August 5th, when EIP1559 went live. EIP1559 is a mechanism that captures bull market excess, and stores it in ETH for a rainy day when blockspace revenue drops.

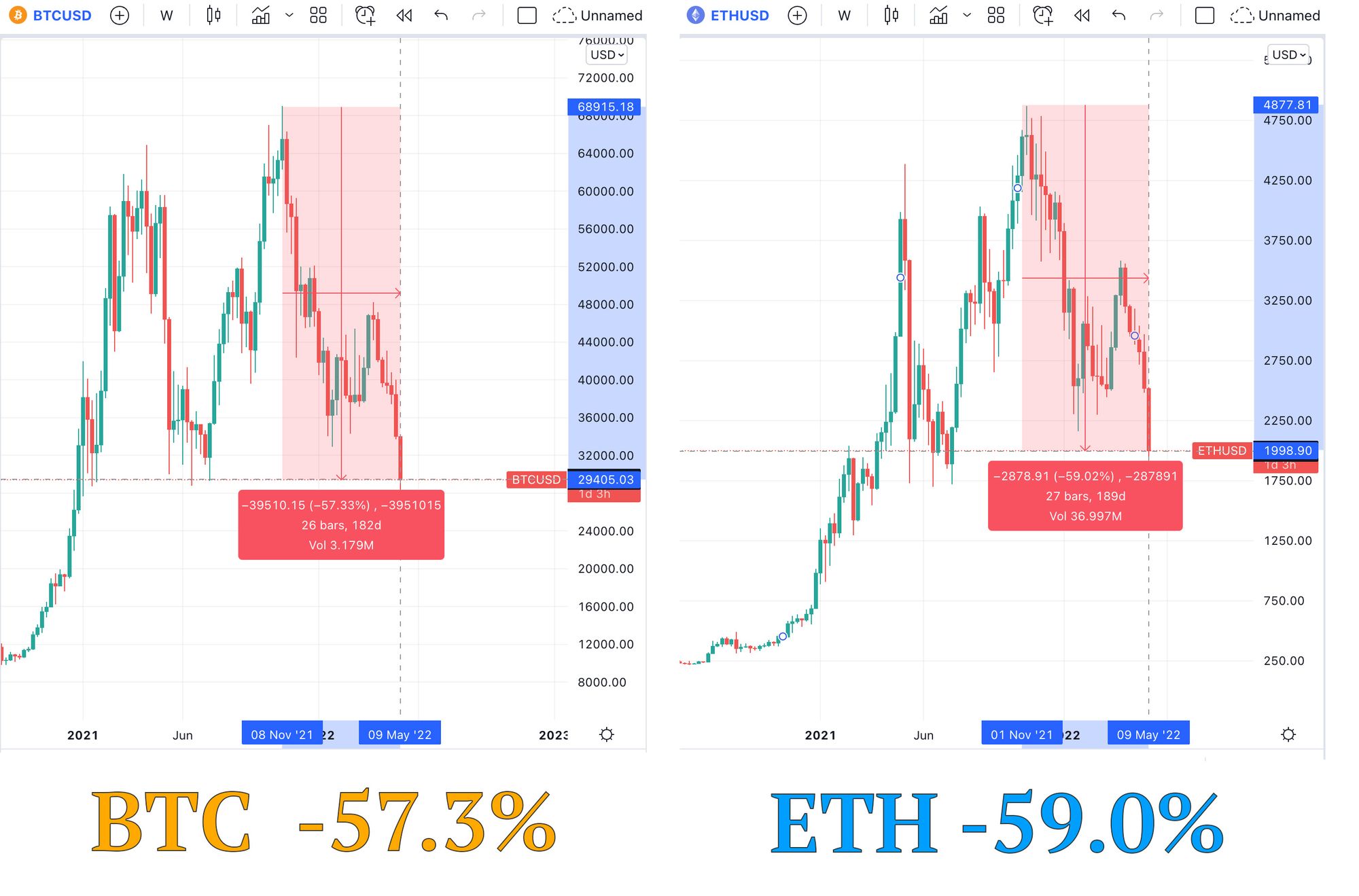

During the 2018-2020 bear, BTC fell 85% while Ethereum fell 95%.

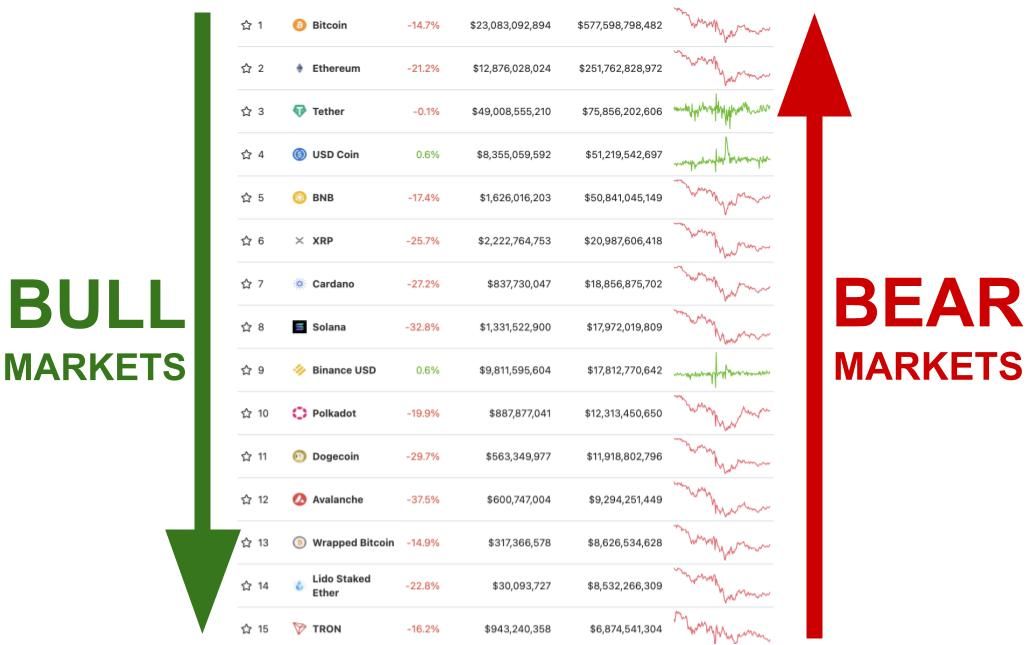

This cycle, they're down about the same amount:

ETH’s improved performance vs. BTC is likely due to Ethereum’s improved fundamentals.

Fundamentals matter.

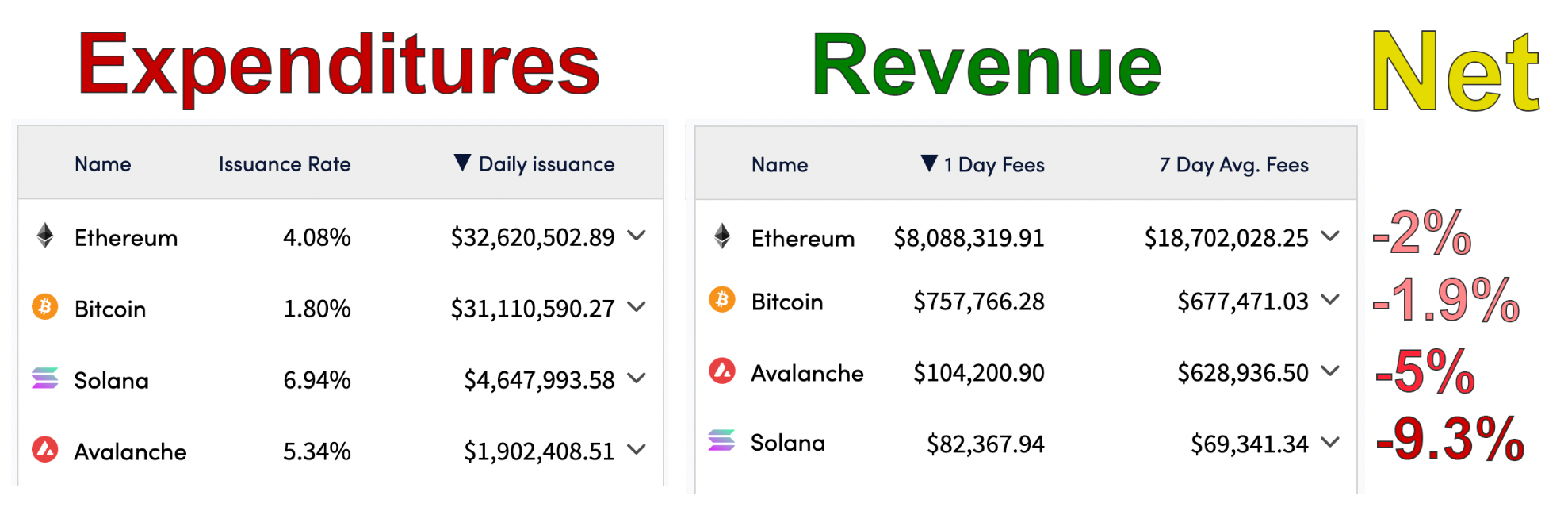

Meanwhile, the high-issuance, low-revenue Alt L1s are down bad:

It’s expected for newer L1s to get hit harder going into their first bear; ETH and BTC have gone through bear markets before and have built up years of investor resiliency.

However, this particular cohort of L1s have two things that previous bear market survivors did not: an overabundance of blockspace supply, leading to an overinflation of the L1 asset, as well as investor supply unlocks.

These Alt L1s will have to carry the burden of high issuance and investor unlocks throughout the duration of the bear market. For those that adapt and make it through to the other side of the bear market wash-cycle: I will actually be bullish on.

Security vs Scale

The market rotation from risk-on to risk-off can be reframed as ‘prioritizing scale’ to ‘prioritizing security’. Similar structural patterns are at play here.

The things that are working are based on security.

The things that are breaking are based on scale.

One type of investment does well in bull markets (those that can scale to meet demand), and the other do well in bear markets (those that have built a foundation of sustainable economics).

DAI vs UST

Terra collapsed because of an overabundance of UST. Unsustainable subsidized growth in Anchor and undiscretionary UST minting produced an unsurmountable liability when the music stopped playing.

Turns out, there wasn’t enough value stored in LUNA to foot the bill.

MakerDAO’s strategy is the antithesis of the Terra design. Terra’s strategy was to flood the market to subsidize adoption. In contrast, DAI supply is designed to lag the market demand.

New DAI only gets minted when the market is producing long-term sustainable demand for the stablecoin. This prevents DAI overproduction and saves MKR from having to bear the burden of unnecessary DAI supply. As a result, MakerDAO is an efficient, revenue-to-risk maximizing credit machine.

Terra prioritized growth over security… and toppled over.

MakerDAO prioritizes security over growth, and has the strongest decentralized stablecoin foundation out there.

Ethereum vs. Solana

The same tradeoff between scalability and security is also found in Ethereum vs. Solana.

Solana floods the market with blockspace supply, creating instability in the blockchain itself. Without fees, Solana becomes susceptible to spam attacks, and must resort to censorship to prevent chain halts.

Solana blockspace supply inherently exceeds demand. That’s its business model. As a result, its foundation frequently becomes too unstable to support the supply of activity occurring on top of it.

Is it really scalable if it’s off?

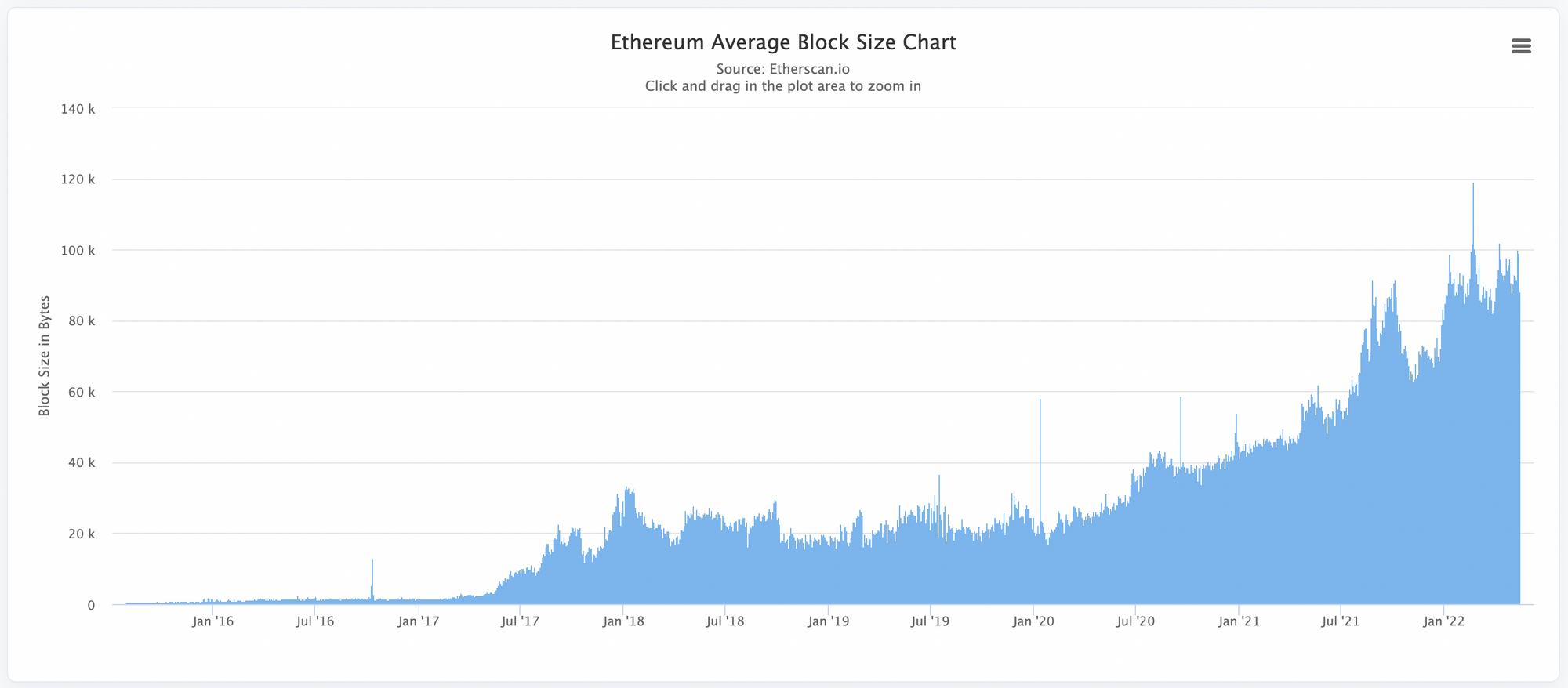

In contrast, Ethereum blockspace supply lags the market. The Ethereum L1 scales very slowly, from 5m gas blocks in 2015 to 15m gas blocks in 2022.

Constraining L1 blockspace creates economic opportunities for L2s to capture this demand. L2s cannot destabilize the Ethereum L1, and they’re able to amplify the efficiency of the blockspace by orders of magnitude.

Unsustainable Designs

These are the Alt L1s design patterns, and they don’t fare well during bear markets. Alt L1s oversupply the market with cheap product, in order to undercut competition and drive growth. But when the market sees outflows of users and capital, that cheap product turns from being an asset to a liability.

Selling your product for $0 isn’t competitive anymore. It’s crazy that it ever was.

You Too, DAOs

DAOs, this is a conversation for you too.

DAOs need to realize that the “free million dollar treasuries” of the bull market is not a sustainable paradigm.

The bottom line matters, and needs to be considered for DAOs to make it through crypto winter. In order to do this, DAOs need to abandon this rejection of structure & hierarchy.

The name DAO has done a disservice to the industry. It doesn’t accurately describe what these organizations are. What you think of DAOs are actually DOs: Digital Organizations.

And with DOs, fundamentals matter. Structure and processes needs to be created. Resources need to be expended wisely.

You can see Gitcoin leaning into this new culture of leadership and structural conservatism.

DAOs need to take a good honest look at their treasury, PnLs, and org charts and see if there’s anything not making sense.

Fundamental Opportunities

The next cycle of adoption will be more risk-averse than previous cycles. This is normal; the biggest risk-takers already arrived at crypto before there were any real fundamentals.

Every new cycle produces new fundamentals and stronger reasons why crypto is a rational investment, slowly winning over investors with increasingly higher standards.

Before the next ‘fundamentals don’t matter’ mania can happen, we’ll need to build through a market cycle in which fundamentals do matter.

This is the next opportunity cycle in crypto: can you identify underpriced fundamentals that have high potential during the next growing season?

This is why I’m bullish on L2s fundamentals.

- L2 chains don’t have to pay for security, making them economically sound right out of the box.

- L2s produce fundamental answers to Ethereum’s scaling problems while producing cheap-fee surface area for entrepreneurs and builders.

- L2s can be measured with tried-and-true DCF valuation models, providing assurances to the investors looking for real fundamentals to base an investment upon.

If you haven’t found a job in crypto yet… look to the L2s and their apps.

The Golden Age of Building

There’s a golden age of building ahead of us. With the noise of the bull market gone, the builders can finally concentrate and get back to what’s real and sustainable in the long-term.

Bull market fuel is built during bear markets.

During 2018, DeFi came alive. MakerDAO, Uniswap, Compound, Aave, Synthetix, OpenSea — these were developed when Ethereum’s customer base felt like just a few thousand people.

This bear market, we have millions of users and a new paradigm of cheap fees with direct bridges to the core heat of the Ethereum economy.

There is so much left to build; our work is cut out for us.

What is built over the next two years will become the fundamentals that produce the next bull run.

Make sure you stick around and watch what gets built, so you can have the information asymmetry when the time comes.

So you can have the alpha.

Happy bear market, fam

- David

Action Steps

- 🤑 Execute any good market opportunities that you saw

- 🔉 Listen to Should We Be Scared? with Raoul Pal