ZKsync is one of the most promising Ethereum rollups. Its structure is so compelling that most Ethereum scaling solutions may generally resemble it within a decade. In this guide, we'll explore the basics of ZKsync Era, how it supports ZK Chains, and top projects to try in the ZKsync ecosystem today.

Key takeaways

- ZKsync is a Layer 2 (L2) scaling solution developed by Matter Labs, a blockchain technology company founded in 2018.

- The L2 was created to address the scalability issues of the Ethereum network by providing a cheaper and faster hub for Ethereum transactions. Currently, the average transaction fee on ZKsync is around ~$0.02 compared to $3.66 on Ethereum, making the L2 over 99% more affordable.

What is ZKsync?

Matter Labs released ZKsync 1.0 as a zero-knowledge rollup (zk-rollup) in June 2020.

In October 2022, Matter Labs next launched the alpha version of ZKsync 2.0, a new distinct zkEVM chain, which is a zk-rollup compatible with the Ethereum Virtual Machine (EVM).

Then in February 2023, Matter Labs renamed ZKsync 2.0 to “ZKsync Era,” rebranding ZKsync 1.0 to “ZKsync Lite” in the process. The following month, the team launched the ZKsync Era mainnet to the public.

Now, the Era and Lite chains exist in tandem alongside each other, though as far as users and developers are concerned, the more advanced ZKsync Era is the main network and represents the future of the ZKsync ecosystem.

How does ZKsync work?

The tech underpinning both ZKsync chains is based on zero-knowledge proofs (ZKPs), a cryptographic technique that enables transactions to be verified with extreme efficiency.

In other words, ZKsync’s networks serve as external execution environments that use ZKPs to validate and post transaction batches on Ethereum.

Both ZKsync Era and ZKsync Lite combine offchain execution and onchain data like this, but Lite is designed only to facilitate simple transfers and swaps while Era is fully compatible with the EVM and its advanced smart contract possibilities.

Why ZKsync?

ZKsync Era is designed to offer Ethereum-like UX for developers and users with the major additional benefits of near-instant transactions and extremely low transaction fees.

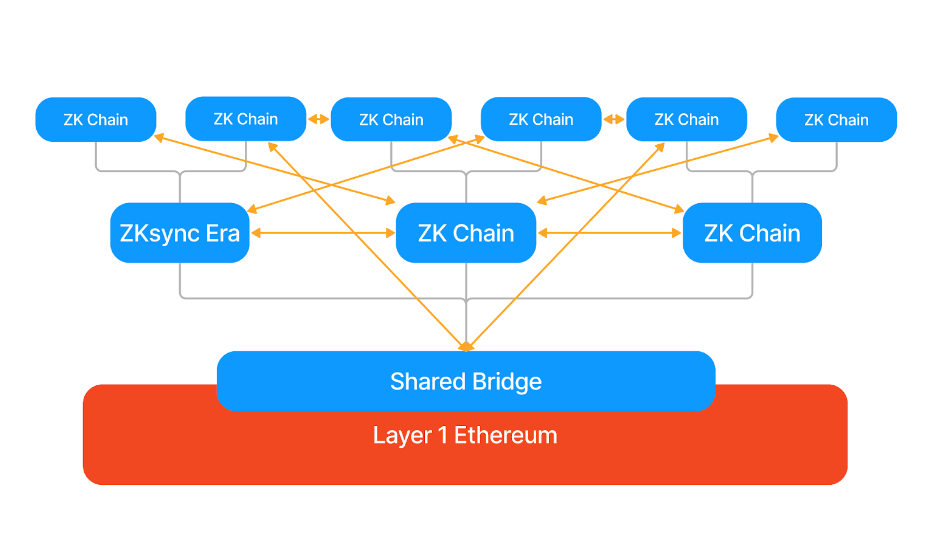

Additionally, ZKsync Era serves as the base of the ZK Stack, a modular framework that projects can use to launch their own custom ZK Chains.

Simply put, these ZK Chains are parallel zkEVM offshoots that can connect through what are known as Hyperbridges for seamless cross-chain interactions among ZK Stack networks.

Notably, ZKsync Era is also set to evolve further over time. For example, in the future the L2 will be extended by zkPorter, a novel “volition” system that can facilitate up to ~20,000 transactions per second (TPS) and will offer users the ability to switch between zk-rollup and validium modes depending on their transaction needs.

How to invest in ZKsync?

The primary way to invest in ZKsync is $ZK, the native token of the L2 that the Matter Labs team introduced in June 2024 as the key to ZKsync’s governance decentralization process.

The token isn’t live yet, but ZKsync users can check their eligibility on Bankless Claimables and claim their tokens starting June 17, 2024, through January 3, 2025.

Thanks to ZKsync’s account abstraction, airdrop recipients can claim their $ZK tokens on ZKsync Era without paying transaction fees. Post-claim, $ZK holders can delegate for governance participation or trade freely.

Once $ZK is live, it will trade on centralized crypto exchanges like Coinbase or Kraken and on decentralized exchanges (DEXes) like Uniswap. If you go the DEX route for investing, you will need a wallet compatible with ZKsync like MetaMask or Rainbow for buying and managing your tokens.

Top ZKsync projects

The ZKsync Era app ecosystem has over 100 apps and counting. Some of the top projects to try here currently include:

1. SyncSwap (the largest DEX on ZKsync per total value locked)

2. Koi Finance (a DeFi liquidity hub with bonds and yield farming)

3. ZeroLend (a leading borrowing and lending protocol on ZKsync)

4. zkMarkets (an NFT marketplace on ZKsync)

5. Libera (a crypto gaming hub built on ZKsync)

More about ZKsync

👉 Bankless ZKsync Profile

👉 All the Details on ZKsync’s ZK Token Airdrop