Stablecoins have emerged as a significant asset class due to their ability to counterbalance the notorious volatility associated with cryptocurrencies like Bitcoin and Ethereum. A prime example of this is USDC, a digital stablecoin that has been engineered to provide a constant value in the unpredictable landscape of decentralized finance.

What is USDC?

USDC, short for USD Coin, is a fully collateralized stablecoin pegged to the US dollar on a 1:1 ratio. This means that for every USDC token in circulation, there is a corresponding US dollar held in reserve, ensuring that 1 USDC always equals 1 US dollar.

How USDC works

USDC, created by Circle and Coinbase, maintains its peg to the dollar through a system where each token is backed by a corresponding dollar in a reserve bank account. The issuance, built on Ethereum's ERC-20 standard, is governed by the Centre Consortium, which ensures the stability and transparency of the token. Accordingly, while popular, it’s important to note that USDC is firmly on the “centralized” end of the contemporary stablecoin spectrum.

History of USDC

USDC was launched in September 2018 as a joint venture between cryptocurrency firms Coinbase and Circle, under the Centre Consortium entity.

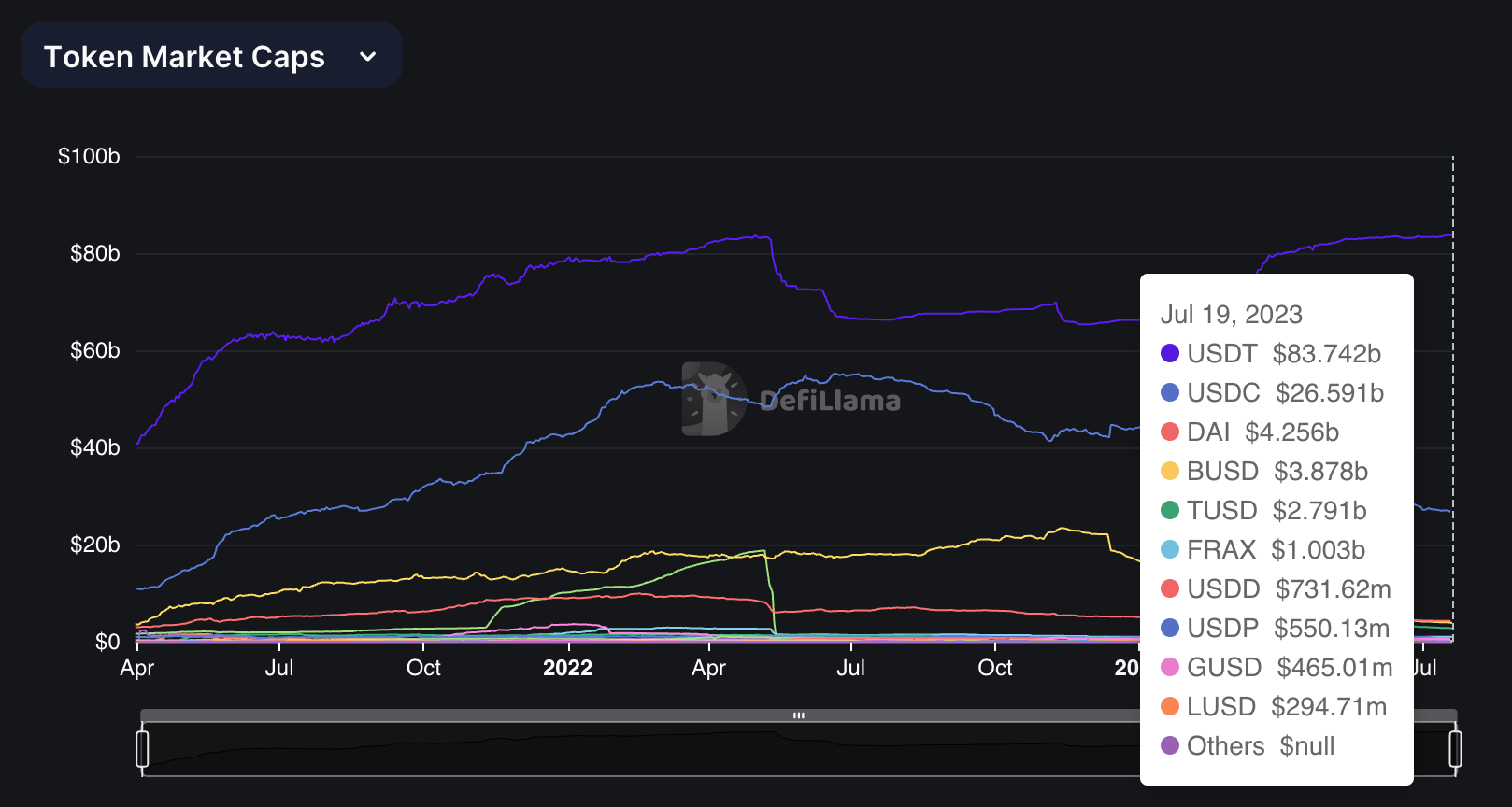

The goal was, and continues to be, to provide a reliable and transparent stablecoin that can be used within the burgeoning DeFi ecosystem. Since its launch, USDC has grown to become the second-largest stablecoin in the market, trailing only behind Tether (USDT) in terms of market capitalization today.

How to acquire USDC

USDC can be bought on numerous cryptocurrency exchanges, such as Coinbase, Binance, or Kraken, using other cryptocurrencies or fiat money. It's also available on decentralized exchanges like Uniswap and Curve. Moreover, you can directly mint USDC on the Circle platform by depositing equivalent US dollars.

How to use USDC

Similar to other currencies, USDC serves as a store of value and a medium of exchange. You can use it to purchase goods and services, or you can deploy it in the DeFi ecosystem, where the token is frequently used for lending, borrowing, and yield farming. USDC is also a relatively common choice for listing or bidding on NFTs on platforms like OpenSea.

Risks of USDC

While USDC offers many advantages, it's not devoid of risks. Namely, users should be aware of the centralized nature of USDC, which could be subject to regulatory oversight. Additionally, there is also counterparty risk with USDC, for example if the banks that hold the underlying dollar reserves go under.

Additional USDC resources

If you want to learn more about the USDC stablecoin, here are some helpful resources that can help you go deeper:

Zooming out

As one of the top stablecoins in the crypto market, USDC has cemented its position within the DeFi space across multiple blockchain networks.

With the exception of a recent temporary depeg event as a result of having $3.3B in deposits stuck at Silicon Valley Bank, USDC has consistently maintained its peg to the US dollar, demonstrating its general resilience amid fluctuating market conditions.

As a result, USDC has become an example of the potential of stablecoins in the wider context of decentralized finance and the ongoing debate over central bank digital currencies (CBDCs).