Uniswap is a decentralized exchange (DEX) built on the Ethereum blockchain that allows users to trade a wide range of cryptocurrencies directly from their wallets without relying on a centralized entity.

As an automated market maker (AMM), Uniswap uses liquidity pools instead of order books, providing a seamless and efficient trading experience.

This innovative design has made Uniswap one of the most popular and widely-used decentralized exchanges in the crypto space.

History of Uniswap

Uniswap was created by Hayden Adams in 2018 as a response to the limitations and inefficiencies of traditional order book-based exchanges.

Inspired by an Ethereum Research post by Vitalik Buterin, Adams developed Uniswap to leverage liquidity pools and eliminate the need for order books.

The DeFi platform's success since has attracted significant attention and evolved further upon the release of Uniswap V2 in May 2020 and Uniswap V3 in May 2021, the latter of which introduced NFT-based liquidity provider (LP) positions for more sophisticated yield possibilities.

In June 2023, the Uniswap team introduced its V4 system, which will allow for extensive customization of liquidity pools, and then in July 2023 it unveiled UniswapX, a new liquidity routing protocol.

The pulse of Uniswap

According to Coingecko, there are currently over 910 cryptocurrencies and over 1750 trading pairs supported by Uniswap V3 alone. These numbers continue to steadily grow over time, considering how the creation of liquidity pools on Uniswap is a permissionless process.

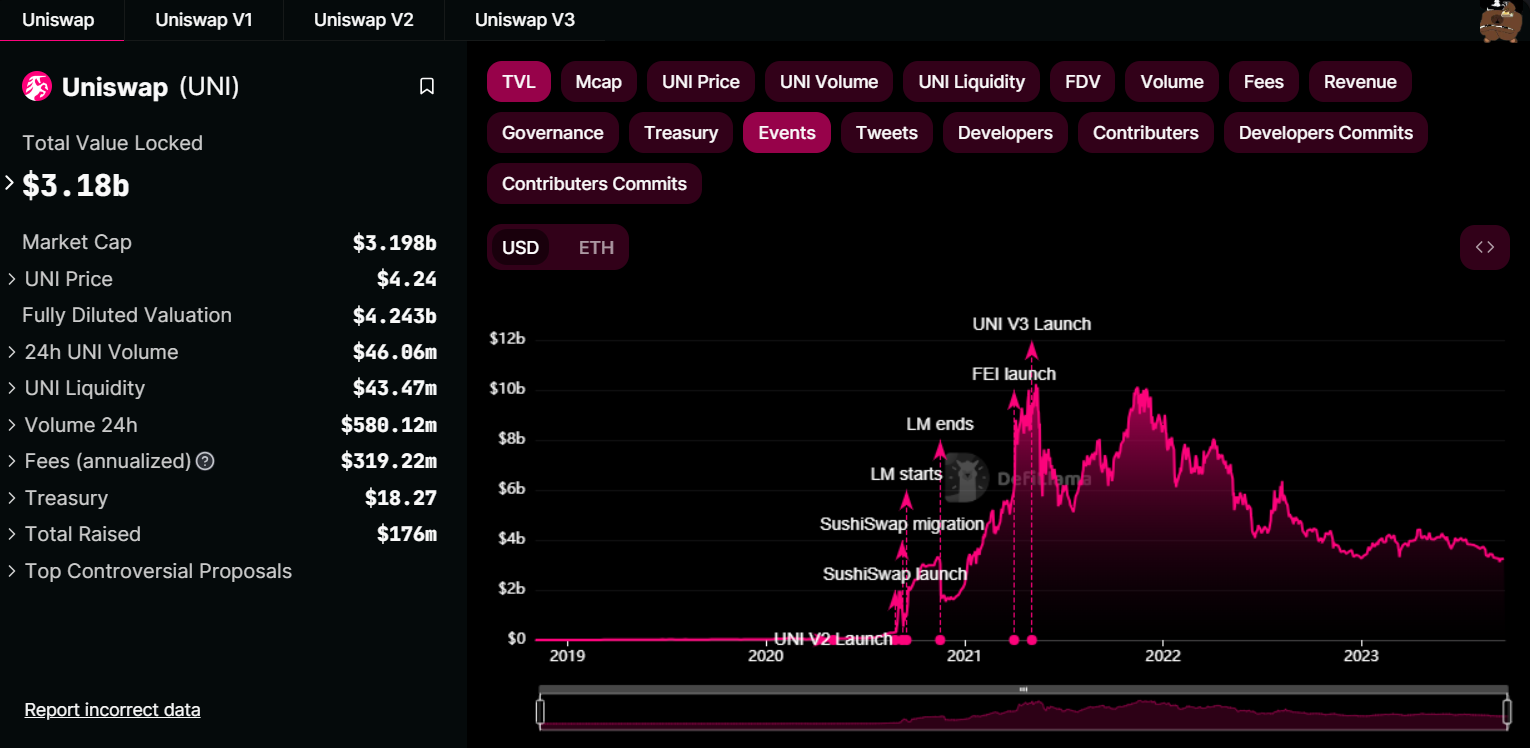

At the time of this guide’s latest update (Sept. 2023), Uniswap was the 5th-largest app in DeFi per its $3.18B in current total value locked (TVL), with deposits accrued across the chains of Ethereum, Arbitrum, Polygon, Optimism, BNB Chain, and Celo.

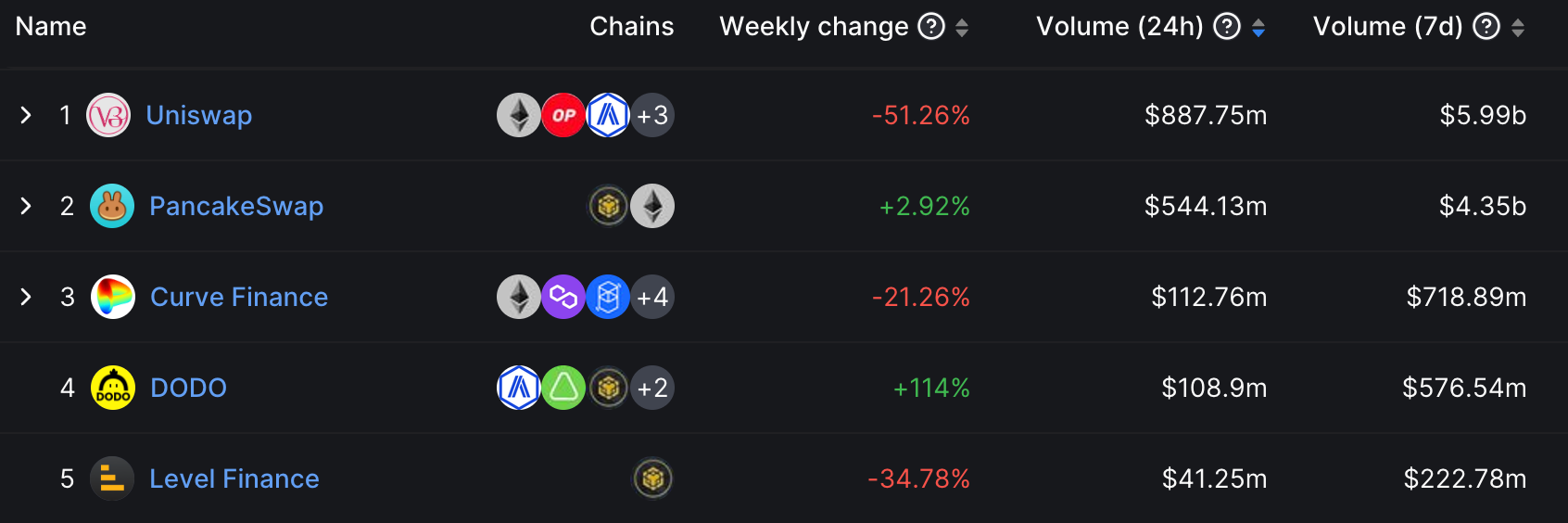

At the moment, Uniswap is trouncing all other DEXes when it comes to 24-hour trading volume stats. For example, at the time of writing Uniswap had just facilitated over $580M in daily trading volume, which was over 222% more than the second-nearest contender, Pancake, which had facilitated $180M in 24-hour volume.

The UNI token

The UNI token is the native governance token of the Uniswap ecosystem. Launched in September 2020, UNI allows holders to participate in the platform's governance, influencing key decisions and future development processes.

Initially, UNI tokens were able to be earned by Uniswap liquidity providers who staked their assets from Uniswap's liquidity pools, further incentivizing participation in the platform.

Per this guide’s latest update, UNI was trading around the $4.23 USD mark with an $3.18B market capitalization, making it the 23rd-largest crypto in the cryptoeconomy at the time. Its circulating supply was just over 753M out of a 1B total supply.

Today, the most common venues for buying or selling UNI are major crypto exchanges, such as Coinbase, Binance, and Kraken, as well as decentralized exchanges like Uniswap itself.

What you need to use Uniswap

- 👛 A wallet — since Uniswap is deployed on Ethereum, any Ethereum compatible wallet should suffice for using with the protocol

- 🪙 Starter gas — you’ll need some ETH to cover the gas costs of trading on Uniswap (of course, if you’re trading on a separate L1 like BNB Chain you’ll need some BNB as the gas token, etc.)

How to use Uniswap

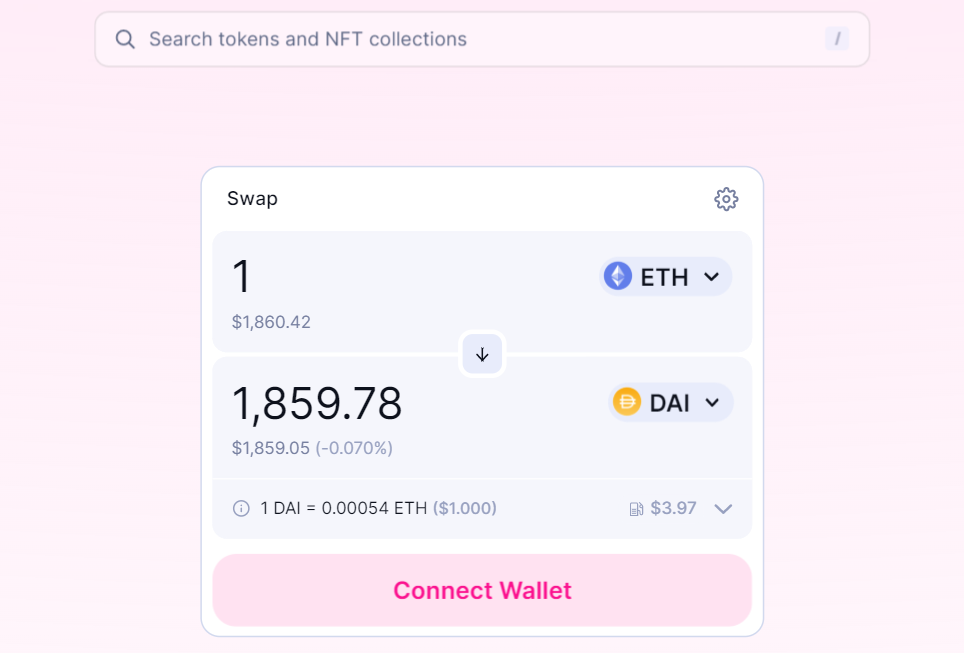

Trading on Uniswap is simple and straightforward. To trade tokens, follow these steps:

- Connect your Ethereum wallet to the Uniswap interface on your supported chain of choice.

- Choose the tokens you want to swap by selecting the input and output tokens.

- Confirm the trade details, such as the exchange rate and slippage tolerance.

- Approve the transaction in your wallet and pay the necessary gas fees.

- Wait for the transaction to be confirmed on the blockchain, and that’s it!

Risks of Uniswap

While Uniswap is thoroughly battle-tested in many regards, there are some risks around trading on Uniswap that can’t totally be ruled out, including:

- Smart contract vulnerabilities and potential exploits.

- Price slippage, which can result in unfavorable exchange rates.

- Impermanent loss for liquidity providers due to price fluctuations.

- Regulatory risks, as decentralized exchanges may face increased scrutiny from authorities.

DeFi competitors to Uniswap

While Uniswap is the largest DEX in DeFi right now, it does face competition from a number of platforms, including:

- 🌀 Curve ($1.95B USD TVL)

- 🥞 Pancakeswap ($1.34B USD TVL)

- ⚖️ Balancer ($690M USD TVL)

- 🍣 Sushiswap ($275M USD TVL)

- 🧑💼 Trader Joe ($70M USD TVL)

Additional Uniswap resources

For further information and resources on Uniswap, check out:

- 📚 Uniswap Documentation

- 🗣️ Uniswap Governance Forum

- 🐦 Uniswap on Twitter

- 📊 Uniswap Analytics Dashboard

- 🦄 Uniswap V3 Bankless Guide

Zooming out

Uniswap has played a crucial role in the evolution of the cryptoeconomy, making decentralized trading more accessible, efficient, and secure.

By eliminating the need for centralized intermediaries, Uniswap empowers users to maintain control over their assets while actively participating in the growth of the platform.

As DeFi continues to expand and mature, Uniswap is likely to remain a key player in shaping the future of decentralized finance, fostering innovation and financial inclusion in the process.