Stablecoins are now among the main cornerstones of the cryptoeconomy, serving as stable sources of value amid volatile crypto markets. Specifically, these assets derive their stability by “pegging” their value to a stable reserve asset like the U.S. dollar. One such stablecoin is FRAX, the most popular offering from the DeFi protocol Frax Finance.

What is FRAX

FRAX was previously known as a “fractional-algorithmic” stablecoin because it operated in both partially collateralized and partially algorithmic fashion. This meant that a portion of its value was backed by collateral, while the rest was stabilized algorithmically.

In this initial system, the Frax protocol achieved FRAX stability by adjusting the collateral ratio based on market conditions. When demand for FRAX was high, the protocol decreased the collateral ratio, allowing more FRAX to be minted without additional collateral. Conversely, when demand was low, the protocol increases the collateral ratio, ensuring stability.

However, as of February 2023, the Frax Finance community voted to approve a shift away from its algorithmic operations toward a fully collateralized model. Going forward this means FRAX will be underpinned by a 100% collateral ratio.

In addition to FRAX, the Frax Protocol also issues two other stablecoins not pegged to USD: the Frax Price Index (FPI) stablecoin, which is pegged to a basket of consumer goods, and FraxEther (frxETH), which is pegged to ETH and can be used as a substitute for Wrapped ETH (WETH) in smart contracts.

To facilitate the operations of Frax Finance, there’s also the Frax Shares (FXS) token, which is used for governance votes.

History of FRAX

FRAX was launched by Frax Finance in December 2020, with the aim of creating a stablecoin that could maintain its peg while minimizing collateral requirements. The protocol's unique approach to algorithmic stability quickly attracted significant attention in the DeFi space and inspired many related projects.

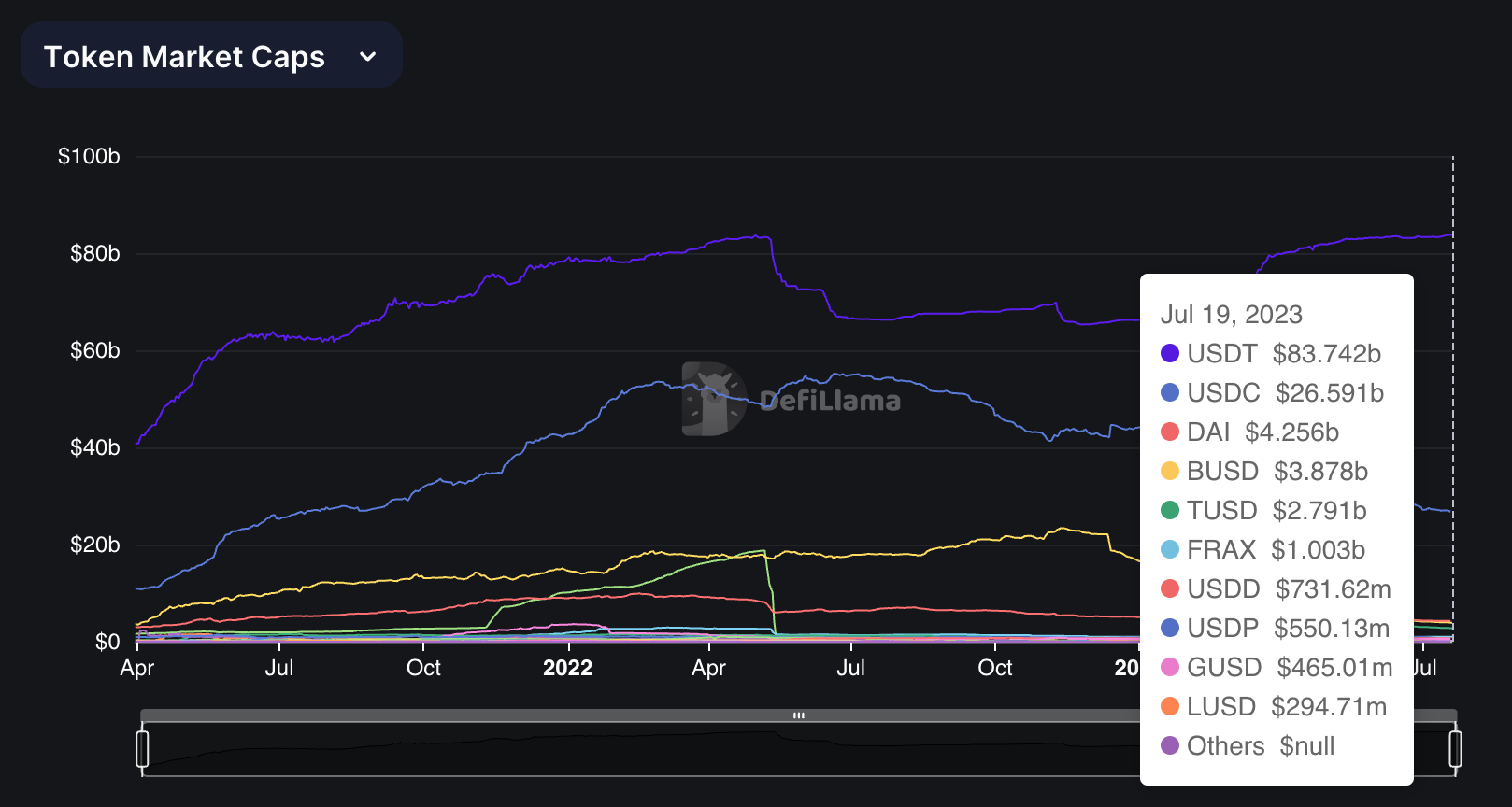

As of today, FRAX has grown significantly and has a substantial market cap of $1 billion USD, making it the sixth-largest stablecoin in the cryptoeconomy at the moment. The majority of this market cap exists on Ethereum right now, but there are also currently millions of FRAX on other Ethereum Virtual Machine (EVM) chains like Arbitrum, BNB Chain, Optimism, and beyond.

How to acquire FRAX

You can buy FRAX on various cryptocurrency exchanges like Binance, Coinbase, or Kraken using other cryptocurrencies or fiat money. FRAX is also purchasable on decentralized exchanges like Curve and Uniswap.

Alternatively, users can consider minting FRAX directly through the Frax Finance platform. Keep in mind that this involves providing collateral, and that minting won’t be possible if the FRAX price is too low (needs to be more than $1.0033).

How to use FRAX

FRAX can be used as a store of value or as a medium of exchange in the cryptoeconomy. FRAX can also be used in various decentralized finance (DeFi) apps for earning opportunities like lending and yield farming.

Risks of FRAX

While FRAX offers many benefits to crypto users, it also comes with risks.

For instance, the protocol's stability depends on the effective management of the collateral ratio over time, which in turn depends on adept governance by FXS holders. If the collateral ratio is managed poorly, FRAX could lose its peg.

Additionally, like all DeFi protocols, Frax Finance is subject to smart contract risks. While the protocol's contracts have been audited, there's always the potential risk of previously unknown bugs that could lead to exploits.

Additional FRAX resources

If you want to learn more about the FRAX stablecoin, here are some helpful resources that can help you dive in:

Zooming out

While it might not be as popular as some of the larger stablecoins like USDT and USDC as yet, Frax Finance’s FRAX token has become a mainstay in the DeFi scene. For now, FRAX will continue to serve as the keystone of the Frax Finance ecosystem around which all aspects of the protocol flow. And with FRAX recently being voted into “fully collateralized” status, the Frax community has shown a willingness to do what it takes to evolve and survive.

More about FRAX

👉 Bankless FRAX Profile

👉 FRAX & the 4pool Curve Takeover | Sam Kazemian