Stacks is a blockchain that brings smart contract capabilities to Bitcoin, allowing developers to create more complex applications, like DeFi and NFT projects, atop Bitcoin's security and decentralization.

Key takeaways

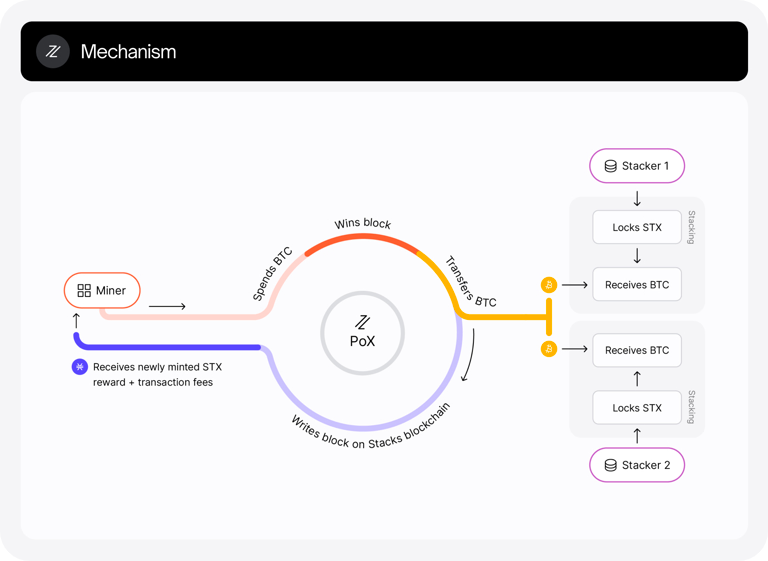

- Stacks uses Proof of Transfer (PoX), linking its security to Bitcoin through miners that commit special Bitcoin deposits to the scaling solution.

- The Nakamoto upgrade, started in May 2024, will be finalized this year and ensure Stacks transactions fully inherit Bitcoin's security and finality, leveraging Bitcoin's robust hash power.

- Commonly called a Bitcoin Layer 2 (L2), Stacks currently boasts around $100 million in total value locked (TVL), making it one of the largest projects and DeFi ecosystems active on Bitcoin today.

What is Stacks?

Stacks is a blockchain designed as a scaling solution for Bitcoin, offering fast and cheap Bitcoin-based transactions.

Unlike traditional Layer 1 (L1) blockchains, Stacks operates as a separate layer that anchors its security to Bitcoin through a unique consensus mechanism called Proof of Transfer (PoX). At the heart of this system, Stacks depositors participate in “Stacking” by depositing their STX to earn BTC rewards.

The new Nakamoto upgrade further enhances Stacks by increasing transaction throughput and achieving 100% Bitcoin finality, making it a compelling solution for developers and users in the Bitcoin ecosystem.

How does Stacks work?

Stacks employs the Clarity smart contract language, which allows contracts to read Bitcoin state and interact with Bitcoin in a trustless manner.

This integration enables sophisticated applications that use Bitcoin as a base layer and BTC as a base asset.

Additionally, Stacks anchors its transaction data to Bitcoin, providing verifiable security and immutability. The new sBTC mechanism also allows BTC to be issued as a Bitcoin-pegged asset on Stacks, allowing Bitcoin to be used within the Stacks ecosystem.

Furthermore, Stacks blocks include a hash of the block data that is written to Bitcoin. This compact storage of hashes on Bitcoin allows anyone to verify the validity of Stacks transactions by referencing Bitcoin’s immutable ledger.

Most important of all is the Nakamoto upgrade, which enhances the interaction between Stacks and Bitcoin by achieving 100% Bitcoin finality.

With Bitcoin finality, transactions on the Stacks blockchain are considered final once they are confirmed by Bitcoin’s PoW consensus. This makes Stacks blocks as secure and irreversible as Bitcoin transactions, linking the security of Stacks directly to Bitcoin.

What is Stacking?

Stacking is the process by which STX token holders can participate in securing the Stacks network and earn Bitcoin rewards. Unlike traditional staking in proof-of-stake (PoS) networks, Stacking on Stacks operates under the PoX mechanism. Key points about Stacking include:

- Earn Bitcoin: STX holders lock their tokens for a defined period to participate in network consensus. In return, they earn Bitcoin rewards from the Bitcoin commitments made by Stacks miners.

- Consensus participation: Stackers play a critical role in the network by acting as consensus-critical signers, helping to validate and secure transactions on the Stacks blockchain.

- No slashing: Unlike PoS systems where stakers risk losing their staked tokens (slashing) for misbehavior, Stackers on Stacks are simply unable to earn rewards if they fail to perform their duties.

Why Stacks?

Stacks is compelling in the Bitcoin ecosystem because it bridges the gap between Bitcoin's unparalleled security and the flexibility of smart contracts. By enabling smart contracts atop Bitcoin, Stacks opens up new possibilities for DeFi, NFTs, and other advanced blockchain applications without compromising security.

How to invest in Stacks?

The native token of the Stacks network, STX, is used to pay for transaction fees and participate in the network's consensus mechanism.

At the time of this guide's latest update, STX was trading around $1.33 per token with a market capitalization of approximately $1.96 billion.

STX can be purchased or sold on various cryptocurrency exchanges, including large centralized exchanges like Coinbase or Kraken as well as decentralized exchanges like Bitflow.

Top Stacks projects

The Stacks app ecosystem features over 50 projects today. Some of the top experiences to explore here include:

- 👛 Leather and Xverse — popular wallets for managing Stacks assets

- 🔄 Bitflow — a decentralized exchange on Stacks

- 🏪 Gamma — a marketplace for Stacks NFTs

- 🪙 Stacks Stacking — a collection of platforms for STX Stacking

- 🍋 Zest — a Bitcoin-centric lending protocol

More about Stacks

👉 Bankless Stacks Profile

👉 8 Bitcoin L2s You Should Be Watching