The Bankless Guide to Rocket Pool

Rocket Pool has helped to revolutionize Ethereum staking by offering a decentralized, trustless, and accessible platform for users to participate in the network's security and earn ETH staking rewards. This guide will walk you through the key aspects of Rocket Pool and how to get started.

Key takeaways

- Rocket Pool enables ETH staking with as little as 0.01 ETH, significantly lowering the entry barrier.

- Users receive rETH liquid staking tokens representing their staked ETH, which can be used in other DeFi applications.

- As of October 2024, Rocket Pool has $3.17 billion in total value locked (TVL) and accounts for nearly 8.7% of all currently staked ETH.

What is Rocket Pool?

Rocket Pool is a decentralized Ethereum staking platform that simplifies the process of participating in Ethereum's Proof of Stake consensus mechanism. It allows users to stake ETH without the need for the traditional 32 ETH requirement or the technical expertise to run a validator node.

By using Rocket Pool, users can stake any amount of ETH and receive rETH tokens in return. These rETH tokens represent the user's staked position and accrue staking rewards over time, similar to how stETH works in the Lido protocol.

How does Rocket Pool work?

Rocket Pool operates by pooling user deposits and distributing them across a network of node operators.

When users stake ETH, the protocol mints rETH tokens representing their staked position. These tokens can be freely traded or used in other DeFi applications while the underlying ETH remains staked.

Node operators in the Rocket Pool network run validators using the pooled ETH. They are required to provide RPL tokens as collateral, which adds an extra layer of security to the protocol. This unique feature sets Rocket Pool apart from other liquid staking solutions.

Additionally, staking rewards are automatically reflected in the increasing value of rETH relative to ETH. When users want to unstake, they can simply trade their rETH back to ETH on various decentralized exchanges or through Rocket Pool directly.

Why Rocket Pool?

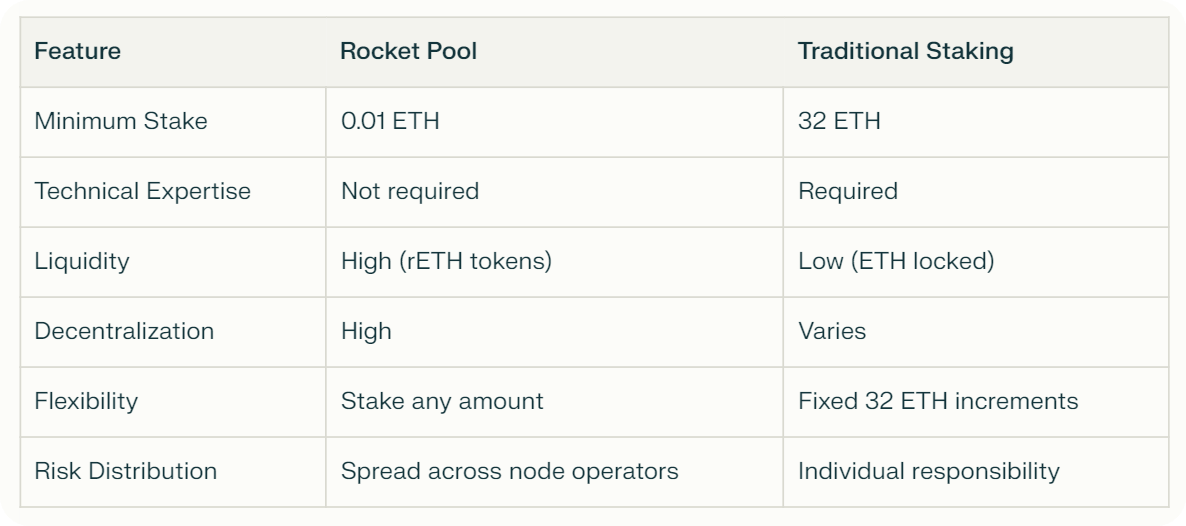

Rocket Pool offers several advantages over traditional Ethereum staking:

How to invest in Rocket Pool?

Investors can gain exposure to Rocket Pool through its native token, RPL. The RPL token serves several purposes within the ecosystem:

- It's used as collateral by node operators, enhancing the security of the protocol.

- RPL holders can participate in the protocol's governance, voting on key decisions and proposals.

- Node operators receive RPL rewards in addition to ETH rewards for their services.

RPL can be acquired on various cryptocurrency exchanges and is currently trading around $10.60 per token with a market cap of $220 million.

However, it's important to note that investing in RPL is different from staking ETH through Rocket Pool. While RPL represents an investment in the protocol's ecosystem itself, staking via Rocket Pool involves depositing ETH to earn staking rewards in the form of more ETH (represented by rETH).

How to stake ETH on Rocket Pool?

Staking your ETH on Rocket Pool is a straightforward process that can be completed in a handful of steps. Here's a step-by-step walkthrough on how to do it:

- 👛 Connect Your Wallet: Visit the Rocket Pool staking app. Click on "Connect Wallet" at the top or middle of the page. You'll need to connect a Web3 wallet, such as MetaMask, that contains the ETH you wish to stake.

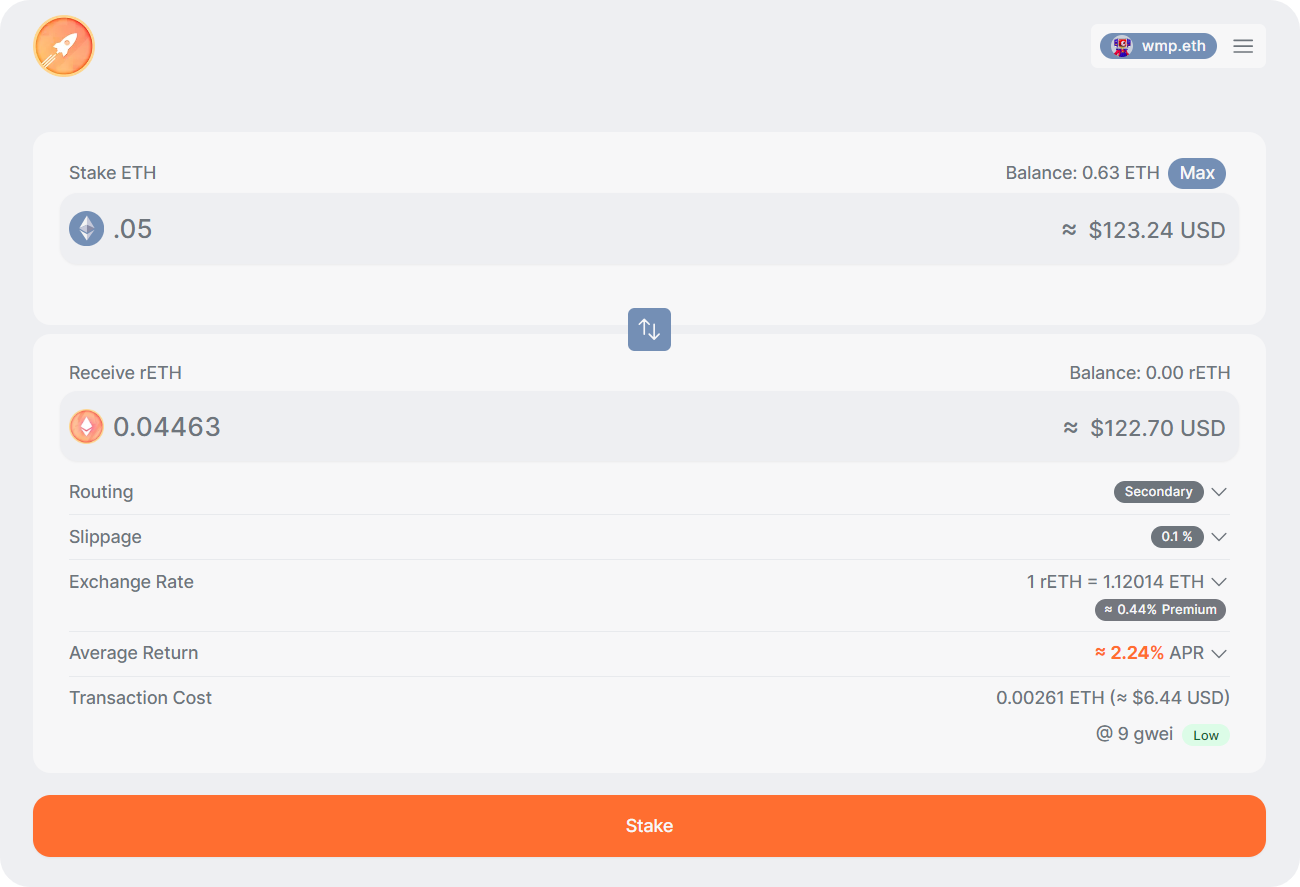

- 🔢 Enter the Amount to Stake: Once your wallet is connected, you can enter the amount of ETH you want to stake in the "Stake ETH" field of the deposit interface.

- 💎 Stake Your ETH: After entering your desired stake amount, click on the "Stake" button to initiate the staking process. You'll need to confirm the transaction in your wallet.

- 🙌 Receive rETH: Once the transaction is confirmed, you'll receive the appropriate amount of rETH tokens in your wallet. Remember, the ETH / rETH exchange rate is dynamic, so currently 1 ETH will fetch you ~0.89 rETH. These tokens represent your staked ETH and the rewards they earn.

- 🔍 Monitor Your Staking: You can monitor your staking rewards using the “Balance” tab on your Rocket Pool profile. Note that whenever you’re ready to unstake your rETH, you can use the same interface you used to stake in order to receive your ETH deposit back.

Risks of Rocket Pool

Engaging with Rocket Pool, like any DeFi project, carries its own unique set of potential risks. It's crucial to understand these possible risks before deciding to stake your ETH:

- Contract Vulnerability Risk: Rocket Pool’s operations are based on smart contracts. Despite the fact that the code is open-source, has undergone audits, and is protected by a bug bounty program to reduce risks, the possibility of bugs or vulnerabilities in the smart contracts always exists.

- Governance Risk: While the possibility is remote, there remains the chance that the DAO overseeing Rocket Pool gets compromised or tricked into implementing malicious protocol changes.