Polygon is a blockchain ecosystem that has gained considerable popularity in recent years for its rising status as a hub for DeFi and NFT activity.

This ecosystem boasts a highly-scalable technology stack that is both deep and wide, and has attracted a large and diverse international community of users and developers accordingly.

Key takeaways

- Polygon is a suite of technologies designed to scale Ethereum, including Polygon PoS, Polygon zkEVM, Polygon Miden, and the Polygon CDK.

- It's currently much more affordable to transact on Polygon's chains than on Ethereum. The average transaction cost is under $0.01 on both Polygon PoS and Polygon zkEVM right now.

- Polygon's ecosystem boasts over 446 million unique addresses, 4 billion transactions, and millions of created smart contracts.

What is Polygon?

Polygon is a suite of Ethereum scaling resources because it offers various blockchain solutions designed to make Ethereum-based transactions faster and more affordable.

The most popular of these solutions today is the flagship Polygon Proof-of-Stake (PoS) chain. Unlike a simple sidechain, Polygon is rather a “commit-chain” system that handles computation offchain and then commits some of its block data to Ethereum to inherit security from Ethereum. The ultimate vision includes migrating the PoS chain to a Polygon zkEVM execution environment.

As for Polygon zkEVM, it's a distinct L2 that operates entirely independently of the Polygon PoS chain.

Specifically, it's a "zero-knowledge" (ZK) rollup that is equivalent to the Ethereum Virtual Machine (EVM). This allows the network to efficiently batch transactions to Ethereum while offering a development environment that is essentially identical to the L1.

The future of the Polygon tech stack also entails third-party projects launching their own L2s using the Polygon Chain Development Kit (CDK). Immutable and OKX are two early adopters here.

Why Polygon?

Polygon PoS is a battle-tested chain that has proven its capabilities in handling high transaction volumes at a fraction of Ethereum's cost. It's also skating to where the puck is going in moving to embrace the zkEVM format, which it seems most L2s will in the years ahead.

Of course, if projects have more custom needs, they can use the Polygon CDK to build scalable and interoperable chains tailored to their specific requirements.

Plus, as Polygon continues to evolve, the user experience (UX) around its ecosystem is set to improve significantly with the rise of AggLayer. AggLayer will enable near-instant, atomic transactions across connected chains, unifying liquidity and state, and providing a smoother, more integrated UX.

How to invest in Polygon?

MATIC is the native token of Polygon. Like ETH on Ethereum, it is used to pay for transactions on Polygon and for staking in the project's PoS system.

At the time of this guide's latest update, MATIC was trading around $0.53 per token with a market capitalization of approximately $4.9 billion. It can be bought or sold on various cryptocurrency exchanges, like Coinbase or Kraken.

Note that Polygon is in the process of transitioning its native token from MATIC to POL. This upgrade aims to enhance the network's functionality and security, aligning with the broader vision of the Polygon 2.0 roadmap. The impending migration will be on a 1:1 basis, meaning that for every MATIC token holders will receive an equivalent amount of POL.

Top Polygon projects

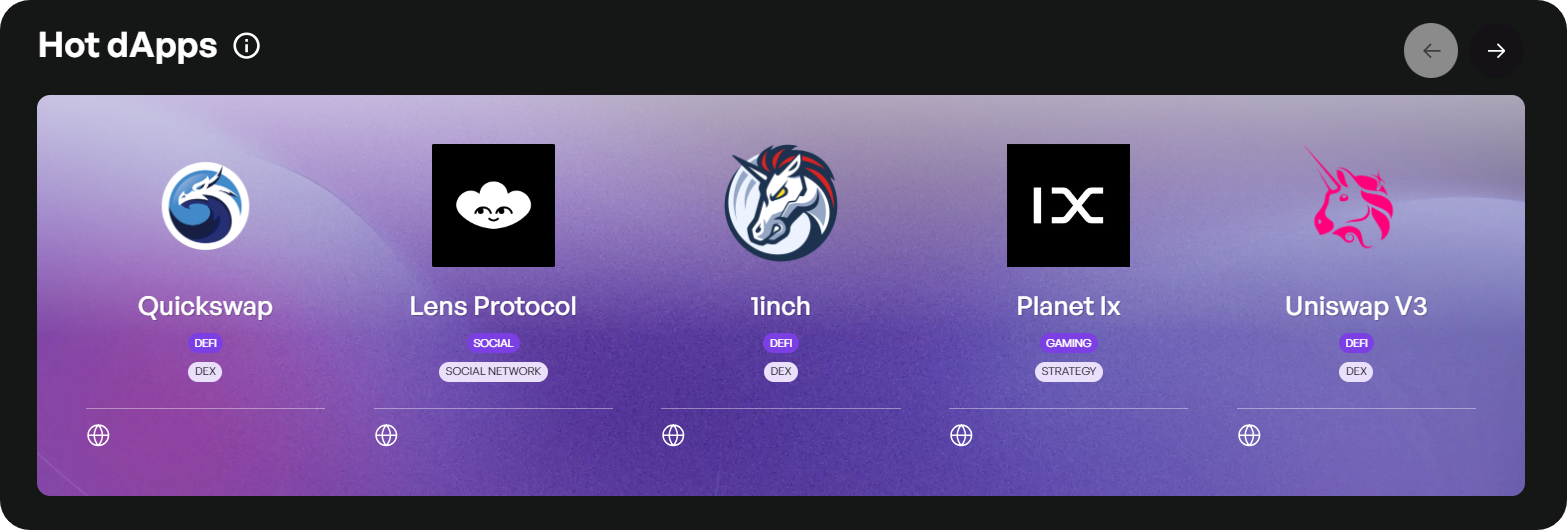

The Polygon app ecosystem is among the largest in the cryptoeconomy, boasting over 600 projects today. Some of the top apps to explore here include:

- 👻 Aave – a leading DeFi borrowing and lending protocol

- 🌉 Bungee – a bridging aggregator with Polygon support

- 🪙 Courtyard – a real-world assets (RWA) tokenization platform

- 🔮 Polymarket– a popular predictions marketplace

- 🦄 Uniswap – the leading decentralized exchange

More about Polygon

👉 Bankless Polygon Profile

👉 Hunt Airdrops on Polygon

👉 Polygon MATIC Token Rating