Bitcoin is breaking new ground with Ordinals, a protocol that lets users inscribe data, like text and images, directly onto individual satoshis, the smallest Bitcoin units. In this guide, we'll explore the mechanics of Ordinals, their implications for onchain storage, and their impact on Bitcoin collectibles.

Key Takeaways

- Inscriptions: Ordinals allow arbitrary data (text, images, etc.) to be inscribed onto satoshis within Bitcoin transactions, making these satoshis unique and trackable.

- Onchain Storage: Unlike many Ethereum NFTs, Ordinals are fully onchain, offering a cost-effective and permanent storage solution.

- BRC-20 Tokens: This experimental token standard uses inscriptions to create fungible tokens on Bitcoin, similar to Ethereum's ERC-20.

- Rare Sats: The Rodarmor Rarity Index categorizes satoshis based on their rarity and historical significance, creating a new collectible niche.

- Marketplaces and Wallets: Popular wallets like Xverse and Leather support Ordinals, with marketplaces such as OKX and Magic Eden facilitating trading.

What Are Ordinals and How Do They Work?

Bitcoin Ordinals is a protocol that allows for the inscription of arbitrary data (like text, images, and videos) directly onto individual satoshis, the smallest units of Bitcoin.

This reality is why the phrase “Inscriptions” has recently become synonymous with “Bitcoin NFTs” or “Ordinals-style NFTs.”

This inscription process is completed by including data within a Bitcoin transaction. Specifically, the data is placed in the transaction witness, a part of a Bitcoin transaction that normally holds data needed to verify the transaction.

Inscriptions are finally ready for Bitcoin mainnet.

— Casey (@rodarmor) January 20, 2023

Inscriptions are like NFTs, but are true digital artifacts: decentralized, immutable, always on-chain, and native to Bitcoin. 🧵https://t.co/a4dK7zdITS

The data inscribed here can be diverse, ranging from simple text to images, SVGs, or even HTML. Once satoshis are inscribed with data and the transaction is mined, the inscription becomes permanent. It's as secure, immutable, and decentralized as any other data on the Bitcoin blockchain. This means that once inscribed, a satoshi carries its data forever, becoming always distinguishable from other satoshis.

Thanks to Ordinal theory it's possible to track the movement and ownership of an inscribed satoshi across different transactions over time. This allows for trading, gifting, or selling these inscribed satoshis like any other Bitcoin transaction. However, special care (sat control) must be taken in transactions to ensure that the specific inscribed satoshi is correctly transferred, as Bitcoin transactions normally don't differentiate between individual satoshis.

Ordinals are onchain

For the sake of flexibility and practicality, many NFTs on Ethereum store their art and metadata offchain, e.g., on a storage network like IPFS rather than on Ethereum directly. This is because, besides its narrow data limitations, onchain storage on Ethereum faces high storage costs, too.

In contrast, every Ordinals mint is completely onchain on Bitcoin thanks to the way the underlying data is stored within transactions, and with much cheaper storage costs than onchain Ethereum NFTs. And what they lack in advanced smart contract functionalities, they make up for with the best permanence-to-cost ratio in the NFT space today.

BRC-20s explained

The Ordinals approach has popularized the creation of 1/1 NFTs and collections of NFTs on top of Bitcoin. Yet atop Ordinals itself has also arrived BRC-20s, an experimental and unofficial fungible token standard built via Inscriptions.

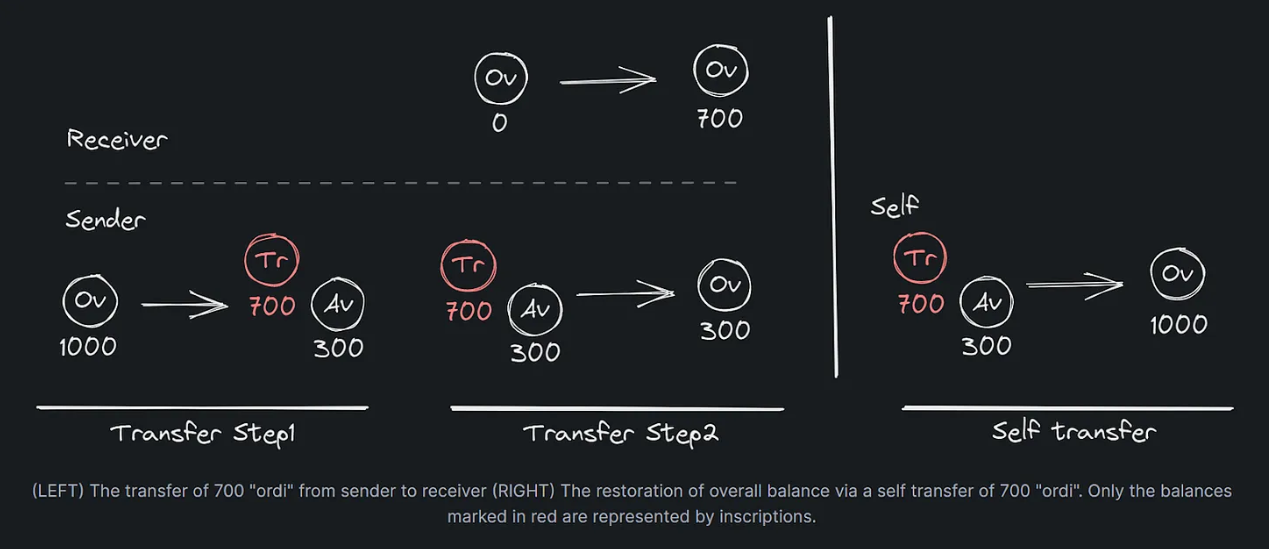

BRC-20s are not smart contract-based tokens like Ethereum’s ERC-20s are, and they’re not completely fungible either. They’re created by inscribing a JavaScript Object Notation (JSON) text snippet into a Bitcoin NFT. This JSON contains a token’s basic information, like max supply and the token ticker. For transfers or buys/sells, additional NFTs are inscribed that can be used to track balance adjustments in batches, e.g., 100 tokens, 500 tokens, 1,000 tokens, etc.

BRC-20 tokens have exploded in popularity recently, with $ORDI becoming the first in the cryptoeconomy to breach the $1 billion market cap mark.

Rare Sats explained

Rare Sats, emerging from the Ordinals protocol, have introduced a new dimension to the perception of satoshis.

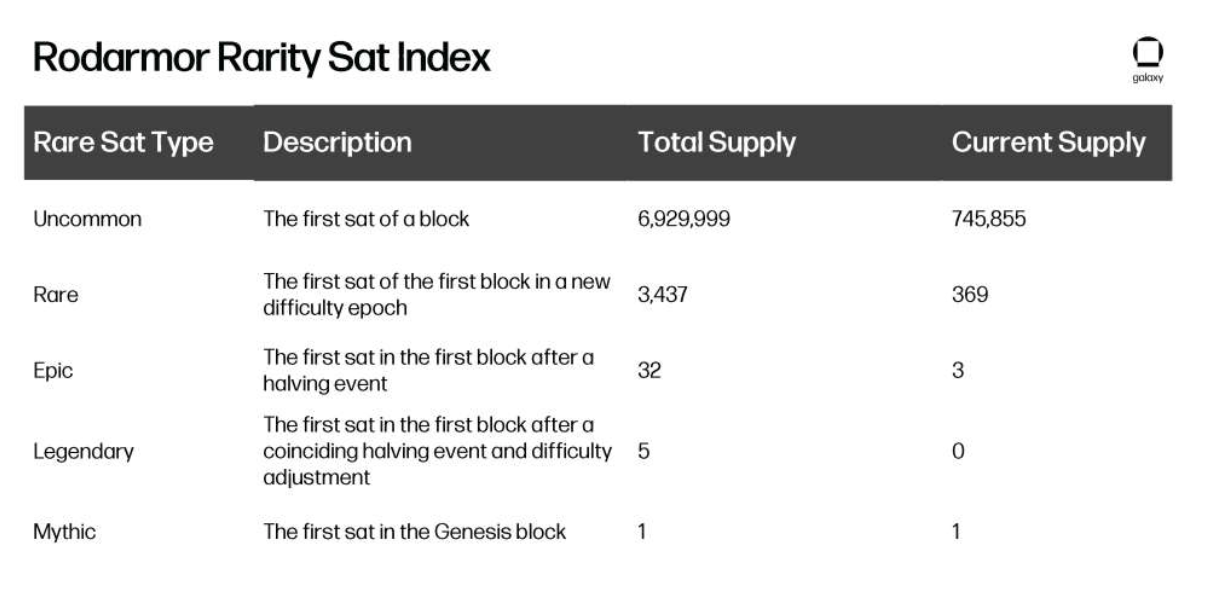

Central to understanding Rare Sats is the Rodarmor Rarity Index, named after Casey Rodarmor, the creator of Ordinals. This index classifies satoshis into various categories based on their uniqueness and rarity. The categories range from the most common, which form the bulk of Bitcoin's supply, to the mythic, which includes the first-ever satoshi mined in Bitcoin's genesis block.

The index also recognizes other significant categories like uncommon, rare, epic, and legendary sats, each with its defining characteristics and maximum supply. These categories are often linked to pivotal moments in Bitcoin's timeline, like mining difficulty adjustments and halving events.

In addition to these categories, other unique types of sats hold historical significance, such as Pizza Sats, Palindrome Sats, Block 9 Sats, and others. Each commemorates special moments or patterns in Bitcoin's history. For instance, Pizza Sats commemorate the first known Bitcoin transaction for tangible goods, while Palindrome Sats have a numerical symmetry that makes them intriguing.

The growing fascination with Rare Sats has given rise to the practice of "Sat Hunting," transforming ordinary satoshis into sought-after collectibles and creating one of the latest niches within the NFT ecosystem.

Top Ordinals marketplaces and wallets

To make and transfer Ordinals and BRC-20s, you’ll need a wallet capable of recognizing and managing inscribed satoshis. Some wallets that have become popular on this front include:

- Xverse — “The Bitcoin wallet for everyone”

- Leather — “Tap into the Bitcoin economy”

- OKX — “Your portal to Web3”

Once you have a wallet ready to go, you can start surfing popular Ordinals marketplaces to see if any NFT listings or BRC-20s catch your eye. Some of the biggest of these marketplaces include OKX’s Ordinals Market, Magic Eden, and Gamma.

Ordinals adoption

In 2023, the Bitcoin community started grappling with a surge in Bitcoin NFT mints upon Casey Rodarmor’s introduction of Ordinals, a protocol that popularized a method for converting individual satoshis—the smallest Bitcoin denomination—into non-fungible digital artifacts.

Notably, Ordinals has been met with derision by some “old guard” hardliner Bitcoiners, not unlike how some of these very same people argued against Bitcoin-based Counterparty NFTs as spam back in 2014. Their argument? Bitcoin should be used only for payments, period. End of story.

In contrast, Counterparty veterans and newer creative experimenters are hailing Ordinals’s approach as potentially revolutionary for Bitcoin’s NFT scene. Most importantly, these new NFTs are driving up transaction fee revenues for Bitcoin miners, pointing the way to a future in which NFT activity helps to replace the ever-decreasing block subsidy on Bitcoin.

Zooming out

The introduction of Ordinals has not only diversified Bitcoin's use cases but has also sparked a debate about its fundamental nature. While some traditionalists argue for preserving Bitcoin's original purpose as a payment system, a growing faction sees these developments as a natural evolution of the network's capabilities, offering new avenues for creativity and financial opportunity.

By enabling onchain storage of diverse data types at relatively lower costs than Ethereum, the Ordinals protocol has proven to be a legitimate game-changer in the NFT space. It challenges the preconceived notions of what can be achieved on the Bitcoin blockchain, extending its utility beyond simple monetary transactions.

However, this innovation does not come without its challenges. The surge in Bitcoin NFT minting, particularly with the popularity of BRC-20 tokens and the practice of "Sat Hunting," has led to increased network congestion. This phenomenon raises concerns about the scalability and efficiency of the Bitcoin L1 as it ventures into new territories of digital asset creation and management.

Looking ahead, this ongoing conversation around network congestion, transaction fees, and the role of NFTs within the Bitcoin ecosystem will likely shape the future direction of the network. As such, the Ordinals space is worth watching for its advances and influence on Bitcoin and the wider cryptoeconomy.

More about Ordinals

👉 Bankless Ordinals Profile

👉 Bankless Bitcoin Profile

👉 Unpacking the Bitcoin L2 Narrative