Stablecoins have been developed as a solution to the price fluctuations often seen in cryptocurrencies such as Bitcoin and Ethereum. LUSD, the native stablecoin of the Liquity protocol, is a prominent example of a decentralized stablecoin. Unlike more centralized projects like USDT and USDC, LUSD is designed to maintain a steady value using only smart contracts and without needing human intermediaries.

What is LUSD

LUSD is a stablecoin that is backed by ETH deposits, with the goal of keeping a 1:1 ratio with the US dollar.

Just like how MakerDAO uses borrowing positions known as “Vaults” to back the DAI stablecoin with crypto deposits, Liquity uses similarly conceived “Troves” to underpin LUSD.

While the smart contracts of Vaults and Troves allow Maker and Liquity’s stablecoins to adapt to real-time changes in the market, the key difference is that Vaults accept multiple collateral types (which can be voted in or out via MKR governance) while Troves will only ever accept ETH (which can’t be changed since Liquity is a governance-free protocol).

Accordingly, LUSD is the centerpiece of the Liquity borrowing protocol, which allows you to draw out 0% interest loans that only require a low minimum collateral ratio of 110% to be maintained. The stablecoin sustains its value through a system of “over-collateralization,” meaning users must deposit an amount of ETH that is more than the amount of LUSD they wish to generate.

Another fundamental element of the Liquity project is the Liquity Stability Pool, which serves to uphold the stability of the LUSD stablecoin.

Specifically, users can deposit LUSD into the pool, forming a reserve that absorbs liquidated debt if a borrower's collateral ratio drops below the 110% threshold. In the event of such liquidations, the pool compensates the debt with the deposited LUSD and receives a corresponding amount of the liquidated collateral (ETH), which is then distributed to the depositors. Additionally, depositors earn LQTY tokens, Liquity's fee-sharing token, providing an extra incentive for LUSD deposits.

This defensive mechanism not only maintains LUSD stability, even amid sharp ETH price drops, but also enables Liquity to offer zero-interest loans, ensuring a robust and secure system.

History of LUSD

In April 2021, the Liquity AG team launched the Liquity protocol on the Ethereum mainnet. While unique in offering zero interest rates and minimum issuance fees, the arrival of Liquity and LUSD also filled the demand gap that Maker’s abandonment of Single Collateral DAI (SAI), which only supported ETH deposits, opened up.

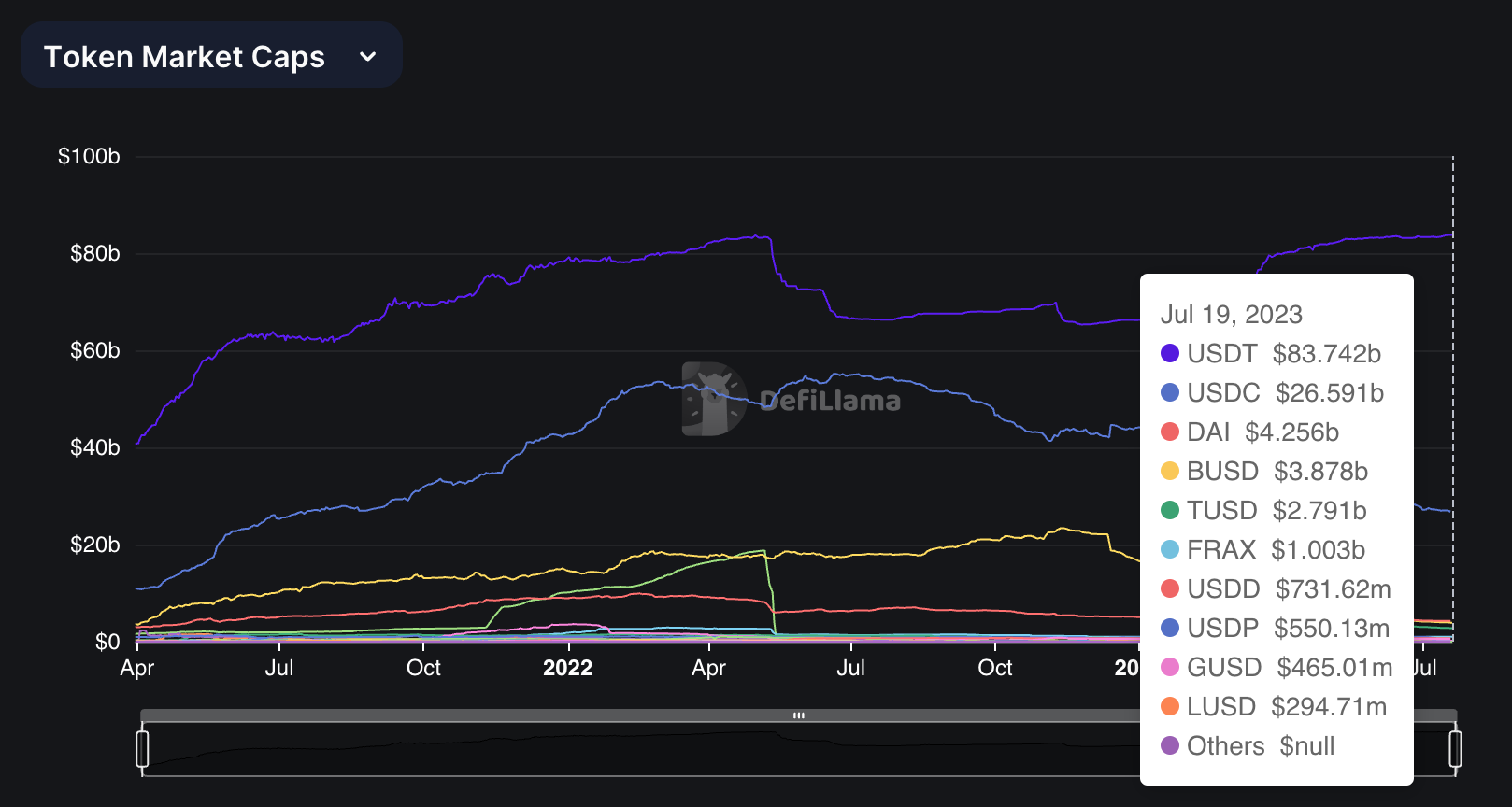

After its release, Liquity saw rapid growth, quickly reaching over $1 billion in total value locked (TVL) within the first month of its launch. Today the market capitalization of LUSD is approximately $264 million, making it the 11th-largest stablecoin in the cryptoeconomy right now, with this market cap underpinned by Liquity’s $619 million in current TVL.

How to acquire LUSD

You can buy LUSD on Gemini using other cryptocurrencies or fiat money. LUSD is also purchasable on decentralized exchanges like Curve and Uniswap.

Alternatively, you can create LUSD by opening a Liquity Trove, depositing ETH, and minting new LUSD against your collateral. The stablecoins can then be sold as needed and the loan repaid according to your schedule. However, keep in mind that if you do open a borrow position, it's crucial to maintain adequate ETH collateral in your Trove to prevent liquidation.

Also keep in mind that the Liquity core team does not host its own frontend, so if you want to draw out a LUSD loan through a Trove you will need to pick from the available third-party frontend options, of which there are many. You can find a directory of these frontends here.

How to use LUSD

LUSD can be used as a store of value or as a medium of exchange, just like other currencies. Additionally, borrowing LUSD is a way to get some liquidity upfront without having to sell or incur tax on your underlying ETH. LUSD is also used in some decentralized finance (DeFi) apps for earning opportunities like lending and yield farming.

Risks of LUSD

While LUSD and the underlying Liquity protocol have been designed with robustness in mind, using the stablecoin is not without risks, namely the risk of liquidation if the value of deposited collateral falls too low.

Additional LUSD resources

If you want to learn more about the LUSD stablecoin, here are some helpful resources that can help you go deeper:

Zooming out

Liquity's unique features such as 0% interest, its minimum collateral ratio of 110%, and being governance-free make it an attractive option for users looking for a decentralized stablecoin. It's also worth highlighting again that Liquity does not run its own frontend, making the project truly among the most decentralized and censorship-resistant stablecoin efforts around.

More about Liquity

👉 Bankless Liquity Profile

👉 AMA with Robert Lauko of Liquity