The Bankless Guide to Lido

Ethereum has popularized the concept of staking, a technical process that allows holders to maintain deposited ETH in a special smart contract to earn ETH rewards by participating in the network's security.

Accordingly, Lido is a liquid staking service, as it simplifies ETH staking to simply holding the Lido Staked ETH (stETH) token. Today, the platform is the largest liquid staking protocol and also the largest DeFi project with +$23 billion in total value locked (TVL).

Key takeaways

- Lido allows users to stake crypto assets without having to lock them up and without having to manually maintain staking nodes.

- The protocol supports liquid staking for ETH and Polygon's MATIC. Support for Solana's SOL was dropped in February 2024.

- As of September 2024, over 9.8 million ETH–or more than 70% of all ETH currently staked–were maintained in Lido's protocol.

What is Lido?

Lido is a decentralized liquid staking platform that allows users to stake ETH and MATIC without locking them up. It provides a solution to the high barriers of entry typically associated with manual ETH staking, where a minimum of 32 ETH is usually required to run a validator node.

By using Lido, users can stake any amount of ETH or MATIC and receive stETH or stMATIC, i.e. ERC-20 tokens that represent their staked positions and that accrue staking rewards over time.

The stETH token is the most popular liquid staking token (LST) in all of decentralized finance (DeFi), and it can be used across various DeFi applications, enabling users to earn additional yields while their original ETH remains staked. This flexibility addresses the illiquidity problem of traditional staking, allowing users to benefit from staking rewards and simultaneously participate in other onchain activities.

How does Lido work?

Lido operates by pooling user deposits and staking them with a network of professional validators.

The Lido protocol manages the staking process through smart contracts, which handle user deposits, withdrawals, and the distribution of staking rewards. The protocol delegates pooled funds to multiple node operators, thereby minimizing the risk associated with any single point of failure.

This distribution across numerous validators enhances security and decentralization, as it prevents any single entity from gaining control over a significant portion of the staked assets.

Additionally, Lido applies a 10% fee on staking rewards, which is split between the node operators and the Lido DAO Treasury. This fee structure supports the ongoing development and security of the platform.

Users can unstake their ETH by burning their stETH tokens, initiating a withdrawal process that allows them to reclaim their original assets along with any accrued rewards.

How to invest in Lido?

Investors can gain exposure to Lido through its native governance token, LDO. The LDO token allows holders to participate in the protocol's governance, voting on key decisions and proposals that shape Lido's future.

LDO can be acquired on various cryptocurrency exchanges and is currently trading around $0.98 per token with a market cap of $867 million.

However, it's important to note that investing in LDO is different from staking through Lido. While LDO represents an investment in the protocol itself, staking via Lido involves depositing supported assets like ETH to earn staking rewards.

How to stake ETH on Lido?

Staking your ETH on Lido is a straightforward process that can be completed in a handful of steps. Here's a simple guide on how to do it:

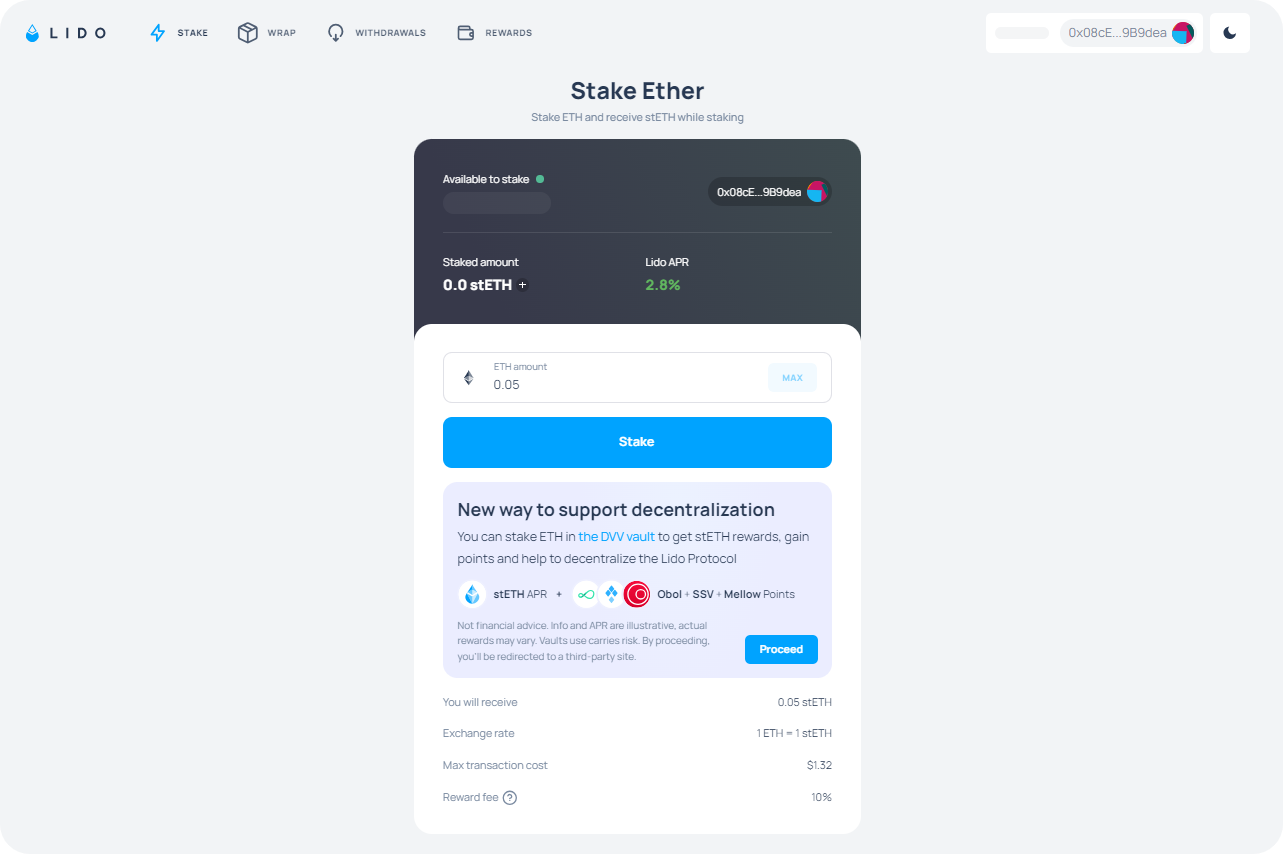

- 👛 Connect Your Wallet: Visit the Lido Staking Portal. Click on "Connect Wallet" at the top of the page. You'll need to connect a Web3 wallet, such as MetaMask, that contains the ETH you wish to stake.

- 🔢 Enter the Amount to Stake: Once your wallet is connected, you can enter the amount of ETH you want to stake in the "ETH amount" field.

- 💎 Stake Your ETH: After entering the amount, click on the "Submit" button to initiate the staking process. You'll need to confirm the transaction in your wallet.

- 🙌 Receive stETH: Once the transaction is confirmed, you'll receive an equivalent amount of stETH tokens in your wallet. The exchange rate is 1 ETH = 1 stETH. These tokens represent your staked ETH and the rewards they earn.

- 🔍 Monitor Your Staking: You can monitor your staking rewards and the total amount of ETH staked with Lido on the same page. The current annual percentage rate (APR) for staking ETH on Lido is displayed (2.8% right now), along with the total staked ETH and the number of stakers.

Risks of Lido

Participating in Lido, as with any DeFi project, comes with its own set of challenges. It's essential to be aware of these challenges before you decide to stake your ETH. Here are some of the potential risks you might encounter when staking on Lido:

- Contract Vulnerability Risk: Lido's operations are based on smart contracts. Despite the fact that the code is open-source, has undergone audits, and is protected by a comprehensive bug bounty program to reduce risks, the possibility of bugs or vulnerabilities in the smart contracts always exists.

- Slashing Penalty Risk: Validators on Ethereum could face penalties if they fail to fulfill their responsibilities properly. Lido addresses this risk by distributing stakes across several professional and trustworthy node operators with varied configurations. Furthermore, Lido maintains an insurance fund, financed by its fees, to provide additional risk mitigation.

- stETH Value Risk: The market price of stETH could potentially fall below its intrinsic value due to Lido's withdrawal limitations, which could hinder arbitrage and market-making activities.