Launched on mainnet in June 2023, EigenLayer is a collection of smart contracts on Ethereum that allow ETH stakers to validate additional projects with their staked ETH, a.k.a. restaking.

Today, more than 32 million ETH are staked to help validate Ethereum, making the blockchain extremely crypto-economically secure. Through EigenLayer, the idea is that efforts like consensus networks, data availability (DA) layers, oracle networks, and beyond can tap into Ethereum’s extensive security in order to avoid having to launch their own chain infrastructure.

As such, stakers can deposit into EigenLayer contracts to grant the protocol the ability to impose extra slashing conditions on their staked ETH, thus earning more fees on top of their 4-6% staking yields from the additional projects they help secure.

How EigenLayer works

At the heart of EigenLayer is the concept of pooled security via restaking, in which multiple parties combine their staked ETH together to provide greater security. This pooling is accomplished in two ways: native restaking and liquid restaking.

Native restaking is for advanced users and entails operating your own Ethereum validator and depositing regular ETH into what’s called an EigenPod.

In contrast, liquid restaking is much easier, as it simply entails depositing liquid staking tokens (LSTs) like Coinbase cbETH, Rocket Pool rETH, or Lido stETH into EigenLayer.

Accordingly, the mission is that EigenLayer functions as a restaking marketplace, where depositors have the freedom to choose which projects or modules they wish to support. This approach lets restakers make decisions based on their interests, risk appetites, and potential rewards.

The pulse of EigenLayer

At the time of this guide’s latest update in June 2024, there were over 5M ETH, or more than $20B USD, restaked through EigenLayer. Ovr 3.59M ETH of that sum is currently derived via native restaking, while the remainder comes via LSTs, with the top contributors today being stETH (1.17M), swETH (132.8k), and mETH (156.5k).

How to restake on EigenLayer

- 🪙 Prep your LST of choice — EigenLayer currently supports LSTs like cbETH, rETH, stETH, and many more. Acquire some of your preferred LST if you haven’t already, and transfer the token into your desired wallet before proceeding.

- 📱 Visit the EigenLayer app — Go to app.eigenlayer.xyz and connect your wallet, then click on the asset you’d like to start restaking with to continue.

- ✅ Complete your deposit — In the provided interface, input the amount you’d like to deposit into EigenLayer, then complete the approval transaction + the final authorization transaction with your wallet to officially start restaking.

Once you’re in, you can track all your deposits from the main EigenLayer app page. You can also withdraw as you please using the “Unstake” button in the deposit interfaces, but keep in mind that EigenLayer currently enforces a 7-day withdrawal delay, so it will take a week for your funds to hit your wallet as things stand.

Delegating restaked ETH on EigenLayer

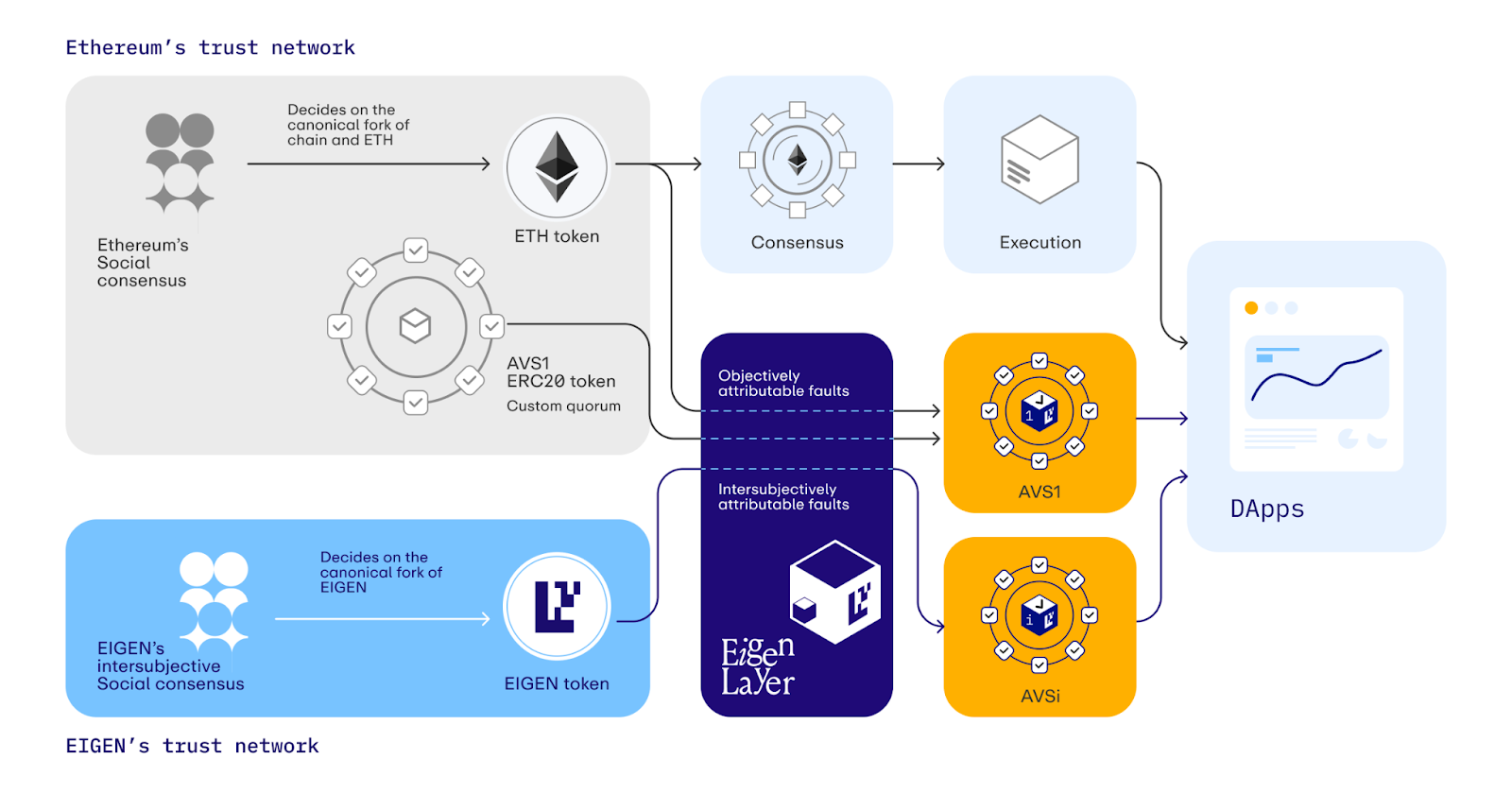

An Actively Validated Service (AVS) is a project that uses the security of Ethereum via EigenLayer to underpin its native functionalities.

AVSs can be anything from data availability solutions to L2s, like optimistic or zk-rollups, and Operators are the entities responsible for running these services. They play a crucial role in maintaining the integrity and performance of the AVSs by managing the underlying nodes and operations.

As such, AVSs expand on the capabilities of Ethereum by providing scalable and efficient solutions for various blockchain applications, while Operators ensure these services are reliable and secure, making them integral to the trust and functionality of the AVSs they support.

The first AVSs on EigenLayer

In April 2024, EigenLayer started its phased rollout of the first AVSs, beginning with its own EigenDA solution. After that, eight more services have come online atop the restaking protocol. Five of the most active AVSs so far have been:

- EigenDA — A new data availability network, EigenDA boasts high throughput and low costs, ideal for scaling Ethereum's data handling capacities. Current TVL: 2.63M ETH

- eoracle — A decentralized oracle network that securely integrates real-world data into Ethereum, powering various decentralized apps. Current TVL: 1.54M ETH

- Witness Chain — Coordinates decentralized physical infrastructure networks, offering a new layer of economic activities for blockchain projects. Current TVL: 1.52M ETH

- Brevis coChain AVS — This service uses zero-knowledge proofs to enable smart contracts to access and compute vast historical blockchain data efficiently. Current TVL: 1.40M ETH

- AltLayer MACH — Focused on providing fast finality for transactions within rollups, enhancing the speed and reliability of Ethereum-based transactions. Current TVL: 1.06M ETH

Choosing an AVS and Operator

When selecting an AVS and an operator, make sure you first understand the specific services and benefits each offers.

For example, EigenYields is one of the operators of EigenDA, and it promises to share airdrops with its delegators. While direct incentives around AVSs are scant for now, look for operators to offer more explicit rewards like this going forward.

While EigenLayer vetted its first wave of AVSs, the ecosystem is moving towards a permissionless model where operators will self-register. This means assessing the risk and potential of each operator will become increasingly important over time.

Additionally, EigenLayer does not guarantee the fitness of any operators, and bad operators can cause slashing events for their delegators once this functionality is activated later. Accordingly, performing due diligence before delegating is crucial. It also takes seven days to redelegate to another operator, so make sure you’re confident before diving in.

How to delegate to AVS Operators

If you already have some ETH or LSTs restaked in EigenLayer, you can follow these steps to delegate your restaked ETH to the Operator of a particular AVS that you want to help secure:

- Access the EigenLayer AVS Dashboard — Navigate to the AVS dashboard and connect your wallet.

- Select an AVS — Review the available AVSs and select one that aligns with your investment strategy and risk tolerance.

- Choose an Operator — Each AVS has a list of operators you can click into. Select an operator based on their performance and any additional incentives they might offer.

- Delegate Your Stake — Click the "Delegate" button next to your chosen operator. You'll be prompted to confirm the delegation with your wallet, and once that's done, you'll be finished!

The EIGEN token

Claims for the highly anticipated EIGEN airdrop began on May 10th, 2024, with an allocation of 5% of the total supply set aside for all restakers who deposited before the March 15th, 2024 snapshot date.

While most tokens will be claimable immediately, 10% of the distribution is reserved for users who had complex interactions with EigenLayer through liquid restaking tokens (LRTs). This portion is slated to be distributed later this year.

Restakers who joined earlier, participated longer, and maintained their stake earned boosted allocations. Additionally, native restakers received extra rewards.

The EIGEN token will initially offer utility by enabling recipients to stake their tokens to secure the EigenDA network. Future distributions will consider users' entire interaction history with EigenLayer and are expected to follow similar allocation trajectories.

Key features of the EIGEN token include a governance mechanism that facilitates intersubjective forking, allowing token holders to challenge incorrect slashing behaviors. A significant fraction of EIGEN tokens must be committed as a bond to initiate a fork, and the community will vote on its legitimacy.

At launch, EIGEN will have a total supply of approximately 1.67 billion tokens, with 15% allocated for stakedrops, 30% for community development, and the rest divided between private investors and the core team. To sustain ongoing deposits, EigenLayer plans to adopt inflationary tokenomics in the future, controlled by the community.

The risks of EigenLayer

Ethereum validators looking to benefit from additional staking rewards through EigenLayer must carefully consider their risks against potential gains. If they fail to adhere to the rules set by protocols at the EigenLayer level, they risk penalization via slashing of their ETH. This slashing possibility necessitates a cautious approach from restakers in studying and choosing which services to opt into.

Conversely, projects that use EigenLayer should be designed so that even in the event of complete failure, the losses are confined to the validators and users who opted into the protocol. This is important to prevent systemic risks that could have widespread consequences for Ethereum and its community.

Additional EigenLayer resources

If you’re interested in diving deeper into the EigenLayer ecosystem, be sure to check out these helpful resources:

Zooming out

With its novel approach to pooled security and a user-friendly system accommodating both native and liquid restaking, EigenLayer extends Ethereum's crypto-economic security into a marketplace of decentralized trust. As EigenLayer continues to evolve, including with its own DA solution, the potential for diverse and innovative projects to be built on this infra is extensive, to say the least.

More about Eigenlayer

👉 Bankless Eigenlayer Profile

👉 $EIGEN Token Announcement With Sreeram Kannan and Robert Drost

👉 The Next Crop of Restaking Tokens