Stablecoins have emerged as a way to avoid volatility in cryptocurrencies like Bitcoin and Ethereum. One such notable stablecoin is DAI, which aims to keep its value as stable as possible without the need for central administrators.

What is DAI?

DAI is a decentralized, crypto-collateralized stablecoin that aims to maintain a 1:1 parity with the US dollar. This means that 1 DAI is designed to always be worth 1 US dollar. It aims to achieve this stability through a system of smart contracts which automatically respond to market dynamics as they happen.

The centerpiece of the Maker borrowing protocol, DAI maintains its value through a system of “over-collateralization.” This means users must deposit an amount of ETH (or other approved tokens) that is more than the amount of DAI they wish to generate and thereafter they must pay back their borrows over time.

The Maker system, governed by MKR token holders, adjusts parameters — like approved collateral types — to ensure the stability of DAI. Various types of crypto assets can be used to back DAI borrows, with ETH, the USDC stablecoin, and Lido’s wstETH being among the most popular collateral choices right now.

History of DAI

The brainchild of Danish entrepreneur Rune Christensen, DAI was first conceptualized in 2014 and launched in December 2017 by Maker, one of the earliest and now most-proven DeFi applications.

Initially, DAI supported only ETH as collateral for borrow positions, a system Maker called Single Collateral DAI (SCD). In November 2019, this evolved into Multi-Collateral DAI (MCD), expanding the collateral options to ERC20 tokens approved via governance.

The same year, Maker unveiled Oasis, a user-friendly interface for managing Maker Vaults and DAI borrow positions. Although Oasis has since become an independent project, it continues to be the most popular frontend for borrowing DAI through the Maker protocol.

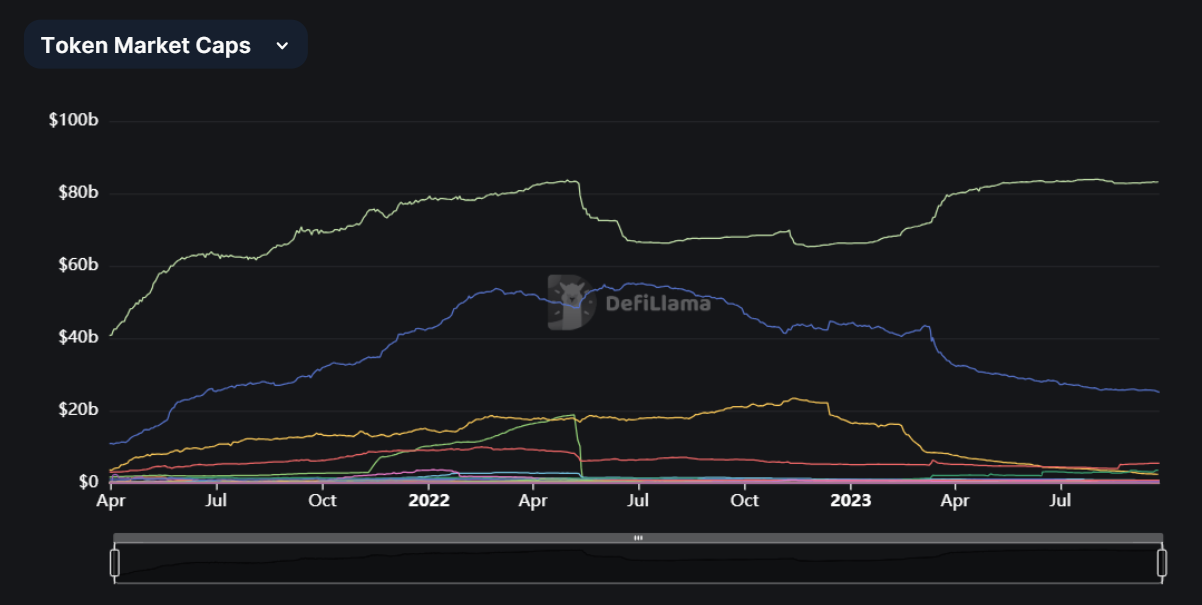

As for where DAI stands today, the stablecoin is currently the 3rd-largest in the cryptoeconomy per its $5.44B market capitalization and thus in size trails only USDC ($25B), and USDT ($83B) right now.

How to acquire DAI

You can buy DAI on various cryptocurrency exchanges like Binance, Coinbase, or Kraken using other cryptocurrencies or fiat money. DAI is also purchasable on decentralized exchanges like Curve and Uniswap.

Alternatively, you can create DAI by opening a Maker Vault, depositing collateral, and minting new DAI against your collateral. For example, the aforementioned Oasis app offers a simple interface for setting up a Maker Vault and borrowing DAI using your collateral, such as ETH, in just a few clicks. This DAI can then be sold as needed and the loan repaid according to your schedule.

However, keep in mind that if you do open a borrow position It's crucial to maintain adequate collateral in your Vault to prevent liquidation. Oasis simplifies this process by offering automated buys/sells and stop-loss protection for managing your positions.

How to use DAI

DAI can be used as a store of value or as a medium of exchange, just like other currencies. For example, with regard to payments you can list NFTs for DAI or make offers on NFTs with DAI on the OpenSea NFT marketplace among other platforms.

Additionally, in many jurisdictions borrowing against your own money is non-taxable income, so in such places borrowing DAI is a way to get some liquidity upfront without having to sell or incur tax on your underlying crypto, e.g. ETH. DAI is also widely used productively in decentralized finance (DeFi) applications for earning opportunities like lending and yield farming.

Risks of DAI

While DAI and the underlying Maker protocol have been battle-tested for years, using the stablecoin is not without risks, namely the risk of liquidation if the value of deposited collateral falls too low and the governance risks associated with MKR and managing the Maker protocol.

Additional DAI resources

If you want to learn more about the DAI stablecoin, here are some helpful resources that can help you go deeper:

Zooming out

DAI is among the most popular stablecoins in the cryptoeconomy and has become a mainstay in DeFi projects across many chains. Over the years of its decentralized operation, the DAI has successfully maintained its dollar peg through various market conditions and cycles, demonstrating its resilience and robust design time and time again. Accordingly, DAI is one of the great early examples of the power of DeFi when done right.