The Bankless Guide to Celestia

Celestia is a data availability (DA) blockchain created as an affordable and efficient hub for Layer 2 (L2) scaling solutions to publish transaction data.

Celestia helps projects launch their L2s by allowing rollup teams to sidestep needing to manage their own DA solutions and instead focus exclusively on their execution layer, where transactions occur.

Key takeaways

- Celestia uses cutting-edge technologies like data availability sampling (DAS) and Namespaced Merkle Trees (NMTs) to enhance the efficiency of L2s.

- Celestia separates its consensus and execution operations, allowing for more specialized and optimized functionalities in its bid to support a burgeoning ecosystem of L2 rollups and decentralized applications.

What is Celestia?

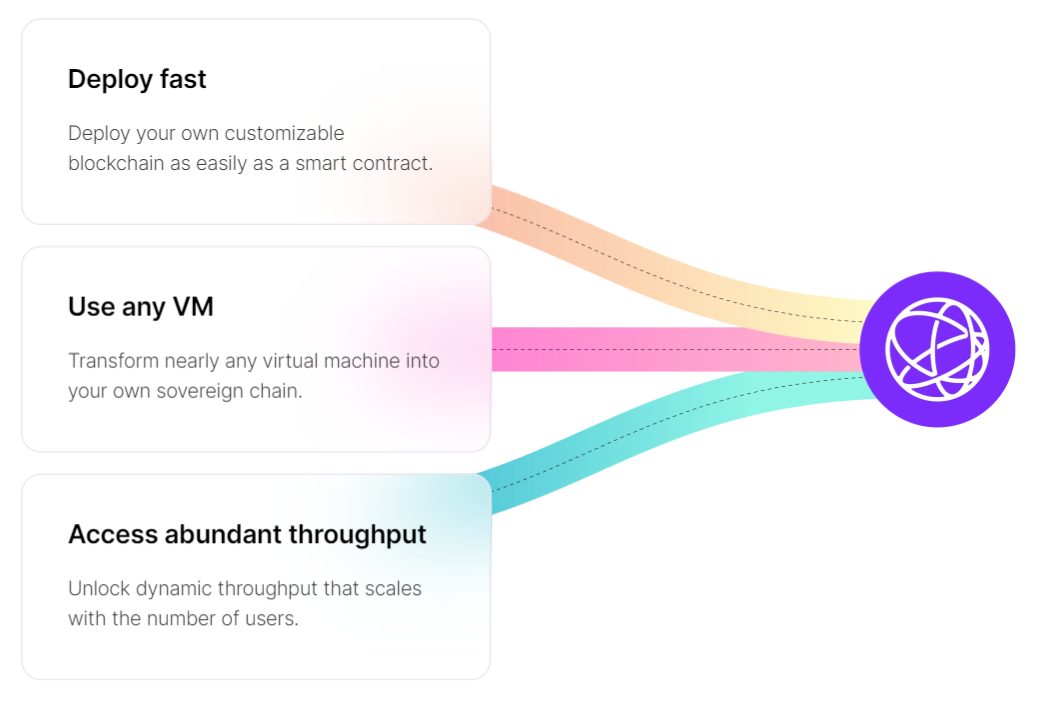

Built using the Cosmos SDK, Celestia is a modular data availability network designed to make it easy for projects to launch their own L2s.

Data availability ensures that all transaction data for a blockchain is published and verifiable, which is critical for the security and functionality of any blockchain.

Celestia's focus on DA for L2s ensures scaling solutions can efficiently access transaction data without needing their own DA solutions, streamlining their development and data management processes.

How does Celestia work?

Celestia operates through a robust architecture that includes several key layers. At its core is a Proof-of-Stake (PoS) blockchain built on celestia-core, a modified version of the Tendermint consensus algorithm.

This base layer ensures consensus and data availability through innovative technologies like data availability sampling (DAS) and Namespaced Merkle Trees (NMTs).

DAS allows light nodes to verify the availability of data without downloading entire blocks by sampling small portions of the block data. This method significantly reduces the computational load on nodes while maintaining high security and scalability.

As for NMTs, they further enhance efficiency by categorizing data into different namespaces, enabling applications to retrieve only the data relevant to them.

Why Celestia?

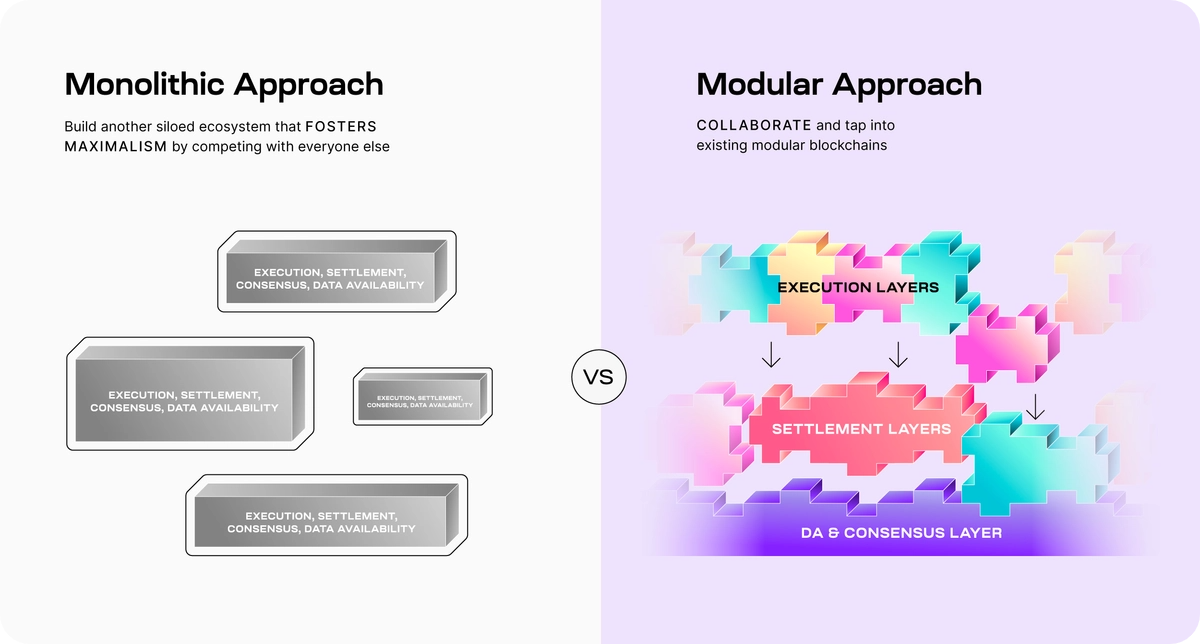

Celestia is compelling in the context of the rise of modular networks in crypto due to its innovative approach to solving the data availability problem, which is a major bottleneck in blockchain scalability.

By decoupling its consensus and execution, Celestia allows for higher throughput and flexibility, which in turn enables developers to launch performant L2s quickly and efficiently. Additionally, Celestia's use of DAS and NMTs ensures that data availability is maintained even as the network scales, providing a robust foundation for builders.

How to invest in Celestia?

The native token of the Celestia ecosystem is TIA. At the time of this guide's latest update, TIA was trading around $6.40 per token with a market capitalization of approximately $1.3 billion.

TIA can be purchased or sold on various cryptocurrency exchanges, including popular centralized exchanges like Coinbase or Kraken, as well as on the leading Cosmos decentralized exchange, Osmosis.

The token is used to pay for DA on Celestia, and it's also offered as a gas token for new L2s. Through its PoS system, TIA holders can secure the network and earn rewards by delegating tokens to validators. If you're interested in staking TIA to earn staking rewards and potential airdrops, it’s simple to get started:

- Create a Celestia wallet — A great option here is Keplr, a user-friendly browser wallet for Cosmos chains like Celestia that also offers a streamlined staking interface.

- Acquire TIA — The easiest avenue is to buy TIA on a large crypto exchange like Coinbase or Kraken. When you have the funds you want to stake ready to go, deposit them into the Celestia address you generated in Keplr.

- Stake through Keplr — Click on the “Manage Portfolio in Keplr Dashboard” button in your wallet. In the “Staking” hub, select “Celestia,” then choose a validator to stake with from the provided list. Input the amount of TIA you want to stake and approve the transaction with your wallet. Keep in mind that withdrawals will take 21 days, though!

Top Celestia projects

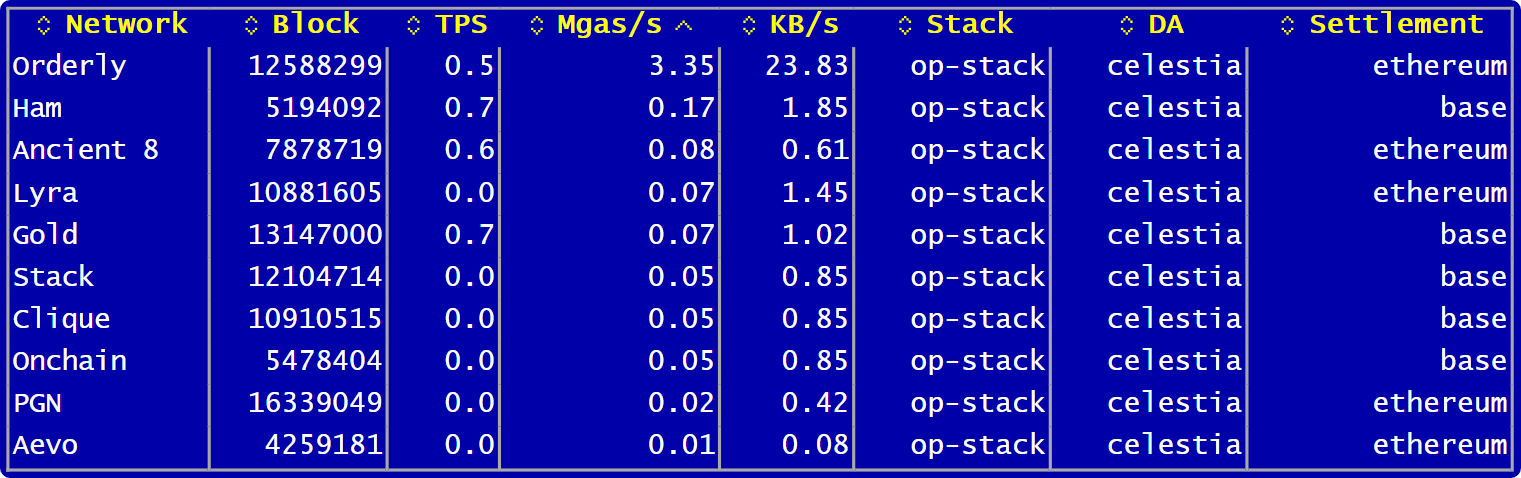

While the amount of L2s built atop Celestia today remains fairly small, the number is growing. Some projects in this early scene include:

- 💰 Aevo — a decentralized derivatives platform and L2 combo

- 🍖 Ham — a project centered around the TN100x token and social tipping

- 🪙 Gold — a Layer 3 (L3) built on Base for onchain gaming

- 📈 Lyra — an L2 for decentralized derivatives and spot trades

- 🌊 Orderly — an OP Stack chain centered around permissionless liquidity