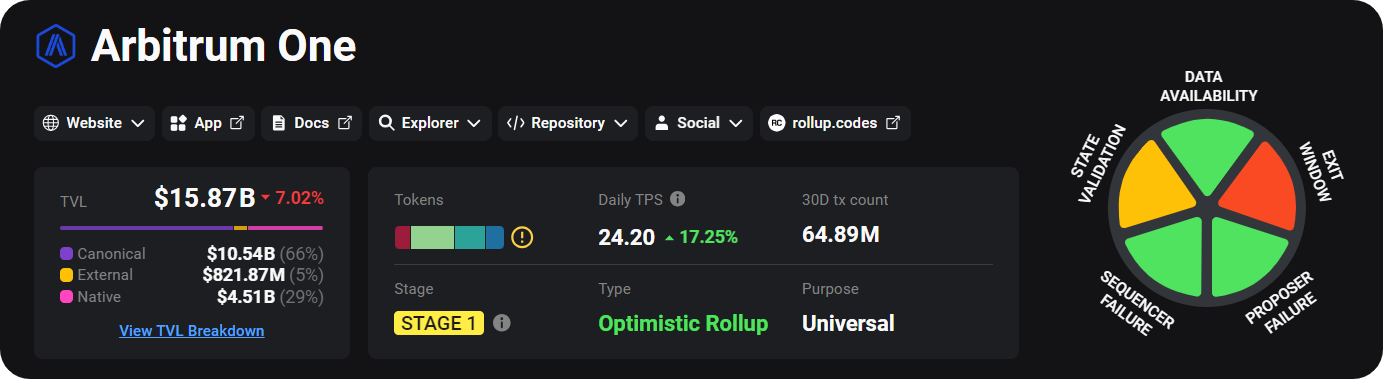

Arbitrum is a leading Layer 2 (L2) scaling solution and suite of technologies designed to enhance Ethereum's scalability and reduce transaction costs. Its main offering today, Arbitrum One, is currently the largest L2 with nearly $16 billion in total value locked (TVL).

Key takeaways

- Arbitrum is a suite of technologies designed to scale Ethereum, including Arbitrum One, Arbitrum Nitro, Arbitrum Nova, Arbitrum Orbit, and AnyTrust chains.

- At the heart of the Arbitrum suite is the optimistic rollup architecture, which reduces the load on Ethereum by processing transactions offchain and posting only batches of data onchain.

- Arbitrum offers trustless security by inheriting Ethereum's security and relying on a fraud-proof system.

What is Arbitrum?

Beyond the main Arbitrum rollup, the Arbitrum technology stack is founded on a handful of core pillars. These offerings include:

- Arbitrum Nitro: An upgraded version of Arbitrum's main rollup tech, Nitro enhances scalability and compatibility with Ethereum by using WebAssembly (WASM) for fraud proofs and incorporating Geth for better performance.

- Arbitrum Orbit: A framework for launching customizable L2 and Layer 3 (L3) chains, allowing developers to create their own scalable blockchains tailored to their specific needs.

- AnyTrust Chains: A framework for launching custom "optimium" chains that provide lower fees with a mild trust assumption, suitable for applications like games that require high throughput without full decentralization.

- Arbitrum Nova: A specialized gaming and social apps AnyTrust chain that offers low fees by using a Data Availability Committee (DAC) to manage its data needs offchain.

How does Arbitrum work?

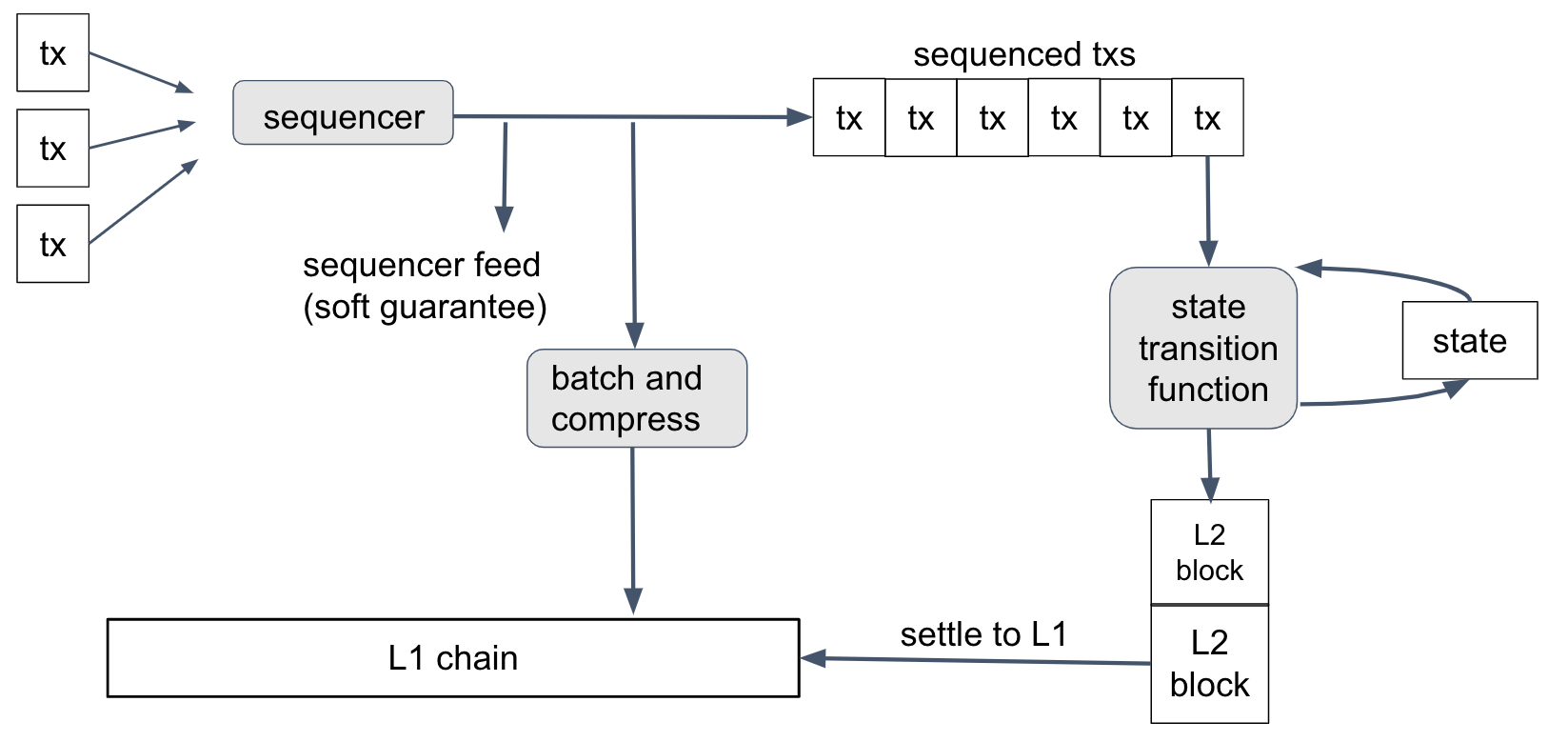

As an optimistic rollup, Arbitrum processes transactions offchain, meaning they are handled outside of the Ethereum mainnet.

These transactions are then periodically batched together and posted on Ethereum, significantly reducing the amount of data that needs to be processed, thereby lowering gas fees and increasing transaction speeds.

This system revolves around the Sequencer, a specialized component of the Arbitrum network responsible for collecting and ordering transactions offchain. The Sequencer provides near-instant transaction confirmations by immediately reflecting changes in the state of the L2.

Additionally, Arbitrum's security model relies on the principle of "optimistic" assumptions, where the network assumes that transactions are valid until proven otherwise. This is where the concept of fraud proofs comes into play.

In other words, validators on the network monitor the batched transactions submitted by the Sequencer. If a validator detects an invalid transaction within a batch, they can initiate a challenge using a fraud proof.

This process involves a dispute resolution protocol where the specific transaction in question is re-executed on the Ethereum mainnet to verify its validity. If the transaction is found to be fraudulent, the party that submitted it is penalized, and the correct state is restored.

Why Arbitrum?

What sets Arbitrum apart is the flexibility that its technology suite offers.

If developers require something more custom than the main battle-tested Arbitrum rollup, they have lots of design space to create their own bespoke networks via Arbitrum Orbit or AnyTrust chains.

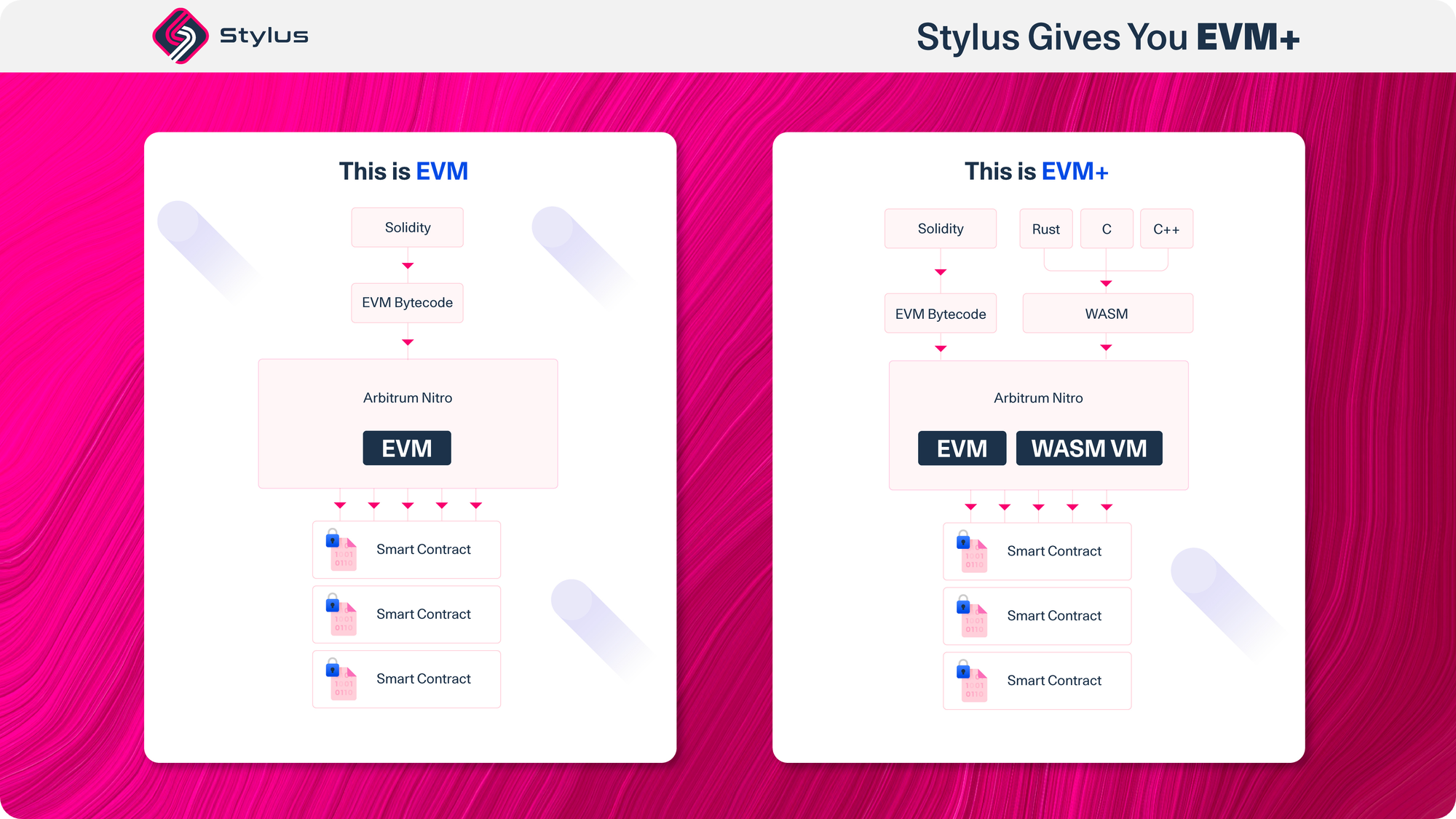

Also, the introduction of Stylus in Arbitrum Nitro is a major and compelling advancement. Stylus allows developers to write smart contracts in multiple programming languages, including Rust, C, and C++, by compiling them down to WebAssembly (WASM).

This flexibility opens up the ecosystem to a broader range of developers who may not be familiar with Solidity, Ethereum's native programming language.

Moreover, Stylus not only improves developer accessibility but also enhances the performance of smart contracts. WASM-based contracts execute faster and more efficiently than their Ethereum Virtual Machine (EVM) counterparts, offering significant gas savings and enabling more complex and resource-intensive applications to run on Arbitrum.

How to invest in Arbitrum?

The native token of the Arbitrum ecosystem is ARB. At the time of this guide's latest update, ARB was trading around $0.71 per token with a market capitalization of approximately $2.3 billion.

ARB can be purchased or sold on various cryptocurrency exchanges, including large centralized exchanges like Coinbase or Kraken as well as decentralized exchanges like Uniswap.

If you're interested in investing in Arbitrum, also keep in mind that ARB holders can participate in the governance of the Arbitrum network, influencing key decisions and future developments.

Top Arbitrum projects

The Arbitrum app ecosystem is among the most sprawling in the cryptoeconomy, boasting over 650 projects today. Some of the top apps to explore here include:

- 👻 Aave – a borrowing and lending protocol

- ⚔️ Camelot – a decentralized exchange catering to the Arbitrum ecosystem

- 🔄 Curve – one of DeFi's most popular automated market makers

- 🪙 GMX – a decentralized perpetuals exchange

- 🌉 LayerZero – an omnichain interoperability protocol

- 🎨 Prohibition – a generative art and NFT minting platform

- 🎮 Treasure – a hub for Arbitrum games

- 🌊 Yearn – a liquidity management protocol

Also, note a handful of custom chains have been deployed atop Arbitrum's tech stack to date, including Degen Chain, Proof of Play Apex, Rari Chain, Sanko, and Xai.