The 2024 Crypto Investing Narrative Glossary

The bull market is in full swing.

BTC struck a new all-time high above $70,000, ETH briefly tasted $4,000 again, and the total value of the crypto market cap has hit $2.5 trillion. History suggests that we’re just at the start of what promises to be an exciting period.

In a bull market, time is of the essence – every second counts. Ape first, research later is a mantra every degen follows.

During such times, when each piece of news can swing prices, projects often get hand-wavy with the use of buzzwords to latch onto a strong narrative.

This Bankless glossary is your cheat sheet to cut through the noise and decide if a project truly has substance. We hope it serves as a valuable resource for you as you research and pick your winners for this cycle.

Let’s dive in! 👇

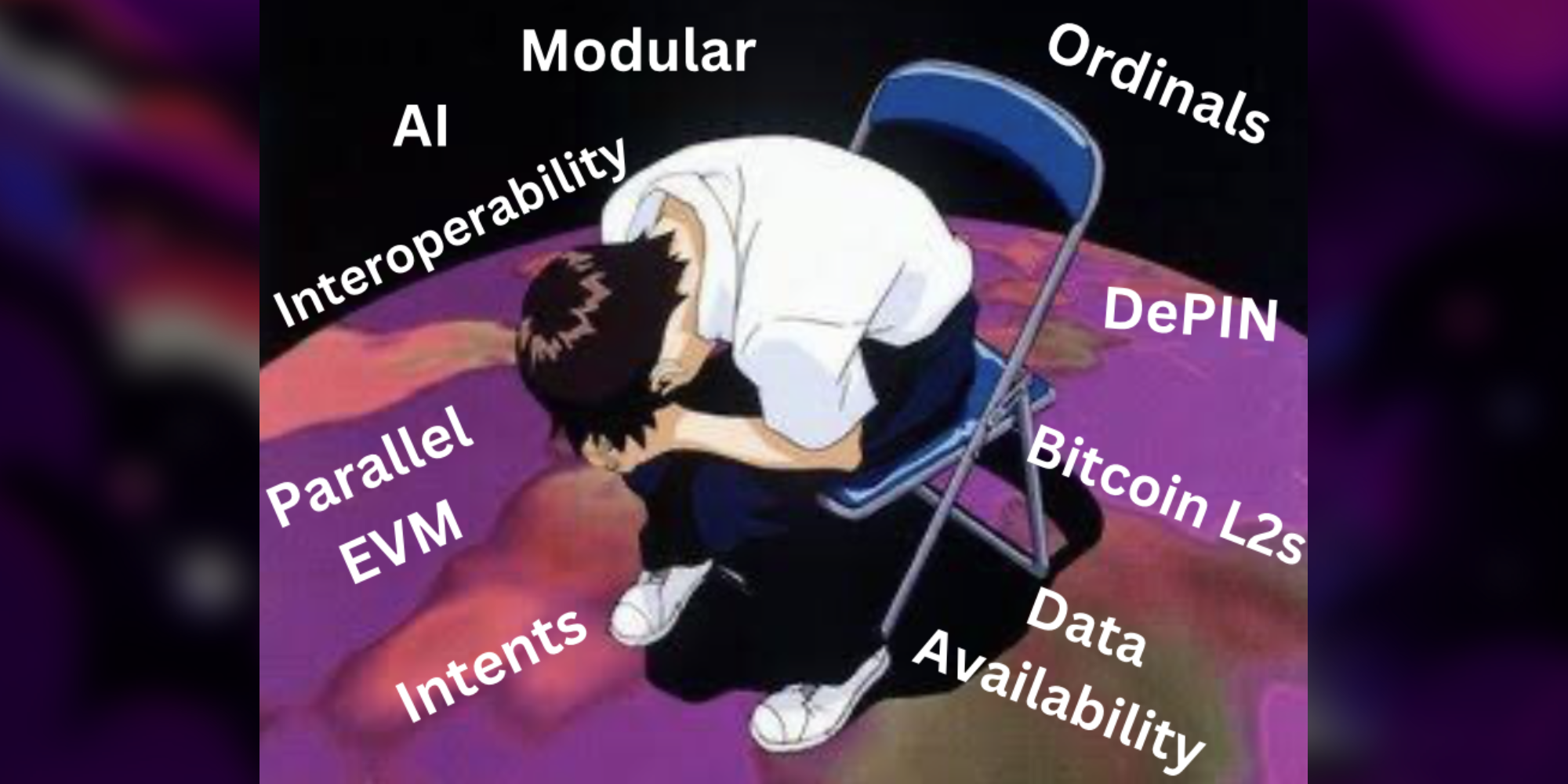

What are the hottest crypto investing narratives in 2024?

- 🤖 Decentralized AI

- ♻️ Restaking

- 🔶 Bitcoin L2s

- 🧱 Modularity

- 💿 Data Availability

- ⚙️ DePIN

- 1️⃣ Alt L1s

- 🗣️ Intents

- 🖇️ Interoperability

- 🟧 Ordinals

- 🛤️ Parallel EVMs

- 🏡 RWAs

🤖 Decentralized AI

Diving straight into the hot narrative of the moment, decentralized AI involves open-source AI systems that operate on a distributed network, such as a blockchain, rather than under the control of a single organization. This approach leverages the benefits of blockchain technology to democratize AI and make it more accessible and available to everyone.

Examples: Projects like Bittensor, Render, Grass, among others, create an open marketplace where individuals can train machine learning models, contribute computing resources, and share data. This creates a more inclusive and incentivized environment for AI innovation.

The Narrative: The general consensus is that the intersection of AI and crypto will be one of the main themes of this cycle as it’s likely the most easily understandable investment opportunity for the masses.

Recommended reads:

♻️ Restaking

Restaking is a strategy where investors leverage their already staked assets to earn additional rewards, effectively compounding their returns. This is done by using the staked assets on a secondary platform to participate in further staking opportunities.

Examples: EigenLayer is pioneering the restaking movement by enabling users to restake their ETH that is already staked with various liquid staking providers. The restaked ETH on EigenLayer is then employed within its security framework, which aims to extend the security guarantees of Ethereum to other applications and blockchains.

Narrative: Restaking promises to be one of the biggest narratives of 2024, with over $11 billion already restaked on EigenLayer, positioning it as the second-largest application by TVL in crypto. There’s a whole ecosystem of apps being designed on and around restaking on EigenLayer, and this growth is expected to continue.

Recommended reads:

🔶 Bitcoin L2s

Bitcoin Layer 2 solutions (Bitcoin L2s) are networks or protocols built on top of the Bitcoin blockchain (L1). They are designed to scale the Bitcoin network by processing transactions off-chain (outside the Bitcoin blockchain) while inheriting its security and benefitting from its network effects.

Examples: Lightning network, Stacks, and BitVM are popular Bitcoin L2s.

Narrative: Bitcoin L2s have the potential to follow in the footsteps of Ethereum's Layer 2 success, unlocking some of the capital sitting idle on Bitcoin. This could drive broader adoption and funnel value into the Bitcoin ecosystem.

Recommended reads:

🧱 Modularity

Modular refers to a design approach to building blockchains and applications in crypto where the system is built with separate specialized components or modules. This design philosophy aims to enhance the efficiency and scalability of the technology stack by isolating the functions of each module from the rest.

Examples: In blockchain development, modularity typically involves dividing the architecture into three primary layers: execution, settlement, and data availability. By doing so, the goal is to make blockchains cheaper and more scalable through specialization.

Different projects specialize in different parts of the stack. The term was popularized mainly by Celestia, which focuses on the data availability aspect of the stack, whereas Ethereum is recognized for its robust settlement layer, and Solana is acclaimed for its execution capabilities.

Narrative: One of the most prominent narratives surrounding modularity is the concept of 'Modular Money'; with Celestia at the forefront of the modular blockchain movement. This narrative combines several of the others mentioned in this list such as the Alt L1 narrative and the DA layer, among others.

Recommended reads:

💿 Data Availability

Data availability (DA) is the guarantee that all the data necessary for verifying transactions on a blockchain is accessible to anyone who requires it.

This is crucial for validating transactions and maintaining the transparency and security of a chain, as this data can be used by anyone to reconstruct the entire state of the chain if needed.

Examples: Traditionally, rollups have relied on Ethereum to meet their data availability requirements. However, with the introduction of more cost-effective options like Celestia, EigenDA, and Avail, we are witnessing a shift as projects begin to embrace these new platforms for their data availability needs.

Narrative: DA Layers offer a fundamentally new way of scaling blockchains and will become the hub for chains to publish their data.

Recommended reads:

⚙️ DePIN

Decentralized Physical Infrastructure Networks (DePIN) are systems that manage and coordinate real-world physical infrastructure through a decentralized network built on top of blockchain technology.

DePIN aims to improve efficiency and reduce the costs of the infrastructure by distributing control and ownership across individuals who are incentivized to participate in the network.

Examples: Helium has gained recognition as a DePIN initiative, creating a decentralized wireless network that rewards individuals for contributing coverage with Helium Network devices. Other notable DePIN projects include Hivemapper, which focuses on a global mapping network, and Filecoin, which provides decentralized file storage solutions.

Narrative: DePIN represents a genuine real-world use case of crypto and blockchain technology. The synergy with emerging trends, such as the integration of crypto with AI, further bolsters DePIN's relevance. The rise of AI agents is likely to increase demand for the resources that DePIN projects can deliver efficiently and cost-effectively.

Recommended reads:

1️⃣ Alt L1s

An alternative layer 1 (alt L1) is a blockchain that positions itself as a competitor to the dominant blockchain. These blockchains are designed to address the limitations of established blockchains by adopting different technical approaches to optimize for unique features.

Examples: During the last bull run, Solana and Avalanche emerged as notable Alt L1s, challenging Ethereum's dominance as the market leader. Solana focused on high throughput, scalability, and low transaction costs, while Ethereum maintained its emphasis on security and decentralization.

Narrative: The Alt L1 trade was the defining theme of the previous cycle, with Solana, Terra, and Avalanche (often grouped as 'SolLunaAvax') at the forefront. The general consensus is that the Alt L1 trade never dies and will remain a key theme in every cycle.

For the current bull market, Solana remains a favorite ,while we also have newcomers such as Celestia gaining traction. The shorthand 'Solestia' has become a buzzword on crypto Twitter to represent this cycle's Alt L1 narrative.

Recommended reads:

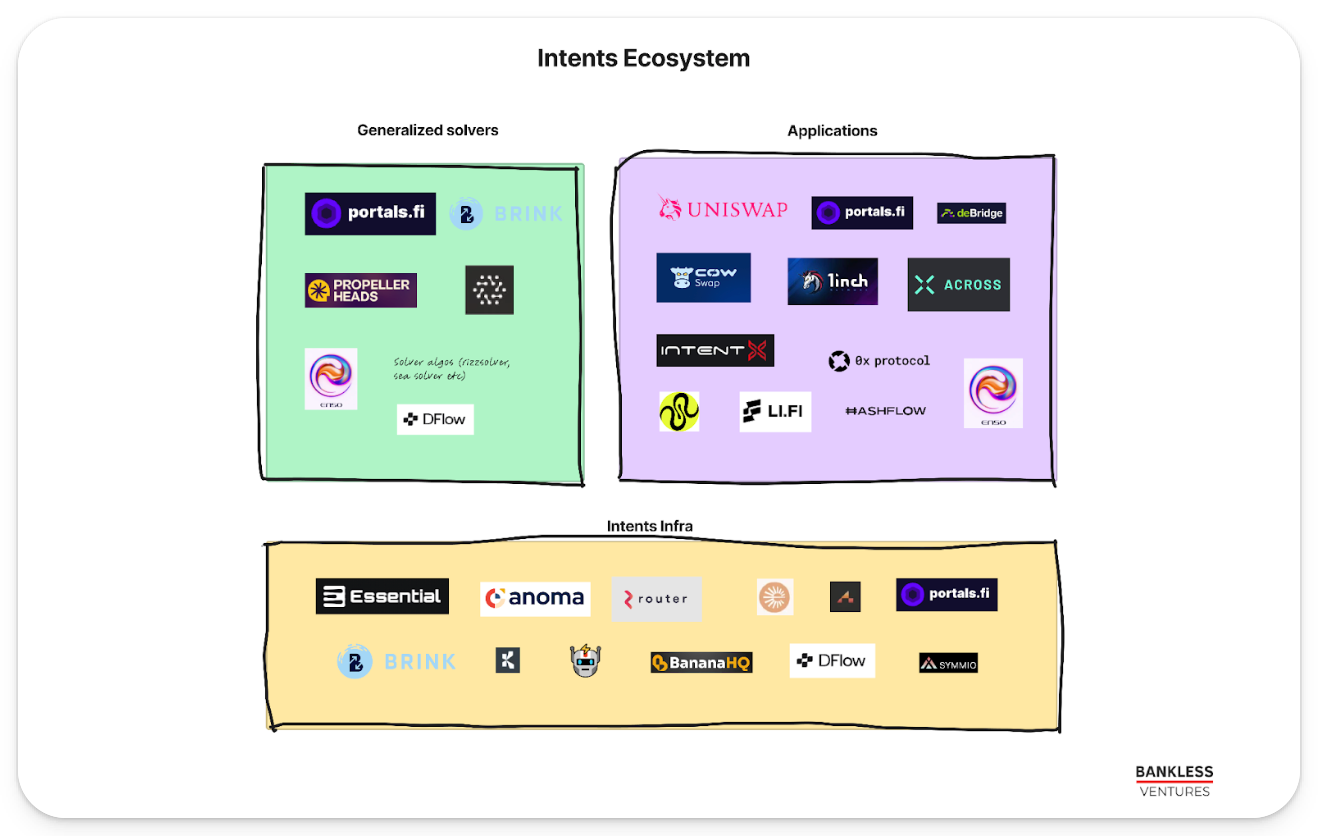

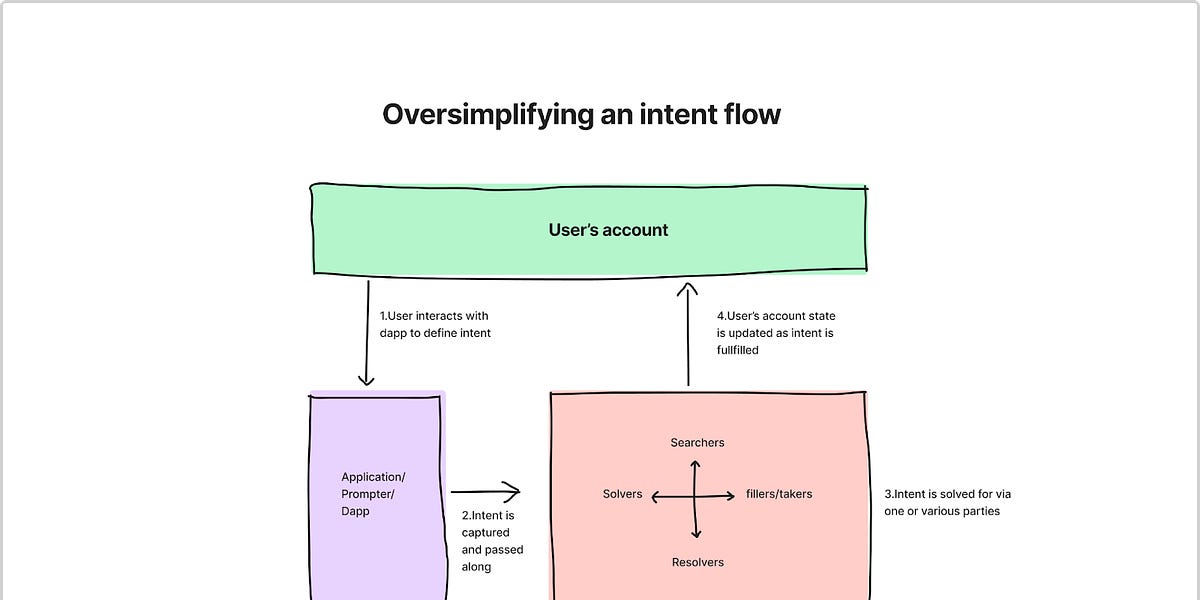

🗣️ Intents

Intents in the context of blockchain refer to the outcomes or end-states users aim to achieve onchain (e.g., executing a trade, lending assets). Rather than users directly executing these actions, the actual implementation is delegated to third-party agents. These agents often compete in an auction-like environment to earn the right to fulfill the user's intent in the most efficient way possible.

Examples: The DeFi ecosystem hosts a variety of intent-driven projects including infra protocols like Anoma, Suave, Essential, apps like Cowswap, Across, and third-party agents like Propellerheads, Barter, among others.

Narrative: Intent-focused protocols are at the vanguard of DeFi, generating billions in order flow. They present a significant opportunity to capture value through fees, MEV, etc. These projects also have the potential to greatly enhance the DeFi user experience, serving as a layer of abstraction that simplifies interactions within an increasingly complex, multi-chain ecosystem.

Recommended reads: The Evolving Research Around Intents

🖇️ Interoperability

Interoperability refers to the ability of different blockchains to communicate and exchange data and assets seamlessly among one another. This functionality unlocks the ability for users to move their assets across chains and for applications to operate on multiple chains.

Examples: Projects like LayerZero, Axelar, and Wormhole are focused on facilitating the transfer of data between chains. Apps like Across, Stargate, and Connext focus on the transfer of assets. Additionally, liquidity aggregators like LI.FI also exist. [Disclosure! I work in research at LI.FI]

Narrative: The multi-chain thesis is playing out in real-time. Today, there are many different chains with billions in value locked across their DeFi ecosystems, serving millions of users. There’s an evident need for data and value to be moved across these chains, and this will only increase as the number of chains increases. The projects that facilitate this exchange of data and value between chains are valuable rails for the multi-chain ecosystem.

Recommended reads:

🟧 Ordinals

Ordinals are a technique for inscribing arbitrary data directly onto individual satoshis, the smallest denomination of bitcoin (1 bitcoin = 100,000,000 satoshis). These inscriptions, often referred to as 'Bitcoin NFTs' by the public, enable the creation of unique digital assets on the Bitcoin blockchain. They can also be utilized for minting BRC-20 tokens under the experimental BRC-20 standard.

Examples: Bitcoin NFT collections such as NodeMonkes, Quantum Cats, and Bitcoin Puppets are notable instances of Ordinals. These can be traded on platforms like OKX’s Ordinals Market and Magic Eden. The leading BRC-20 tokens by market capitalization include ORDI, SATS, and MUBI.

Narrative: NFTs have become some of the most sought-after and valuable assets in crypto. Bitcoin holders now have the opportunity to expand their investments into new Bitcoin-based applications like NFTs and BRC-20 tokens, presenting a potentially significant opportunity.

Recommended reads:

🛤️ Parallel EVMs

Parallel EVM is an innovative blockchain architecture designed to overcome the scalability challenges faced by the standard EVM. It achieves this by executing transactions in parallel — processing multiple, independent transactions simultaneously rather than sequentially — thereby increasing throughput and improving user experience.

Imagine a trading platform on Ethereum where each transaction is processed one after the other. In contrast, a Parallel EVM would allow for trades that are independent of one another to be executed concurrently, significantly accelerating transaction processing times.

Examples: Projects like Monad and Sei are leading the way in parallel EVM development. Other notable projects, such as BNB Chain and Scroll, have also included parallel EVM capabilities in their future plans.

Narrative: The Parallel EVM sector is particularly promising as it capitalizes on the established network effects and developer ecosystem of the EVM while also incorporating the parallel processing techniques that have contributed to Solana's rapid execution speeds. By offering a hybrid of EVM compatibility and high-speed transaction processing, these platforms have tremendous potential.

Recommended reads:

🏡 RWAs

RWAs, or Real-World Assets, encompass a broad range of tangible and intangible assets such as gold, real estate, commodities, equities, and fiat currencies like the US dollar, whose intrinsic value exists outside the blockchain ecosystem. The tokenization of these assets brings them onto the blockchain, offering innovative ways for them to be traded, managed, and valued.

Examples: The best examples of tokenized real-world assets are stablecoins like USDC and USDT which represent the US dollar onchain. While stablecoins are a basic application of RWAs, there are numerous projects like Ondo, Parcl, and Mattereum that are extending the concept to a variety of assets, including real estate, treasury bills, gold, art, and more.

Narrative: RWA protocols have the potential to tokenize virtually any asset in the world and bring it onto the blockchain, tapping into a total addressable market worth hundreds of trillions of dollars. As more asset classes are tokenized, the scope of the RWA narrative is expected to expand significantly.

Recommended reads: