Dear Crypto Natives,

It’s Tactics Tuesday! Every Tuesday I’ll release one tactic to help you level up. Some weeks the tactic will be useful immediately. Sometimes it’ll come in handy down the road.

This week you’ll learn how to open a self-directed retirement account to tax shelter your crypto. Stay tuned to the end—there’s an offer you won’t find anywhere else.

On Thursday I’ll send you the weekly thought-piece.

- RSA

Non-US readers: focus is IRAs but you can apply the principles if a self-directed retirement structure is available in your country. In Canada? Check out the self-directed rrsp.

Tactic #1:

Open a self-directed retirement account

If you live in the US you can use tax-sheltered money in your IRAs to invest in crypto. But first you have to break it out of brokerage jail. I’ll show you how.

- Goal: Tax shelter your crypto in an IRA

- Effort: 5-10 hours

- ROI: $300 costs to yield 15 to 37% savings on crypto gains

No good options in your brokerage

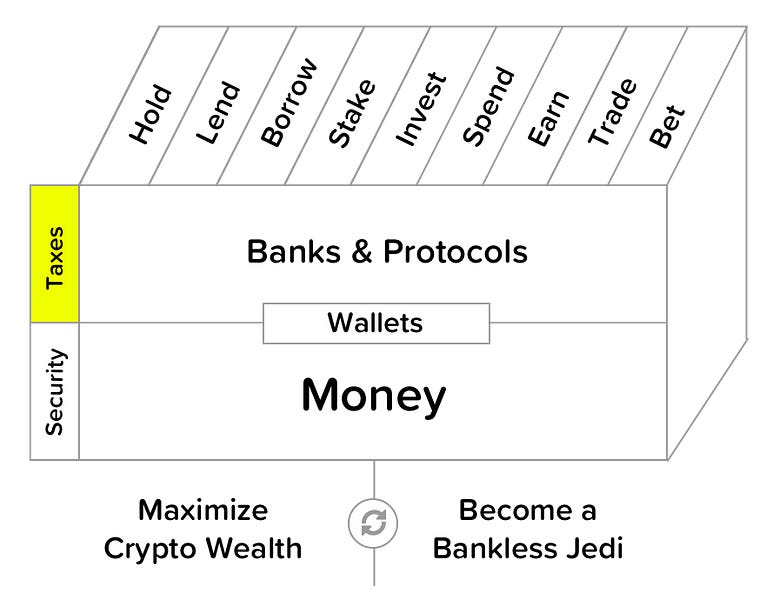

In the US all gains on crypto are taxed as capital gains. Even crypto-to-crypto trades. But taxes on gains inside an IRA are deferred. Or in the case of a Roth IRA, they are never incurred! This opens up some interesting possibilities for an asset class like crypto with high upside—you want the lowest taxes on your biggest gains.

Unfortunately, there aren’t good ways to get access to crypto assets in your retirement accounts. Crypto ETFs do not exist. So if you have your IRA inside a brokerage like Fidelity, your funds are locked down. Your only option is trust products like GBTC or ETHE from Greyscale.

Three problems with trust products:

- Management fees high—2%

- Overpriced vs spot—ETHE trades 3x vs ETH price on Coinbase

- Trapped in your brokerage—no staking, no open finance, no self-custody

This last point won’t be solved by an ETF either. All legacy products are trapped in the prison of the legacy options allowed in your brokerage accounts.

Or are they?

Not for the bankless army.

Breaking your IRA out of jail

I recently discovered a way to break my IRA out of brokerage jail: it’s called the Self-Directed IRA. More importantly, I found a way to do it painlessly. More on that soon.

Here’s how it works:

- You have an IRA—Roth, Traditional—whatever (Solo 401Ks work too)

- You find a Self-Directed Custodian to help you setup your Self-Directed IRA

- Custodian sets up an IRA LLC to own the IRA and a bank account in LLCs name

- You have checkbook control on this new bank account owned by IRA LLC

- You transfer IRA funds from your brokerage to bank account

- You wire the IRA funds from the bank account to a crypto exchange & buy crypto

The crypto you bought is now owned by [your IRA] LLC. This means the crypto is tax sheltered within the structure of the IRA. If it’s in a traditional IRA, taxes on future gains are deferred until you take them out. If it’s a ROTH IRA, taxes on future gains are never owed.

Think through the implications of this!

Tax sheltered crypto

Let’s assume you did this with a ROTH IRA. Maybe you bought ETH for your IRA. What could this mean?

- No need to track capital gains/losses on the transactions in this account

- Any ETH staking income earned is never taxable

- Any interest earned on the lending of the ETH is tax free

Magic!

And you could get more creative. Maybe the ETH appreciates 4x, you think the market is overheating so you decide to sell it for DAI and lend the DAI out for 8% interest until the market cools down. No taxes on the ETH to DAI trade! The interest income on DAI lending isn’t even taxable! As long as the crypto remains the property of your IRA entity it’s tax-sheltered.

Other ideas:

- Buy BTC & lend it out on BlockFi for tax-free interest (6.2% right now)

- Buy ETH and deposit it in the SET20DAYMACO (beats an ETH hold strategy)

- Buy USDC and lend it in Compound (6.3% with lower risk)

Or just stick it on Ledger and hold. It’s your tax-sheltered crypto. You decide.

Note: Run your ideas by a crypto-friendly CPA

This is not tax advice. You should talk to a crypto friendly accountant who can vet these ideas and others you come up with. But the Self-Directed IRA structure is nothing new. This structure has long been used by individuals as a way to invest their funds in assets based on their own research and beliefs, not just what is available in a brokerage.

Also, I’m sure your accountant can provide guidance around non-blending of funds. Everything you do with you IRA crypto should be separated as much as possible from all other non-IRA accounts and all other non-IRA crypto assets.

I would:

- Open a separate crypto exchange account in the name of your IRA LLC

- Keep all IRA LLC crypto account activity in separate ETH/BTC addresses

I would not:

- Blend your IRA LLC crypto with any other crypto exchange account

- Co-mingle your IRA LLC crypto with in a ETH/BTC address

If you use a hardware wallet, you may even want a maintain a separate one for these tax-sheltered transactions. Again, talk to your accountant!

The easy button

Since this is Tactics Tuesday let’s get back to the How.

I did the research to find the easy button for us.

It turns out, the hardest part about creating a self-directed IRA is coordinating all the transfers, setup, and paperwork involved. You could do it all yourself. But wouldn’t you rather be spending your time in open finance instead of mired in the world of faxes, phone calls, and paperwork? (Closed finance sucks)

A Self-Directed Custodian can make work easy. After testing a few of these, I recommend RocketDollar. These guys are the easy button.

Self-Directed crypto IRA in a box

RocketDollar is a Self-Directed Custodian for self-directed retirement funds. And they’re crypto friendly. They setup the LLC and bank account for you. They pre-fill all the faxes and paperwork for funds transfers from your brokerages. They guide you through process. And they have real live humans to help if you get stuck.

I know this because I recently used them to break an IRA out of brokerage jail.

Some things you should know about the process:

- The information here was helpful

- It takes a while to transfer funds from brokerages—plan for 3-6 weeks

- Brokerages can be a pain to work with—one charged me exit fees

- It may take some finagling to get your a crypto exchange to open an account in the name of your IRA LLC—RocketDollar has a relationship with Gemini so it’s pretty seamless if you use them

- Fees for RocketDollar are $360 + $15 per month—this covers the LLC and bank account too, there were no surprise fees

ALTERNATIVES: If you want alternatives to RocketDollar check out IRA Financial Group. You can also look at Bitcoin IRA for a custodial crypto IRA alternative.

Notes on these alternatives:

- Custodial crypto accounts like Bitcoin IRA didn’t meet my needs because the crypto is locked inside their custody platform. Also setup and ongoing fees are expensive! Some people may like their insurance guarantees, but I wanted an account with Checkbook Control to go fully bankless

- IRA Financial does provide checkbook control like RocketDollar so you can do what you want with your crypto, however I found them more expensive and less streamlined.

Final words

The Self-Directed retirement account is a killer tool in the bankless toolkit—unparalleled flexibility to do what you want with your crypto in tax-advantaged format. Of course, this article assumes you’re transferring an existing retirement account, but you can also start from scratch too. That’s even easier.

Before getting started, make sure you refresh yourself on the contribution limitations and other rules associated with IRAs and Solo 401ks. And obviously talk to your financial advisor.

Be prudent. Don’t invest retirement funds you can’t afford to lose. Power tools like these highly effective, but you can also lose limbs.

Action steps

- Refresh yourself on IRA and Solo 401k rules to see how they apply

- Determine if a self-directed account generates an ROI for your circumstances

- Open up an account and transfer funds using RocketDollar or a TPA you trust