Surviving The Crab Market 🦀

Dear Bankless Nation,

Did the recent drawdown hurt a bit?

No one really likes when numba go down. The euphoria of “up only” is gone and the whole market goes sober.

We’re in the crab market now: choppy, sideways moves, just crabbing along. 🦀

But these market conditions present opportunity. During these times we put our heads down and get to work.

This is the time to start building. It’s the time to really dig into what you’re investing in and build your conviction around it. That’s the only way you’ll succeed on a multi-year timeframe.

With that in mind, there’s two things that you need to be aware of while we’re in these market conditions:

- Some things will go to zero (which leads us to #2)

- There are lemons and peaches. It’s up to you to figure which one is which.

Hint: you want peaches. 🍑

Today, Eugene walks through these insights, some of the learnings he’s had being a traditional investor in emerging markets, and some key lessons to learn from on how to capitalize on the opportunity at hand.

This is a new paradigm in value and ownership. The number may have changed, but the fundamentals haven’t. Keep your eyes on the prize.

Here’s how to survive and thrive in the crab market.

- RSA

Eyes On The Prize: Surviving the Crab Market

As investors who have cut our teeth in the world of Emerging Market equities, we have looked at crypto over the past few years with great excitement.

We know very well the difference between a market price and what is actually happening on the ground. The key to successful investing is knowing that difference. As historical stock investors, we have a saying we use in our business all the time: We invest in stocks not companies.

In this piece we dig a little to understand how this can be applied to the enormous opportunity that is crypto. The parallels to investing in the emerging markets of old are stark: there is potential everywhere, in bucketloads, and every founder can spin a fantastic story of how their particular project is going to revolutionize the world—the broader narrative of potential growth enables it.

Discerning the difference between a potential winner and a potential zero (and there will be many of them) is a challenge in the best of times, stocks and crypto alike, as a result of the asymmetry of information between founders, investors and the broader communities around these projects.

But in crypto, that challenge is compounded by the fact that we are still so early in crypto’s life cycle: some of the winners of the future may not even have been invented, much less thought of; while the winners of today may well fade into obscurity in the years to come.

That said, our message is one of encouragement and motivation, especially when we find ourselves in range-bound, choppy 🦀 markets: volatility is par for the course, but given how early stage crypto is, fundamentals will show themselves in asset prices as dispersion, where the good is separated from the bad. On one hand, there has been immense progress in what crypto can do, especially in the realm of DeFi, and we must not let volatility and market dislocations distract us from that fact.

On the other hand, there is also large amounts of worthless debris that has been dredged up by the rising tide, capitalizing on the hype cycle, which could well head back down towards zero as the tide goes out. Maintaining a healthy skepticism against one’s incumbent opinions, acknowledging that one may be wrong, allows us to re-examine our convictions and evolve with the market. And if after close scrutiny and open criticism we remain convinced that our views were right, all the better for conviction.

Just as it wasn’t the case that every “Emerging Market” upstart ended up becoming a resounding success, so it is also true here in crypto that no amount of big-picture potential will make those challenges disappear.

Survival in markets is not an entitlement, no matter how strong the big-picture narrative—just ask the legions of .com boom investors who never saw their money again. Avoiding losses is as important as making gains, if not more important. The unadulterated bull market of “numba go up” may not persist, but the good news is that for those who put in the work, there remains potential for manifold returns.

Crypto offers those who put in the effort to learn, examine and take sensible risks a generational opportunity to make exponential wealth. It is more open and accessible than any traditional equity investment, with founders interacting directly with their communities and on-chain metric transparency as standard. No investment banks are around to build restrictions on information access because those barriers can’t exist in an on-chain world, and you, Bankless Nation, are miles ahead of the average big institutional investor when it comes to crypto.

The institutions will have to buy from you—let that thought sink in for a moment.

So let’s keep our eyes on the prize and get down to work.

The Fundamentals Haven’t Changed

The birth of Decentralized Finance (DeFi) and the potential it has to improve (or in some cases, supplant) the offering of traditional banking services all around the world, in developed and developing economies alike, is profound.

We attended our first DeFi conference at Imperial College in London in 2019 out of pure curiosity. And we realised we had stumbled upon something special. “Mind blown” is an understatement, although even at that time, it wasn’t yet clear how anyone would make any money out of anything.

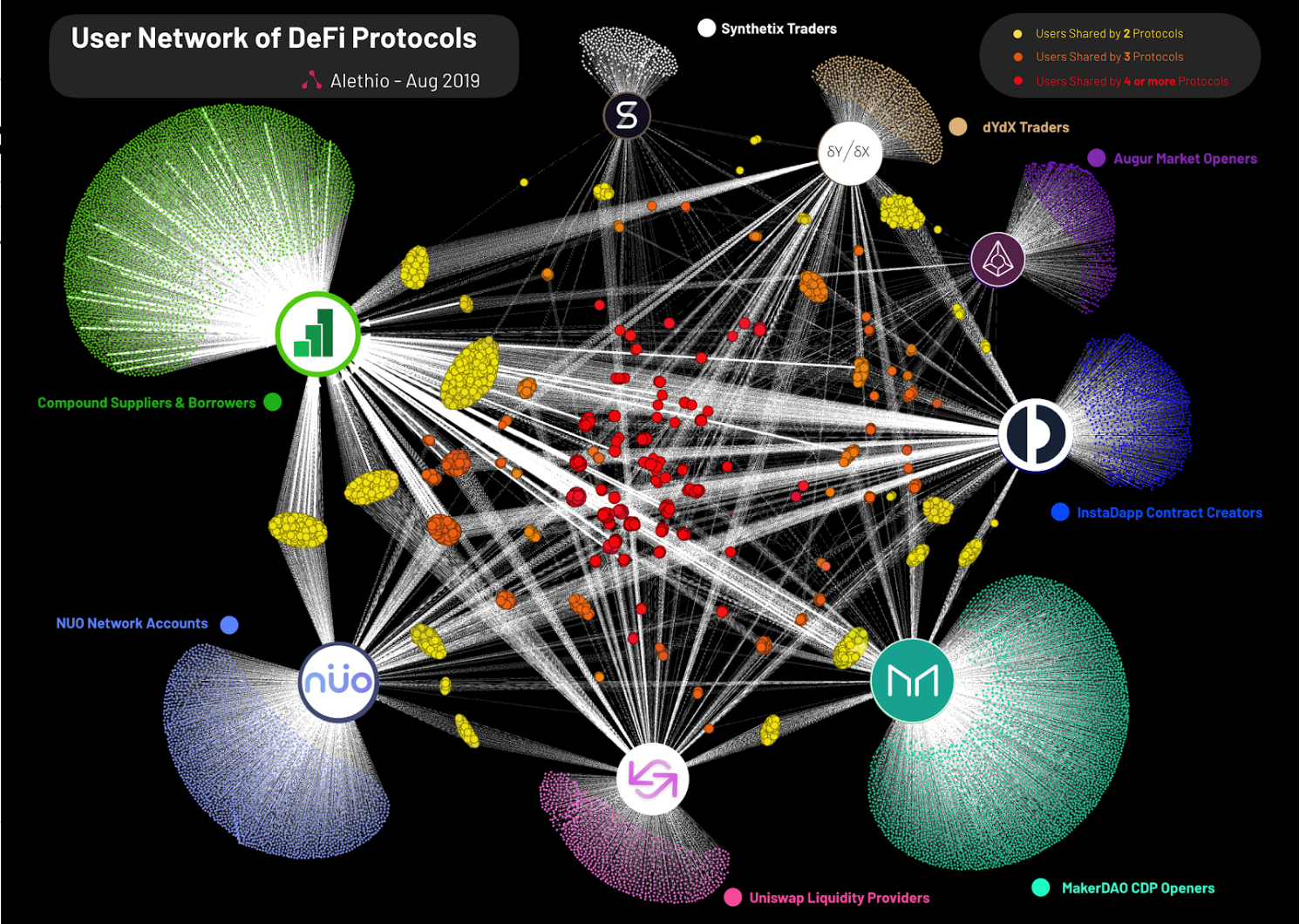

But one thing struck us: the sheer number of smart young people who have dedicated their time and resources to developing a permissionless banking system based purely on code, free from interfering third-party middlemen, is almost a statistical guarantee to produce some brilliant, creative outcomes. And fascinatingly the mindset was one of cooperation with each other and not competition as we see elsewhere.

Two years on, price volatility aside, the crypto community—and in particular the projects in DeFi—have much to be proud of. From decentralized loans to yield aggregators to automatic market makers, the degree of innovation has been astounding.

On the flipside, crypto is highly public. It is a market that has no barriers to entry. The tides of liquidity that have come into the system, coupled with the hype machine of Twitter, memes, YouTube, TikTok and everything else in between, have turned the market into the wild west: no safeguards, no regulations and an all-round free for all.

It is ripe for manipulation by anyone who is capable.

No wonder then that when numba go up, it really goes up; and when numba go down…ouch

As a team, we’ve been long-time consumers of the content coming from Bankless, which have helped us to gain valuable understanding of the many developments in the DeFi space by allowing us to learn the perspectives of the movers and shakers in the space. Understanding these perspectives and ideals helps us to put the developments and thought processes of founders into context and make sense of the decisions that are being made in real time, in an industry that is developing and maturing at lightning speed.

So having been given the opportunity by the BanklessHQ team to contribute, we thought we’d return the favour and share our perspective: the view from “the outside”.

Insight #1: Some stuff will go to zero

First, the bad news. There are going to be MANY zeroes.

As we’ve written before on our own blog, dispersion is coming. While there are a handful of brilliantly innovative DeFi protocols that have grown their businesses over the past few years—the likes of AAVE, Maker, Uniswap, Curve, Yearn and Synthetix, to name a few—there are also many others that are likely doomed to obsolescence.

There isn’t anything wrong with this—this is EXACTLY how it should work, a brutal process of creative destruction where only the best projects survive. It’s DeFi Darwinism. Lots of experimentation, some of them succeed and most of them do not, and none of them are entitled to survive. Think first generation Layer 1 chains, which have been promising (and continue to only promise, not so much deliver), as well as tokens that take jokes a little bit too far—we won’t name names, but we all have a pretty clear idea of which we’re thinking of.

The typical imagery of dispersion is that of “separating the wheat from the chaff”. Ideally that would be the most comfortable resolution to a market, since the bad projects are simply shaken off, while the good projects remain. A bit of a tumble here and there, but nothing too drastic.

Unfortunately, this isn’t the case. Whether a function of narrative, market structure, participant makeup or any combination of the three, at this early stage of crypto, correlations are high. The common narrative of “Bitcoin is the biggest crypto and everything else is same-same but different from it” leads to a situation where the fate of the entire market rests on the sentiment around Bitcoin.

That is starting to change, but only marginally. Each bear cycle sees a cleansing and the next bull run tends to see new ideas and projects gaining real traction which lead it apart from the already established ones.

Separating good from bad in crypto is more akin to refining gold in fire. Everything gets melted down, but the impurities get incinerated, leaving the good stuff behind. Trial by fire isn’t pleasant, but it’s the only way to disentangle instruments that are so inextricably intertwined.

Many tokens represent nothing more than ideas, and the same can be said of some stocks. And whatever the asset type may be, reality always catches up: if it’s worth zero, it’s heading to zero, one way or another.

This is especially true if the only reason something has value is because the price is going up. Sounds familiar? No surprise that crypto gets a bad reputation as a “casino”.

We all have a part to play in shaking off that image.

As we alluded to earlier, for better or for worse (we think for better), most projects trade publicly 24/7 and sometimes we can lose sight of the fact that there is a very much non-linear relationship between a project’s fundamental progress and its publicly traded price. Just like stocks, but even more so. As crypto lacks institutional participation to any large degree, the stickiness of money is low—generally speaking.

What about “HODLers”, you may ask? The fact that people have to be told to HODL itself implies that making a decision to hold isn’t self-evident. Same for “diamond hands 💎🤲”—the fact that anyone needs to be reminded suggests that contrary to what the memes represent, capital is NOT sticky.

Why? Because at the back of their heads, there’s that niggling doubt that says, “what if this is all a zero-value ponzi?” That sliver of doubt recedes in a bull market, but comes back with a vengeance once “up only” ends, and the reason it exists is because of all the shilling and quick-money promises that goes on—no one’s really sure if they’ve been sold a dud.

Of course, there are the maximalists who have ideologically thrown their lot in with their favorite projects, resolved to NEVER sell—sometimes it pays off (e.g. Bitcoin or Ether), other times it doesn’t (e.g. Bitconnect).

Who knows if they really have diamond hands?

Survivorship bias is huge—remember that almost no one ever tells people about the tokens they HODL to zero.

Insight #2: 🍋 vs. 🍑 and market structure

One of our favorite pieces of economic theory is colloquially known as the “Theory of Lemons”. The long form of the paper’s title is “The Market for Lemons: Quality Uncertainty and the Market Mechanism”, authored by George Akerlof, winner of the 2001 Nobel Memorial Prize in Economic Sciences (shared with Michael Spence and Joseph Stiglitz).

Less well-known is the fact that his wife is none other than former Fed chair and current Treasury Secretary, Janet Yellen. Brainy couple.

The Theory of Lemons lays out a story of information asymmetry: a buyer goes to a marketplace for used cars, in which there are two types of used cars. Good used cars (peaches) and bad used cars (lemons) are both on offer, but the buyer can’t tell the nature of a car just by looking. He relies on a used car salesman to pitch the cars on offer. However, while the clueless buyer wants to look for a good car (a peach), the used car salesman wants to sell bad cars (lemons) for the price of a good car.

Is this starting to sound familiar?

Most importantly, the buyer knows that the salesman is incentivized in this way. So, what happens? In short, the buyer needs a car, but isn’t sure if the salesman is shilling trash. As a result, he has to assume that all cars are lemons, and bid accordingly. Bad news for the peaches, but thanks to the selfish motives of the salesmen, everything’s a lemon now.

The same can be said of the state of the crypto market. There are MANY lemons and very few peaches, but because of the plethora of used car salesmen around, anyone who lacks access to that asymmetric information and is unable to discern lemon from peach, dabbling in the market because it was “up only”, would shoot first and ask later.

Lemons and peaches alike.

It was programmed, and that is exactly what we’re getting now.

Whenever we look at a market the most important thing for us to understand is market structure.

Once you understand who you are playing against you can build a mental model of how these various participants tend to behave under different circumstances. Clearly an investor in meme coins is different to an investor in DeFi and an investor in Bitcoin these days has a completely different profile to an investor in Bitcoin even a year ago, nevermind a year before that. Furthermore, different investor types have different extents of knowledge, understanding and hence conviction.

It is absolutely imperative to understand this—if you know, you know.

Flow drives markets over the short and long term. What anyone who believes in the structural bull case for crypto wants is to get long term, sticky money into projects that fundamentally warrant the capital. This dampens volatility over time and also improves the incentive for projects to do things properly.

Build useful things, rather than chase a bull market to sell into—eyes on you, the likes of Shiba-Inu coin. 👀🐕

DeFi Has Caught the World’s Eye

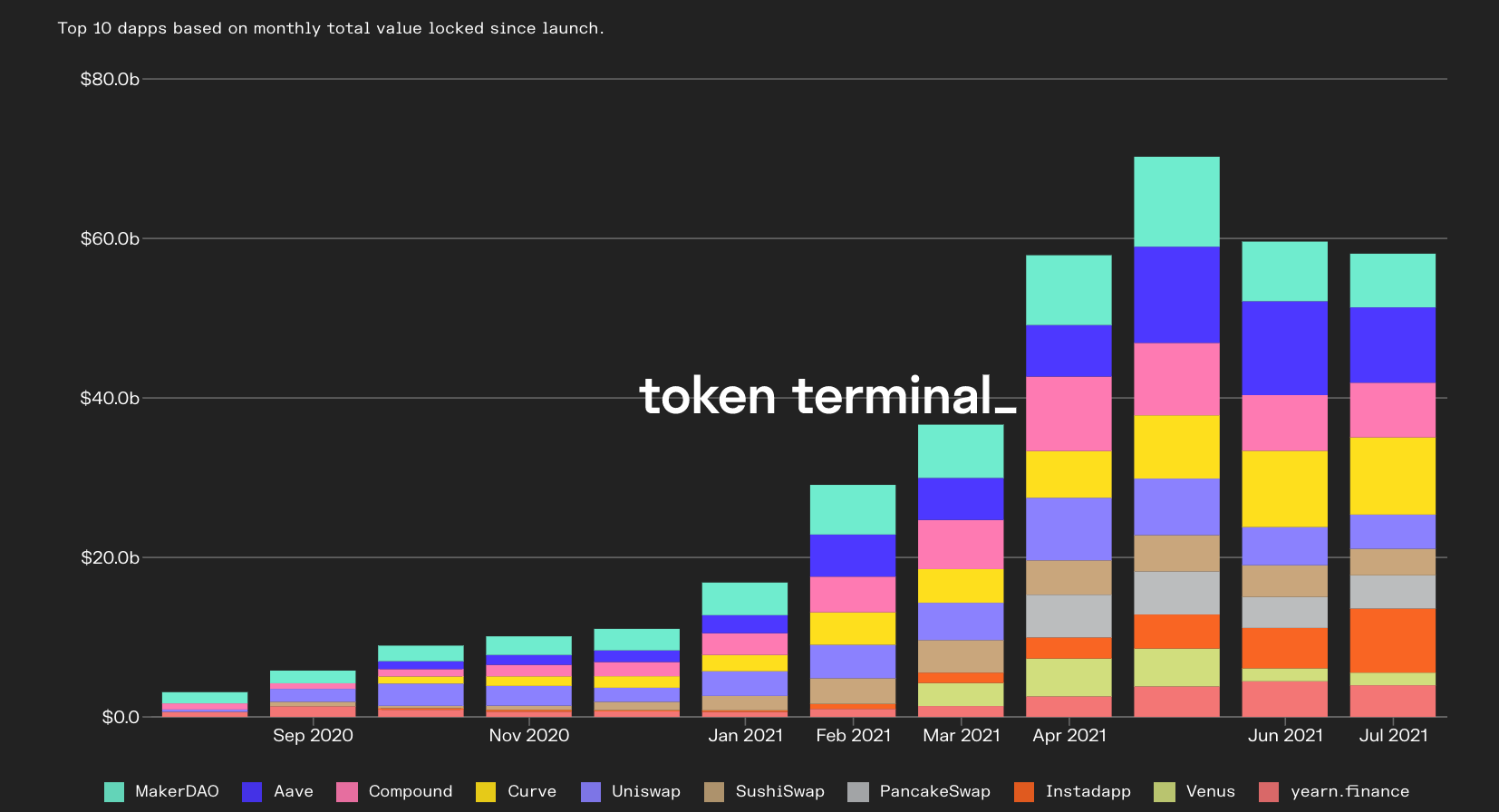

The good news is that crypto has a plethora of useful experiments going on. Unlike in 2017-18, when a large proportion of the space was “vaporware”, with nothing material in them other than whitepapers and clever ideas, we’re looking at projects now that are not only successfully deployed but have also achieved product-market fit AND have gone on to become profitable in their own right.

Rapidly rising prices draw everyone’s attention, from the gunslinging traders to institutional investors. And it’s the latter who have arguably been slow to get on board, but who will enjoy the benefit of hindsight. There’s nothing like a bear market to triage the good from the bad.

Exchanges that require no market makers, banks that require no bankers or loan officers, an ecosystem that allows protocols to interact freely and seamlessly—these are investment opportunities that all investors have dreamt for decades. Believe us when we say that reviewing the quarterly results of a commercial/investment bank, broker or exchange operator anywhere in the world is one of the least appealing things to find on a to-do list.

And they are coming for these opportunities. When we start seeing traditional investment funds write research reports on Ethereum and DeFi projects like we have recently, you know things are getting serious. Yes, they may be more measured in their investment approach, and eschew the highly exhilarating (at least on the way up) YOLO approach many of us have taken at some point in our crypto journey. But they’re the ones that will provide stable capital to the projects that show the most fundamental promise.

They’re doing the work, and when they do come, they’ll buy only the best. We need to be in first.

This recent selloff is our chance to shift the focus away from ideologies like “up only” and “to the moon!” and towards properly understanding how projects create tangible value (or not). Just think of the projects that have proven themselves as critical pieces of DeFi infrastructure this cycle: Ether, Aave, Synthetix, YFI, Curve, Compound, Maker, Uniswap—the list goes on. Some were tiny before DeFi summer, but in all likelihood, they will return bigger and stronger the next time round, accompanied almost certainly by a second wave of new projects that perhaps are still germinating and developing at this moment.

In the broader crypto space, the same principles apply: the projects that will survive and thrive in the end are those with proper intrinsic value in them.

We’ve seen some pretty innovative applications of token economics and structure this cycle: from blockchain gaming in the metaverse with the likes of Axie Infinity, whose metrics are shooting the lights out; to bootstrapping a global wireless network like what Helium is doing, with hotspot counts and utilization growing steadily; to the stratospheric success of NFT art auctions in the most famous of auction houses, which have put a new breed of artists in the global spotlight. There will be more.

Creators, musicians and others are just getting started figuring out how blockchain technology can evolve their industries.

For us, going bankless is more than just being able to replicate basic banking functionality. It’s about spawning an entire ecosystem which assimilates tangible, real-world value, allowing a seamless transfer of value in and out of the ecosystem. You can’t break up with your bank if they hold the keys to the fiat offramp (or all other real-world assets for that matter).

There’s much more work to be done, and this is by no means the end. It is only the beginning.

Ask not what its price is doing, but what it can do for you

Investment managers are profit maximalists—with a job and a responsibility to clients to manage and protect their assets. Deciding to put client money at risk is a huge responsibility, so “YOLO” is 100% off the table for any respectable institutional manager.

Try explaining to a risk management committee why Dogecoin is in the portfolio—the thought of having to make that explanation is reason enough not to own it. Fiduciary duty instantly takes 95% of assets out of the investable universe. We like to think of crypto as VC projects with public liquidity—but just because something has a price that moves up doesn’t mean it needs to be chased.

Institutions will buy proper projects—that we have zero doubt.

On the contrary, we need to understand how every piece of exposure taken translates to creating value in a fundamental manner, measured against the risk that things go wrong. Once the fundamentals are in place, then conversations around price action and market timing can be had – not the other way round, and certainly not just the latter in isolation.

Here’s an alpha leak: in a bankless world, there are no investment banks controlling information flow to privilege their clients. On-chain data is accessible to everyone. No one has any reason not to do research.

So where does that leave us?

Going back to the Theory of Lemons, we don’t need used car salesmen in crypto. Everything is out in the open. Every single one of us has access to the data, and doing the research is no longer the preserve of Wall Street analysts. For once, that information asymmetry can be resolved.

This approach gives us the confidence to manage risk and size exposures in a manner that corresponds to our levels of conviction. We never truly know for sure if every position we take will make us money but having done the work to understand what we’re taking risk on gives us sufficient comfort to take those risks, as well as an objective basis for determining when we have made a wrong decision that needs to be cut.

Put differently, we might not know whether a peach is sweet before we bite into it, but we will certainly know for sure that it isn’t a lemon. And that’s a good start.

Ultimately, a well-considered, well-researched decision process can apply in the crypto space. For the space to truly mature and develop, we all need to look through the hype, contain FOMO and rein in YOLO, and realize that for all the volatility, “up only” and to some extent “down only” we experience in the space, it is ultimately intrinsic value creation that counts.

The cycles will come and go, but as Mr. Bezos proved post-2000, if you’re good enough, even a -95% fall in valuation can’t stop you from taking over the world.

Keep your eyes on the prize, Bankless Nation: we’re still early. This is a new paradigm in the way that we perceive and interact with value and ownership. While this round may be over, the next round will be way bigger. And with every iteration, the Bankless realm grows—in size, scale and capability. Not all will survive, only the best, but through the process of creative destruction, the realm will thrive.

We all just need to be ready for it.

Thinking caps on, ladies and gentlemen—stay in the game and let’s get strapped in for the ride. This crab market is your opportunity. 🦀

Action steps

Position yourself to survive and thrive in the crab market

Read up on other great reads from 3Body Capital

Everything is a meme (bankless favorite)

Author Bio

Eugene is the co-founder at Three Body Capital Management LLP. His career includes Asia-Pacific equity sales roles at Morgan Stanley and CLSA as well as a role on the Capricorn Global Emerging Markets team. He currently co-manages the Three Body Emerging Opportunities Fund—an absolute return strategy focused on liquid, publicly traded assets including equities and crypto.