State of Ethereum Report — Q2, 2022

Dear Bankless Nation,

Uncertain times, anon! It’s everywhere you look these days.

Fittingly, Q2 2022 was a bonafide bear quarter for crypto.

But how did it play out for Ethereum fundamentals?

Bankless Analyst Ben Giove goes deep this week on the State of the Ethereum network.

He’s got topline metrics on the Protocol, DeFi, NFT, and Layer 2 — along with insights on the Merge, future of DeFi, and the emerging competitive landscape.

Buckle up!

Let’s see how bad it really was, and where we’re all going next...

- Bankless Team

Key analysis sourced from James Wang’s “Ethereum Announces First Quarter 2021 Results”

This report looks at topline metrics for the second quarter of 2022 — ending June 30— for the Ethereum protocol and ecosystem as broken down into four categories: Protocol, DeFi, NFT, and Layer 2.

We’ll then move on to ecosystem highlights and forward outlook.

Key Results

These numbers compare performance in Q2 2021 to Q2 2022.

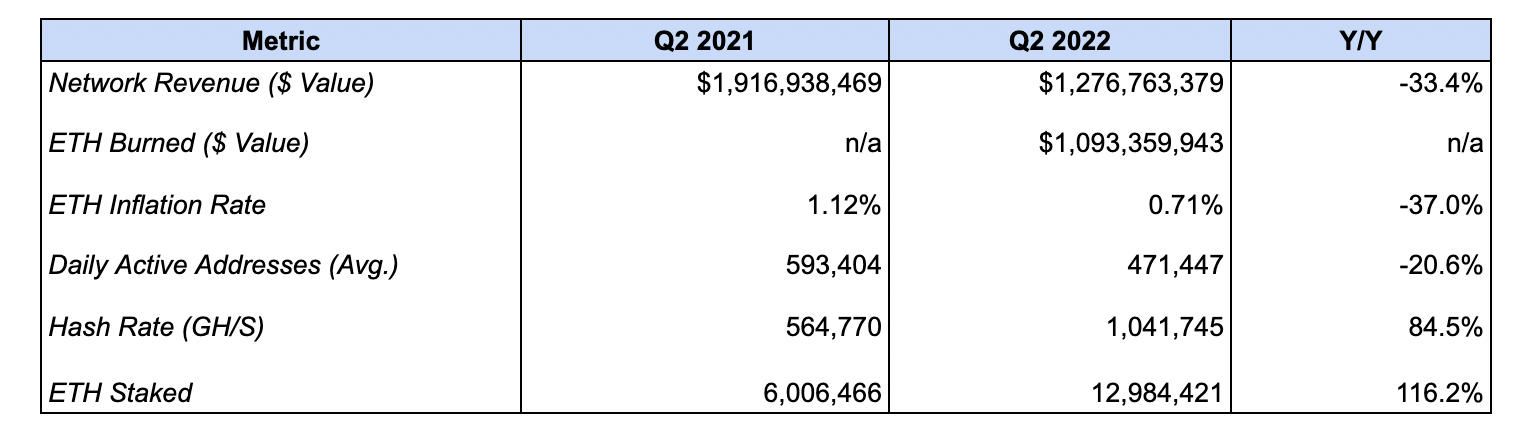

Protocol

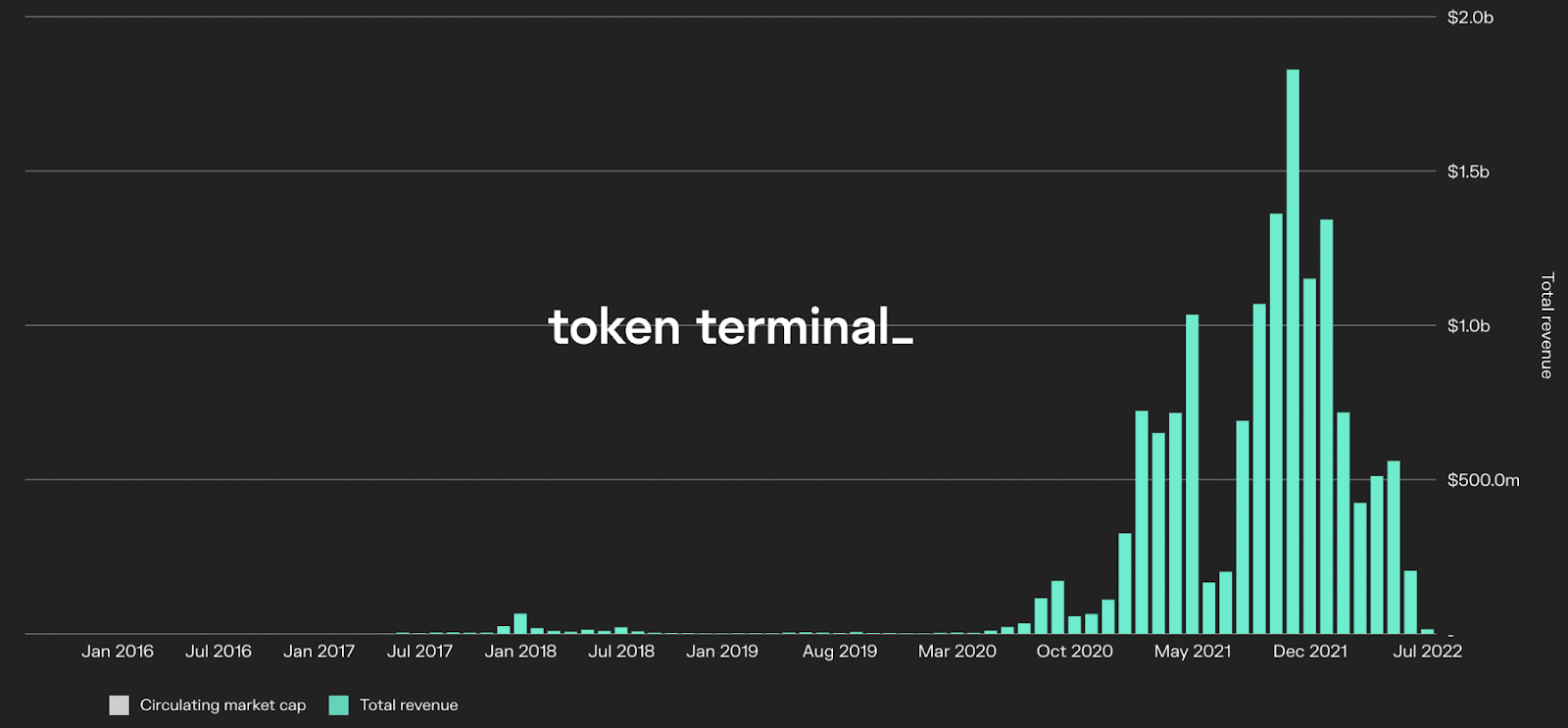

Network Revenue fell 33.4% — from $1.91B to $1.28B.

This measures the value of the transaction fees paid to use the network. Of this, $1.09B of ETH (85.4% of it) was burned, removing it from circulating supply.

This decreased demand for blockspace is likely attributable to the market weakness during the quarter, which dampened speculative activity.

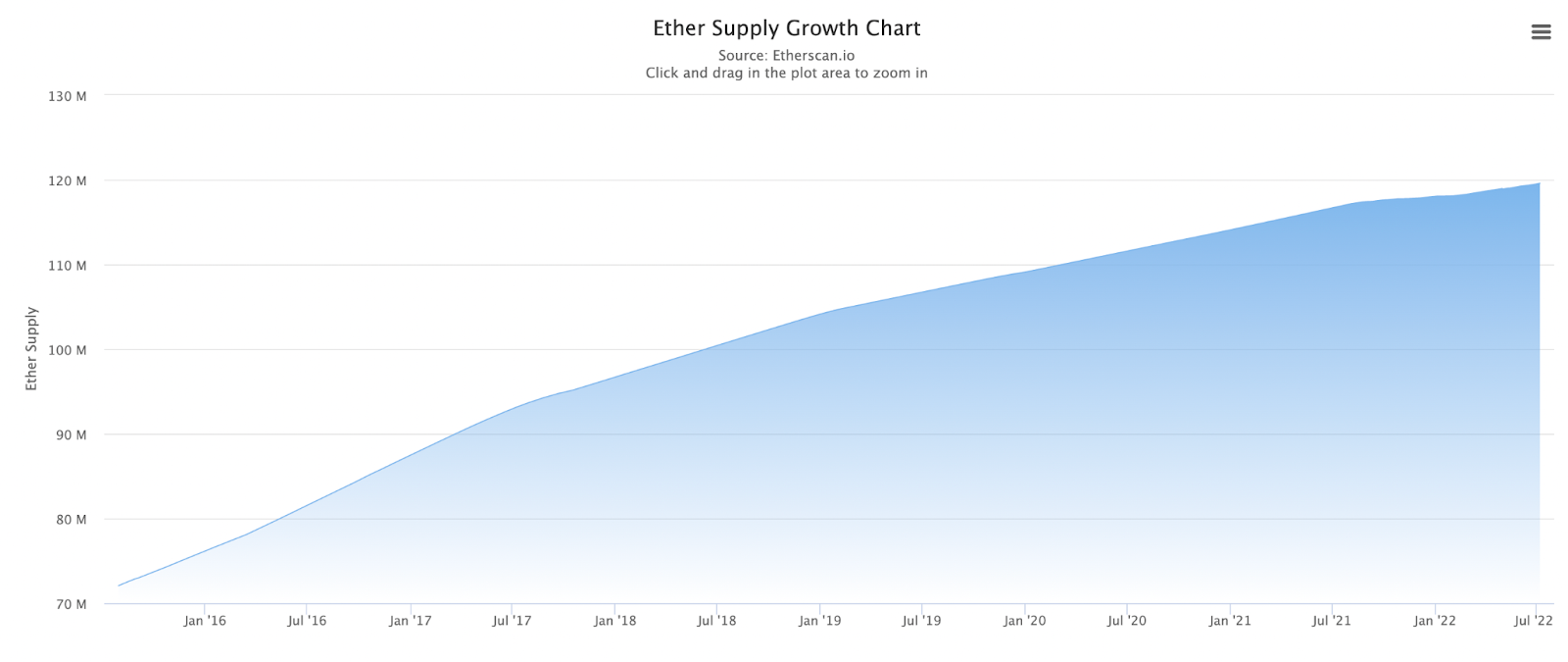

ETH Inflation Rate decreased 37% from 1.12% to 0.71%.

This measures the growth in supply of ETH over the course of the quarter.

The decline is likely a result of the fee burning mechanism implemented in Q3 2021 via EIP-1559.

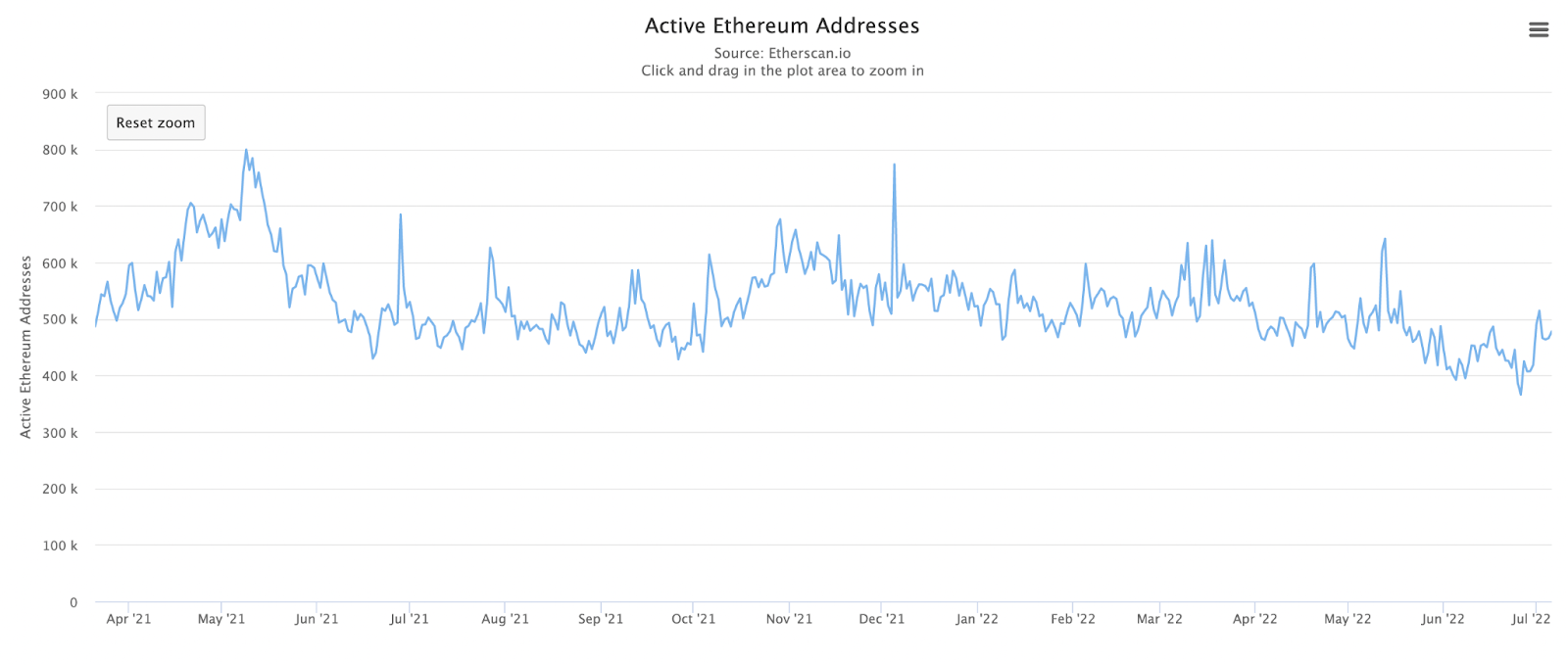

Average Daily Active Addresses fell 20.6% — from 593,404 to 471,447.

This tracks the average number of wallet addresses to transact on Ethereum each day over the duration of the quarter.

As with network revenue, this decline is likely due to the decreased speculative appetite among users as a result of the quarters bearish backdrop.

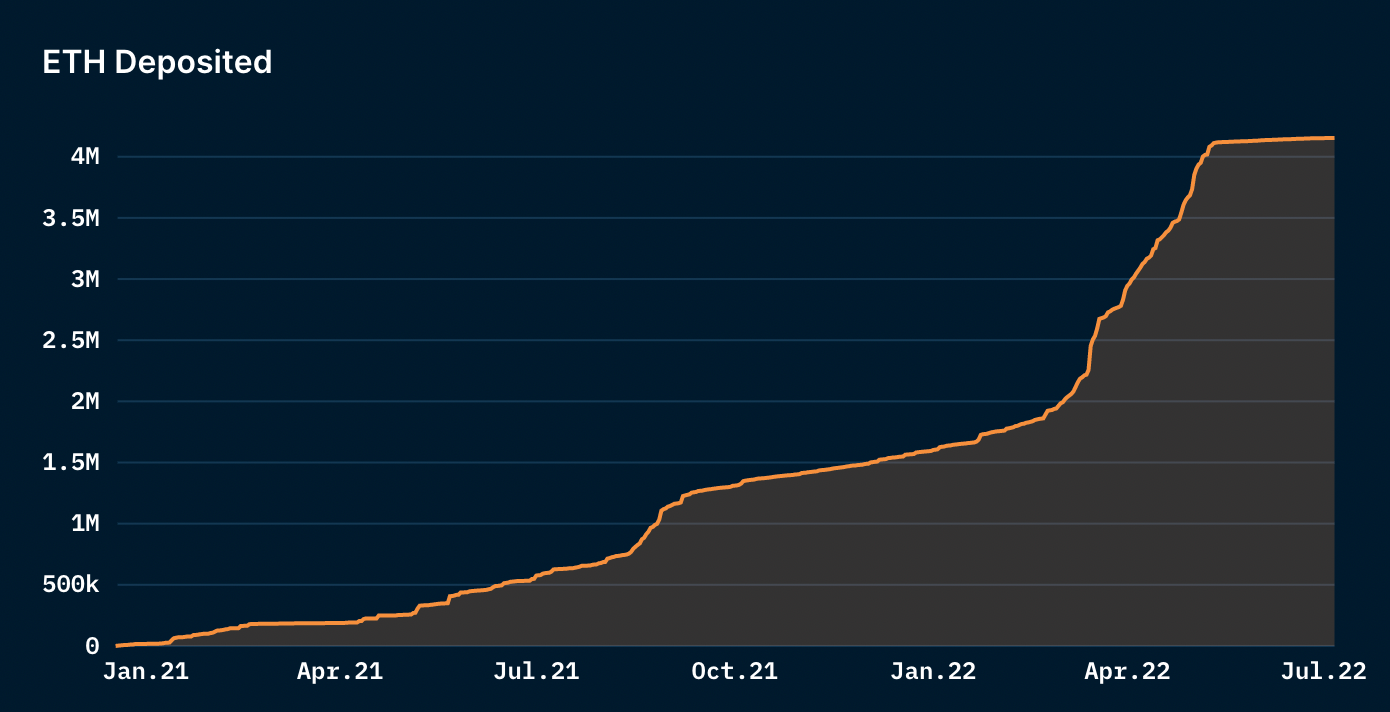

Staked ETH increased 116% from 6.01M to 12.98M.

This measures the amount of ETH staked on the Beacon Chain ahead of the network's upcoming transition from Proof Of Work (PoW) to Proof Of Stake (PoS).

Roughly 10.86% of the total supply of ETH was staked by the end of Q2.

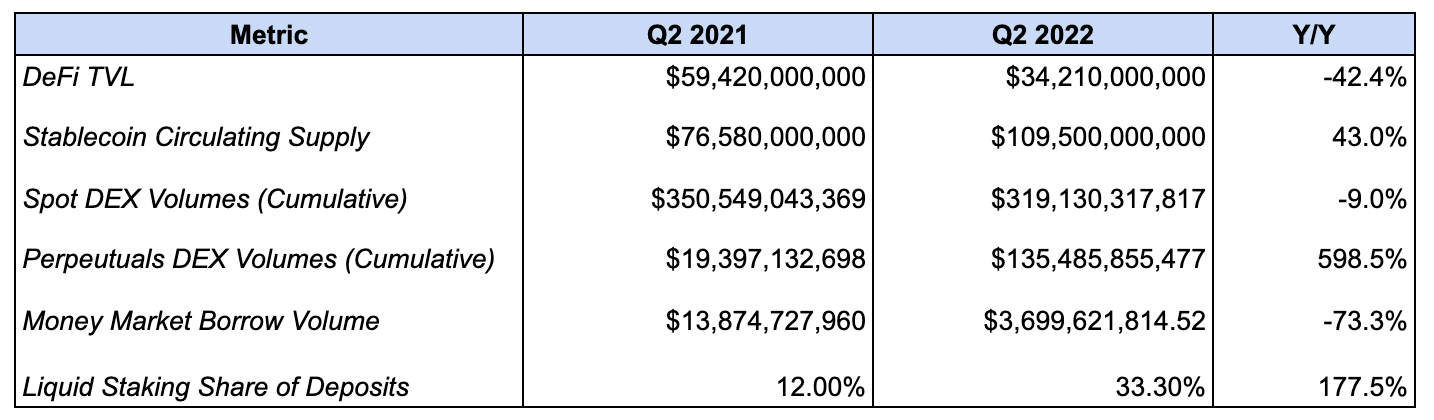

DeFi Ecosystem

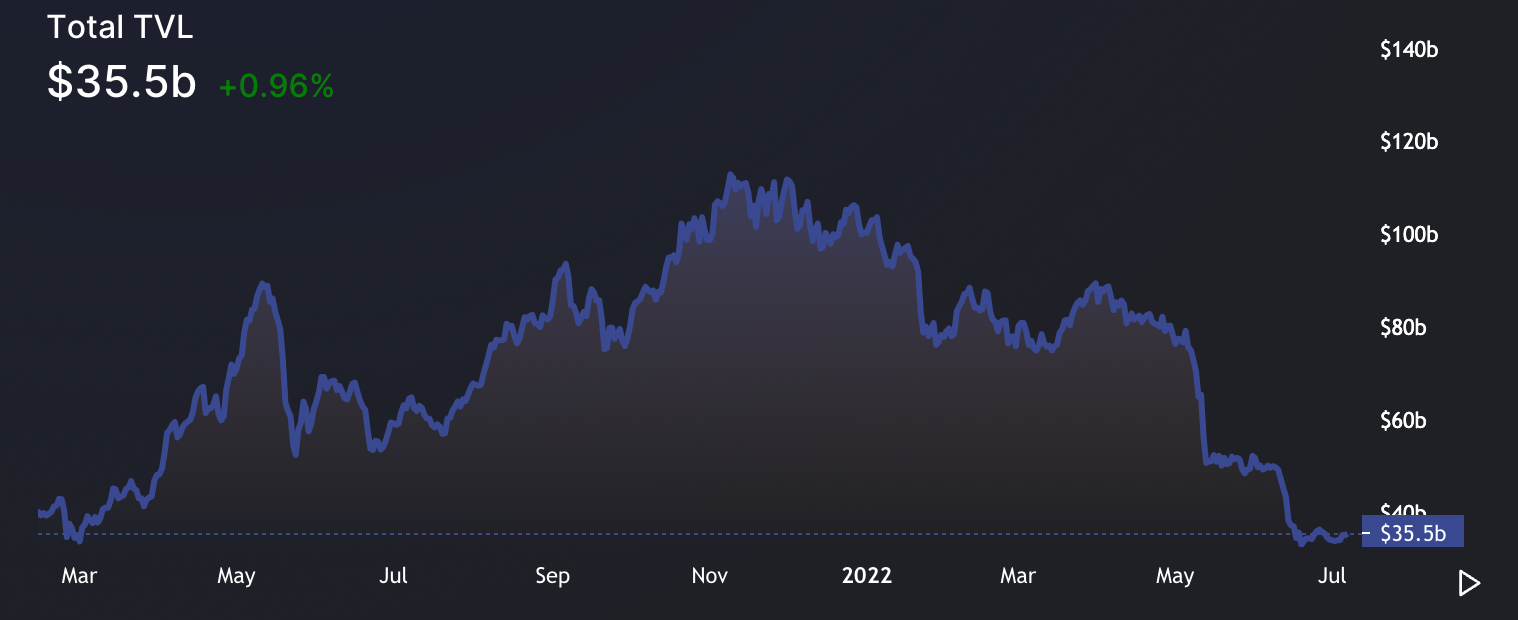

DeFi TVL fell 42.4% — from $59.42B to $34.21B.

This tracks the value of the assets deposited into DeFi protocols deployed on Ethereum.

This decline is likely driven by the fall in crypto asset prices during the quarter, as well as liquidity outflows as a result of compressed yields, and diminished risk appetite among DeFi users.

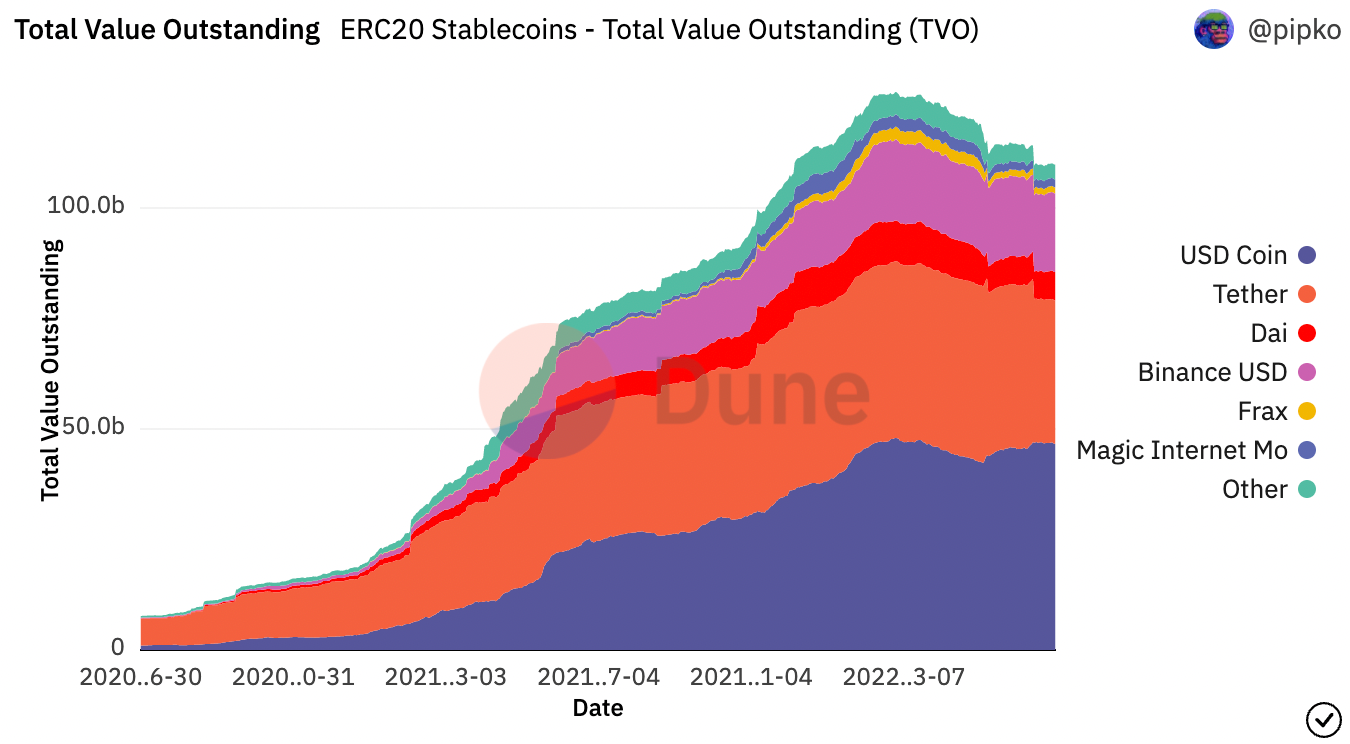

Stablecoin Circulating Supply increased 43.0% — from $76.58B to $109.50B.

This measures the amount of USD-pegged stablecoins issued and circulating on Ethereum.

Growth can l attributed to the increased demand to transact or lever up with stable-assets, as well as growth of newly issued stablecoins such as FRAX.

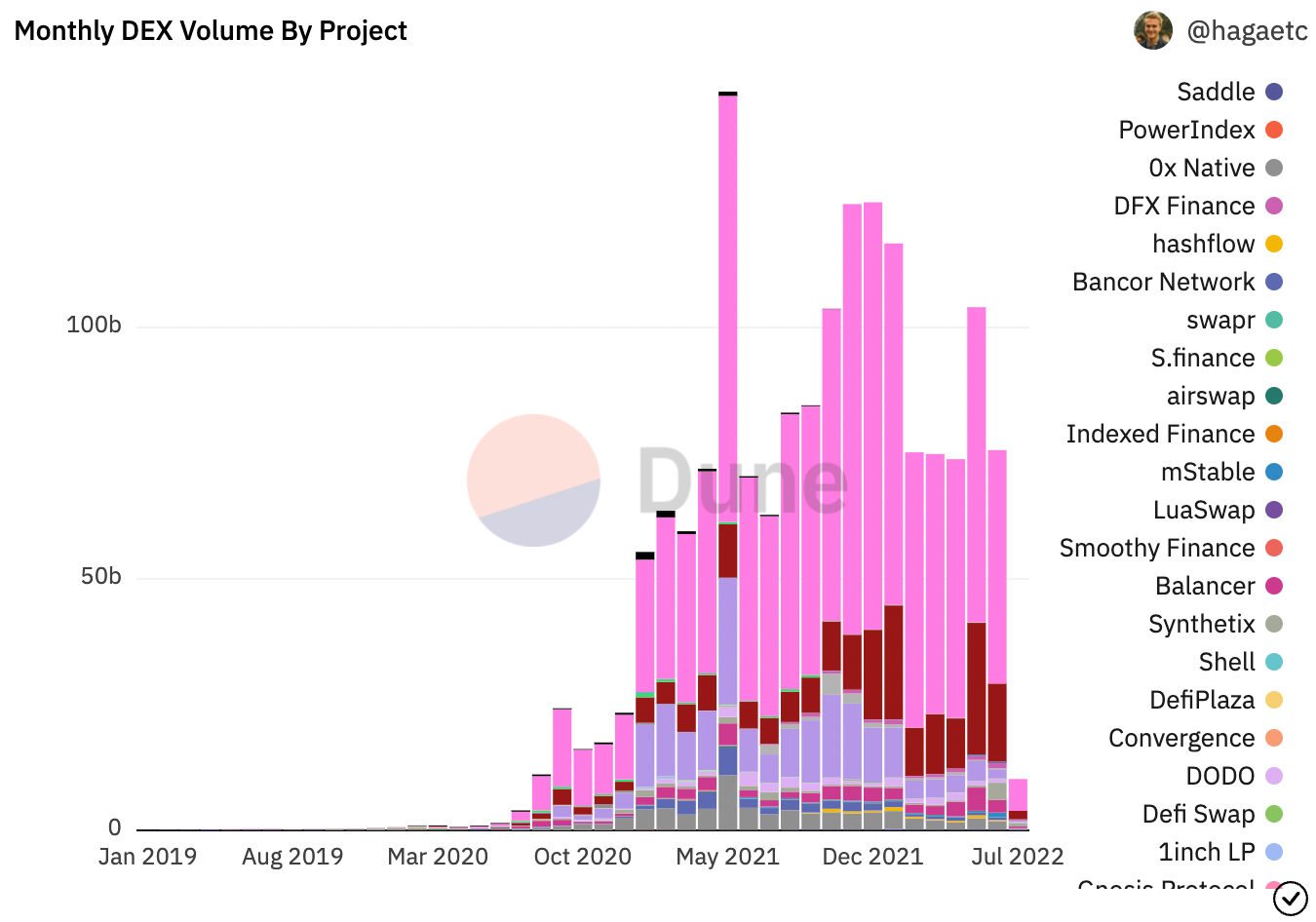

Spot DEX volume fell 9.0% — from $350.54B to $319.13B.

This measures the total trading volume on decentralized spot exchanges live on Ethereum over the course of the quarter.

The decline in spot volume is likely due to market conditions, as trading volumes have been highly correlated to bullish price action.

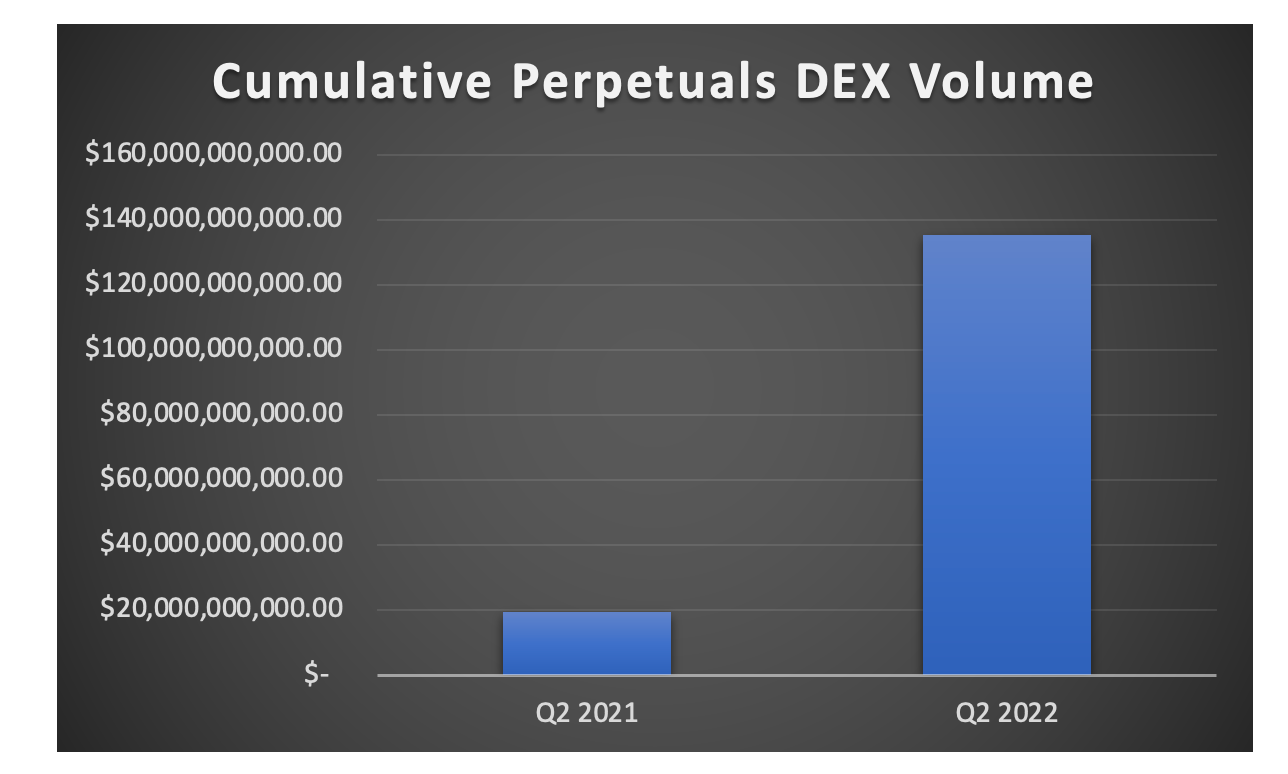

Perpetuals DEX Volume increased 598.5% — from $19.39B to $135.48B.

The rise in perpetual volumes can be attributed to the growth of dYdX — which saw a volume increase 598.4% Y/Y.

Note: Perpetuals DEX Volume tracks volumes from dYdX, Perpetual Protocol, and GMX.

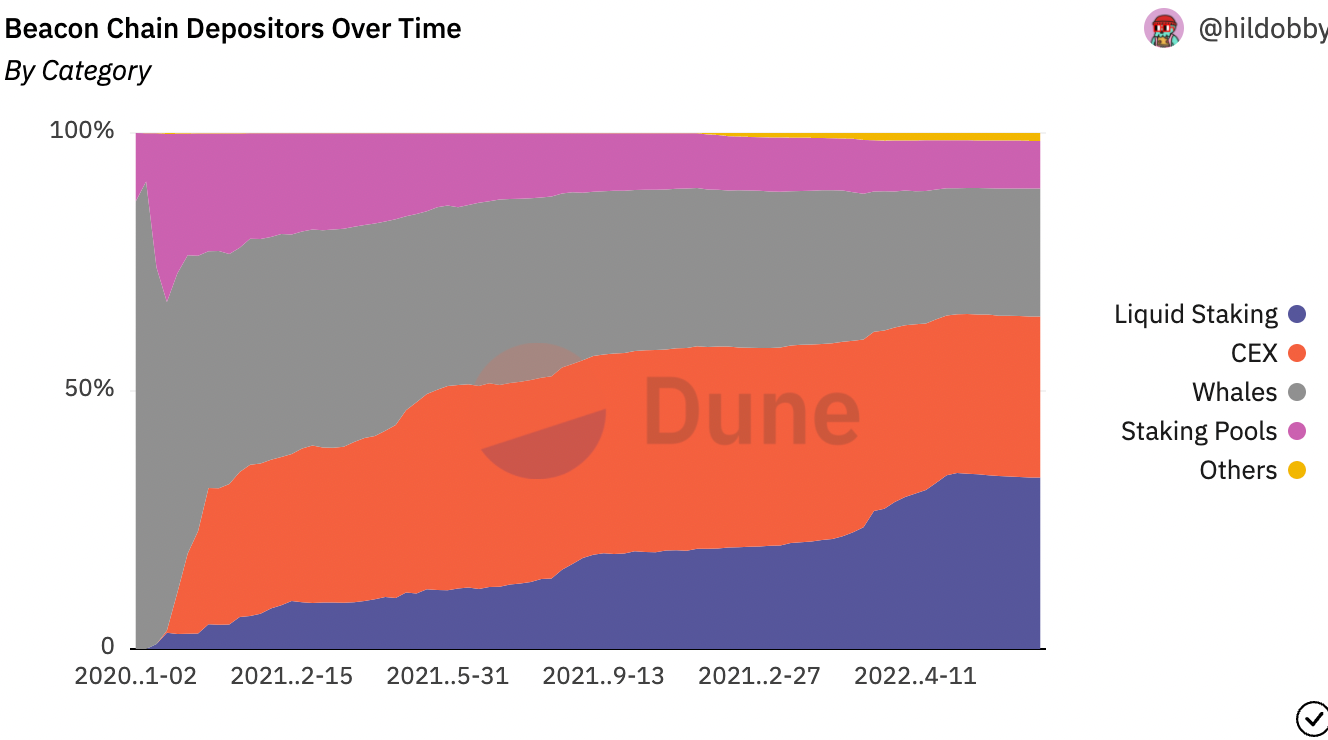

Liquid Staking Share of Deposits increased 177.5% — from 12.0% to 33.3%.

This measures the share of ETH that is staked with non-custodial protocols that issue liquid staking derivatives (LSD).

This growth is likely a result of the secular increase in ETH staked on the Beacon Chain during Q1, as well as due to increased integrations of LSD’s, such as Lido’s stETH, into different DeFI protocols.

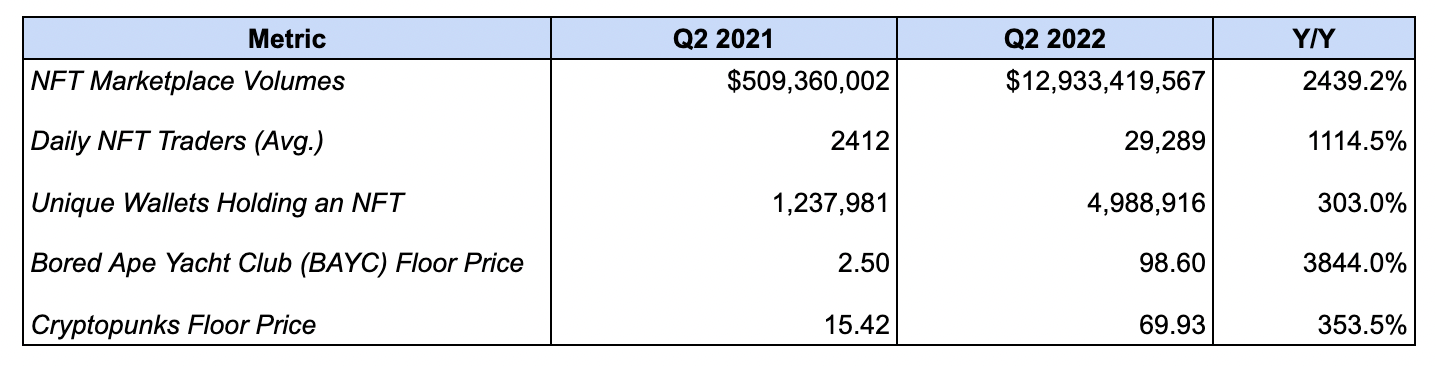

NFT Ecosystem

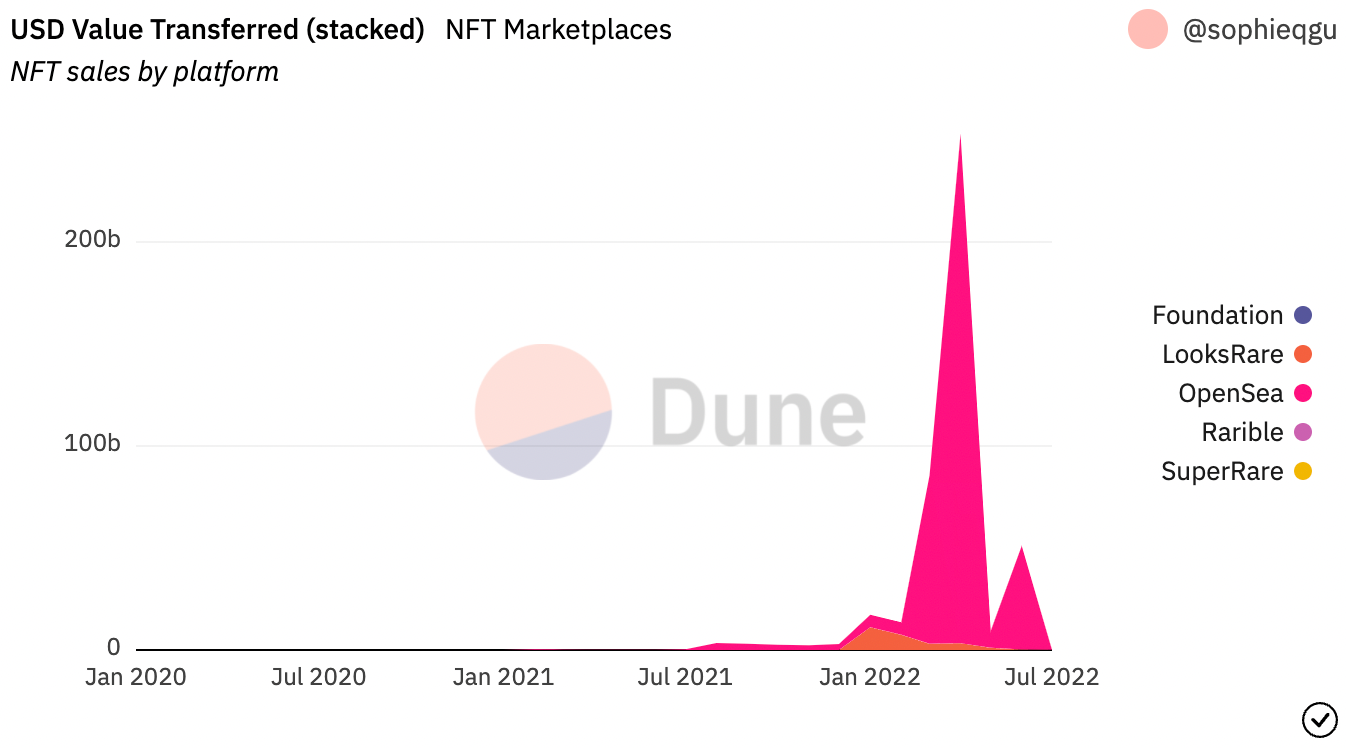

NFT Marketplace Volumes erupted 2439.2% from $509.36M to $12.93B.

This tracks trading activity on marketplaces OpenSea, Foundation, LooksRare, Rarible, and Superrare.

This growth is likely due to the secular growth of the NFT ecosystem between Q2 2021 and Q2 2022 — in particular the rise in popularity of PFP collections.

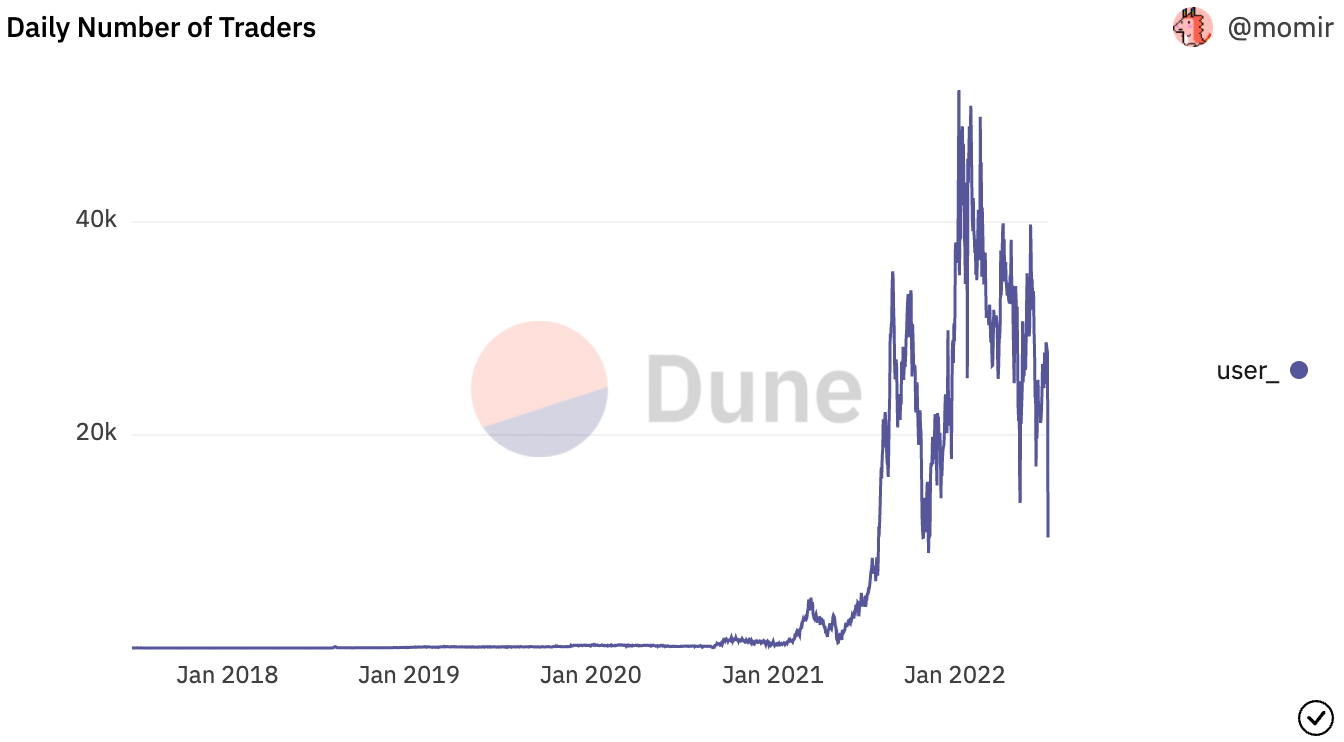

The Average number of Daily NFT Traders grew 1114.5% from 2412 to 29,289.

This measures the average number of users to trade NFT’s each day during the quarter.

As with marketplace volumes, the growth in this metric is likely the result of the secular growth of the NFT ecosystem.

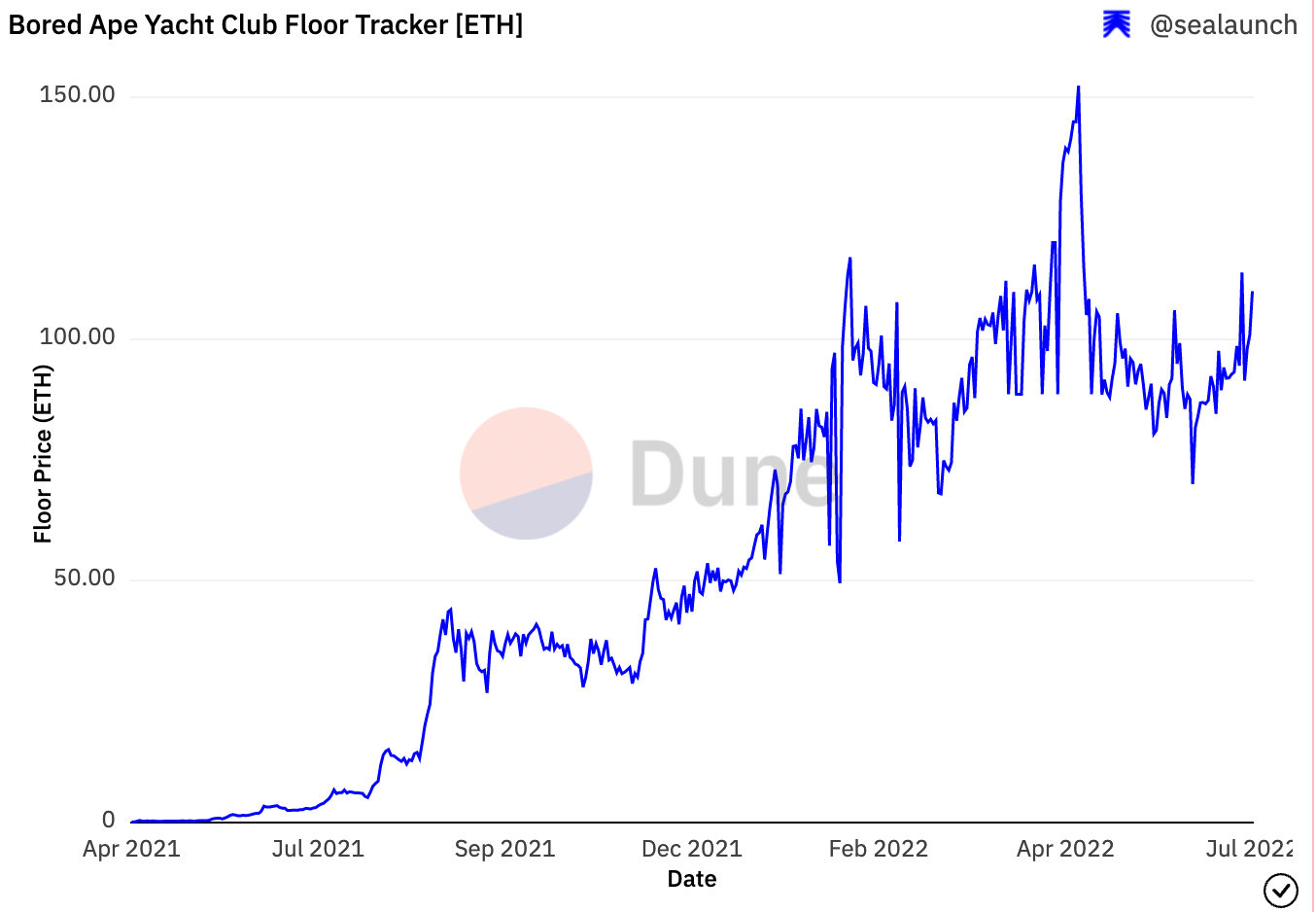

Bored Ape Yacht Club (BAYC) floor soared 3844% — from 2.50 ETH to 98.60 ETH.

This increase is likely due to the broader growth in popularity of PFP NFTs, as well as in the increased adoption of BAYC from an assortment of celebrities and high-profile public figures.

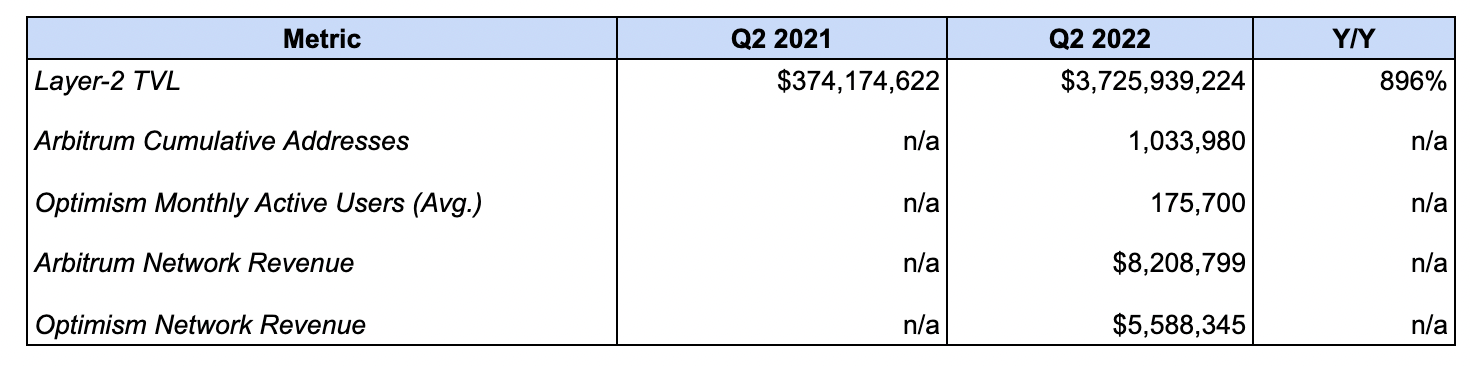

L2 Ecosystem

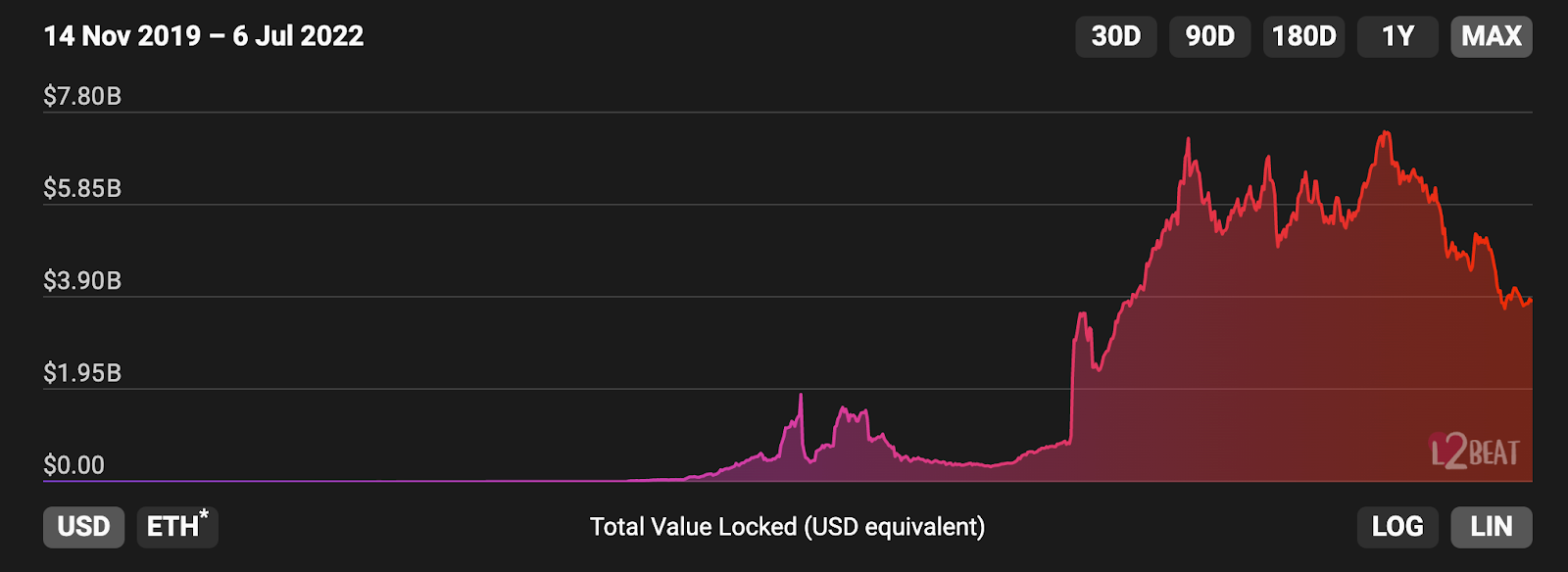

TVL on L2s increased 896% from $374.17M to $3.72B.

This measures the value that has been bridged into Ethereum’s L2 ecosystem, with growth likely fueled by the increased usage, liquidity, and deployment of applications to networks such as Arbitrum and Optimism.

Arbitrum Network revenue reached $8.20M. Optimism revenue was $5.58M.

This tracks the value of fees paid by users in order to transact on each L2.

Average Monthly Active Users on Optimism was 175,700. The Cumulative Address total on Arbitrum reached ———

This measures the average number of users to interact with Optimism per month during the quarter, as well as the total number of individual addresses on Arbitrum.

Note: Given that Aribtrum and Optimism both launched in Q3 2021, and due to the limited publicly available data for both networks, we are not able to make Y/Y comparisons.

Ecosystem Highlights

DeFi Proves Resilient

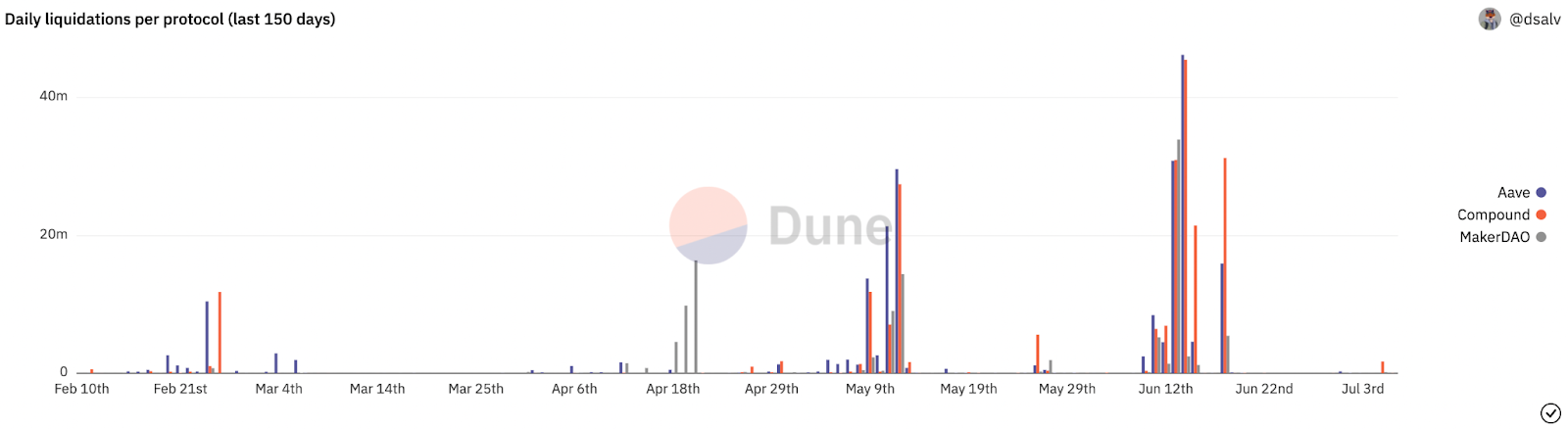

Despite a decline in TVL as well as a slowdown in spot volumes, the Ethereum DeFi ecosystem continued to prove its fortitude by withstanding considerable stress-tests throughout Q2.

The major turmoil began with the implosion of UST in May 2022, which at its peak was the third largest stablecoin with a market cap ~$18.78B. While on-chain damage was largely limited to the Terra blockchain itself, contagion from UST’s downfall spread throughout the broader crypto industry, with the market falling 45% in the fallout.

This led into the collapse of numerous CeFi entities. Over-leveraged hedge fund Three Arrows Capital and lending platform Voyager were both plunged into insolvency battles. The domino charge caused considerable stress on other lenders like Celsius and BlockFi, the latter of which was acquired by FTX.

Despite the CeFi carnage, DeFi on Ethereum managed to weathered this storm without a hitch.

The three largest lending protocols, Compound, Aave, and Maker managed to process $462.25M in liquidations, continuing to operate with 100% uptime and currently sits on negligible bad debt.

Fascinatingly, the transparent nature of DeFi protocols allowed market participants to monitor the positions of entities like Celsius, with analysts on Twitter providing advance warning about the precarious state of the lenders finances.

Although liquidity may have dried up and activity slowed during this bear market, the value proposition of the on-chain financial system has never been more clear than throughout Q2.

NFTs Stay Hot

Ethereum’s NFT ecosystem have remained hot throughout 2022.

NFT prices peaked in Q2, with Nansen’s Blue Chip-10 — a market-cap weighted index that tracks the ten largest collections by market-cap — reaching its all-time high on May 2.

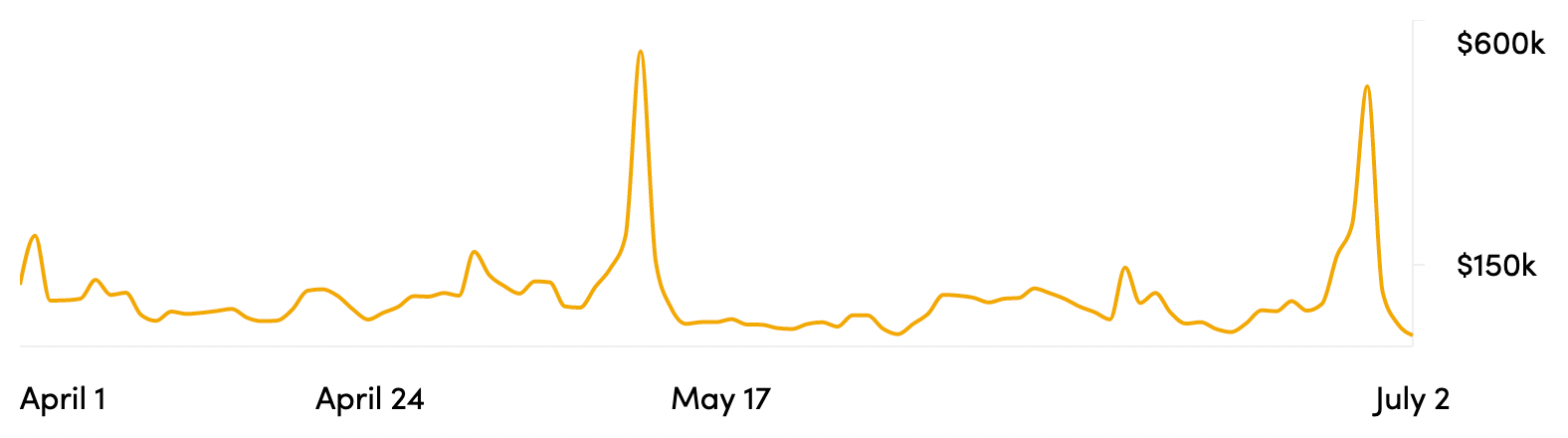

This coincided with the $317M land-sale for Otherside, the soon-to-be launched metaverse via Yuga Labs, the company behind Bored Ape Yacht Club (BAYC) and largest constituent of the NFT-10.

The sale caused massive congestion on Ethereum, leading to record-high gas prices (As well as ETH burns).

Another prominent collection which rose to fame in Q2 was Goblintown. Styled after the bear-market “goblin town” meme, the free-to mint collection saw a tremendous surge in popularity following its viral twitter spaces. Holders of the PFP spent hours making Goblin noises. The Goblintown floor price reached as high as 7.1 ETH within a few weeks.

The NFT space also saw several high-profile acquisitions and protocol launches in Q2. This includes the purchases of NFT-aggregators Genie and Gem by Uniswap Labs and OpenSea respectively. OpenSea also announced the launch of its decentralized marketplace protocol Seaport.

L2 Token Season Begins

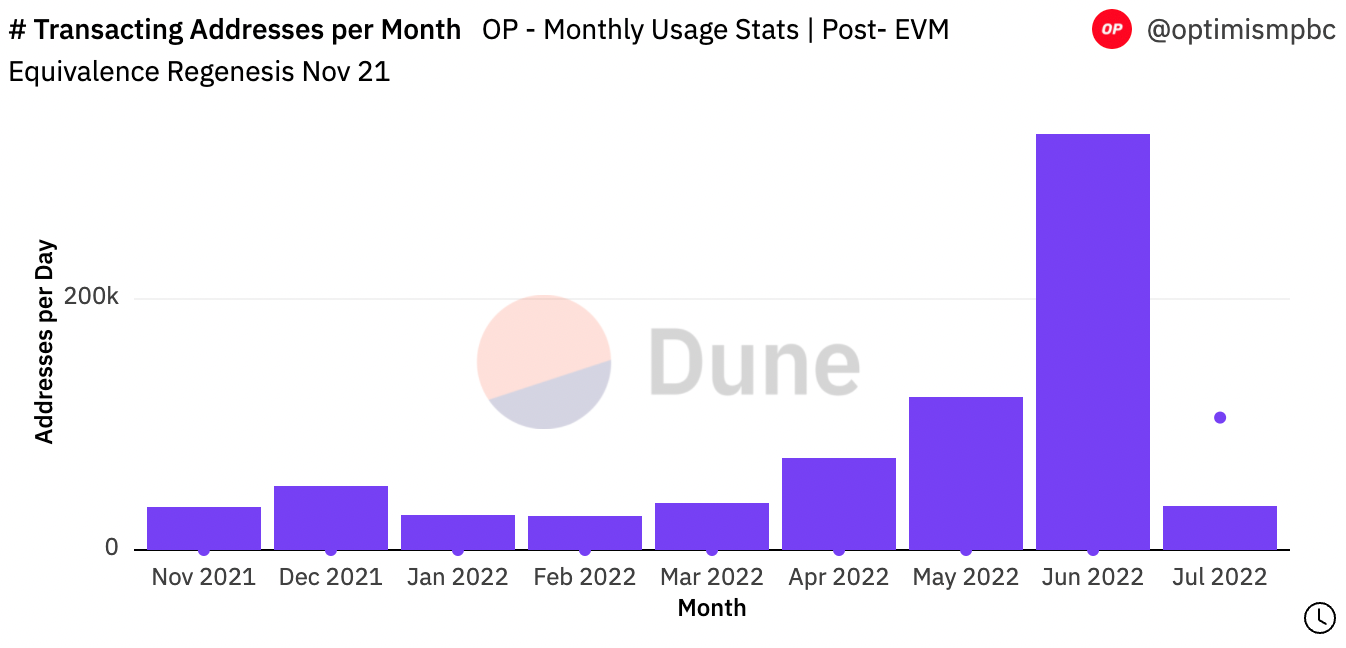

Ethereum’s L2 ecosystem experienced one of its most significant milestones with the launch of Optimism’s governance token OP.

The first of the “big four” rollups to launch a token, OP will be used to govern over the “Token House” as a part of Optimism’s bi-cameral governance system. The model sees holders able to vote on network upgrades and the allocation of ecosystem incentives. In the future, it’s likely this token will also be used to decentralize and accrue revenues from the sequencer, the entity responsible for batching transactions to L1 which is currently operated solely by Optimism PBC.

Although the problematic post-airdrop claims process served as a stark reminder of the nascency of the network, OP has demonstrated the potential L2 tokens possess to drive increased interest, usage, and activity to the network.

Since going live, Optimism has seen its share of DeFi TVL on rollups grow from 17.26% to 30.42%.

Another notable token announcement came when Immutable-X, a gaming focused L2 built using StarkEx, announced it plans to begin directing a portion of “protocol fees” to its IMX token. Once the protocol fee is activated, holders will be able to earn 0.8% of all primary and secondary NFT sales on the network.

Arbitrum recently began its Arbitrum Odyssey event, with the intent to bootstrap usage of popular applications on the network while rewarding participants with NFTs. The event has since been postponed until the completion of the Arbitrum Nitro upgrade after causing a spike in gas fees amid record-high transaction totals.

Despite the hiccup, the inevitable launch of the Arbitrum token — along with upcoming incentive programs from Optimism — should help grow usage of L2s and accelerate migration of users from Ethereum.

As it sits right now, just 0.40% and 0.22% of L1 addresses have used Arbitrum and Optimism respectively. There’s already a lot happening here, and there’s incredible room for growth in the offing.

Forward Outlook

The Merge Is Coming

Ethereum’s long anticipated transition from PoW to PoS seems to finally be on the precipice of completion. The merge has been successfully completed on both the Ropsten and Sepolia testnets, leaving just Goerli as the final remaining testnet before mainnet rollout.

The numerous reasons as to why the merge represents the most significant event in Ethereum’s history has been articulated ad nauseum, but are still worth repeating.

As we know, a PoS Ethereum will enable the completion of scalability upgrades, such as the implementation of EIP-4488 and EIP-4844, which will reduce the cost of L2 call data storage and implement danksharding respectively. In addition, it will also enable the implementation of proposer builder separation (PBS), which aims to separate block building from block validation in order to mitigate the negative externalities of MEV.

The merge is of course poised to be a tremendous bullish catalyst for ETH the asset. Based on the current amount of ETH staked, issuance required to secure the network post-merge expected to fall ~89% from ~5.5M ETH to ~0.6M ETH.

Based on the last 30 days of network revenue — which is at lowest since the summer 2021 thanks to the correction and fee burns — ETH is expected to be net-deflationary, with its supply projected to decrease 0.6%.

Coupled with the removal of structural sell pressure due to the upgrade from miners to validators, this represents a significant improvement to the long-term value proposition of ETH.

Competition Heats Up

Although many competitors have lost momentum during the bear market, Ethereum and its L2s continue to face significant competition from alternate ecosystems.

These competitive forces have been highlighted by the recent announcement that dYdX plans to migrate from StarkEx and launch its V4 protocol as its own Cosmos chain. An early-adopter of new tech, the DEX’s migration is a validation of the app-chain thesis and a leading indicator that suggests teams and protocols may follow its lead and pursue increased sovereignty.

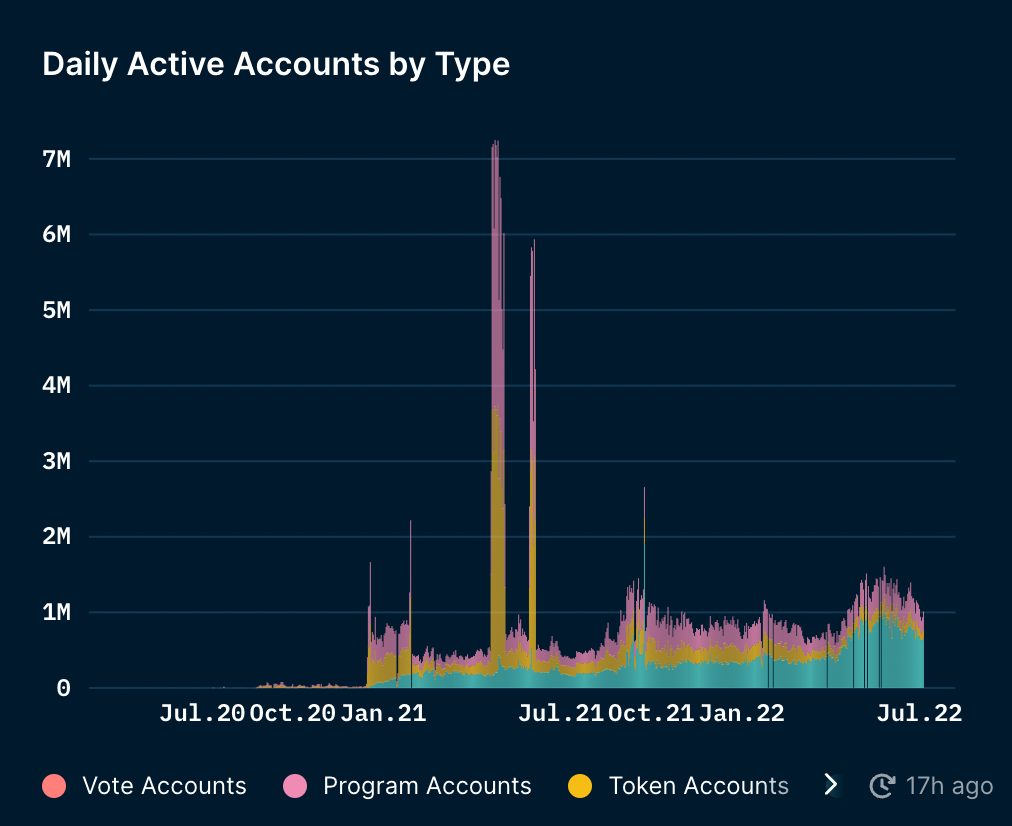

Another network placing increasing pressure on Ethereum is Solana. With a fast growing NFT ecosystem, the network boasts the most users of any blockchain over the past 30 days at 20.3 million. Solana has continued to execute, grow its user-base, and maintain developer mindshare despite bearish headwinds.

As L2s such as Optimism and Arbitrum run into difficulties as usage increases and both work through the growing pains that comes with implementing new, bleeding edge tech, the door seems open for other ecosystems to continue to place competitive pressure on Ethereum and its web of scaling solutions.

Results Tables

Protocol

DeFi Ecosystem

NFT Ecosystem

L2 Ecosystem

About Ethereum

Ethereum is an open-source, decentralized blockchain network. Ethereum is a technology that's home to digital money, global payments, and applications. The community has built a booming digital economy, bold new ways for creators to earn online, and so much more. It's open to everyone, wherever you are in the world – all you need is the internet

(Taken from the Ethereum.org website.)

About This Release

This report is not affiliated with Ethereum or the Ethereum foundation.

Action steps

- Watch the pod to find out how Binance’z CZ is playing the bear market.

- Brush up on our Framework for Evaluating Layer 1’s.