Stablecoin Supervisors

Dear Bankless Nation,

One story of 2023 has been all of the talk around regulators creating rules for crypto companies. Some governments are doing more than others.

Today, we look at some of the recent action around stablecoin regulation, including dead-on-arrival American efforts and more successful attempts in the EU.

- Bankless team

How Regulators Are Thinking About Stables

Bankless Writer: Jack Inabinet

Stablecoins! Regulators the world over are turning their attention to pegged crypto assets. Perhaps unsurprisingly, proposed legislation has been a mixed bag.

There have certainly been some chaotic happenings stateside -- from the House Financial Services Committee's session last week to some dead-on-arrival stablecoin legislation proposals. But across the pond, things are at least moving. The EU successfully approved its comprehensive MiCA framework, a major initiative with some big potential consequences.

Are we ever going to get regulatory clarity stateside? What does MiCA mean for builders in the space? Let's dig in!

🇪🇺 EU Pushes Ahead

Regulators in the EU are pushing ahead to ensure outsized future influence by front-running policy framework introductions in other geographies.

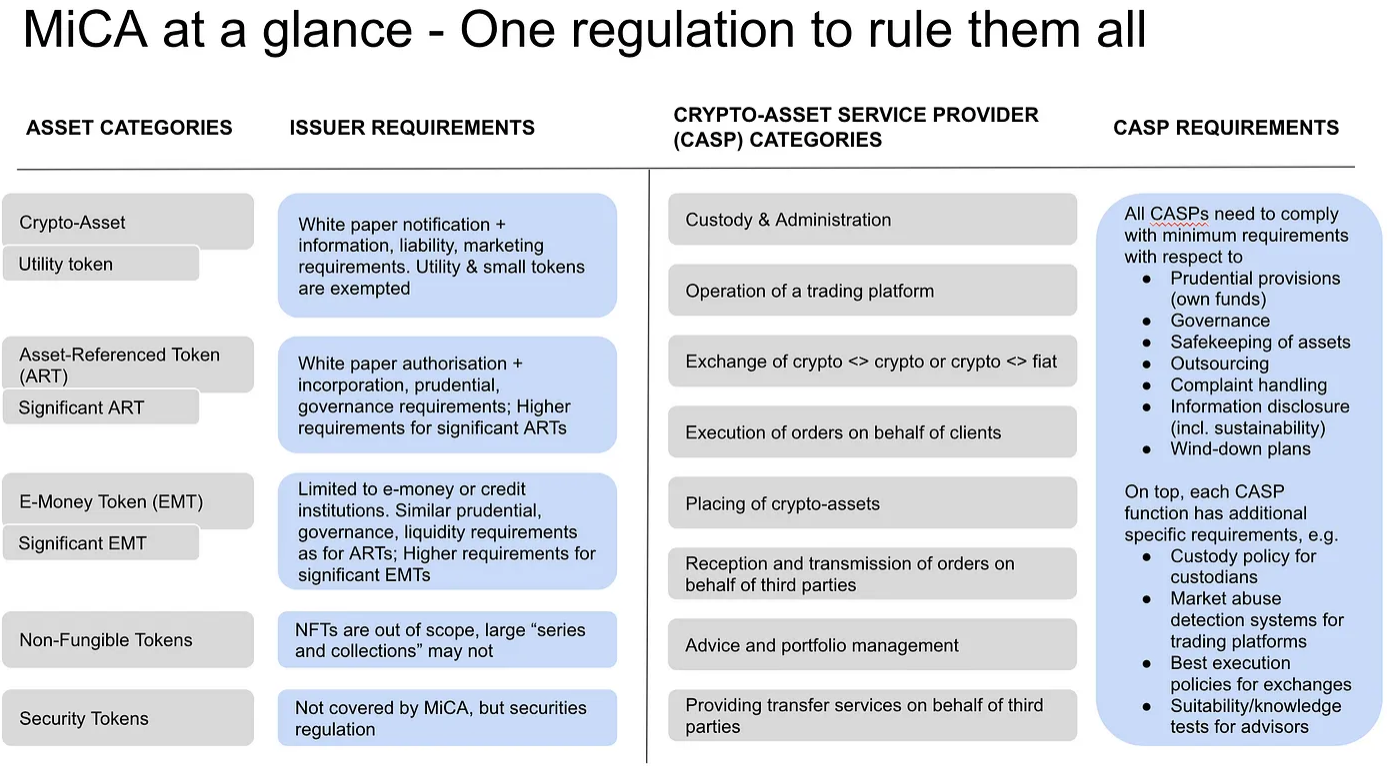

After years of negotiations, the European Union’s Markets in Crypto-Assets Regulation (MiCA) supertext was finally approved. MiCA’s text is a broad patchwork of regulation, intended to provide a comprehensive crypto regulatory framework touching centralized crypto actors.

✅ I welcome the European Parliament’s vote today to approve comprehensive EU rules on crypto: a world first.

— Mairead McGuinness (@McGuinnessEU) April 20, 2023

The rules will start applying from next year. We’re protecting consumers and safeguarding financial stability and market integrity. pic.twitter.com/cdn58rb9FA

Circle’s Director of EU Strategy and Policy, Patrick Hansen, writes, "MiCA could represent a positive boost for EU crypto businesses and the EU economy overall, but its success is highly dependent on the upcoming development of practical implementation standards.”

What does MiCA have to say specifically about stablecoins? MiCA is a meaty framework and bundles its stablecoin language into two subcategories: E-Money Tokens (EMTs) and Asset-Referenced Tokens (ARTs).

Under MiCA, an EMT is any token which aims to stabilize its value by referencing the value of a single fiat currency -- tokens falling under this designation include USDC, USDT, and EUROC. EMT issuers must have certain equity capital reserves and so-called “significant” institutions are subject to additional rules and are regulated by the European Banking Authority.

Meanwhile, the ART specification is essentially the EU’s response to concerns over efforts like Facebook’s scuttled Diem token and covers stablecoins not pegged to a single fiat currency, including those referencing brackets of currencies, commodities, and cryptos.

These designations may at least allow stablecoin issuers to have clarity on what rules they are subject to, but every bit of MiCA's effectiveness will still depend on how standards are implemented.

Perhaps MiCA’s most commendable feature is some effort to create carveouts for decentralized organizations. MiCA clarifies that “where crypto-asset services… are provided in a fully decentralized manner without any intermediary, they should not fall within the scope of this Regulation.”

Despite attempting to provide a sandbox for decentralized development, MiCA could actually alienate European developers from building projects that aim to progressively decentralize. Note that full decentralization is the prerequisite for unfettered, unregulated access to EU markets.

While mature DeFi stablecoin issuers, such as DAI’s Maker, may be able to prove full decentralization under scrutiny, early-stage stablecoin issuers reliant on many centralized features may find the regulatory atmosphere hostile and avoid incorporation in EU member states.

🇺🇲 Stuck Stateside

Speaking of hostile regulatory atmospheres... the House Financial Services Committee was in session last week and when they weren’t busy brow-beating SEC Chair Gary Gensler, they were getting hung up on stablecoins.

Brought before the Committee for discussion was an unnamed House Resolution, which introduced regulations for so-called “payment stablecoin issuers” (encompassing both bank and non-bank entities), banned algorithmic stables for two years, and called for a study on the potential impacts of CBDCs.

Progress on stablecoin legislation in the House has been minimal since the failure of the Stablecoin TRUST Act prior to last year’s midterm elections, with Ranking Member Representative Maxine Waters suggesting that legislators are “starting from scratch.”

It doesn't seem like things will be moving quickly anytime soon. Some committee members took pessimistic stances towards crypto, with Representative Stephen Lynch proclaiming “we need to separate crypto assets from our banking system.”

Meanwhile, outside figures like Blockchain Association’s Jake Chervinsky were there to offer the industry perspectives and make the case for stablecoin opportunities, “given the right policy, stablecoins can revolutionize the payments system and reinforce the dominance of the US dollar.”

Beyond selfish motivations for solidifying US dollar dominance, increased access to USD-pegged stablecoins would empower individuals seeking financial stability where relatively low rates of inflation make dollars an attractive alternative to local fiats subject to inflationary pressures.

Despite clear opportunities, solidifying dollar dominance and broadening access to stable financial instruments seems to be longer-term thinking than stateside regulators are broadly ready for, but let's hope for some more comprehensive progress soon.

Go direct to DeFi with the Uniswap mobile wallet. Buy crypto on any available chain with your debit card. Seamlessly swap on Mainnet and L2s. Favorite and follow wallets, ERC20s and NFTs. Safe, simple self-custody from the most trusted team in DeFi.

🏴 Crypto Keeps Building

MiCA may have some negative consequences for builders, but it's hard to imagine an outcome worse than what's currently happening in America, where regulators have failed to provide nearly any clarity on crypto rules. This uncertainty is evidenced by continuously stalled legislation (stablecoin-focused and otherwise) and ham-fisted enforcement efforts that provide little benefit to good actors in the space.

This uncertainty has pushed U.S.-based businesses to continue spreading their roots abroad, as evidenced by Gemini’s latest push into the Asian Pacific and Coinbase’s registration in Bermuda.

If U.S. hostilities toward crypto continue and the EU frameworks box some crypto companies in, how are we as an industry supposed to proceed? By continuing to build, however we need to! Crypto is people from the ground up; it’s up to us to fight tooth and nail for the ideals we hold dearly.

MiCA may be a massive leap forward for crypto regulation, but the hard truth is that crypto is a rapidly evolving landscape. Crypto is not a moment in time, and building comprehensive legislation for an industry just beginning to spread its wings is a tall order, yet a critical moment.

Action steps

- 📕 Read our tactic "How to fight for crypto"

- 👀 Read "The EU's new MiCA framework for crypto-assets - the one regulation to rule them all"

MARKET MONDAY:

Scan this section and dig into anything interesting

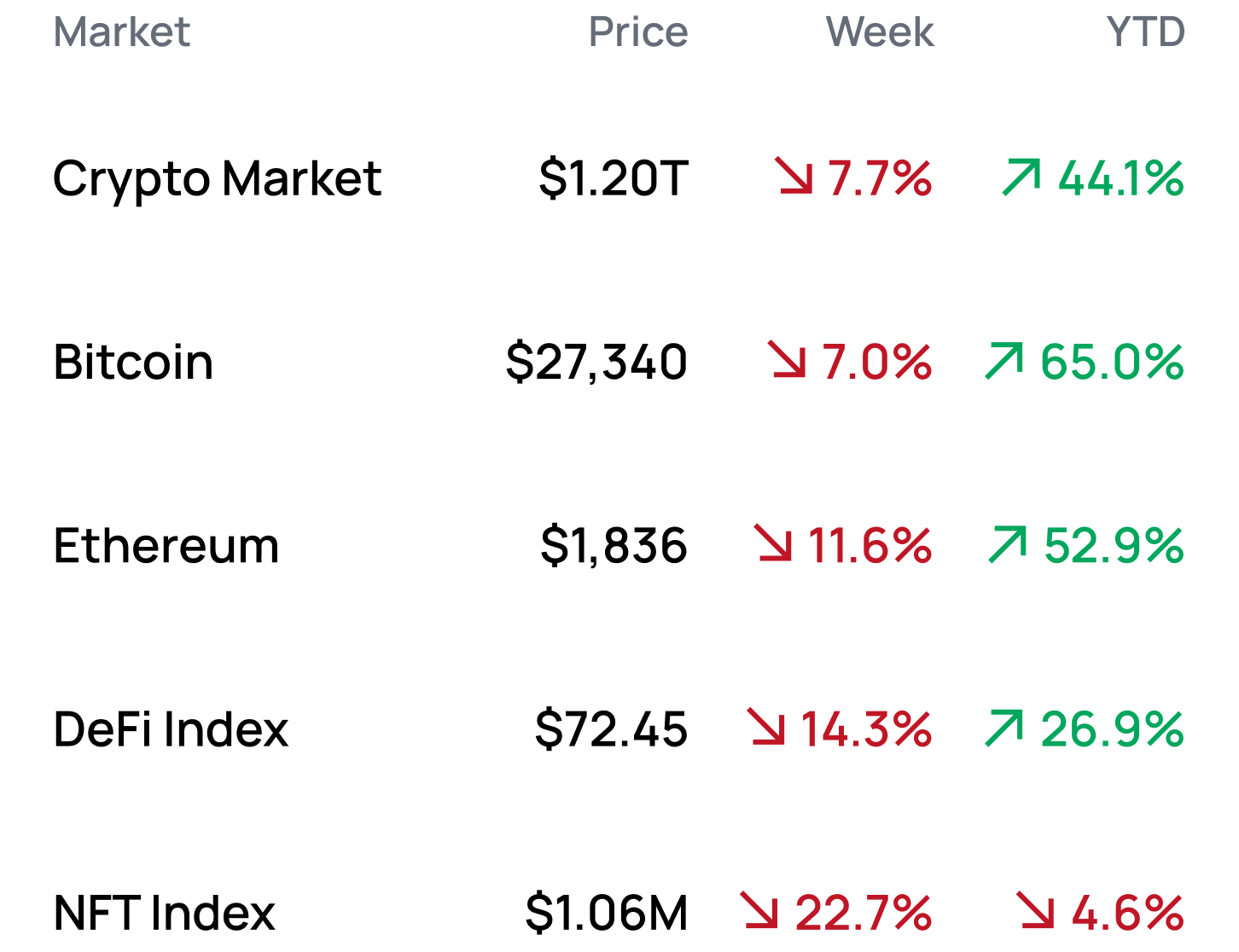

Market Numbers 📊

*Data from 4/24 1:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Explore Delphi’s Datahub and their Ethereum Dashboard

- Prevent your crypto wallet from getting hacked

- Trade on Contango - an Arbitrum protocol bringing expirable futures to DeFi

- Preserve privacy with the RAILWAY wallet

Yield Opportunities 🌾

- ETH: Earn up to 7.0% APR running a node for Rocket Pool

- ETH: Earn up to 13.3% APY with Yearn’s crvrETH vault

- ETH: Earn up to 27.6% APR staking unshETH

- USD: Earn up to 15.4% APR with 03swap’s USDC vault on Arbitrum

- USD: Earn up to 15.2% APY with Gain Network’s DAI vault on Polygon

What’s Hot 🔥

- A16z working on OP Stack client called Magi

- Congress starts from scratch on stablecoin legislation

- Let’s get HAI, a new multi-collateral stable coming to Optimism

- Massive wallet hack drains 5k+ ETH from OG’s wallets

- Berachain announces $42.0M raise on 4/20

- Senator Warren to introduce her own stablecoin bill

- Gemini gears up for Asia push

- Coinbase secures Bermuda license

- Judge rules BAYC ripoff violates US copyright laws

Money reads 📚

- On the Brink of Great Disorder - Ray Dalio

- zkSync Era vs Polygon zkEVM- BanklessDAO

- Exit Liquidity - Arthur Hayes

Governance Alpha 🚨

- Stargate DAO makes Velodrome the STG hub of Optimism

- GMX Labs receives early support from DAO to implement V2 in frontend

- Aave governance considers deprecating Aave V2 AMM market

- Balancer begins preliminary discussions to allocate 3M ARB airdrop

- Frax looks to add rETH/frxETH to the FXS gauge controller

Trending Project: RAILGUN 📈

Analyst: Jack Inabinet

- Ticker: RAIL

- Sector: Privacy

- Network: Ethereum

- FDV: $51.0M

RAILGUN is a privacy and anonymity layer built on top of Ethereum that allows users to directly interact with DEXs, lending platforms, and popular smart contract platforms. A collection of smart contracts verify zero-knowledge proofs, allowing users to make, send, or receive transactions without revealing any assets, amounts, or identities.

The Project offers both a native wallet application, RAILWAY, and a Quickstart SDK that allows you to pull RAILGUN functionality into your own web3 wallet with 100 to 200 lines of code. Additionally, RAILGUN can generate verifiable reports of actions and balances (for say auditors or compliance officers) while preserving privacy with zero-knowledge technology.

HODLers can stake RAIL for governance power -- however, there is a mandatory 30-day unstaking period, intended to hold governance responsible for vote outcomes -- and earn biweekly distributions from the protocol’s $5.6M treasury. Protocol fees are taken on all shield and unshield transactions.

Hotness Rating: (🔥🔥🔥/5) The RAILGUN TVL story, while turbulent at times, has been steadily grinding over the course of 2023, up by 188% from the start of the year, with the project seeing an explosive 77% increase in TVL in the month of April.

Price has been slow to respond to the massive increase in TVL. RAIL is up 31% off of April’s lows, however, the token is still down 47% off its February 14 local high, or 56% when denominated in Ether. RAIL represents a unique opportunity for investors to gain legal liquid token exposure to crypto’s privacy sector. Additionally, while the protocol has gained adoption in the market, token price is down significantly from January 2022 highs ($3.99) -- a pump resulting from DCG’s $10M acquisition of RAIL tokens. With token price down and protocol adoption up, RAIL appears attractive, however, it remains worth noting that the hostile regulatory environment facing privacy services could pose future challenges for RAILGUN.

Meme of the Week 😂

nightmare blunt rotation. pic.twitter.com/rU9uY6wmem

— Bankless (@BanklessHQ) April 20, 2023