Farming Stablecoin Yields on Beefy

Stablecoin yield farming isn't very sexy.

It's certainly not quite as exciting as finding the next moonshot on pump.fun. However, it can significantly hedge your positions against a potential market downturn, and that's something a lot of investors are interested in after last week's shock drop.

I’ve been both yield farming and investing in crypto assets since 2017. Perhaps I’m just a terrible investor, but I have consistently outperformed my asset bets with sustained yield-farming.

In this guide, I dig into showcasing my own personal methods for selecting and executing on yield opps using Beefy. It’s fairly easy to generate over 20% APY on stable assets, arguably much better than most traders will do in a year, and definitely better than what my bank will ever give me.

Why Stablecoins?

- Impermanent loss:

Impermanent loss is the bane of yield farming. It’s what makes or breaks a yield farming strategy, and it’s why stablecoins or single-sided liquidity provide the best opps as they are immune to impermanent loss. - Asset volatility:

Another reason why stablecoins offer the best opportunities in terms of sustainable yield? You don’t have to earn enough yield to counteract any negative swing in your position value.

Still, be aware that stablecoins are not immune to depegging, or going to zero. There are definitely different degrees of risk when it comes to stablecoins.

Why Beefy?

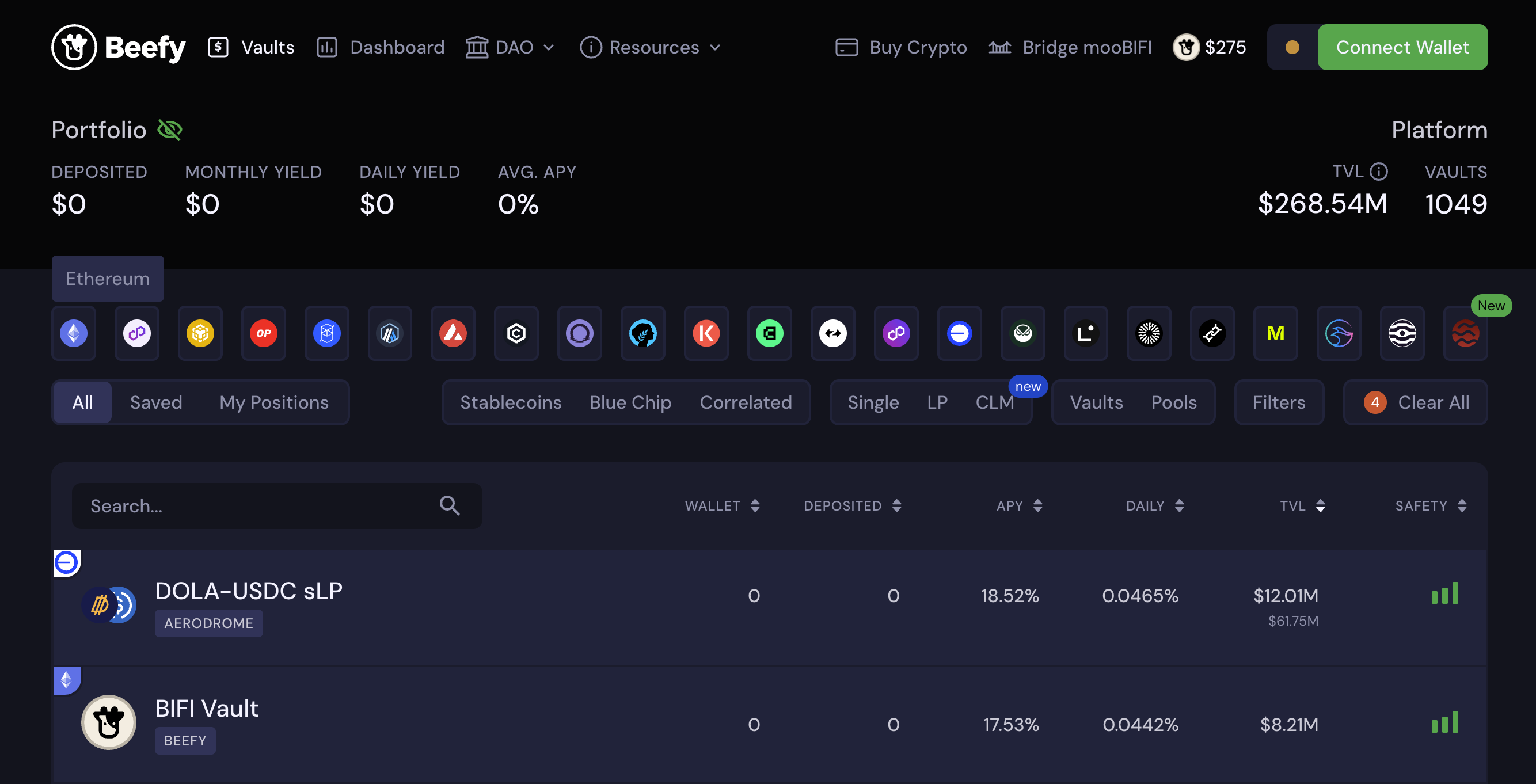

Beefy is a yield aggregator – it allows you to access a number of yield opportunities from a single interface and adds features such as auto-compounding or reporting. These platforms usually charge a small fee for these features either on a transaction basis or on the ongoing yield generated.

Usually you have to build the liquidity or staked position with the underlying platform. So say the vault on Beefy is for USDT/USDC on Uniswap on Arbitrum. You have to go to Uniswap, make sure you have USDT and USDC to build the liquidity position. Uniswap then gives you liquidity tokens you can stake on Beefy to enable auto-compounding and tracking.

The main reason I like Beefy is that I can just zap in and out of opportunities with something like USDC without swapping a bunch of assets beforehand to match whatever assets are in the liquidity pool. While it does not carry all available liquidity and vaults available, it has a decent amount of opportunities across most L2s.

The two downsides I cope with are that sometimes zapping doesn’t work on certain networks and for certain DeFi apps (looking at you Velodrome/Aerodrome), and sometimes Beefy vaults expire so you have to dig through your transactions history to find the liquidity you had and withdraw it.

🥩 Using Beefy

1️⃣ Finding a Vault

The first step is to find a Vault that works for you!

It will depend on several factors:

- Chain:

Chains with lower fees such as L2s are best because the transaction fees will be lower overall. Transaction fees eat into your profitability, depending on how often you update your positions.

You may want to consider more strongly chains that you have assets on already, or are planning to use on a longer time frame so you don’t have to keep bridging assets back and forth.

- Platform & Assets:

Here it is usually a tradeoff between risk and profitability. Newer vaults sometimes have incentives but they usually carry assets that have not been around for a while, or are on platforms that have not proven themselves yet.

- APY Consistency:

Since there are incentives to get into Vaults early, sky-high APYs generally crash down as the Vaults mature, leaving you with a position that sometimes didn’t accrue enough interest to balance out your transaction fees.

Sometimes I may take a gamble on some of these, but mostly I like sticking to a lower APY that is less volatile. You want to avoid removing and rebuilding positions all the time, it defeats the purpose of the automations!

2️⃣ Zapping in

Pick the asset you want to zap into and follow the prompts! If zapping doesn’t work, you’ll have to manually build your positions on the platform and stake the "proof of position" token on Beefy. Beefy provides a link to the underlying platform under the token selection.

3️⃣ Monitoring

I make sure I come back every so often to compare my positions to the new opportunities on the chains I’m using. If the gap in opportunity is too big, and I’ve made enough to pay back my transaction fees, I consider withdrawing from my existing position to build a new one.

Last notes

The best way to learn about new platforms in crypto is to use them! Explore the opportunities of Beefy or other yield aggregating platforms, and build your positions as hedge to market downturns.