Dear Bankless Nation,

It was a chaotic morning for crypto as some fake news around the status of a spot BTC ETF application sent Bitcoin prices skyrocketing (!!!) and then plunging (!!!) – wiping out shorts along the way! This afternoon, we dig into the chaos.

- Bankless team

A Spotty Morning for BTC Markets

Bankless Writer: William Peaster | disclosures

Crypto started off the week with a bang on Monday when some fake news shared by a crypto media outlet sent the markets into a frenzy.

Here’s what happened:

- A user in a crypto Telegram channel shared the message “BREAKING: SEC APPROVES BITCOIN SPOT ETF.” Other users started clamoring for a source, but no further context was added here.

- Some 40 minutes after that Telegram message was shared (the message was later deleted along with the account that had shared it), the crypto news outlet Cointelegraph ran with the non-story. Note the identical language:

- The problem? The SEC hasn’t actually approved any spot Bitcoin ETFs yet, so the news wasn’t real. Cointelegraph later deleted the tweet and apologized for the inaccurate info.

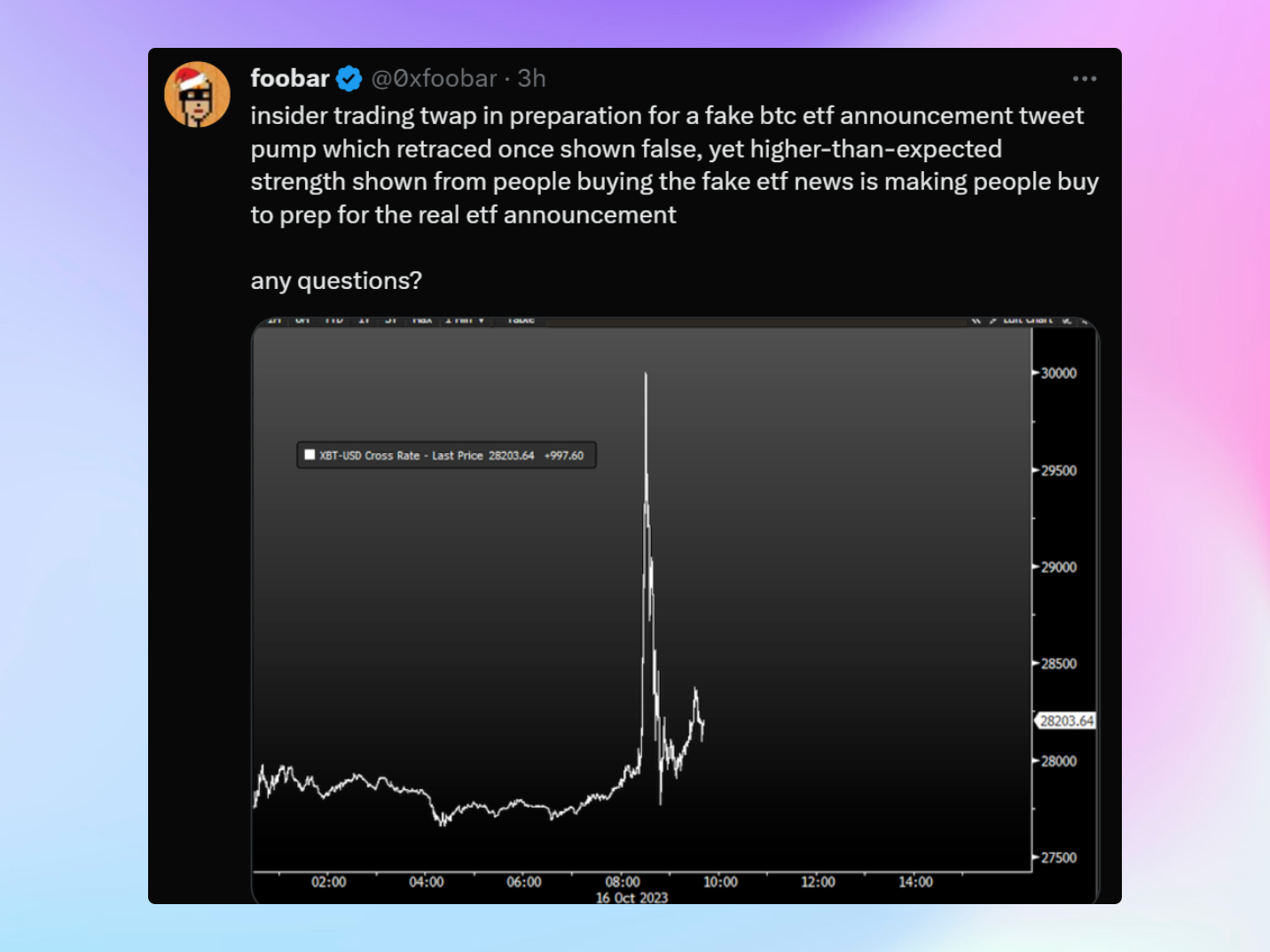

But for many traders, the admission was too little, too late. In the pseudo-announcement's immediate aftermath, word began to spread and people took action with the Bitcoin price temporarily rocketing up to $30,000, causing BTC short liquidations all along the way.

Watcher.guru reports that some $65 million was liquidated. 🤯

Of course, the initial bullish reaction here comes as no surprise since there is huge anticipation of the first spot Bitcoin ETFs in the U.S. now that the SEC is considering multiple applications.

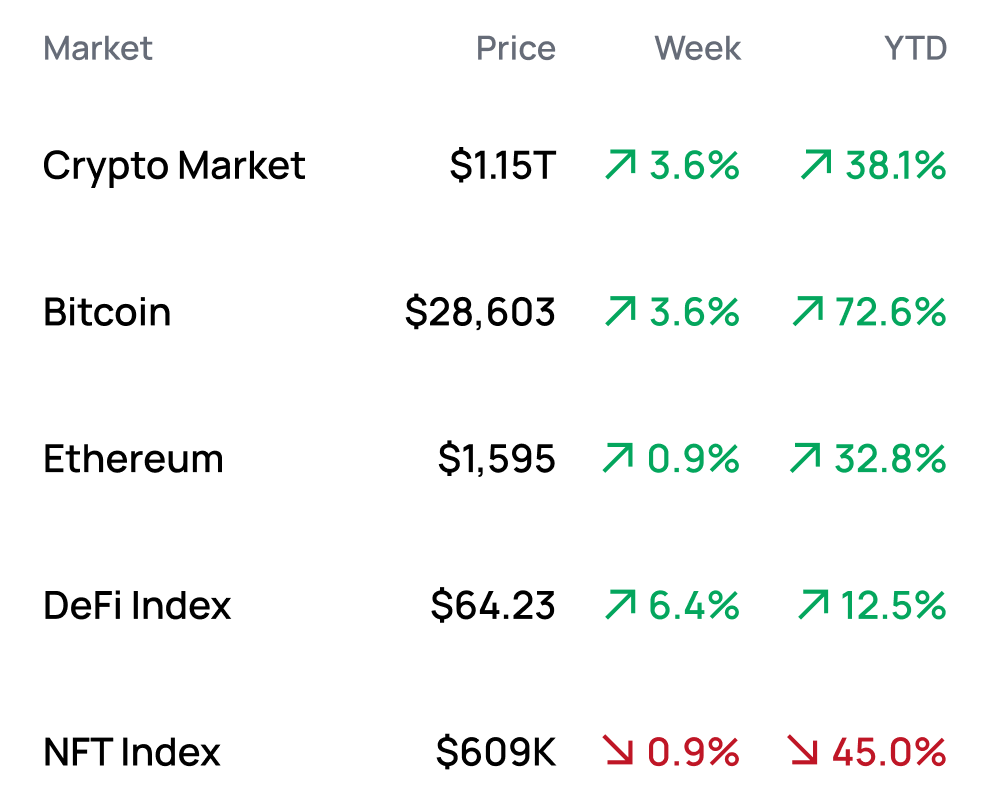

When the first such ETF is actually approved, we’ll likely see BTC and the other majors like ETH immediately rocket up, just like we saw today. The market seems to have already begun further pricing this in as the initial selloff has already softened with BTC up over 5% today.

Why the buildup? More mainstream adoption, institutional investment, better liquidity, etc.

The person who planted this fake “SEC approves spot Bitcoin ETF” story undoubtedly knew all of this! They knew how the market would react. And presumably, they made some sort of direct bet to capitalize on the chaos. Accordingly, this case likely has “market manipulation” written all over it. We don’t know the specifics yet, and Cointelegraph is still investigating the incident.

Was it the work of a lone trader on Telegram? A rogue intern at Cointelegraph? A coordinated effort by a group looking to profit from the market’s knee-jerk reaction? It’s unclear for now, but that hasn't stopped the speculatooors.

In any case, the episode has drawn a lot of attention to the need for better verification of news sources in crypto. This kind of fumble doesn’t help crypto. And if you think SEC Chairman Gary Gensler isn’t going to use this story as an example of potential market manipulation in the space, you’re fooling yourself.

If there’s a silver lining here, though, we did just get a preview of how the market will react once a spot Bitcoin ETF does get approved, i.e., impressively exuberant.

And why not? Such an ETF would be a game changer for legitimizing crypto in the U.S. It’d lower the operational risk of holding BTC, raise crypto education across the board, and pave the way to later additions like spot ETH ETFs.

And that thinking is exactly what today’s market manipulator was trying to take advantage of. Stay sharp, then, because this may not be the last “false start” we see here accordingly.

Kraken is one of the largest and most secure crypto platforms in the world. They've been in the crypto game for over a decade, and now they're inviting us all on a journey to see what crypto can be.

MARKET MONDAY:

Scan this section and dig into anything interesting

*Data from 10/16 3:30 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Implement Uniswap hooks into any project

- Secure your friend.tech account with 2FA

- Mint perpetual NFTs on Insrt Finance

- Sign up for a Farcaster account

- Purchase yield-bearing USDM

Yield Opportunities 🌾

- BTC: Earn up to 6.8% APY with Frax’s WBTC vault on Ethereum

- ETH: Earn up to 22.4% APR with Convex’s rETH-frxETH pool on Ethereum

- ETH: Earn up to 20.5% APR with Convex’s ETH-xETH pool on Ethereum

- USD: Earn up to 6.9% APY with Frax’s sFRAX vault on Ethereum

- USD: Earn up to 17.8% APR with Aura’s DOLA-USDC vault on Arbitrum

What’s Hot 🔥

- NFT trader accidentally bids 1,055 ETH for a CrypToadz

- Binance’s $1B crypto recovery fund deployed less than $30M

- Goldfinch loan defaults, $7M at risk of being unrecoverable

- Israel war prompts crypto firms to start up aid fund

- Trader Joe’s grocery store sues DEX with the same name

- Jim Cramer thinks “Mr. Bitcoin is about to go down big”

- Tangible releases plan of action to prop up USDR

- Stars Arena announces recovery of 90% of stolen funds

- Immutable announces partnership with AWS

- JPMorgan’s blockchain settlement system goes live

- Israeli police seize Hamas accounts on Binance

- CFTC charges Voyager co-founder with fraud

Money Reads 📚

- Why I Built Zuzalu - Vitalik

- Introducing Programmable Trust - Eigenlayer

- Thoughts on Impermanent Loss - Hayden Adams

- Magnitude and Direction of Lido Attack Vectors - Mike Neuder

Governance Alpha 🚨

- Sandeep from Polygon proposes that ApeChain be built on his CDK

- BarnBridge prepares to liquidate treasury to fend off SEC lawsuit

- Aave temp check seeks addition of crvUSD to V3 Ethereum pools

- Aave governance approves further increase to GHO borrowing rate

- Alchemix seeks approval on plan to re-back alETH after Cruve hack

- Voting results for Arbitrum’s Short Term Incentives Program (STIP)

Meme of the Week 😂

You wanna talk about decentralization?

— Bankless (@BanklessHQ) October 11, 2023

When Discord goes down, half of web3 companies go down with it pic.twitter.com/HDV3WRkAKW