Breaking Down Sport.fun’s $FUN Token Sale

Bankless is working on ICO Watch, a new dashboard tracking notable public token sales. I helped input details for the first batch of listings, and one entry stood out to me: $FUN.

That’s partly because I covered Football.fun in Metaversal back in August, when it was still a soccer-first experiment on Base. Since then, the project has expanded into Sport.fun, adding NFL fantasy play and formalizing a broader onchain sports economy.

The $FUN public sale kicked off today and runs through Thursday, December 18th. Below, I’ll catch you up on how the Sport.fun ecosystem works, what $FUN is designed to do, and how the sale itself is structured so you can assess the token for yourself.

From Football.fun to Sport.fun

Football.fun launched earlier this year with a vision to turn fantasy fútbol into a persistent onchain market.

In other words, instead of drafting lineups that reset every season, users buy and trade ERC-20 shares of real players whose values move based on demand. This model and the initial platform gained quick traction, as they've already generated +$80M in total volume (and millions of dollars of revenue) to date.

Sport.fun is the next step, with Football.fun being the first title in this broader multi-sport ecosystem. Accordingly, NFL fantasy play is now live alongside fantasy fútbol, and more sports are incoming. Importantly, all of these titles plug into the same underlying economic framework.

Where $FUN fits in

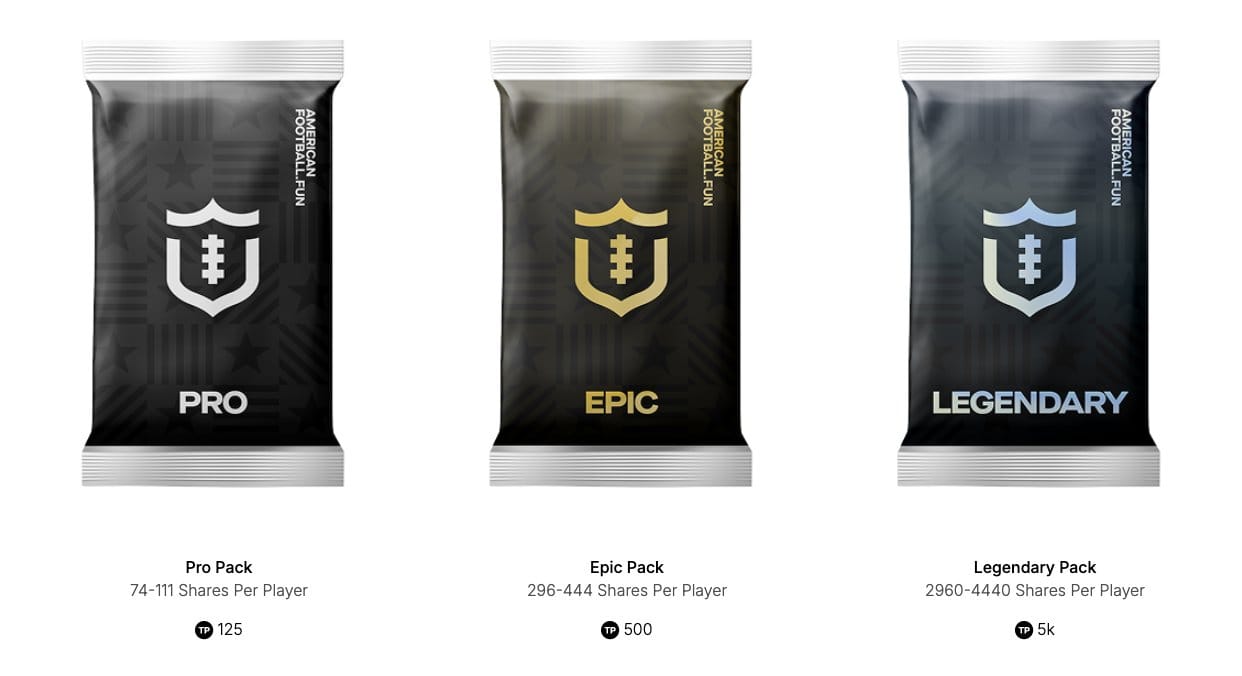

Sport.fun play centers around three tokens: Gold (pegged 1:1 with USDC on Base, used for trading players), Player Shares (25M max supply tokens that represent real-world athletes), and Tournament Points (for opening Player Packs, earned in tournaments).

All that said, the incoming $FUN token doesn't sit inside the gameplay economics here. You don't need $FUN to buy Gold or Player Shares, and you don't need it to enter tournaments.

Instead, $FUN exists atop the game as an ecosystem token that has multiple primary roles:

- Value capture: Sport.fun generates revenue through real trading fees. A portion of that revenue will be used to buy back $FUN continuously over time.

- Fee rebates: Holding $FUN in your in-game wallet will unlock tiered discounts on trading fees. Naturally, the more you hold, the bigger the discounts.

- Player curation: Later on, $FUN holders will gain governance influence over which players are onboarded next through a token-voting "Scouting" feature.

Keep in mind, then, that $FUN is not an inflationary rewards token. There are no emissions. There is no play-to-earn faucet. There is no requirement to speculate to participate, as all Sport.fun titles have free-to-play modes.

The $FUN public sale

The $FUN ICO is running in parallel on both Kraken Launch and Legion, using a merit-based allocation model. Kraken uses things like account age and trading activity to determine merit, while Legion focuses on historical Sport.fun activity for scoring.

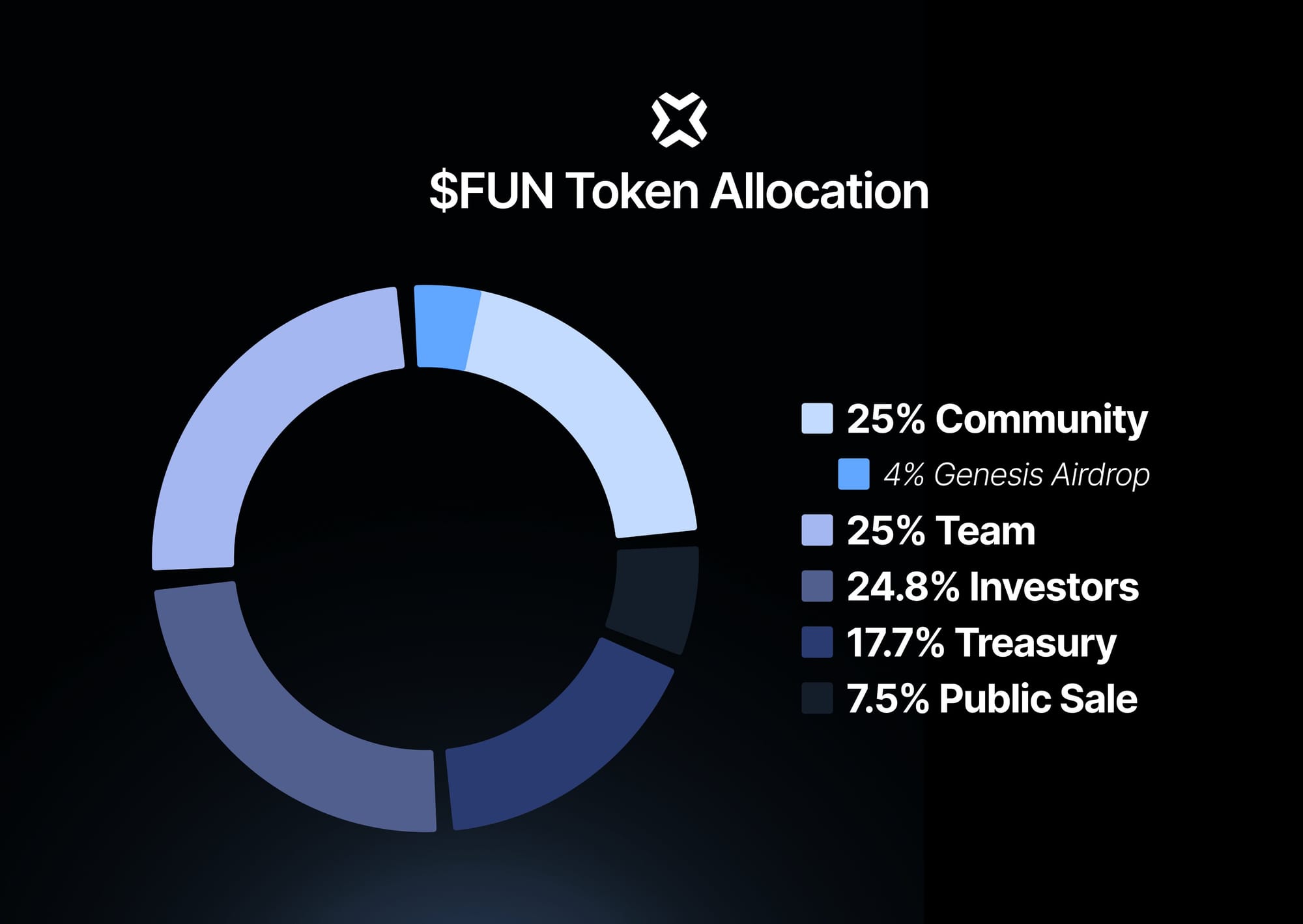

As for the offering itself, the target raise is $3M with a hard cap of $4.5M. The total supply is 1 billion $FUN, so with a sale price of $0.06 per token, the implied FDV here is $60M.

Also note the vesting details. 50% of tokens will be fully unlocked for purchasers upon the token generation event (TGE) in January 2026, while the other 50% will be vested linearly over six months.

The stated goal of the sale isn’t to maximize capital raised or push the project's valuation higher, but to bring in a relatively modest amount of funding while broadening ownership among people who actually use, or plan to use, the platform. In that sense, this ICO functions as a distribution mechanism as much as a fundraising event.

If you decide to explore the offering, there are some jurisdictional restrictions. For example, U.K. investors are barred from the sale. U.S. investors can participate on Kraken if they have "Verified" or "Pro" KYC, while accredited U.S. investors can participate on Legion.

Buy / hold / skip?

Whether $FUN makes sense for you depends on how you weigh its tradeoffs. In my opinion, some of the mains pros and cons here:

The good

- The product already exists, and people are using it. The token is coming after a level of product-market fit has been achieved.

- $FUN isn't driven by rewards. There are no inflationary emissions for play-to-earn mechanics. Trading fees and buybacks provide the foundation.

- The raise size isn't absurd. With a $3M target raise and a $60M implied FDV, this seems like a reasonable funding ask.

- Distribution favors participation. The ICO's merit-based allocation will stymy bots and mercenary whales, so players will remain the main stakeholders.

The question marks

- Sustained activity is needed. The long-term value of $FUN hinges on continued trading volume across Sport.fun titles. This means if user growth stalls, buybacks will weaken.

- Consumer crypto is hard. Sport.fun has traction, but scaling beyond early adopters in this vertical is difficult. It's possible, but it will take a lot of work.

Zooming out

How the platform performs post-ICO remains to be seen. However, Sport.fun has already shown that onchain fantasy sports can generate real revenue, and the shift toward a multi-sport ecosystem gives it additional surface area to grow into.

Beyond the ICO itself, another near-term milestone to keep an eye on is the initial $FUN airdrop around the January TGE, which will distribute 4% of the total $FUN supply to active players. All platform activity is being tracked until that airdrop, so you still have time to up your eligibility if you're interested.

Ultimately, then, $FUN is at least worth keeping on your radar, even if that means simply watching how the token and the broader Sport.fun economy evolve through the first half of 2026. If nothing else, consider it an early case study amid this new era of ICO projects.