Everyone is taking a closer look at decentralized predictions markets this year thanks to the breakout success of Polymarket.

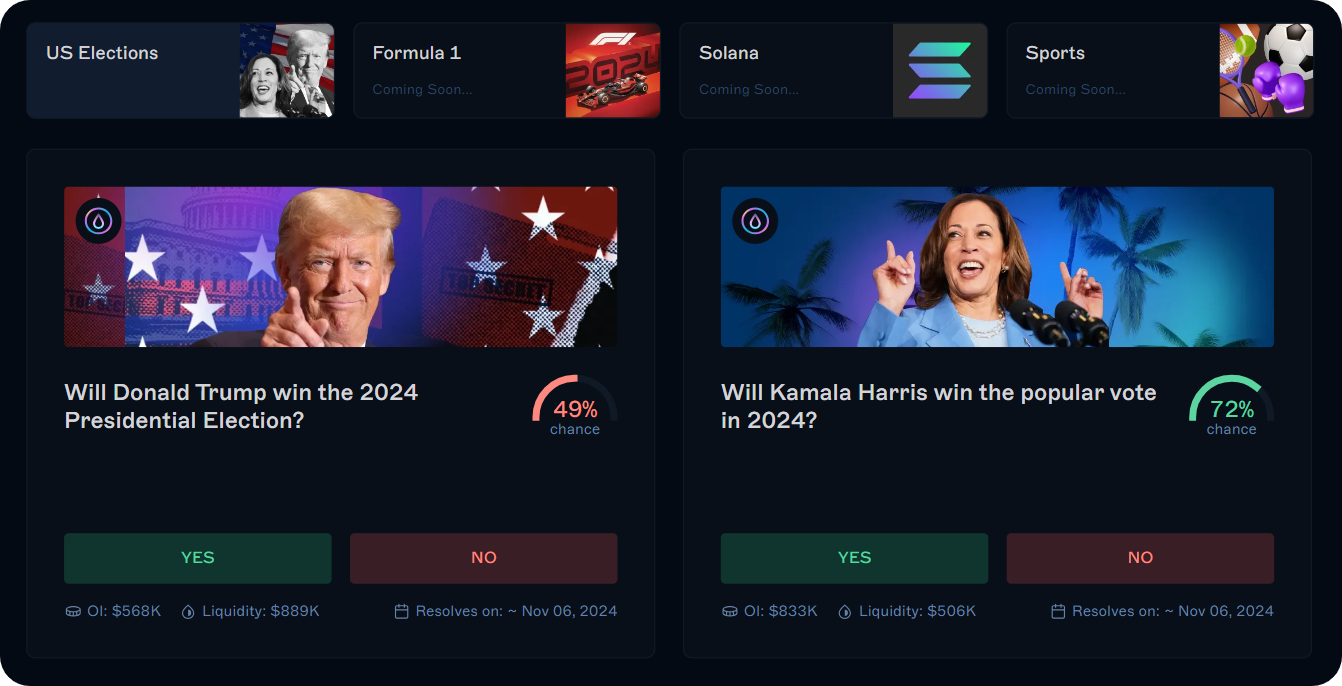

And while Polymarket is far and away the leader of the sector, with monthly volume, active users, and open interest stats currently near all-time highs amid 2024 presidential election excitement, there are other players to watch too.

If you’re a Solana user, then you ought to check out BET!

Last week, the popular Solana decentralized exchange Drift announced BET, for “Bullish on Everything,” a capital-efficient prediction market built atop the Drift Protocol.

The grand vision? Offer a prediction marketplace where users can tap into Solana’s signature speed and low costs while also earning yield on their underlying positions before event outcomes.

Also, BET goes wide on token support. While Polymarket is centered around USDC trading, BET supports trading with over 30 different cryptocurrencies, including stablecoins and Solana liquid staking tokens (LSTs).

Out of the gate, BET has launched a handful of markets centered around the upcoming U.S. Elections, e.g., Will Kamala Harris win the popular vote in 2024? Going forward, Drift will add more market categories, like sports, and shift toward fully permissionless markets.

All that said, if you’re interested in trying these first markets for yourself, head over to app.drift.trade/bet and connect your Solana wallet. At this point, you will need to fund and create an account. Select your preferred deposit approach and approve the account creation, which costs ~0.03 SOL.

After this, you can click into one of the available markets on the BET platform to dive in. First things first, note the market’s “Resolves on” date so you know how long it will run for. Then head over to the “Market” tab and select “BET YES” or “BET NO” depending on your prediction.

Now, it’d be time to size your trade. In the trading interface, input the amount of yes or no shares you want to acquire using the “Cost per share” metric to help you decide. Once this is done, the interface will show you additional info, like your potential profit and how much FUEL you stand to earn.

If everything looks good, press the final “BET” button and complete the purchase transaction with your wallet. Boom, that’s all it takes!

With your position locked in, you can use the “Positions” tab beneath the market interface to monitor your bet’s performance or close it early ahead of its resolution date. This is where you’ll also find a “Balances” tab for depositing, withdrawing, swapping, or transferring your assets as needed.

There are some more advanced things you can do with BET, like making limit orders, and there are some additional services you might be interested in here, like staking DRIFT to earn extra FUEL. But the walkthrough above shows that even just the basics here are straightforward and compelling.

Of course, Polymarket has already laid out the blueprint for how an onchain prediction marketplace can achieve major popularity; the question is now whether BET can meet (or surpass) Polymarket's success by following a similar playbook with its own flourishes.