Solana Isn't Dead, Yet

Dear Bankless Nation,

Solana has taken a beating after catching outsized heat from both the FTX implosion and SEC crypto crackdown.

Today, we revisit our November 2022 article charting the network's outlook. Have things gotten any less grim? Let's dig in.

- Bankless team

Solana: Seven Months After FTX

Bankless Writer: Ben Giove

Is Solana dead?

This was a question we asked back in November 2022 in the weeks following the collapse of FTX. Our takeaway was that despite the carnage, Solana was going to make it. The network had withstood a significant stress test, and was backed up by a strong community and NFT ecosystem.

Have things changed in the seven months since?

Let’s take another look at the Solana ecosystem and see if we can find an answer to that question.

Regulators attack!

Solana has been anything but immune to the SEC’s crypto crackdown. SOL has been caught in the regulatory crossfire, with the SEC alleging in its lawsuits against Binance and Coinbase that the asset, along with an assortment of other tokens, is a security.

The token has sold off nearly 30% in the two weeks since the announcement of the suits, with centralized exchanges like Robinhood and Bakkt having already delisted the asset to avoid direct regulator conflict. It’s unclear how long it will take to get clarity on whether SOL is indeed a security, with a potential years-long legal battle looming. For comparison, Ripple has been fighting its case for nearly two and a half years.

It’s possible that this uncertainty could constrain capital from investing into the Solana ecosystem as well as eat into the resources of the Solana Foundation. Furthermore, should it be delisted by other centralized exchanges, it may also weigh on the price of SOL over the short-to-medium term.

Alameda Overhang

The SEC is not the only entity haunting the Solana ecosystem, the ghosts of FTX and Alameda Research continue to loom large.

Per research from Delphi Digital, 8.2% of the SOL supply is locked by Alameda, and has an average unlock date of mid-2025. These tokens are now subject to bankruptcy proceedings, meaning that they are likely to be sold in an attempt to recoup losses and make creditors whole. This may not weigh on the price of SOL in the short-run, as we are roughly two years from when the brunt of tokens are set to vest, but does represent a significant medium-term headwind.

However, it may also still cause some chaos in the near-term, as it has prompted discussions of a hard fork in order to burn Alameda’s tokens. This could pose a serious threat to Solana’s credible neutrality, as it establishes a precedent of arbitrarily confiscating assets from tokenholders. Now, this seems firmly in the “discussion” phase. However, as we’ve seen in Bitcoin and Ethereum, pushes to fork can often take on lives of their own and cause chaos and division within a community.

Unlock the future of gaming with Immutable. Experience Immutable’s transformative power, where true digital ownership and web3 technology redefine gaming. Join a vibrant ecosystem backed by our leading web3 gaming platform, millions of players and a diverse lineup of 150+ games. Build, play and connect.

Builder community holding

Despite a cocktail of long-term uncertainty hanging over it, the network has seen pockets of opportunity thanks to new projects on the horizon.

That said, the metrics are still trending downwards amid a deepening bear for the network's growth areas. Since our last article, SOL-denominated TVL has decreased from 20.93M to 16.42M – an over 20% decrease. The network currently boasts the 11th highest TVL among all networks at $253.6M.

While total active wallets on the network have taken a major hit, with its 7-day moving average (7DMA) down some 40% to 235.1k since the end of November, non-vote transactions have inched upwards, with the 7DMA up 7% in the same time frame.

Solana’s NFT ecosystem has remained a bright spot of innovation for the network despite a broader slowdown in NFT volumes. Per CryptoSlam, Solana facilitated $39.4M in NFT trading volumes over the past month, the third highest of any network, behind Ethereum and, more notably, Bitcoin, which has seen a rapid explosion in interest with Ordinals.

A much hyped catalyst for Solana is the upcoming launch of Firedancer, a client developed by Jump Crypto. The client would be the network's third alongside the Solana Labs client and Jito-Solana client. Firedancer is highly anticipated due to the immense scalability benefits that it could bring to Solana. In a recent performance demo, validators running Firedancer were able to process more than 1 million transactions per second (TPS), far exceeding the processing capabilities of any blockchain in production today (including Layer 2s). A successful production rollout could position Solana as a go-to chain for building high-throughput, computationally intensive applications.

The Verdict

So... is Solana dead?

Between the SEC suit and Alameda unlocks, Solana still faces significant challenges as it recovers from a truly brutal 2022.

Solana is dealing with plenty of bearish sentiment, as are many other alt-L1s – including those also mentioned in the SEC's latest suits. But, despite general slowdowns across DeFi and NFT volumes, don't count the network out quite yet. 🏴

MARKET MONDAY:

Scan this section and dig into anything interesting

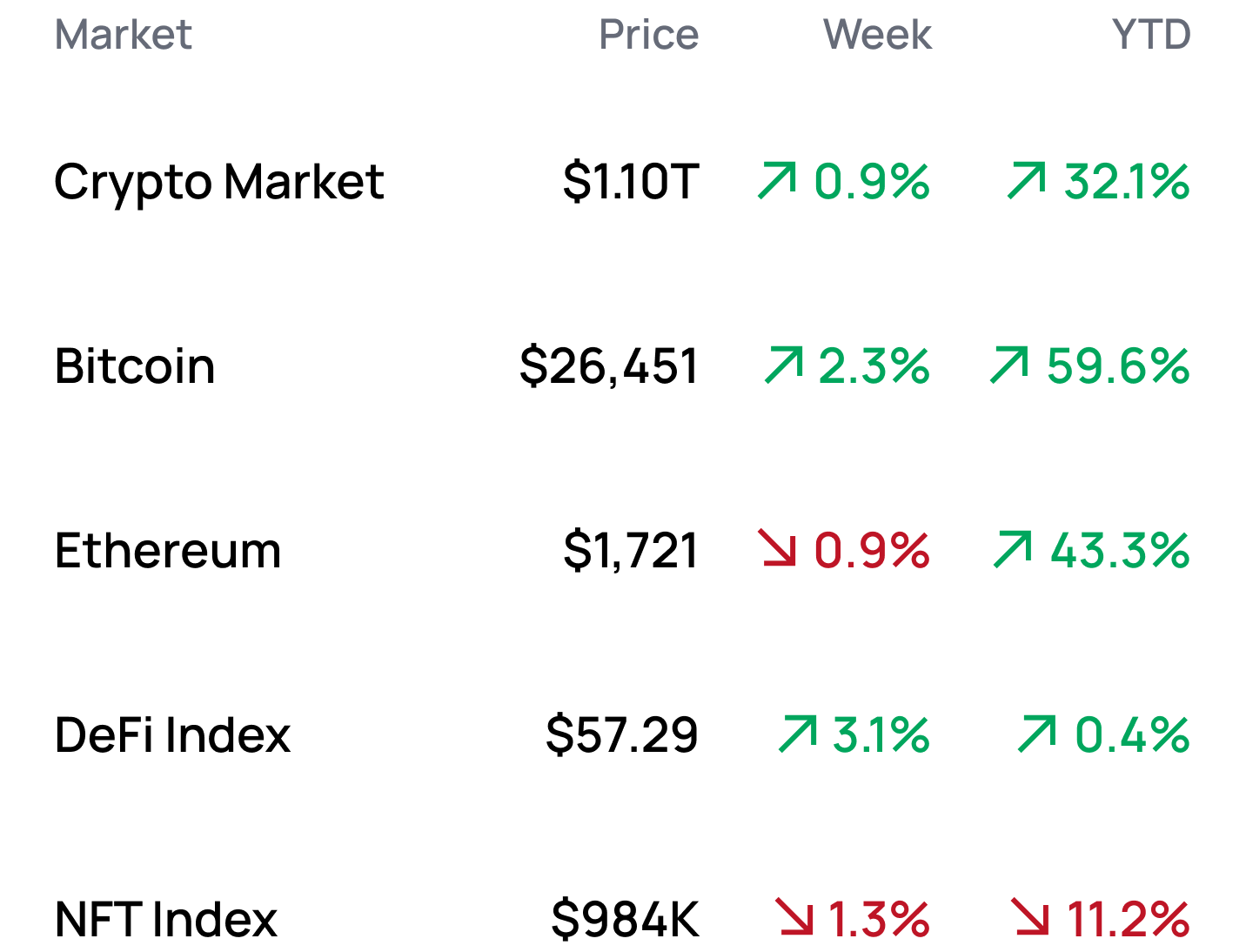

*Data from 6/19 1:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Try out EigenLayer on mainnet

- Analyze NFT royalty revenues with DeFi Llama’s new NFT Earnings Dashboard

- Mint NFTs on Manifold on Optimism

- Assess the fundamentals of perps DEXs on Artemis’s perpetuals exchange dashboard

Yield Opportunities 🌾

- ETH: Earn 14% staking rETH-ETH Curve LP tokens in Convex on Ethereum

- ETH: Earn 12% staking alETH-frxETH Curve LP tokens in Convex on Ethereum

- USD: Earn 26% lending USDT in Yama Finance on Arbitrum

- USD: Earn 14% depositing crvUSD into Conic Finance’s Ominpool on Ethereum

- BTC: Earn 3% lending wBTC in Gearbox on Ethereum

What’s Hot 🔥

- Blackrock files for a Bitcoin ETF

- Frax announces their Fraxchain L2

- ZachXBT receives more than $1M in donations for legal defense

- The Goose NFT sells for $6.2M

- Uniswap decides to partner with Axelar for cross-chain swaps

Money reads 📚

- Understanding Rollup Value Accrual - Sanjay Shah

- L2 MEV Wat - Lisa A.

- Introducing World Engine by Argus - Scott Sunarto

- Uniswap V4 Takeaways - Robert Chen

Governance Alpha 🚨

- Balancer explores launching a veToken launchpad

- Aave looks to to build out liquidity for GHO

- Aave moves to freeze CRV markets on V2

- Aura weighs deploying on Arbitrum

- StakeWise moves to overhaul their tokenomics

Trending Project: Uniswap (UNI) 📈

Analyst: Ben Giove

We are reiterating our neutral rating on UNI.

Uniswap remains neutral due to the upcoming release of Uniswap V4.

Catalyst Overview:

On June 13, Uniswap Labs announced and released the whitepaper for Uniswap V4, the next iteration of the protocol. V4 brings with it several new features to the protocol, the most significant of which are hooks, which enable the ability to create custom pools with features like dynamic fee-tiers, limit orders, TWAP orders, as well as those that re-deposit out-of-range liquidity into other protocols. Another major feature is the singleton, a single contract which contains all pools in V4 in order to significantly reduce gas costs.

Potential Price Impact:

The launch of V4 represents a positive catalyst for UNI, as the aforementioned features of the new protocol are likely to help Uniswap retain its market share and position as DeFi’s leading DEX. However, given the difficulty to date in turning on the fee-switch, a mechanism that will carry over to this latest version of Uniswap, V4 is unlikely to translate to meaningful outperformance for the UNI token over the medium-to long-term.

See more ratings in the Token Hub.

Meme of the Week 😂