Solana Fallout

View in Browser

Sponsor: Frax — Fraxtal Ecosystem: Where DeFi Meets AI.

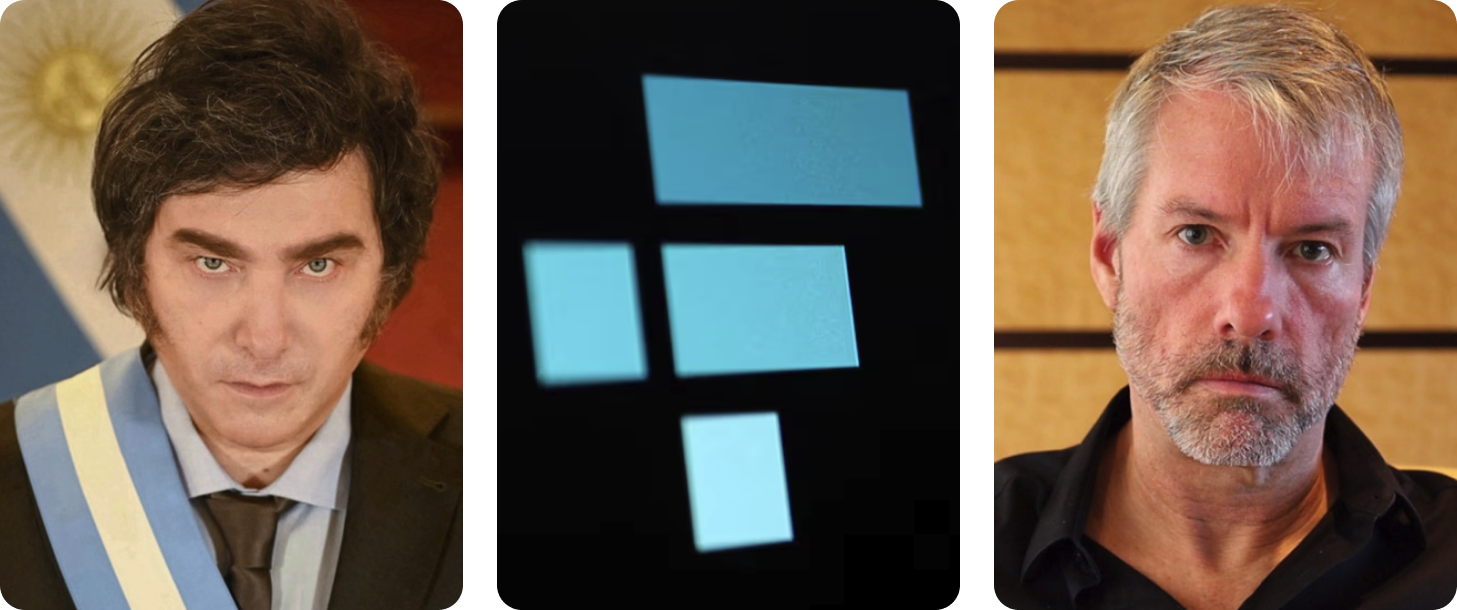

- 🇦🇷 LIBRA Memecoin Fallout Continues. Argentina President Javier Milei's memecoin foray continues to snowball, with the latest reporting from CoinDesk suggesting that LIBRA's creator claimed to be 'controlling' the president via payments to his family.

- 🔵 FTX Begins Repayments. More than two years after the exchange's collapse, FTX is finally sending out creditor repayments, starting with holders who had less than $50K in assets on the exchange at the time of the collapse.

- 🟧 Strategy Announces a $2B Convertible Note Offering. Saylor is back at it again, with a new pitch for investors, even as the value of its BTC holdings takes a hit.

| Prices as of 7pm ET | 24hr | 7d |

|

Crypto $3.14T | ↘ 0.3% | ↘ 0.9% |

|

BTC $95,433 | ↘ 0.2% | ↘ 0.5% |

|

ETH $2,670 | ↘ 2.1% | ↗ 2.7% |

There's no perfect way to launch a token. That being said, there are plenty of shitty ways to launch one, something that the crypto industry is only growing more familiar with in recent days.

Years ago, crypto mega-influencer/investor Cobie, aka Jordan Fish, highlighted one particularly shitty token launch strategy that was prevalent (and still is) among projects backed by the industry's top VCs. These so-called low-float, high-FDV (fully diluted value) token launches gave venture investors all of the early upside and ensured that a lack of volatility at launch ensured insiders got paid.

Cobie's musings triggered some solution hunting, and he ended up shipping Echo, an investment app built for “allowing onchain natives to invest together.” The product launched in beta nearly a year ago, and since then, 238 deals have been facilitated using Echo by 7,654 unique investors and just under $100M total raised. The firm has been capturing more and more attention in recent months, led by MegaETH's $10M raise from the platform in December.

To understand more about why Echo is having a moment, we have to take a step back and learn what Cobie means by low-float high-FDV. 👇

The Fraxtal ecosystem is expanding at lightning speed—this month’s biggest highlight is IQAI.com, the newest Agent Tokenization platform from IQ and Frax. IQ is building autonomous, intelligent, tokenized agents launching on Fraxtal in Q1. Empower on-chain agents with built-in wallets, tokenized ownership, and decentralized governance—all within a fast-growing Fraxtal ecosystem.

Back in April of 2023, we launched Bankless Ventures. Our thesis at the time was simple: We believed a small fund with a powerful brand could punch well above its weight class.

Over the past 21 months, we’ve been able to test that thesis as Ryan, Ben, and I evolved from opportunistic angel investors to competitive deal-winners. As angels, deal flow often found us. But as VCs, we had to secure that deal flow in a fiercely competitive ecosystem.

Could Bankless Ventures succeed? In order to win, we had to answer yes to these four questions:

- Can we get into the right deals?

- Can we deliver massive value to our portcos?

- Can we keep nailing hits?

- Can we build the best team?

Now that Bankless Ventures Fund I is 90% deployed and our gaze turns to Fund II, let’s take a moment to evaluate our performance and measure results. 👇

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.