Coinbase Suits Up for Battle

Dear Bankless Nation,

After years of plugging their ears to crypto executives looking to negotiate, American regulators are in attack mode. Just today, a new lawsuit was filed against Binance.

Today, we look at Coinbase, which appears poised to fight any potential SEC legal action. It's a big moment for crypto.

- Bankless team

SEC v. Coinbase

Bankless Writer : Jack Inabinet

Out of last week’s slew of regulatory actions came an SEC Wells notice for crypto behemoth Coinbase.

While the exchange is unlikely to be in court anytime soon, the Wells notice informs Coinbase that SEC staff have made a preliminary determination to recommend an enforcement action against the firm for violations of federal Exchange and Securities Act violations.

Multiple Coinbase products are coming under regulatory scrutiny, including:

- An unidentified portion of listed digital assets;

- Coinbase Earn, the platform’s staking service;

- Coinbase Prime, an institutional custody and trading solution, and;

- Coinbase Wallet, a self-custodial wallet.

Following disclosure, $COIN took a nosedive, tumbling 20% off of Wednesday's lows on the Thursday open. While the $COIN price already incorporates the impact of the Wells notice, the significance of the SEC’s actions on the broader crypto industry has yet to be seen. Coinbase appears intent on going to court and advocating for crypto clarity.

So what happens next? We avail ourselves of the court system to finally start to get some clarity for the crypto industry in the U.S. Ironically, establishing some case law may be our best shot at getting the regulatory clarity that the industry deserves. 14/15

— paulgrewal.eth (@iampaulgrewal) March 22, 2023

Previously on SEC v. Everyone

Gary Gensler went after Kraken’s staking service on February 9th, regulatory talons on full display. The crux of the SEC’s disagreement with Kraken appeared to be centered around the pooled nature of customer assets and yield to provide stable, regular payouts to users.

Kraken chose to settle with the SEC and the resulting $30M fine and shuttering of US staking operations accomplished nothing other than eliminating a convenient staking-as-a-service option for American retail consumers.

You could have:

— RYAN SΞAN ADAMS - rsa.eth 🏴🦇🔊 (@RyanSAdams) February 9, 2023

- Mandated proof-of-reserves

- Required staking transparency

- Supported decentralized staking

Instead, we just got another gary g. ban hammer to the head. And we have no confidence you won't come for decentralized staking next.

You're driving it all offshore.

Coinbase took immediate steps to avoid similar enforcement action, clarifying in its terms of service that the firm is a service provider, connecting users with validators and protocols to pass through staking rewards, less a small fee, while requiring the unstaking of certain assets before sale or transfer.

The Infura NFT API + SDK is the toolkit you’re missing.

🔥 Learn More at Infura.io

A Pivotal Moment

American regulatory frameworks are set by legislation and legal precedent. Because Kraken chose to settle, no new regulation was created. With Coinbase intent on meeting the SEC in court, legal precedent will be set; the ramifications of failure are significant.

Nine months ago, the SEC began investigating Coinbase. In the following months, the two parties met over 30 times, with Coinbase soliciting feedback on its regulatory proposals in December 2022.

Over the past 9 months, CB has met with the SEC more than 30 times, sharing details of our business to build a path to registration. During this time, the SEC hasn't given basically 0 feedback on what to change, or how to register. Instead, today we received a Wells notice. 2/15

— paulgrewal.eth (@iampaulgrewal) March 22, 2023

SEC staff anticipated issuing guidance in January, however, one day before their scheduled meeting, Coinbase was informed the agency would be pursuing an enforcement action. Receipt of a Wells notice does not necessarily mean the SEC will file an enforcement action, however, given Coinbase’s prior attempts to cooperate with the regulator, it is likely that we will see resolution through the judicial system.

While we are unlikely to receive specifics on the investigation at this time, it is troubling to see such a wide range of products coming under the SEC’s ire. Coinbase did not receive any specifics on which cryptocurrencies the SEC considers securities, however, digital assets referenced in SEC v. Wahi are likely encompassed, including the Rari and Ampleforth governance tokens.

Alterations to Coinbase Earn’s terms of service failed to satiate the regulators. The SEC may have set its sights on “pooled” rewards models and seek to fine Coinbase for past wrongs. A more sinister outlook, however, sees the SEC attempt to classify staking as a security and look to use its day in court to set such precedent.

Strangely, the SEC includes Coinbase Prime and Coinbase Wallet as products under investigation in its Wells notice. This marks the first regulatory inquisition targeting a licensed institutional custody solution and smart contract wallet. Potentially, a Coinbase failure to successfully defend these products in court could result in additional hurdles to both institutional and retail access to crypto markets.

Coinbase-probed products were all included in the firm’s Form S-1 registration filing with the SEC, required for the listing of a publicly traded company in the United States.

Why the SEC is now choosing to raise questions remains unknown, yet, an SEC victory against Coinbase could set a detrimental precedent and hamstring crypto adoption in the US.

Son of Crypton

Fending off an army of SEC lawyers is expensive.

Just ask SushiSwap Head Chef Jared Grey. On March 21st, Sushi DAO and Grey were served with SEC subpoenas. Details are not disclosed, however, it is clear that the two parties are on the SEC’s naughty list.

SushiSwap deprecated the Kanpai fee share with xSUSHI stakers and is set to claw back SUSHI sitting dormant in the Merkle Distributor to secure operational runway.

Currently, the cash-strapped protocol’s CEO is looking to establish a $3M legal fund. Court proceedings are lengthy and lawyers are expensive; for many DAOs, including Sushi, battle against regulators creates a major financial strain.

Coinbase is one of the few crypto entities well-capitalized enough to take on the regulators. The firm has built up internal legal and policy departments, spending millions to craft proposals for quality crypto regulation.

They will be able to wage combat against the SEC in what is likely to be a protracted legal battle. Crypto needs firms like Coinbase to stand up to the SEC and engage with Washington.

While the laws of smart contracts are sufficient in DeFi, regulation is necessary to empower institutional adoption and foster retail comfort in the meatspace.

Coinbase’s refusal to become another pawn in Gensler’s power grab and their active participation in the legislative process is necessary to prevent adoption of harmful legal precedent and to craft positive-sum regulation that will benefit crypto and foster adoption. We salute your efforts, Coinbase 🫡

How Can I Help?

Not a multi-billion dollar crypto institution but still looking to fight the good fight and prevent regulatory overreach?

Crypto is people from the ground up; you are a component in the stack. However you contribute, be it sharing crypto resources with a friend or donating to organizations tirelessly defending crypto, you’re making an impact. We'll have more tips and tricks to get involved in the newsletter tomorrow 😮

Anticipate more blood in the waters soon™. Our known battles are far from over and it is highly unlikely that we've seen the last victims of SEC enforcement action. Whatever you do, don’t stay silent: the regulatory assault is here and we need all hands on deck.

Action steps

- 📺 Watch Bankless' podcast episode What SEC Commissioner Hester Peirce Thinks About the SEC

- 📞 Call, email, or write your Representative and Senators

MetaMask Learn is an educational resource to help people understand what web3 is, why it matters, and how to get started. Consider adding MetaMask Learn to your onboarding guides if you’re a dapp developer or NFT creator to give your community the welcome they deserve.

MARKET MONDAY:

Scan this section and dig into anything interesting

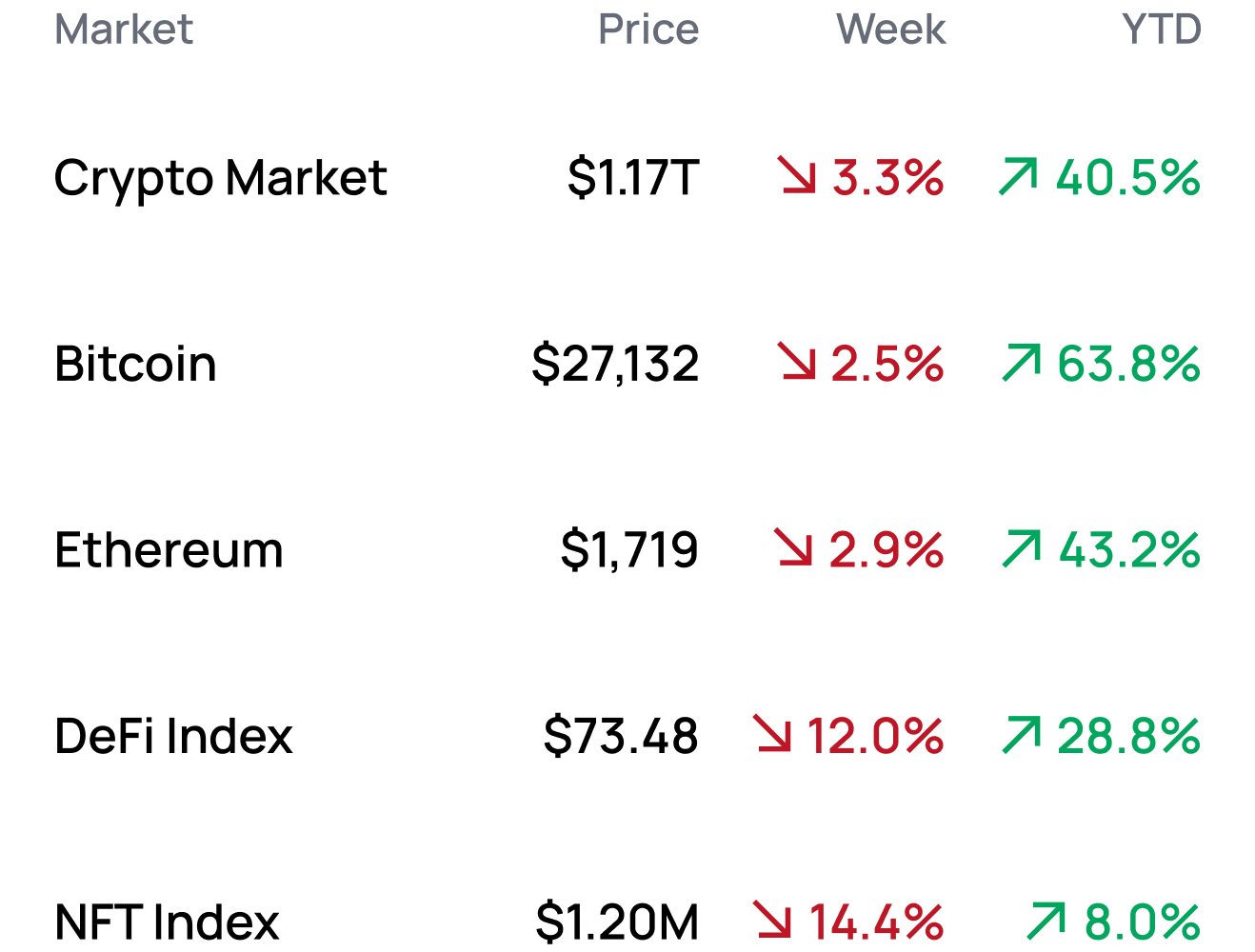

Market Numbers 📊

*Data from 3/27 3:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Apply to the Variant Founder Fellowship

- Play around (and potentially farm an airdrop) on Scroll’s Testnet

- Explore strategies to farm a potential Layer 0 airdrop

- Analyze perpetual futures funding rates on CoinGlass

- Qualify for $OP tokens for wstETH holders on Optimism

Yield Opportunities 🌾

- ETH: Earn 13% staking ETH/alETH Curve LP tokens in Convex Finance on Ethereum

- ETH: Earn 13% LPing ETH/alETH in Velodrome on Optimism

- BTC: Earn 3% lending wBTC in Gearbox on Ethereum

- USD: Earn 16% staking NOTE/USDC LP tokens in the CLM on Canto

- USD: Earn 10% lending USDC in Sentiment on Arbitrum

What’s Hot 🔥

- The DEX vs CEX volume ratio hits an all-time high

- Telegram enables in-app USDT transfers

- Seed Club announces a $25M Venture DAO

- Variant announces its Founders Fellowship

- Nasdaq aims to launch a crypto custody service in Q2

Money reads 📚

- The Crypto VC List: 2023 - Ryan Allis

- Hitchhiker's Guide To Rollups as Service (Thread) - @0xJim

- SEC’s Path to Registration: Part 1 - Rodrigo Seira, Justin Slaughter, Katie Biber

- We asked the SEC for reasonable crypto rules for Americans. We got legal threats instead. - Paul Grewal

- Farcaster vs Lens Protocol - Daniel Lombraña

Governance Alpha 🚨

- Aave considers deploying on zkEVM

- Aave explorers launching V3 of its governance

- Balancer looks to launch a gauge for RDNT/wETH on Arbitrum

- SushiSwap weighs creating a legal defense fund

- StarkNet moves towards launching its Alpha V0.11.0 upgrade

Trending Project: Arbitrum 📈

Analyst: Ben Giove

- Ticker: ARB

- Sector: L2

- Network: Arbitrum

- FDV: $12.3B

- Hotness Rating: 🔥🔥🔥🔥/5

- Arbitrum is an optimistic rollup that settles to Ethereum. Arbitrum One is the largest L2 by several key metrics, including TVL, Daily Active Addresses, and Daily Transactions.

- On March 23, Arbitrum launched its token, ARB. ARB will be used to govern over Arbitrum One and Arbitrum Nova, with holders also collectively possessing the rights to license out the Arbitrum tech stack. 12.75% of the tokens total was airdropped to early users and DAOs, with this allocation worth $1.57B at current prices.

- ARB experienced significant volatility on the day of its launch. As is typical with airdrops, ARB sold-off heavily upon going live, falling from as high as $10.60 on ByBit to as low as $1.18. This massive selloff was likely due to a scramble among users to sell their allocation as fast as possible, with the frenzy even causing the Arbitrum airdrop page to crash. To date, 86.3% of the total ARB airdropped to users has been claimed, suggesting that the majority of the sell-pressure from this event has subsided.

- There are several other near-term tailwinds for ARB. For instance, market makers have been loading up on the token. According to data from Nansen, both Wintermute and Amber Group have loaded up on a combined $46.1M worth of ARB that they acquired from OKX, ByBit, and KuCoin, suggesting that there is likely to be high demand to trade the asset. Furthermore, there are no team and investor unlocks for 1-year, meaning that there should be no structural sell pressure in the immediate future until ARB incentives are rolled out via governance.

Hotness Rating: (🔥🔥🔥🔥/5)

ARB should benefit from a lack of near-term structural sell pressure, as the vast majority of airdropped tokens have been claimed and there are no currently vesting insider unlocks. While its FDV of $12.3B, the 6th highest of any non-stablecoin asset, may limit the token's medium-term upside ARB is well-positioned to capitalize on the L2 hype over the next several weeks and months.

Meme of the Week 😂

Hey @SECGov !

— Bankless (@BanklessHQ) March 23, 2023

Fixed this for ya 😘 pic.twitter.com/1nwC2aAeMa