Dear Bankless Nation,

The Securities and Exchange Commission (SEC) just undertook an enforcement action against the Founder’s Key collection.

The project, led by Tom Bilyeu and the Impact Theory team, was marketed boisterously in the way many NFT projects were, leading to uncertainty about which dominos will fall next here in the NFT space.

For today’s post, we'll dissect what Impact Theory did wrong according to the SEC, the Commission’s troubling focus on NFT royalties, and why the dissenting opinion of Commissioner Hester Peirce, a.k.a. "Crypto Mom," should have us all concerned.

-WMP

The SEC Squares Up on NFTs 🥊

On August 28th, the SEC published a press release announcing that it had charged Tom Bilyeu’s media company Impact Theory with conducting an unregistered “crypto asset securities” offering via its Founder’s Key NFTs.

Remember, in the U.S. a security is a financial instrument that can make its owner money through dividends, interest, or increased value over time. If you create and market an asset in this profit-centric way, the SEC demands that you come in and register.

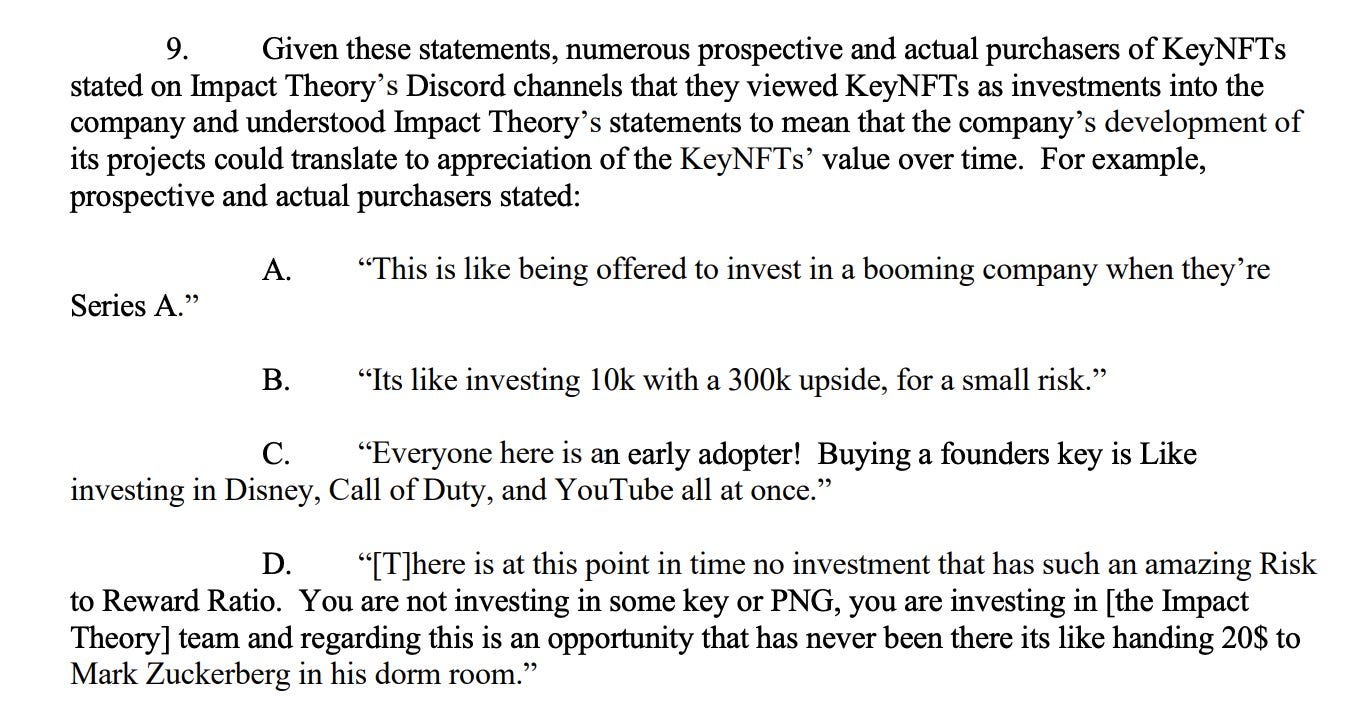

According to the SEC, Impact Theory framed and sold these NFTs as investment instruments, raised $30M USD accordingly, and repeatedly told people they’d walk away with more ETH than they invested.

Impact Theory agreed to settle with the SEC without admitting guilt, though they’re now on the hook for $6.1M in fines and must set up a new fund to refund investors. They also agreed to destroy the Founder’s Key NFTs and remove future royalties from those NFTs.

“We will operate our go-forward business consistent with our good faith best understanding of all applicable laws, rules, and regulations … and will fiercely discourage people from treating our digital assets as anything other than what they are—collectibles with utility,” Bilyeu said in a response statement.

The SEC's Focus on Royalties

In the wake of the news, Drew Hinkes, Partner at K&L Gates and an Adjunct Professor at NYU School of Law, pointed out that the SEC is now notably focusing on royalties as a factor in determining whether an NFT is a security.

“Another classic SEC enforcement move,” Hinkes said. “Finding a ‘low hanging fruit’ type of target and using a consent to sneak in language that creates new theories of liability/new glosses on [The Howey Test].”

"Now NFT creator royalties are a factor," he added.

In other words? The SEC seems to just be winging it with regard to its targeting of royalties, and now it appears the Commission is suggesting royalties even contribute to making an NFT a security.

I’d love to hear the argument(s) for why they think that’s the case because it makes no sense to me, but unfortunately that’s where the SEC’s head is at currently.

This unprecedented focus on royalties may thus have a ripple effect across the NFT ecosystem, affecting how creators structure their drops and smart contracts going forward. The attention here casts more uncertainty at a time when the NFT royalties landscape is already more uncertain than ever.

The Dissent of Crypto Mom

SEC Commissioner Hester Peirce, in collaboration with Commissioner Mark Uyeda, offered a powerful dissenting opinion against the charging of Impact Theory.

In her statement, she notably argued the SEC does not usually take these sorts of actions against similar non-digital offerings.

"We do not routinely bring enforcement actions against people that sell watches, paintings, or collectibles along with vague promises to build the brand and thus increase the resale value of those tangible items," Peirce argued.

In other words, this SEC enforcement action was extremely aggressive and overstepped the Commission’s traditional jurisdiction.

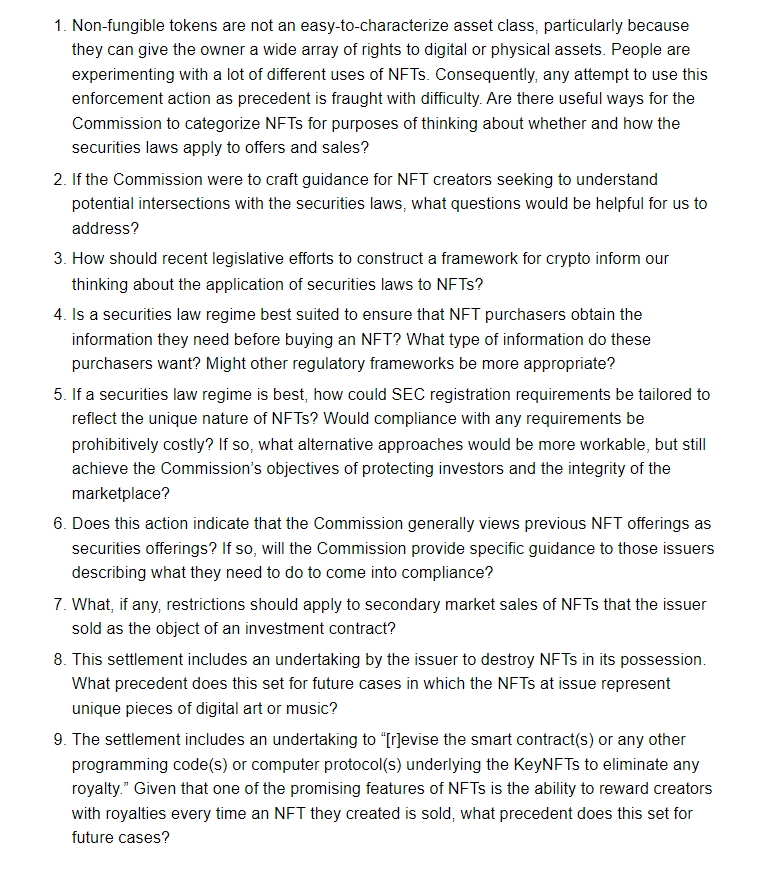

Commissioners Peirce and Uyeda went on to present 9 questions to their colleagues at the SEC, noting “The Commission should have grappled with these … long ago and offered guidance when NFTs first started proliferating.” The questions were as follows:

The questions presented here highlight the lack of clear guidance from the SEC on how NFTs should be treated under securities laws. Of course, it’s hard to be compliant when the SEC itself hasn’t been clear!

This absence of clarity leaves the NFT community in a precarious position about how to navigate the U.S. regulatory landscape without inadvertently crossing legal lines. The dissenting commissioners here have underscored the urgent need for the SEC to eschew piecemeal enforcement actions in favor of common-sense guidelines.

What Comes Next?

It's worth noting that plenty of NFT projects appear to have committed the same wrongdoings as Impact Theory, at least if you’re going by the SEC's criteria.

As such, we may see more NFT-centric enforcement actions in the near future so long as crypto hawk Gary Gensler remains Chairman of the SEC.

Also, keep in mind that the SEC still has its investigation open into Yuga Labs, creators of the Bored Ape Yacht Club universe. The investigation was first unveiled in October 2022.

I’m not a lawyer, but it seems obvious to me that most of Yuga’s offerings aren’t securities, and yet some like The Otherside plots may be. We’ll have to see what the SEC does, and if it’s big, it’ll undoubtedly send shockwaves across the space considering Yuga’s stature.

The Impact Theory settlement doesn’t inspire much confidence here, as it suggests the SEC’s current leadership sees most NFT drops as securities offerings! If this tone continues in the U.S., many NFT projects will simply shift operations overseas just like many DeFi projects have started doing. That’d be a huge mistake, but it’s clear Gensler doesn’t care at this point.