Scaling Ethereum's DeFi App Scene with Singletons

One of my favorite indie developers in the Ethereum ecosystem is Ross, a.k.a. z0r0zzz.

He's got a long track record of pushing Ethereum forward from the ground up. His early work on SushiSwap’s BentoBox was a boon for DeFi, and his more recent efforts with onchain agents (NANI) and onchain legal-tech (KALI) are one-of-a-kind in quality.

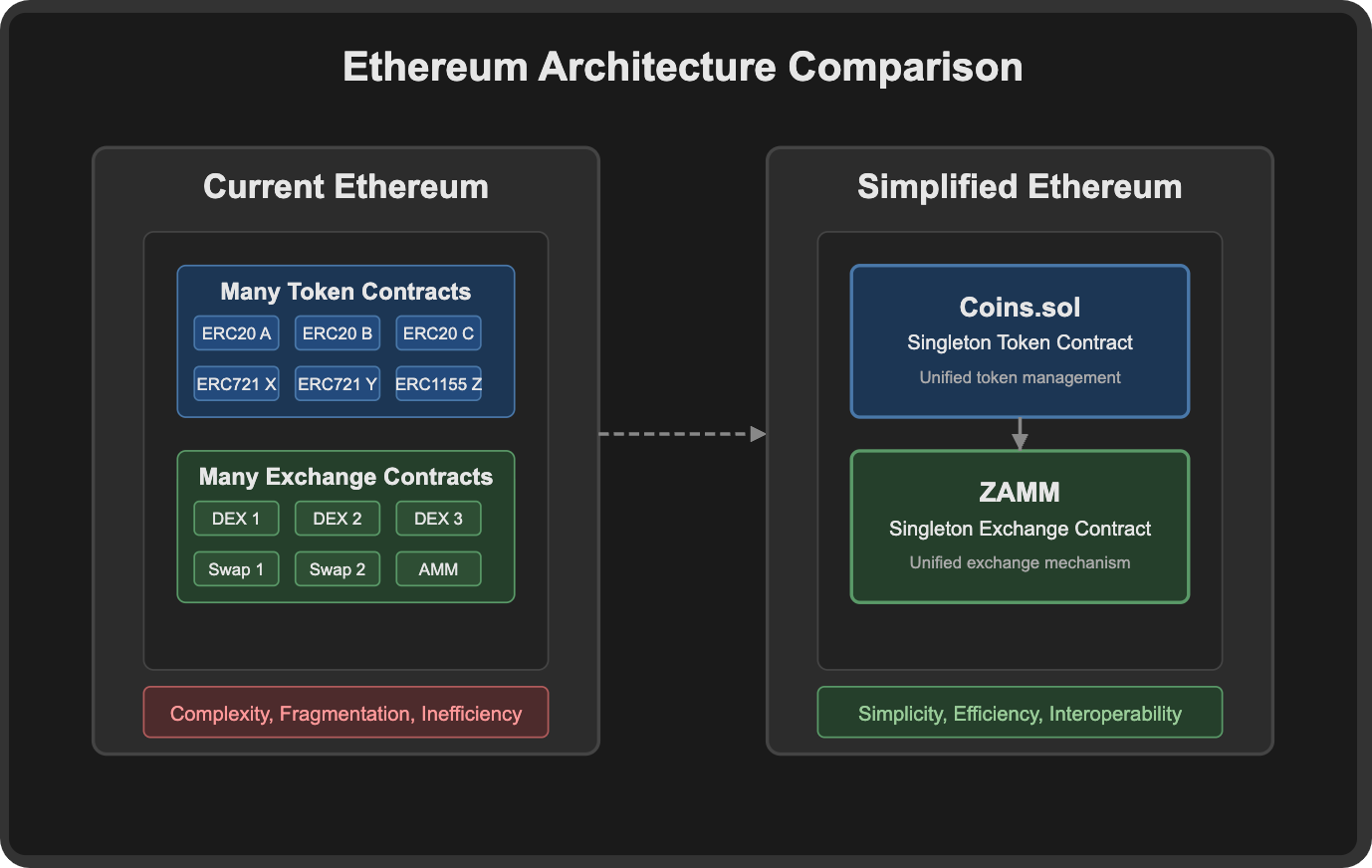

His newest vision is even more ambitious, involving scaling Ethereum not at the network level, but at the app level. Most Ethereum scaling discourse these days centers around two pillars: how best to scale the L1 as a base layer, and how dominant should L2 rollups be in the Ethereum economy.

Yet there is a third pillar: scaling in the app layer. Build once, use everywhere, and cut gas to the bone. This is the way of singletons, and it can simplify basically everything we do around Ethereum DeFi.

This is Ross's plan, which he breaks down wonderfully in his essay "How I Would Like to Scale Ethereum." This work has flown under the radar, but it's absolutely worth more attention. Let's catch you up on everything you need to know.

🧮 I am become singletons, destroyer of state

At the heart of the singletons approach is ERC-6909, a new multi-token standard that drastically minimizes state usage while maximizing design flexibility.

With this standard, you can integrate hundreds of thousands of assets in a single smart contract without the gas overhead or state bloat of today’s token factories. Imagine all ERC-20 and 1/1 NFT deployments unified into a clean, gas-optimized schema.

Put otherwise, instead of deploying a new contract for every token, DAO, or decentralized exchange, Ross proposes using single contracts—e.g. Coins for tokens, ZAMM for swaps, and Dagon for governance—to support these use cases.

The big idea? This design style minimizes code duplication and dramatically reduces onchain state growth, i.e. the amount of data Ethereum nodes must store going forward.

For instance, Ross has noted Ethereum hosts over 330,000 ERC-20 contracts today, most of which are virtually identical. In contrast, his research indicates the Coins singleton could support the same number of tokens using the state space of just two ERC-20s. In other words, if Coins was used instead of all these regular ERC-20 contracts, the state savings would be 99.99%!

The gas efficiency that comes with singletons is nothing to sneeze at either. According to Ross's benchmark tests, a single swap via ZAMM offers between 49% and 63% gas savings when compared against Uniswap V2, V3, and V4.

Benchmark tests again univ2 & 3 & 4, showing very aggressive gas efficiency gains with consolidated router,https://t.co/IHHKZdGmQp (lemme know if anything pops out) pic.twitter.com/RsyXNrYtt7

— ross (@z0r0zzz) April 26, 2025

🪙 Enter the Coinchan

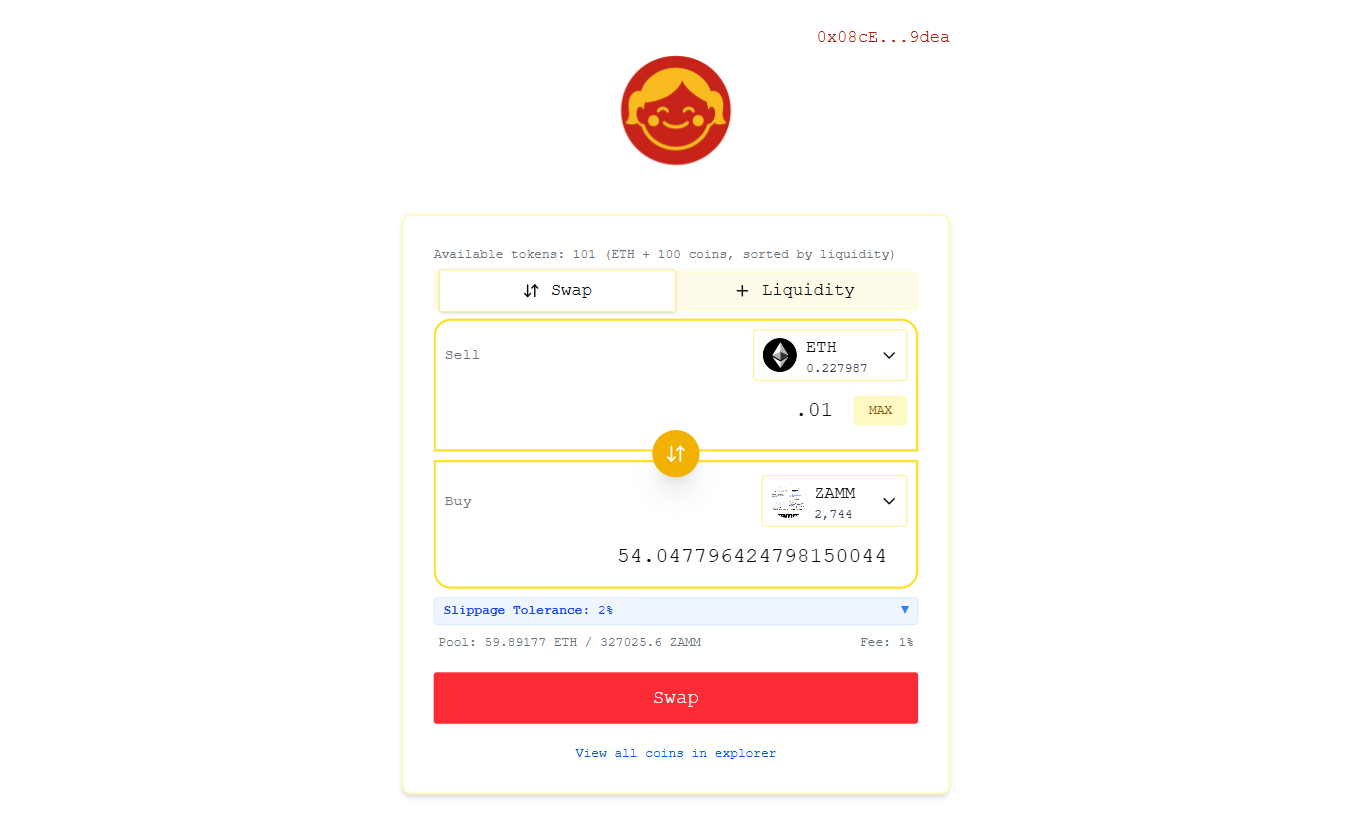

If you want to see these concepts in action, check out Coinchan, Ross’s work-in-progress app built atop the ZAMM singleton.

It’s a decentralized exchange for ERC-6909 coins, and also a minimalist coin launcher designed to demonstrate what a super optimized DeFi experience can look like on the Ethereum L1.

Keep in mind that ZAMM is unaudited, so for now it's best to approach Coinchan like an onchain testbed.

However, ZAMM's code is a minimalist adaptation of Uniswap's proven V2 code, so it's far from a total unknown. Ultimately, Coinchan offers a preview of what a singleton-centric future can feel like, so it's worth checking out.

As for diving in, if you visit the homepage at coin.nani.ooo, you'll instantly be greeted with a basic swap and liquidity interface.

Currently, the tokens with the most liquidity on the platform are the eponymously named $ZAMM and $DAGON coins, so you might consider starting with one of these if you want to try a small test swap. The swap will be cheap and just a single transaction, no token approvals required.

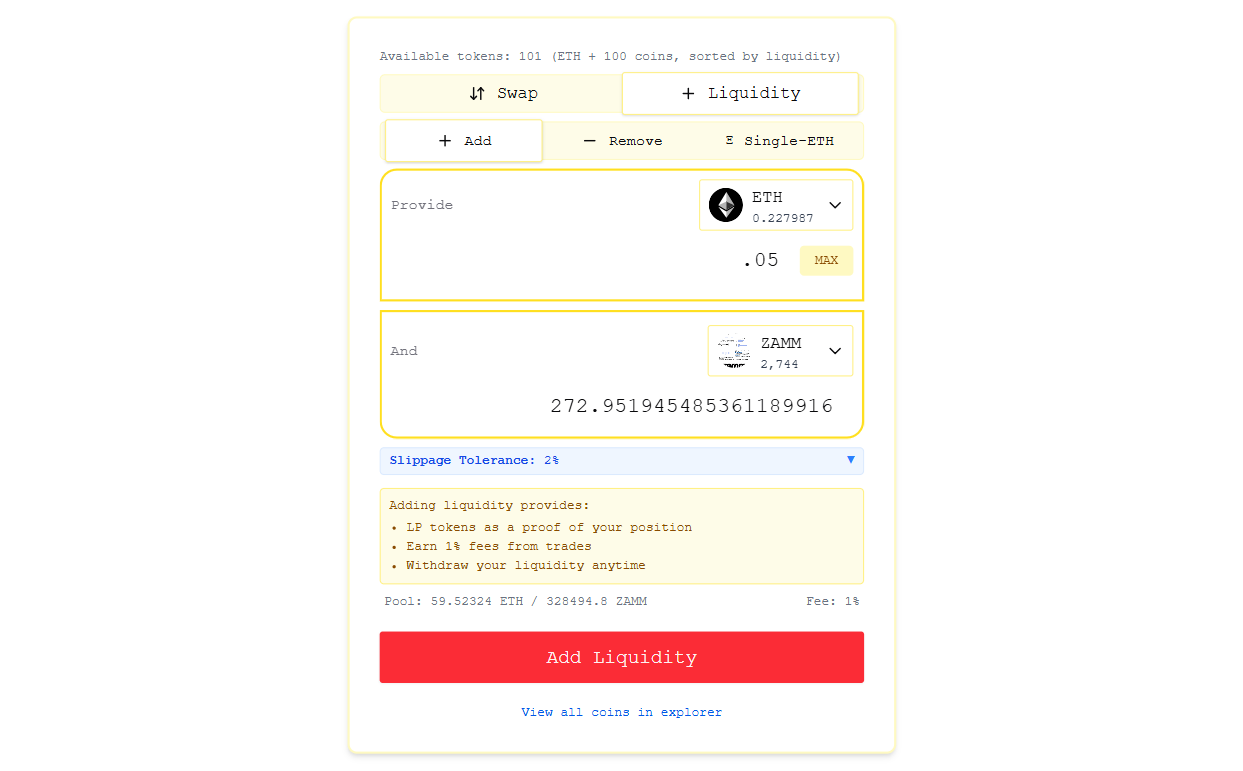

Then flick over to the "Liquidity" tab if you want to trial LPing here and earning fees on trades. I admittedly ran into a failed transaction when I first tried this, though I'm not sure why. But like I said earlier, Coinchan is a work-in-progress testbed, so kinks come with the territory and can be smoothed out.

Lastly, you can explore Coinchan's coin launcher. You can access this interface by clicking on the app's "View all coins" button, the ensuing "Read the Coinpaper" button, and then finally the "I want to coin it!" button. Coins minted through Coinchan follow a fixed-supply, fair-launch model. 21 million ERC-6909 tokens are created and instantly seeded into a ZAMM liquidity pool, and pool creators earn 1% swap fees, but can’t rug—their LP tokens vest linearly over 6 months.

🧠 Food for thought

Is adopting singletons in DeFi a panacea for all of Ethereum's scaling needs? No. But singletons are a compelling way to make a difference here, and at the protocol level at that. As Ross has previously explained:

Nobody has to use these particular deployments or similar singleton architecture. Coins, Dagon, and ZAMM are my personal heuristics or symbolic overtures that feel tidy for the task of convincing the current social layer of their merit. I would be more than happy to see them fail fast in the market of ideas and protocol design that makes Ethereum interesting as a canvas to sketch on.

[...] However, going forward, we should be more clear and concise. Ethereum has incubated many diverse use cases that can be serviced by convergent protocol design. This would improve ETH price, user experience and above all else, the state of the chain itself. All without introducing any new breaking changes or hair-pulling on hardforks with untested science.

This is how I would like to scale the L1 and help Ethereum win.

The bottom line, then, is that Ethereum can benefit from protocols doing more with less, and singletons are among the best tools we have to achieve that. Keep an eye on the work being done here accordingly.