SBF’s Christmas Miracle

Dear Bankless nation,

Merry Christmas Eve Eve! 🎅

We’re dropping the weekly recap a day early because of the holiday weekend. Late December is generally a bit slow on tech news, but not this year... crypto continues to pop off.

Here’s what we’re recapping today:

1. Visa gets serious about crypto

2. SBF’s friends turn on him

3. Crypto mining faces catastrophe

4. L2 action is exploding

5. Exchanges eye what’s next

- Bankless team

📅 Weekly Recap

Here’s a recap of the biggest crypto news from this past week.

1. Visa gets serious about crypto

This week, DeFi found some new centralized friends. A handful of tradfi and CeFi crypto services announced new onramps and payment methods for users to more easily navigate the crypto world.

Most notably, Visa announced that it was working with the L2 StarkWare to develop recurring auto-payments on self-custodial crypto wallets.

This leverages on Ethereum developer proposals going back to 2016 that were trying to develop what is known as “account abstraction”. Account abstraction is the answer to the bajillion complaints over the past two years that “DeFi won’t be mainstream until the UX experience is improved.” It seeks to unify regular externally owned Ethereum accounts (what we use today) and “contract accounts,” a piece of immutable code on the EVM.

At @Visa , we want to serve as a trusted bridge between the crypto ecosystem and our global network. Excited to share some update today, here is the 🧵 pic.twitter.com/OK1sWIaxY3

— Catherine Gu (@catgu_) December 19, 2022

By turning wallets into smart contracts, it opens up a world of options for the user experience. Wallets can be automated to pull funds, similar to how modern day bank accounts are used to pay recurring bills. It can also be used to enable 2FA security, social recovery, gasless transactions, block transactions and set daily transfer limits.

Polygon is also partnering with Mastercard and neobank Hi to create a web3 debit card that on top of standard merchant uses can also be used to mint NFTs at zero gas costs.

Finally, Uniswap is building direct ramps to DeFi through its collaboration with Moonpay. Buy crypto with your credit/debit card directly into your MetaMask wallets!

1/ Go direct to DeFi 🚄

— Uniswap Labs 🦄 (@Uniswap) December 20, 2022

Starting today, you can now purchase crypto on the Uniswap Web App using a credit/debit card or bank transfer at the best rates in web3 thanks to our partnership with @moonpay! 💸https://t.co/YVyk8e6d2h

2. SBF’s friends turn on him

FTX co-founder Gary Wang and Alameda Research CEO Caroline Ellison pled guilty Wednesday for conspiracy to commit wire, commodities, securities fraud and money laundering on pretty much all of their customers. For the charges, Ellison and Wang face up to 110 and 50 years in prison respectively.

Sam has meanwhile been sticking it out for the past week in Bahama’s only prison Fox Hill that has repeatedly been described by the media as having “inhumane” conditions, though he was apparently hosted in a sick bay with access to cable to air-conditioning. Nice.

He’s been extradited to the U.S. and just posted bail for a whopping $250M. Where did he get the money?

WATCH: Sam Bankman-Fried leaves the federal courthouse in New York after posting a $250M bail. https://t.co/5fZxx6Lis3 pic.twitter.com/PSyRdOlDVm

— CNBC (@CNBC) December 22, 2022

While the mini manhunt for Sam is over, the new executives at FTX are on a separate treasure hunt having “discovered” ~$1B worth of previously unknown assets, including $720M in cash that was dispersed in hundreds of bank accounts across the U.S., Bahamas, Japan, and probably more.

Dear Kevin O’Leary, politicians, celebs and charities, FTX would also like some of Sam’s generous donations back, please. As reported by The Guardian, FTX has issued a statement announcing its intention “... to commence actions before the bankruptcy court to require the return of such payments, with interest accruing from the date any action is commenced." The DoJ is demarcating those funds as a result of criminal money laundering.

3. Crypto mining faces catastrophe

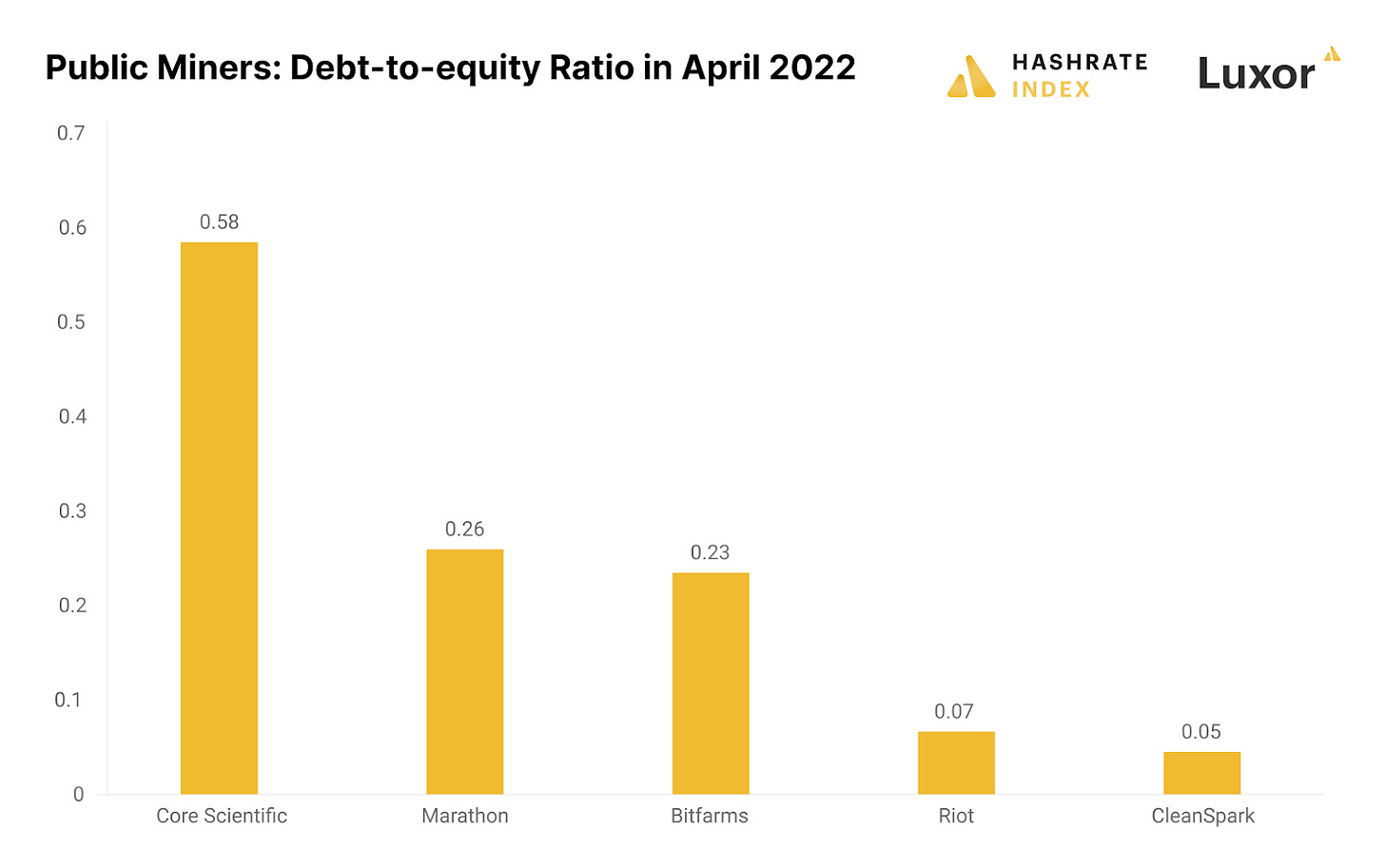

Core Scientific, the biggest public Bitcoin mining company powering about 10% of the Bitcoin network, is filing bankruptcy this week.

How did Core end up here?

The mining company expanded rapidly in the height of the 2021 bull market by acquiring massive debt to purchase ASIC mining equipment.

Core adopted a HODL strategy and refused to sell its Bitcoin holdings off at the then-price of $40,000, before capitulating to the impending bear market in May-June and dumping 2,698 Bitcoin in May and 7,205 in June.

Rising electricity costs from geopolitical turbulence and the depreciation of ASIC equipment prices brought Core Scientific to its knees. HashRateIndex has the full story.

Existing debt is likely to be converted to equity, leading to a predictable stock dump before the massive equity dilution. CORZ stocks are down ~50% to $0.051 as of the announcement. Core’s estimated liabilities range from $1B-10B from 1000-5000 creditors.

Another public Bitcoin miner Greenidge Generation is also on the verge of bankruptcy as it reaches an agreement with New York Digital Investment Group to restructure $~75 million worth of debt.

4. L2 action is exploding

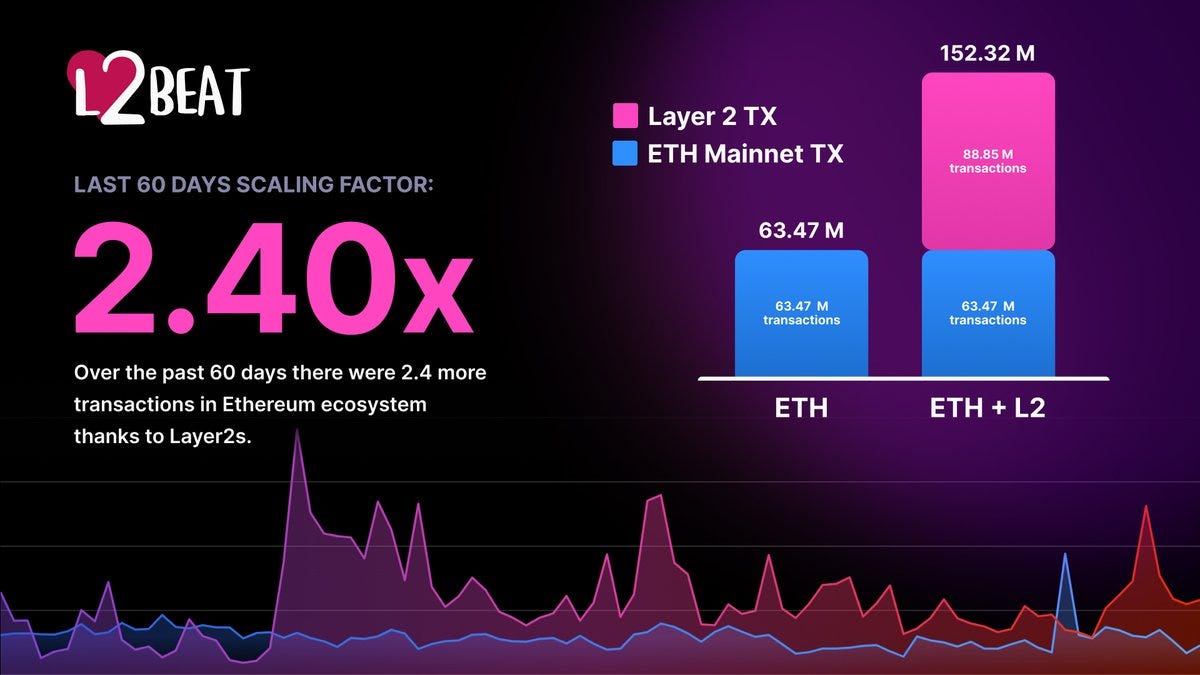

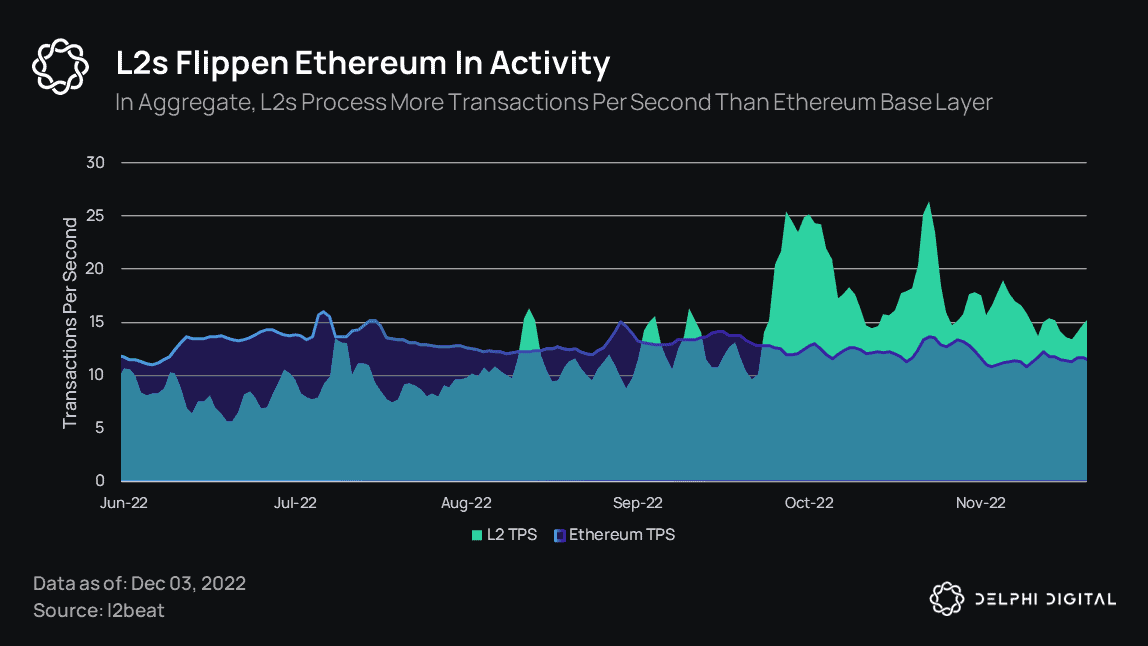

If there’s one ecosystem that’s punched above its weight in 2022, it’s the Ethereum Layer-2 ecosystem. No drama, no scams, just work. L2Beat shows that in the past two months alone, 58% of all Ethereum transactions were on L2s.

Optimism, Arbitrum, ImmutableX and dYdX leads the way in transactions per second.

Tap into Optimism and zkSync’s recaps of 2022 below.

sup nerds!

— Optimism (✨🔴_🔴✨) (@optimismFND) December 20, 2022

As we bid adieu to ‘22, we thought we'd take a look back at another prolific year of Optimism.

So pour yourself a mug of your favorite hot beverage and let's review 2022 at Optimism together. 🔴✨https://t.co/Oxi1wwcjci

Then, take a gander at zkSync’s year-in-review:

The mission continues. With 2022 coming to a close, we’re looking back on the amazing growth the zkSync ecosystem has seen this year, securing the largest Layer 2 ecosystem at mainnet launch to date. #jointhemissionhttps://t.co/JRFqGW93Yp

— zkSync (@zksync) December 21, 2022

🧵(1/7)

5. Exchanges eye what’s next

Binance US is reportedly scooping up for $1B the now-bankrupt Voyager Digital that is owed $655M by Three Arrows Capital and was previously being bailed out by Alameda Research.

$1.7M worth of Bitcoin on addresses tied to the now-dead Canadian exchange QuadrigaCX was being transferred Saturday. Co-founder of QuadrigaCX AKA Michael Patryn AKA Sifu was the infamous treasury manager of the Wonderland protocol.

Finally, Coinbase CEO Brian Armstrong published a regulatory proposal for crypto this week. A tldr:

- Regulate centralized stablecoin issuers, exchanges and custodians with traditional financial laws (AML, KYC, audits, cybersecurity standards, etc)

- Devise a modern day Howey Test and decide once and for all what crypto assets are commodities/securities

- Create an equal playing field by enforcing crypto regulations consistently for both domestic and international companies

- Treat self-custodial wallet providers not as financial businesses but as software companies, and treat protect decentralized protocols with First Amendment “code is speech” protections

Other news:

- Swap directly on Arbitrum and Optimism within MetaMask

- ETH Global 2023 schedule is out!

- ex-COO of Activision joins Yuga Labs as CEO

- Mercedes Benz files five Metaverse and NFT-related trademarks

- MakerDAO rakes in revenue from RWA

- Airbus launches NFTs in celebration of 30th anniversary on Avalanche chain

- Polygon launches Beacon, a web3 accelerator supporting early-stage projects

- Whale-dominated SushiSwap governance proposal to divert transaction fees earn by xSUSHI stakers to treasury for one year