Ronin Levels Up

View in Browser

Sponsor: Mantle — Mass adoption of decentralized & token-governed technologies.

- 📉 NFT cascade. After top Blur farmer CBB0FE pulled their bids, top NFT collections like CryptoPunks, Bored Apes, and Pudgy Penguins have faced considerable selloffs, with the 'Punks floor now at 26 ETH.

- ⏳️ Tokenize your time. Time.fun, a new platform for trading and redeeming meetings via bonding curves and NFTs, launched on Base.

- 📱 Phantom adds charts. Popular multichain wallet Phantom just unveiled support for in-app charts, featuring historical prices and other key metrics for analyzing tokens.

Ronin, which started as an Ethereum sidechain, now boasts north of 1 million daily active users (DAUs) and supports a growing ecosystem of games beyond just Axie Infinity.

Yet as Ronin blooms, so will its blockspace demands. As a singular sidechain, its capabilities can only go so far.

That’s why the network’s builders, Sky Mavis, just announced they’re working on the Ronin zkEVM, a solution for games to launch their own Layer 2 (L2) chains on Ronin.

This is one of the biggest developments announced in crypto gaming this year, so let’s break down all the basics! 👇

Mass adoption of token-governed technologies. With Mantle Network – an Ethereum rollup, Mantle Treasury, and a token holder governed roadmap for products and initiatives.

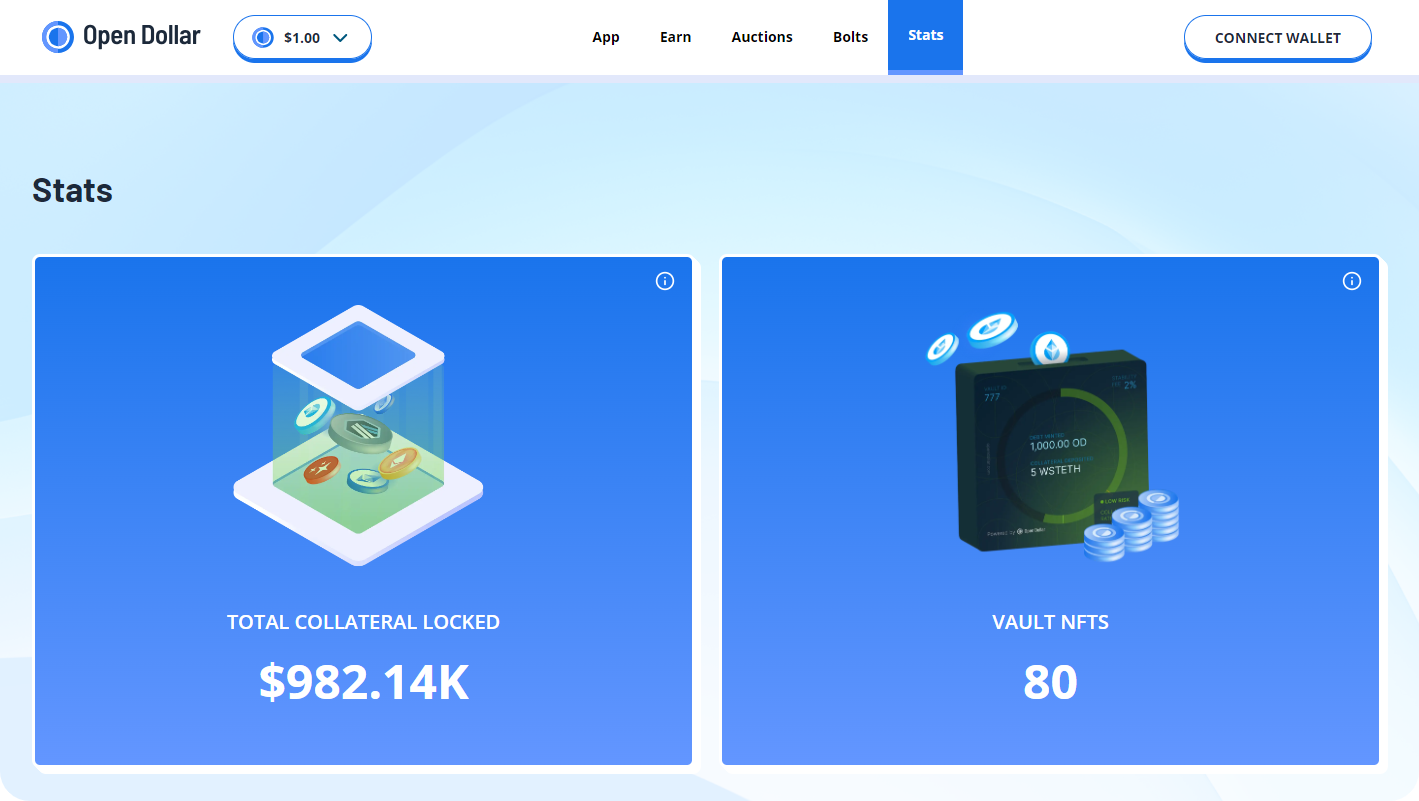

I've used Maker Vaults to borrow stablecoins against my ETH for nearly 5 years now. I love this capability, but what if it was even more flexible?

That's the question that Open Dollar answers with Non-Fungible Vaults, which are $OD stablecoin borrow positions represented as tradable NFTs on Arbitrum.

This approach makes these positions liquid and transferable, allowing users to manage their debt directly from their wallets without being tied to a protocol’s front end.

This model also offers instant liquidity, as NFVs can be traded on NFT marketplaces, and users earn 1% on future sales of their tokenized assets.

All that said, Open Dollar's NFVs enable new use cases, like selling debt positions without incurring liquidation penalties and cross-chain compatibility. If you're keen on novel experiments at the crossroads of DeFi and NFTs, this is definitely one to check out!