Right-Click Saved 🤳

Dear Bankless Nation,

“Why would anyone buy an NFT? … I have the same thing on my phone, I can take a screenshot of that NFT and I have it.”

This particular quote comes by way of Joe Rogan this week on his podcast:

BREAKING:

— Value & Time (@valueandtime) 2:50 PM ∙ Mar 8, 2023

Joe Rogan wants to right click save your NFTs.

The operative phrases above are “I have the same thing” and “I have it.” Screenshotting a dollar doesn’t give you purchasing power, of course, nor does screenshotting an NFT grant you that NFT.

Here, then, it’s an ontological misunderstanding, as Joe conceptually equates a screenshot with an NFT when in fact, technologically, they are very different. An NFT can be a durable, tradable, programmatic digital artifact, while a screenshot is more like a single-use digital disposable.

All that said, it’s an understandable misunderstanding for someone not very familiar with NFTs, but this episode is just the latest stark reminder that we still have a long ways to go on educating the public about what NFTs actually are.

In the meantime, I hope you all have a great weekend. For now let’s get you up to speed on the past week’s intrigues and top happenings✌️

-WMP

🧠 The big picture

Keep the streak alive! The overall market cap of the NFT space has maintained its growth trajectory for the 8th week in a row. This week, the market cap rose from 10.02 ETH to 10.15 ETH marking a 1.3% climb since the previous Friday recap. Interestingly, the growth comes as most top cryptocurrencies just experienced big 7D price dips.

📊 This week by the numbers:

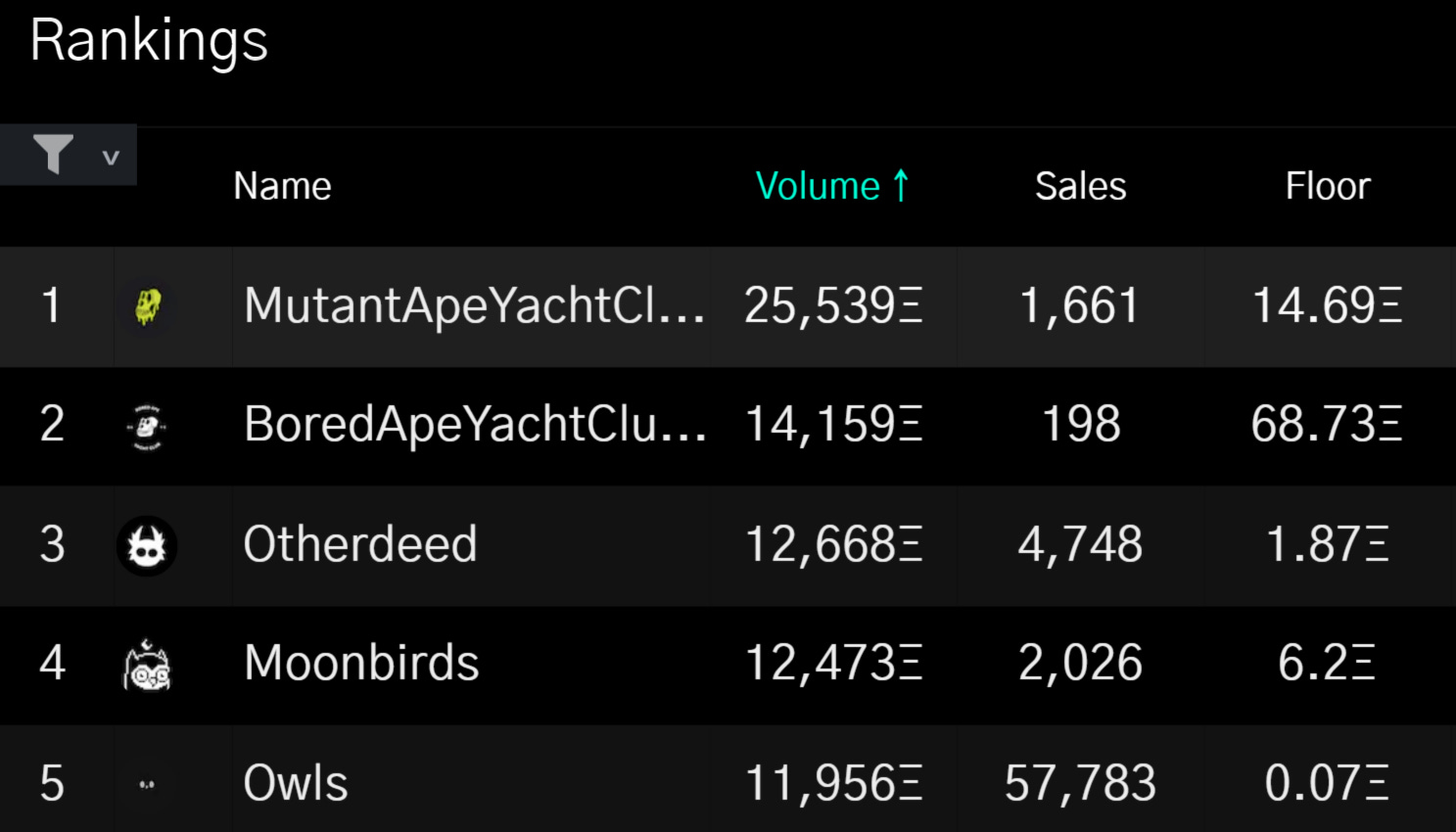

At the top of the 7D trading volume rankings it was a typical week, with Yuga Labs’s ever dominant MAYC, BAYC, and Otherdeeds collections collectively facilitating +50k ETH worth of activity. The surprise appearance came via the Owls, a Checks-inspired ASCII art collection that just burst onto the scene and has already inspired a new wave of ASCII projects accordingly.

🔝 7D top collections by volume

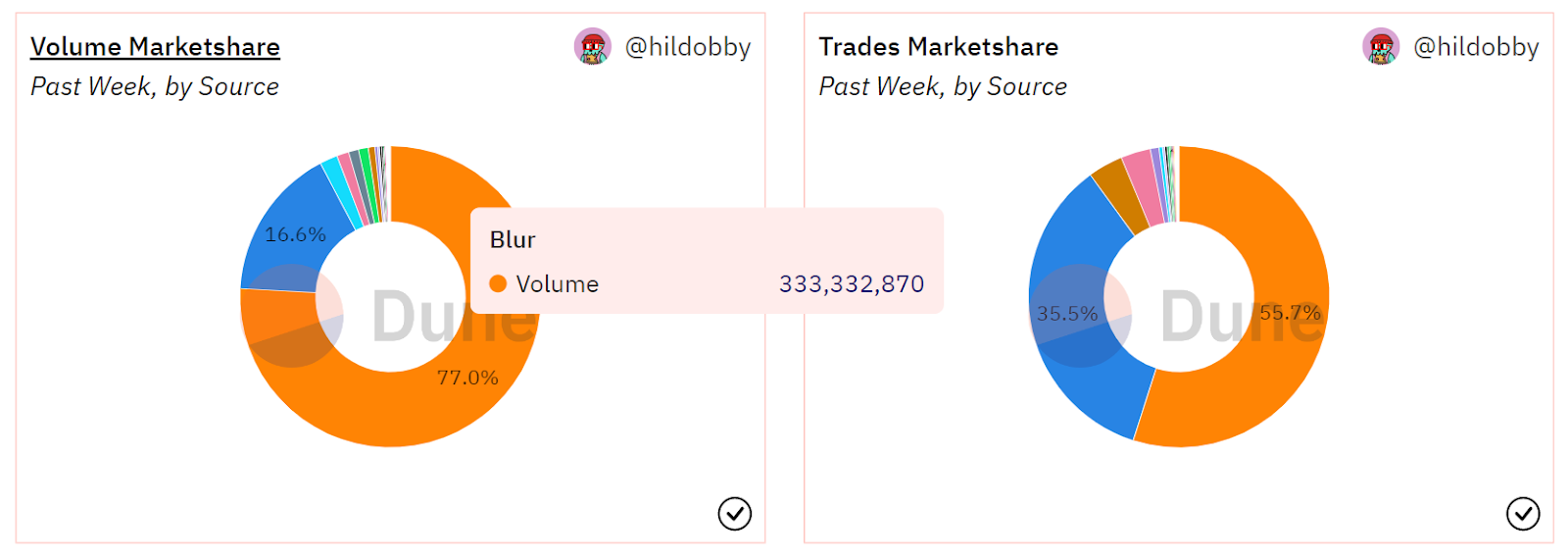

🛒 7D NFT marketplace stats

Other NFT marketplaces are, well, just a blur in Blur’s rear-view mirror right now when it comes to trading activity. Blur accounted for roughly 80% of the space’s 7D trading volume once more after having accomplished the same feat last week. Who can challenge the power of $BLUR now? I just received access to the new Gem beta, and after exploring some I think it can eat into Blur’s dominance once public. For now, we’ll have to wait and see.

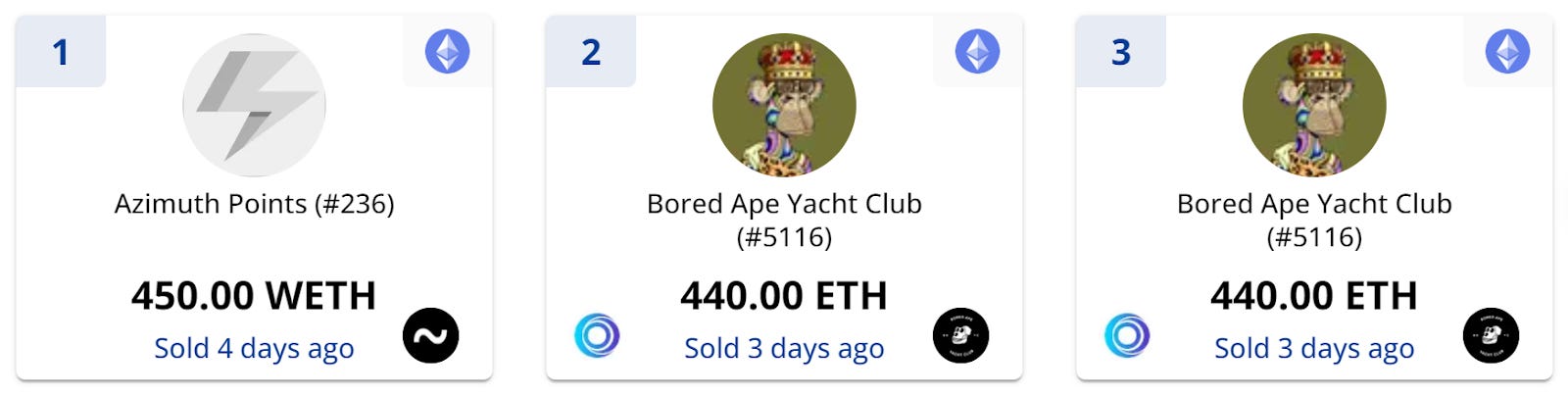

🛍️ 3 biggest buys this week

No surprise that two big Bored Ape sales appeared in the top 3, but what’s unexpected is that the largest sale on the week was for an Urbit ID / Azimuth Points NFT dubbed ~Fed. Perhaps one day I’ll be able to explain Urbit in depth, but suffice to say this whopper transaction is an unusual sighting compared to the projects we typically see at the top here.

📰 General news

- Mirror intro’d a Subscribe to Mint feature.

🏆 Digital collectibles

- Luca Netz appeared on Overpriced JPEGs and talked all things Pudgy Penguins.

🎨 Cryptoart & music

- Foundation launched an editions feature.

- Osinachi released Room for Everyone on Async Market.

- Sound intro’d Viral Sounds, a new dashboard for discovering trending songs on Sound.

- WME signed AI artist Claire Silver.

- Yuga Labs’s TwelveFold auction raised 735 BTC.

🎮 Decentralized gaming

- Axie Infinity Origins Season 3 is now live.

- Pirate Nation held its first World Boss event.

🌐 Virtual worlds

- Decentraland now supports an Audius music player plugin.

- Simon Denny published Five Views of the Metaverse in Outland.

- Webaverse held its first drop for Genesis Pass holders.

🪙 NFTfi

- paprMEME now supports loans against Chimpers, goblintown, Lil Pudgys, Mooncats, and Sappy Seals NFTs.

- Sodium, a new peer-to-peer and peer-to-pool NFT lending protocol, is now live.

🎆 Mint spotlight: Gitcoin Presents

Metalabel’s Quality Drops series kicked off with “Gitcoin Presents,” a.k.a. The Quadratic Funding Collection, an open-edition release for celebrating and raising funding for public goods. The collection features contributions from regen stalwarts like Vitalik Buterin, Kevin Owocki, Zoë Hitzig, and beyond. Minted at 0.05Ξ each, the NFTs briefly surged to +0.5Ξ in value after the mint closed on Wednesday as word spread of “Vitalik NFTs.”

Just bought the @VitalikButerin Gitcoin NFT so that I can, for the first time in the history of NFTs, properly ask:

— 6529 (@punk6529) 8:19 PM ∙ Mar 8, 2023

"Can the devs do something?"

🔭 Mint watch:

- Zerion Subscriber OGs — An example of Mirror’s new “Subscribe to Mint” feature in action, this is a free mint that was still open for a handful of days at the time of writing; it’s a way for projects to take their branding and communities onchain, and in Zerion’s case the minted NFT will offer holders perks and access to exclusive content

- Bankless 2.0 Launch Badge — To commemorate the launch of the new Bankless.com, you can head over to the website and mint a commemorative POAP right now! Just sign in to your account and look for the “Claim POAP” button on the home screen.

🙇 3 insightful threads weekly to level up your NFT knowledge!

1. Giancarlo on the “Deader than Dead” concept in NFTs:

So @punk6529 did a discord Q&A this week and used an interesting phrase:

— Giancarlo (@GiancarloChaux) 10:33 PM ∙ Mar 9, 2023

DEDER THAN DED

No, he wasn’t referring to a rando derivative or a low effort rugpull

He was talking about the largest art NFTs in the space — so called “blue chips”

2. Hiroba on the ins and outs of verticalized NFT marketplaces:

🔮 The Future of NFT Marketplaces

— Hiroba (@HirobaGG) 3:14 PM ∙ Mar 9, 2023

Part 1: Verticalization

🟨 Horizontal vs vertical marketplaces

🟨 Learnings from web2

🟨 Verticalization in web3

🟨 How @HirobaGG fits in

🧵

3. Oscar on expectations management with NFT drops:

Besides being a talented animation studio with ties to Disney.

— Oscar | Memento Mori (@Web3_Memento) 10:00 PM ∙ Mar 9, 2023

It is mindblowing how @Momoguru_NFT messed up.

A 🧵 on they made the dumbest 'mistake', and how it could have been prevented.

✨ My NFT tool of the week: DeFiLlama browser extension

If you’re someone who regularly digs through Etherscan in the course of your NFT activities and research, then you ought to check out the DeFiLlama browser extension. Among other things, this resource enhances the popular block explorer with an informative wallet tagging system, which can help you visualize NFT activity and identify scams much easier than before.

We've tagged millions of wallets based on their behavior, with labels such as:

— strobie reeeee 🍓 莓莓 ストロベリ (indexing arc) (@0xstrobe) 10:09 PM ∙ Mar 7, 2023

⛵️ Name on Opensea

👩🎤 CryptoPunks minter

🏦 CEX funding source

...

🤑 Does it have alpha?

We are constantly growing the tags variety as llamas continue to sleuth on chain. 🥸

2/5

💥 Understanding post-reveal trading action…

In the chart below, you can see how after the Momoguro art was revealed the collection’s floor price immediately started slouching. Why? Many people who realized they didn’t collect rares quickly floored their NFTs. On the flip side, a string of trades many multiples above the floor price began popping off as initial trading activity around the found rares took place. Be on the lookout for this sort of action, as it’s typical to see around new NFT collections right after their art has been revealed.

Kind of cool chart for what happened after the Momoguro reveal.

— NFTstatistics.eth (@punk9059) 4:31 PM ∙ Mar 7, 2023

Sales start popping up in the 5x floor range.

But floor goes ⤵️

😜 Built different…

As fears of a prolonged bear market continue to make their way through traditional crypto circles, large swathes of the NFT community seem to be rather unbothered in contrast. We’re just a little bit wilder here, you know. Weirdos, as Joe Rogan would call us…

Whole different world

— Alan Carroll (@alancarroII) 1:29 PM ∙ Mar 8, 2023