Resilient Truth Markets

View in Browser

gm Bankless Nation,

Prediction markets are hotter than ever, but what exactly are we building?

In today’s essay, David Hoffman argues for resilient truth markets: censorship-resistant, cryptography-hardened platforms that price reality under pressure instead of drifting into plain ol' glossy gambling apps.

After that op-ed, we've curated links of recent developments from around the Ethereum ecosystem for you to catch up with, and then we'll wrap with the latest Weekly Rollup episode focused on the Uptober rally, Tom Lee's new $1B ETH buy, and more.

Thanks for being a subscriber,

WMP 🫡

Sponsor: Mantle — Mantle is pioneering "Blockchain for Banking,” a revolutionary new category at the intersection of TradFi and Web3.

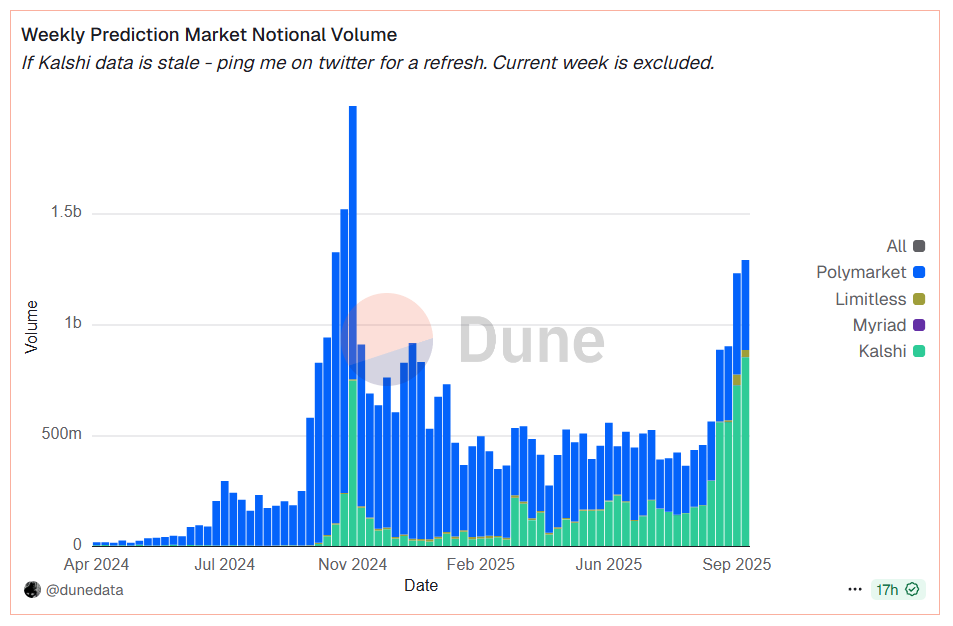

Ever since the U.S. election, prediction markets have been front and center both in crypto and in mainstream society’s awareness around emerging financial technology.

Even with the massive volumes of the 2024 U.S. election as a distant memory, prediction market volumes today are pushing new heights with the start of the American football season.

As consumer platforms for making speculative bets on real world events, these things are growing fantastically. Events in the zeitgeist are receiving an outsized amount of attention — politics, sports, and pop culture dominate trading volumes on these platforms. Fun!

On this side of prediction market technology, we have entertainment-finance where consumers are free to speculate on whatever pop-culture zeitgeisty event is the "Current Thing."

Yet on the other side of this same technology, we have anti-authoritarian truth-discovering mechanisms that wield financial incentives against autocratic control.

Prediction markets are truth machines — they incent truth to emerge front and center as fast as the free market can price it.

If someone knows something the rest of society doesn't, prediction markets allow them to arbitrage the difference between what they know and what society thinks. Since markets are priced at the margins, the marginal truth of the universe is allowed to emerge and express itself in high fidelity, so long as the prediction market platform is functioning optimally and without censorship.

With this context, we can see two different paths that prediction market platforms can take:

1. Consumer-oriented, entertainment-finance, speculative gambling platforms.

2. Hardened, anti-authoritarian, censorship-resistant, truth platforms.

All prediction markets can be both, and in this dichotomy we see the age-old friction between cypherpunk ideals and consumer UX.

Do we want a platform that reduces the number of clicks to make a bet on the Big Game? Or do we optimize for permissionless, censorship-resistant access so that a dissident of an authoritarian regime can broadcast secrets to the rest of the world?

Truth is often inconvenient

The dystopian trope of a “Ministry of Truth” illustrates how valuable it is for an autocratic regime to determine what's truth from fiction. This is why governments should never get involved in media and journalism, and why freedom of speech is such a critical part of a free society.

Prediction markets are the integration of Speech and Markets — the quality and effectiveness of prediction market platforms will be downstream of the freedom that society has to use them as speech platforms.

If we can only use prediction platforms to bet on who wins the Big Game, but not who wins the Big Election, then their value to society has been severely neutered.

Prediction Markets should not just be the Roman Colosseum to entertain and distract the masses from the reality of the state of the empire. They should be the Global Colosseum where Nation-States and individuals battle it out on equal footing.

“But David, don’t be such a prepper-doomer. Nation-States aren’t going to interfere in prediction markets — that’s so far fetched.”

History shows truth gets punished

Wikileaks, the platform that disintermediated truth and individuals, was built around the fact that truth was getting hidden from the public by editorial filters and state influence. Unflattering hypocrisies, civilian casualties, military misconduct — all things that no mainstream media outlet would dare to report on — were all were shown directly to the public via the Wikileaks platform.

The US tried to silence Wikileaks via financial repression by cutting off their banking access. Thanks to BTC donations, Wikileaks was able to maintain its operations as a platform. These two things, Bitcoin and Wikileaks, both represent weapons for the individual to fight against the autocratic tendencies of the state.

Let’s never forget that prediction markets are a weapon for individuals to wield against power structures far larger than themselves. Prediction markets are a new tool being added to the arsenal of the the modern day sovereign individual, alongside encrypted messaging, cryptocurrency, VPNs, and ZK technology.

Let’s make sure as prediction markets are adopted by the rest of society that these tools sharpen, not dull, in their protection of individual rights and sovereignty.

Truth is often inconvenient.

Free markets require free speech.

Arbitrary lines destroy credibility.

History shows truth gets punished.

Markets without truth collapse intro triviality.

📈 The Asset

- BitMine purchased another 234k ETH

- GameSquare is lending ETH via Morpho

- OnePay, a banking app backed by Walmart, is adding support for ETH

- SharpLink earned 457 ETH in staking rewards last week

🏛️ The Protocol

- The Ethereum Foundation introduced a new leadership structure for its privacy efforts

- Holesky, the Ethereum testnet, successfully conducted its Fusaka upgrade fork; next up is Sepolia

- Project Mirror, a report commissioned by the EF on perceptions of Ethereum, was published

📱 The Apps

- Aave unveiled limit orders via CoW Swap

- Aerodrome is now open to all U.S. users of Coinbase DEX

- Brave browser reached 100 million monthly active users

- EigenCloud unveiled EigenCompute and EigenAI for building trustworthy, cryptoeconomic AI agents

- Farcaster rolled out Referral Rewards

- Gnosis Pay crossed $100M volume through its card offering

- Lido revealed the 2nd version of its Community Staking Module

- Morpho released its V2 Vaults standard

- Poidh facilitated a new world record for the number of kickflips in one minute through a user bounty worth $29k DEGEN

- Rainbow unveiled King of the Hill, a daily trading game built atop Clanker

- Securitize tokenized its 1st Nasdaq stock on Ethereum, $FGNX

- zAMM welcomed Milady Rescue, an NFT + DeFi + DAO game where players rescue Miladys from an onchain vault

🐸 The Culture

- Devconnect announced its planned districts for its upcoming Ethereum World’s Fair event

- Gitcoin announced Gitcoin Grants 24

- Infinite Node Foundation (NODE) is opening its permanent CryptoPunks exhibition in Palo Alto in January 2026

- Larva Labs, the CryptoPunks creators, are launching a new gen art collection, Quine, via Art Blocks

💽 The Tech

- Base unveiled OnchainTestKit, a framework for testing onchain apps, via its Engineering team

- First Abu Dhabi Bank introduced its ADI Chain, an L2 built atop ZKsync

- Josh Stevens released rrelayer, a performant, open-source EVM relayer written in Rust

- Lighter activated the mainnet of its ZK-powered perps DEX L2

- Optimism rolled out Flashblocks on OP Mainnet

- Swift demoed a tokenized bond deployment on Ethereum’s Sepolia testnet

In the latest Rollup, Ryan and David dig into the BTC and ETH rallies that have kicked off Uptober in style, and then they break down Tom Lee’s latest $1B ETH buy and what it signals for DAT treasuries.

Also on deck: Plasma’s TVL rocket, Zcash’s surprise comeback, and Lighter’s ZK rollup taking the fight to Hyperliquid.

Tune into this week’s Rollup! 👇

UR, the world's first money app built fully onchain, transforms Mantle Network into a purpose-built vertical platform — The Blockchain for Banking — that enables financial services onchain. Mantle leads the establishment of Blockchain for Banking as the next frontier.