How to Buy Index DTFs on Reserve

Sometimes there's a group of tokens you want to buy, but it can be a pain going through and double checking every token address, submitting transactions for each swap, and so forth.

Enter Reserve.

Reserve is an onchain toolkit for building and buying baskets of tokens, called Decentralized Token Folios (DTFs).

Think exchange-traded fund (ETF) type investments, but onchain. Reserve currently supports Ethereum and Base, and every DTF is an ERC-20 that represents a token basket you can mint and redeem against 24/7.

There are two families of DTFs here. Index DTFs wrap diversified baskets (from 10 to +100 tokens) and behave like onchain index funds. Yield DTFs hold yield-bearing collateral and add an opt-in safety buffer via RSR stakers.

Ultimately, DTFs aim to trade near their net-asset value (NAV) because anyone can arbitrage. In other words, mint a basket when price is high, redeem the basket when its price is low. That permissionless mint/redeem loop keeps markets in check.

Under the hood, baskets are transparent and rebalanced onchain. Index DTFs use Dutch auctions to nudge weights back toward their targets, while Yield DTFs automatically harvest and route yield per their settings.

RSR is the ecosystem token. On Yield DTFs, staked RSR can be slashed to cover rare collateral failures. Stakers earn a share of the overall revenue for taking that risk. On Index DTFs, RSR is the default vote-locking token for managing parameters and basket changes, and platform fees buy + burn RSR over time.

I'll leave the Yield DTFs and RSR staking to more advanced users, but buying Index DTFs on Reserve is straightforward.

First, make sure you have some funds (e.g. ETH, WETH, USDC, USDT) on Ethereum or Base. Then go to app.reserve.org, connect your wallet of choice, and down in the Index DTFs dashboard toggle between "Ethereum" or "Base" depending on which chain you want to buy on.

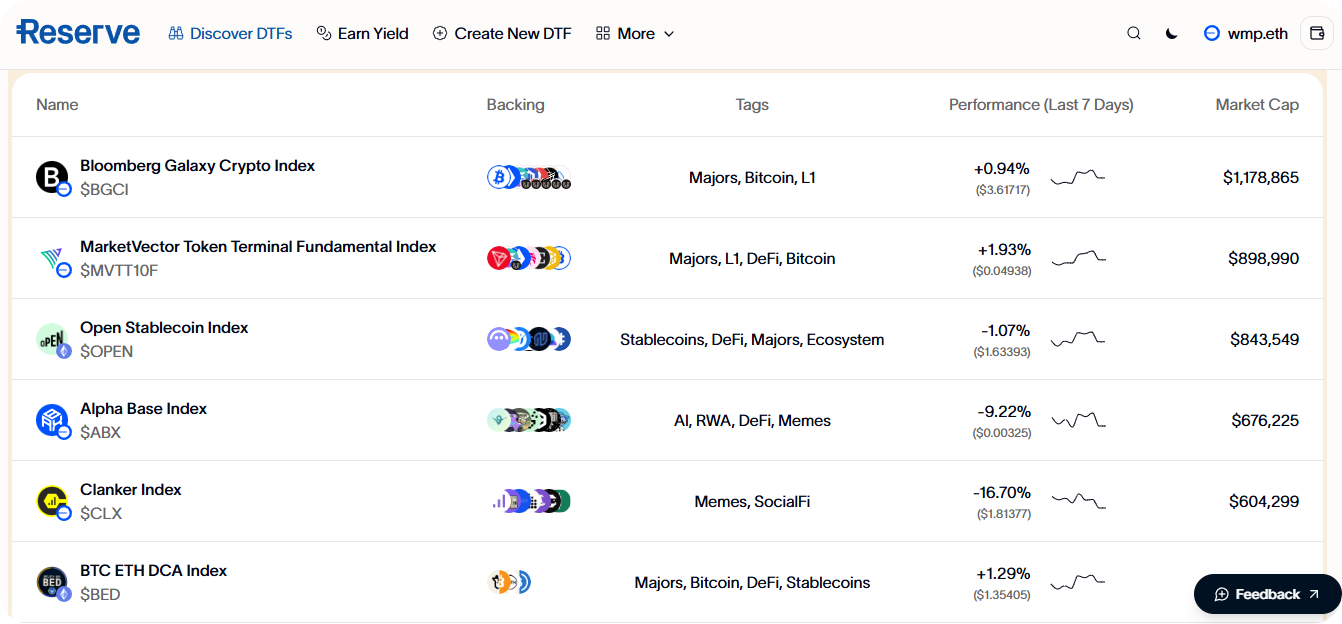

The page will look like this:

At this point, you can start reviewing the available DTFs with a quick bird's-eye view of their backing assets, their category tags, their 7-day performance, and their market caps.

If you find a fund that piques your interest, click into it for more info and to pull up the swaps UI.

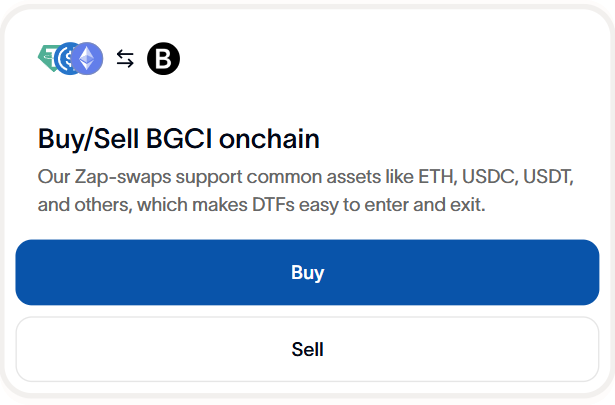

For example, if you click into the Bloomberg Galaxy Crypto Index, you'll find the basket's creator, curator, factsheet, fees, links, and its exact constituent tokens and their weights in the batch. This particular basket focuses on prominent L1s, so if you want simple exposure here, you'd just skim over to the Buy/Sell portal and press "Buy."

Doing this would pull up Reserve's Zap-swaps UI, where you could readily swap into the basket from the tokens you have on hand, like ETH or USDC. Approve the swap, then confirm it, and you're done!

Don’t be surprised by tiny dust amounts spent during routing, and note there’s a small mint fee plus a management fee that accrues over time inside the token. This is what generates ongoing revenue for the Reserve protocol.

On the flip side, exiting is just as straightforward. Use the “Sell” button on your target DTF page to redeem back into something simple, e.g. ETH.

Size modestly at first and treat this like any other DeFi smart contract interaction. You inherit risks from the DTF contracts and from whatever sits inside the basket, so keep an eye on the parameters and the relevant tokens with routine check-ins.

Zooming out, we've seen various index projects come and go in DeFi over the years. Most of the entrants so far were before their time, so to speak. But it feels like the time for a simple, programmable index protocol has finally arrived, and the simplicity and flexibility of Reserve is appealing here in this moment.

The bottom line is that Reserve offers broad crypto exposure without having to mess with multiple tabs and approvals. At the very least, it's a nice option to have. Buy the basket, skip the busywork, move on. Consider checking the project out sometime accordingly.