Remixing the NFTStrategy Playbook: 3 New Takes

In the NFT scene, TokenWorks kicked off the strategy token meta.

It all started with PunkStrategy, which uses fees from PNKSTR trades to buy CryptoPunks, relist them at a premium, and buy-and-burn PNKSTR with the ETH proceeds.

NFTStrategy, also by TokenWorks, is the generalized version. It can run this strategy loop (buy, relist, resell, buy-and-burn) for any other NFT collection. Per project, 8% of the trading fees go to accumulation, 1% go as royalties to the collection's creators, and 1% goes to burning PNKSTR.

TokenWorks has continued to add new strategies (the newest being PainStrategy for XCOPY's Max Pain NFTs) and adapt its mechanics, e.g. its upcoming auction system for deploying new tokens.

Understandably, these dynamics have generated a lot of excitement around the NFT space. And this excitement is paving the way for a new wave of remixes that are inspired by the NFTStrategy approach.

Some aren't live yet. For instance, Gami just introduced TokenStrategy.

- Slated to launch on the International Meme Fund platform, the protocol will let people deploy ERC-6551 NFT collections "where each NFT is a fixed basket of tokens."

- Deposit a particular token recipe to mint an NFT, burn the NFT to redeem the tokens. Ultimately, it's an NFT-based avenue for creating things like an onchain "TeslaStrategy" and beyond.

Introducing @tokenstrat ✨

— Gami (@gamiwtf) October 7, 2025

TokenStrategy is a factory contract built on ERC-6551 for deploying NFT collections where each NFT is a fixed basket of any token(s).

Mint an NFT by depositing the tokens defined at deployment, and burn it to redeem the same basket from its… pic.twitter.com/mKACdb5zu4

Then, there are some remixes that are already live, like punk.auction.

Its gist is similar to PunkStrategy: the automated protocol buys and sells CryptoPunks and burns its native PAST token at the end of the loop. Yet there are a few key differences:

- PAST is bought and sold along an ETH-back bonding curve, while PNKSTR is traded in an automated market maker (AMM) pool.

- Punk.auction doesn't plainly relist purchased CryptoPunks for ETH. Instead, it runs a Dutch auction for them denominated in PAST.

- Lastly, PAST is directly burned at the conclusion of successful auctions in contrast to PunkStrategy's buy-and-burns via ETH.

Introducing https://t.co/V7dMmnXHl2

— punk.auction (@punkdotauction) October 5, 2025

A permissionless protocol to get exposure to @cryptopunksnfts that introduces $PAST and uses a bonding curve and Dutch auctions. It builds on @token_works PNKSTR meta, but adds a twist:

There are other small quirks here, but you get the idea. The project is broadly inspired by PunkStrategy but swaps in some different, unique mechanics to propel its operations.

Perhaps the most interesting of all to me, though, is Milady Rescue. The app isn't a fork or even a close remix of PunkStrategy, though it is loosely inspired by the OG while using entirely different onchain legos.

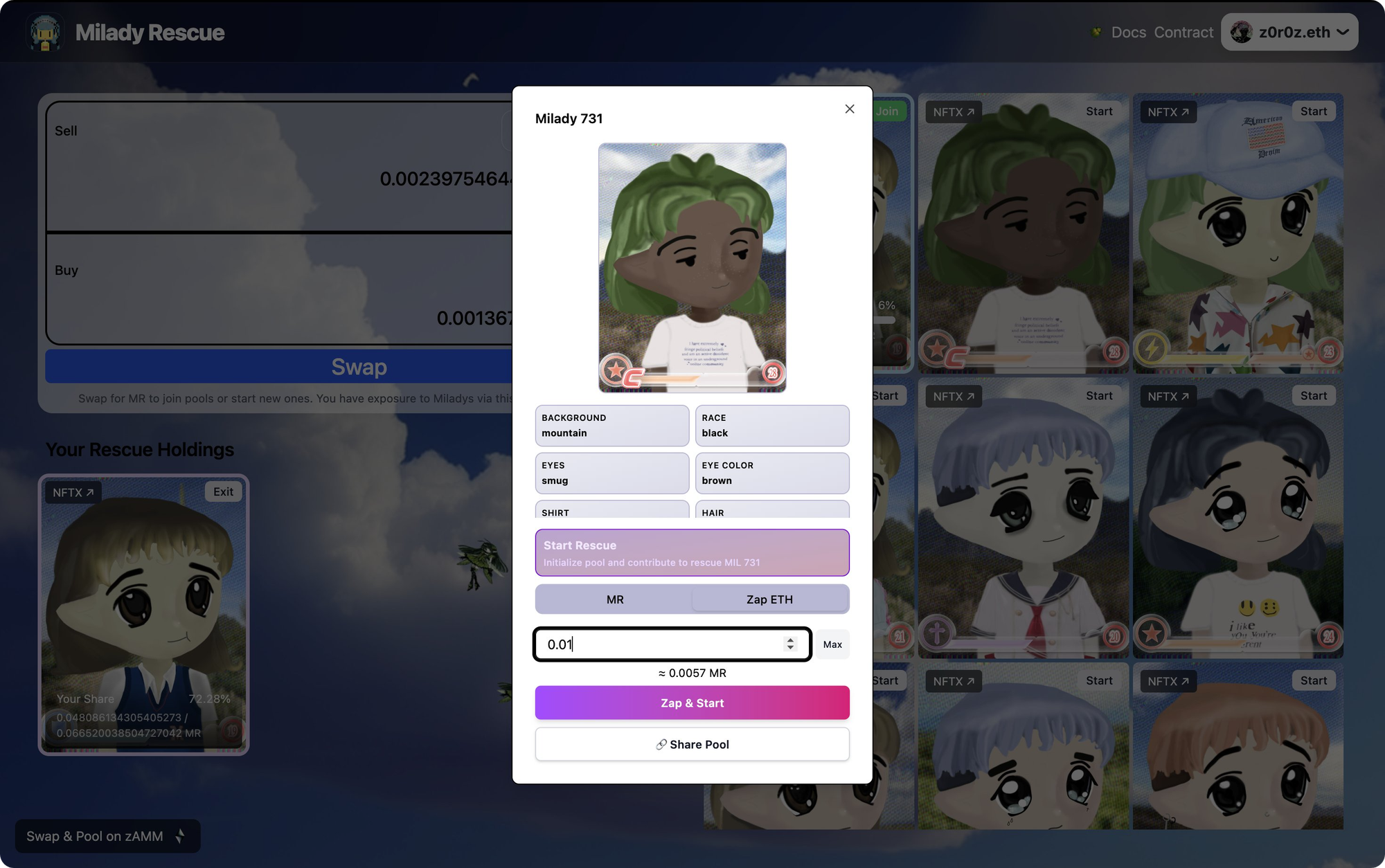

Recently introduced by ross of zAMM renown, Milady Rescue's essentially a group collecting game powered by DeFi + DAO + NFT tech.

Built on the old NFTX Milady vault, the project lets you swap ETH for MR (wrapped MILADY shares) and pool funds with others to "rescue" specific Miladys from NFTX. Then, participants vote on a resale price and list their rescue, earning a pro-rata cut of ETH if it sells. It's also possible to "raid," i.e. target, Miladys outside the NFTX vault.

This design could be synergized with NFTStrategy, too. Once an official MiladyStrategy token is released, Milady Rescue players could use MR to buy Miladys from the strategy holdings, 'round and 'round.

My grand point is that with the popularity of the PunkStrategy and NFTStrategy arrivals, we'll continue to see a bloom of additional experiments here.

There will be lazy copycats, and there will be neat projects that ultimately can't sustain momentum amid growing saturation. Yet in the chop, there will be opportunities. And some gems will come to the fore that do bring 0-to-1 innovations to the table, like Milady Rescue.

Do your own research, treat unaudited projects as experiments, etc. But keep your eyes open in this niche in the months ahead, as in all likelihood the action's just beginning here.