Checking out Rainbow's Browser Wallet

Dear Bankless Nation,

Welcome to Market Monday.

Rainbow Wallet has long been a colorful mobile wallet experience that's introduced a number of stellar conventions to the space – today, we check out its newly launched browser extension and see if it has what it takes to compete! 🌈

- Bankless team

Getting Started with Rainbow Wallet's Latest Release

Bankless Writer: William Peaster | disclosures

For a while now, Rainbow has offered one of the slickest mobile wallet experiences in crypto. But if you’re like me, I do most of my crypto transactions at my desktop battle station, so until recently, I hadn’t had much of a place for Rainbow in my wallet stack.

That all changed last week when Rainbow made its highly-anticipated browser wallet extension available for download on the Arc, Brave, Chrome, and Edge browsers, with Firefox and Safari support next on the slate.

If you’re already a user of browser wallets like MetaMask and Coinbase Wallet, then you already know the gist of Rainbow Extension. When you’re on your computer conducting crypto activities, e.g., sends or swaps, the app pop-up offers a streamlined interface for interacting with your assets.

So, what sets the Rainbow Extension apart, then?

Well, to be sure, it covers all the fundamentals needed for the current times, like...

- Auto-discovery of tokens (no more manual adds!)

- Support for L2s (all the big ones and counting)

- An in-built bridging system (no need to leave your wallet for transfers)

- Impersonation mode (so you can track any wallets you want).

Yet, where Rainbow is really separating itself from the pack right now? Its Magic Menu and keyboard shortcut systems.

The Magic Menu is a search bar feature that macOS users can open by pressing ⌘K, and Windows users can open via Ctrl-K. In this bar, you can pull up and punch out a range of useful commands, from “View NFTs” to “Lock Rainbow.”

See the full list of current command possibilities here.

As for the keyboard shortcuts, these help you get right to the actions you want without wasting any time. For example, tap “P” to pull up your profile or “F” to flip tokens in the swap UI, etc.

Check out this cheat sheet for all of the shortcut options.

Of course, if you’re hesitant to add another wallet to your stack, just know:

- You can use your existing hardware wallets in combo with the Rainbow Extension. Trezor and Ledger Nano S Plus, Ledger Nano X, and Ledger Stax devices are supported.

- The Rainbow Extension makes it simple to manage and organize dozens of wallets simultaneously, so it could make for a good “base command” if you want to try consolidating your main wallets in one place.

And that’s the 101 on the Rainbow Extension! Pretty neat, right?

Indeed, whether you’re a seasoned crypto veteran or just starting out here, this new browser wallet offers plenty of flexibility and efficiency and is worth a spin for anyone curious.

Lastly, if you’re the type that likes to collect commemorative NFTs, Rainbow is running a free mint on Zora in celebration of the Rainbow Extension launch. Check it out!

Go direct to DeFi with the Uniswap mobile wallet. Buy crypto on any available chain with your debit card. Seamlessly swap on Mainnet and L2s. Explore tokens, wallets and NFTs. Safe, simple self-custody from the most trusted team in DeFi.

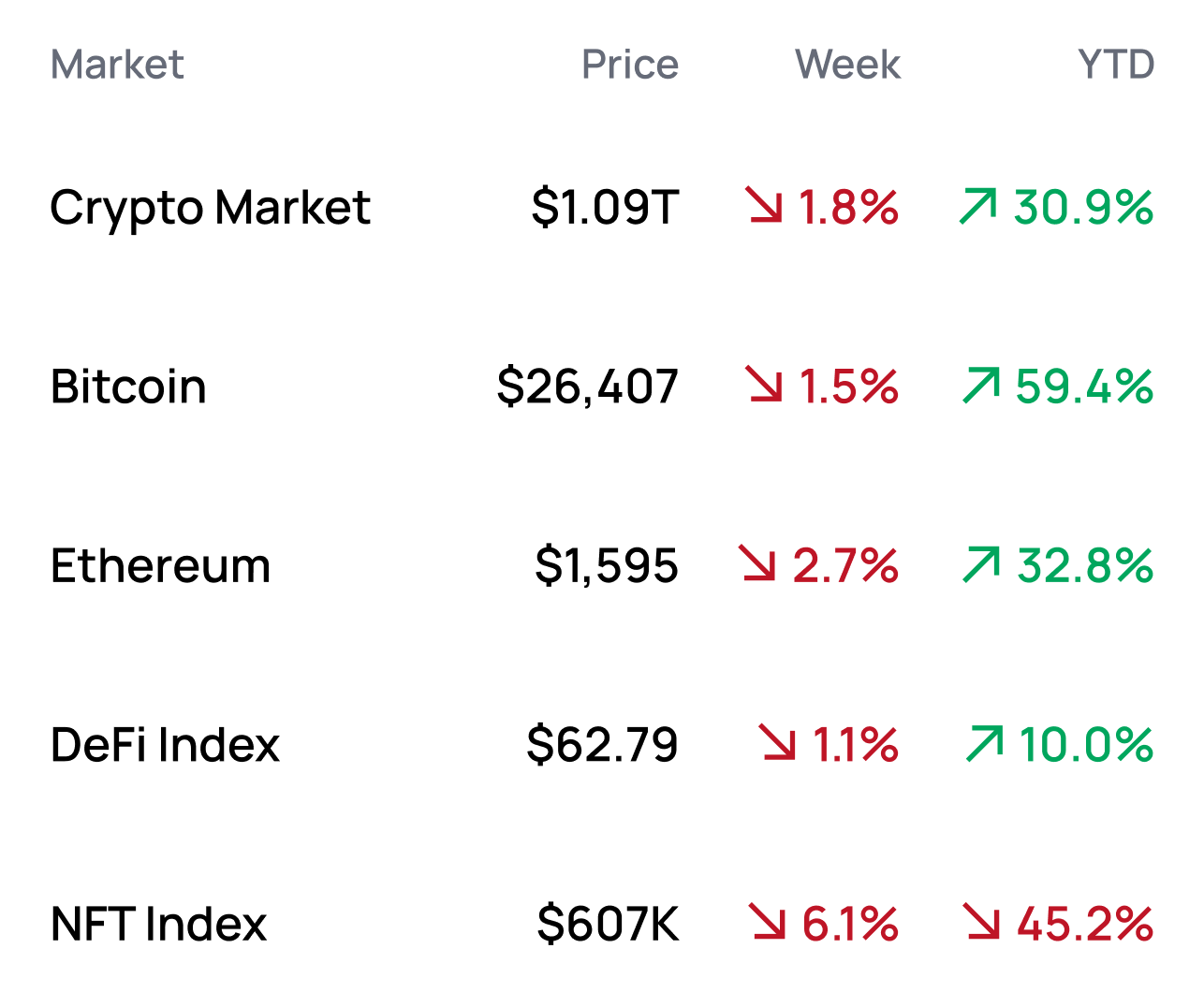

MARKET MONDAY:

Scan this section and dig into anything interesting

*Data from 9/25 4:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

☁️ Visit layerzero.network for more info! ☁️

Market Opportunities 💰

- Restart the Arbitrum Odyssey

- Diversify your LST exposure with Yearn’s yETH

- Test Aztec Sandbox, a privacy-preserving L2

- Explore post.tech, a SocialFi app built on Arbitrum

- Join fan.tech, a friend.tech fork “on steroids”

Yield Opportunities 🌾

- BTC: Earn up to 8.3% APR with 03Swap’s BTC vault on Arbitrum

- ETH: Earn up to 14.5% APR with Umami’s GLP WETH vault on Arbitrum

- USD: Earn up to 17.9% APR with Aerodrome’s DOLA/USDbC vault on Base

- USD: Earn up to 16.1% APR with Umami’s GLP USDC vault on Arbitrum

- ERC20: Earn up to 15.1% APR with Hop’s SNX pool on Optimism

What’s Hot 🔥

- Dencun upgrade likely delayed until 2024

- Judge denies SEC motion to inspect Binance

- Ethereum profitability turns negative

- SEC warns more charges coming against crypto and DeFi exchanges

- Crypto-critical Senator charged with corruption

- 10-year UST yields rise to levels unseen since 2007

- Centrifuge to launch on Base and Arbitrum

- dYdX chain announces integration with squidrouter

- Conduit expands suite of rollup stacks to support Abritrum Orbit

- Pocket Network announces plans to become a sovereign rollup

- ByBit to suspend operations in the UK

- US government shutdown appears increasingly likely

- JPMorgan says Ethereum has disappointed post-Shanghai

- Proof of Play announces $33M seed round led by a16z

Money reads 📚

- Fund Solo Ethereum Validator Node with IRA - Buttondown

- Extending the Definition of Ethereum-Equivalence - Matt Finestone

- Rollbit is the reason securities laws exist - Gabriel Shapiro

- SVM Rollups and the Elgin Marbles - Frankie

- The Casino on Mars - Matt Huang

- Risk Analysis of stUSDT - LlamaRisk

Governance Alpha 🚨

- Optimism Foundation informs community of OTC sales

- Aave considers whether to wind down V2 markets

- Aave approves deployment of V3 MVP to Polygon zkEVM

- Galxe extends GAL contributor rewards program through Q4

- Radiant Capital delists BUSD as a supported asset

Token Hub: Fantom (FTM) 📈

Analyst: James Trautman

Rating: Bearish

Risk: Medium

Sector: L1

We’re establishing coverage of FTM with a bearish rating.

TL;DR

- After a strong Q1'23, FTM was silenced when cross-chain router Multichain was exploited at the end of Q2'23.

- Since the exploit, several applications have shut down, and Fantom's TVL and market cap have been crushed by 84% and 38%, respectively.

- Fantom DeFi remains battered, and until more infrastructure is integrated and investment in the ecosystem renews traction, we're bearish FTM.

Catalyst overview

Fantom introduced its Ecosystem Vault and Gas Monetization program in late 2022/early 2023. The initiatives changed network parameters, and Fantom's burn rate of transaction fees changed from 30% to 5%. The 25% allocation in fees burned is instead reallocated to its Ecosystem Vault for future investment and to the Gas Monetization program to provide a stream of income for developers.

At the onset of these programs, the market responded positively, and FTM rebounded 162% during Q1 2023, likely catapulted under the assumption that the ecosystem would receive capital for growth.

However, the zest was silenced when cross-chain router Multichain was exploited at the end of Q2 2023. Given Fantom's dependency on Multichain at the time, the aftermath of the debacle significantly impacted Fantom's fundamental value-driving DeFi ecosystem.

After the exploit, several applications were forced to shut down, including one of Fantom's largest DeFi protocols, Geist Finance. Fantom's TVL dropped from ~$455 million as of March 31, 2023, to ~$74 million by September 24, 2023 (an 84% decline). Looking ahead, the Fantom network is faced with reestablishing its primary revenue-generating DeFi ecosystem.

Price impact

The Ecosystem Vault and Gas Monetization program put downward pressure on value accrual by burning less supply. Given that the initiatives also require projects to meet certain criteria and growth milestones before receiving capital and the Multichain exploit has hindered most projects on the network, investment in the ecosystem may take time.

Ultimately, catalysts for revenue-generating activity on the Fantom network do not appear on the near to mid-term horizon. The outlook for value accrual to the network and its token holders appears bearish over the next several months until the Fantom network integrates more diverse infrastructure around its ecosystem.

See more ratings in the Token Hub.

Meme of the Week 😂