Pump's Stream-to-Earn Payday

View in Browser

gm Bankless Nation,

Crypto largely shrugged off the Fed's first rate cut of 2025, but altcoins like PUMP are still finding plenty of bullish momentum.

Today's Issue ⬇️

- ☀️ Need to Know: Fed Cuts Rates

Bitcoin barely budges on quarter-point cut. - 🗣️ Opinion: Pump's Streaming Payday

Pump.fun is back in the headlines. - 🎧 Latest Pod: Fintech Payment Chains

Tempo and the Trojan horse of tokenization.

Sponsor: Surf — AI-powered crypto copilot that combines institution-grade research and onchain execution.

- ✂️ Fed Cuts Interest Rates by Quarter-Point, Signals Two More Cuts This Year. Lower rates may push investors toward crypto as traditional yields soften.

- 🌊 Circle Launches Native USDC on Hyperliquid’s HyperEVM. The stablecoin giant doubles down on Hyperliquid with token investment, cross-chain tooling, and ecosystem incentives.

- 🐂 Bullish Scores New York BitLicense. The Peter Thiel-backed firm gets regulatory approval for spot trading and custody services in New York.

| Prices as of 4pm ET | 24hr | 7d |

|

Crypto $4.03T | ↘ 0.3% | ↗ 2.3% |

|

BTC $115,746 | ↘ 0.9% | ↗ 2.0% |

|

ETH $4,510 | ↗ 0.5% | ↗ 4.4% |

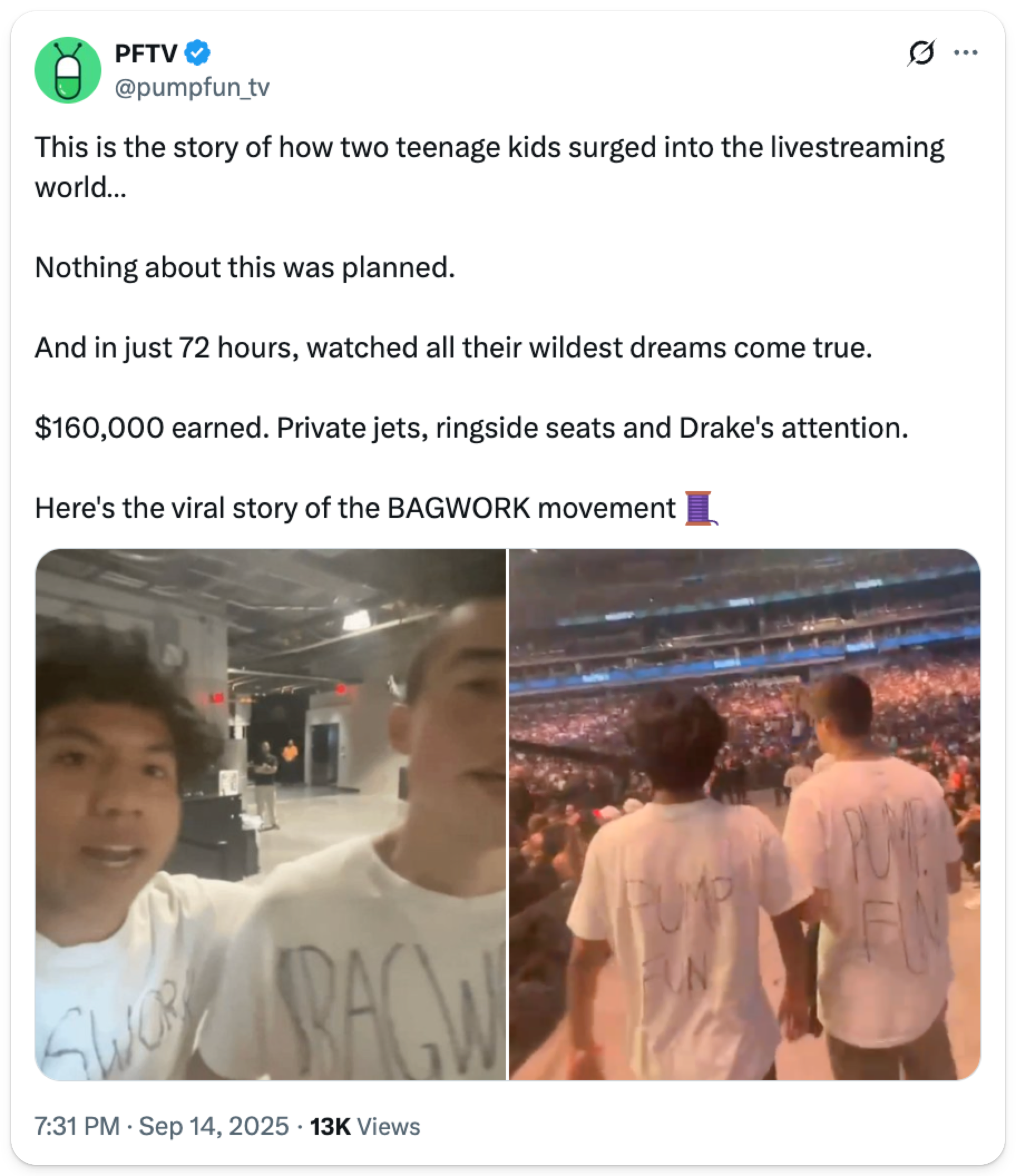

Over the weekend, Crypto Twitter watched in stunned awe as BAGWORK exploded from a $1.2M market cap to a $39.5M high in under 72 hours — a 32x pump fueled by the chaotic, live-streamed antics of two 19-year-old personalities dubbed the "Bagwork boys."

What started with a run across a Dodgers game field, streamed to a few hundred viewers, devolved into arrests, bailouts with their creator fees — raking in $160K from just 500 average concurrent viewers — run-ins with celebrities, private jets, and even an accidental leak of unreleased Drake tracks.

Welcome to the new era of Pump.fun?

While certainly one of the more flamboyant streaming moments on Pump, BAGWORK is not the only one. More creators are discovering that live-streaming transforms the economics of token launches — turning what was once a zero-sum game of dumping into a potentially sustainable revenue model that aligns creator and holder interests.

This shift has profound implications both for Pump's potential to compete with traditional streaming platforms and to reinforce trust in its own platform, a critical yet fickle determinant of its success.

The Perfect Storm

To be clear, live-streaming isn't the only catalyst fueling Pump's recent run:

- Daily buybacks totaling $96M, offsetting 6.6%+ of supply

- Project Ascend's 10x creator fee increase

- Market share recovery from 11% to 96.6%

- P/E valuations showing PUMP still significantly undervalued

There are countless inputs here, but Project Ascend combined with live-streaming appear to be the factors causing PUMP to light up like a Christmas tree.

Now, trading fees paid to creators start at 0.3% of each trade during the early stage (up to an ~$85K market cap). As the coin’s market cap grows, the creator fees rise as high as 0.9% until the cap hits around $10M, at which point, fees progressively reduce before reaching ~0.05% by around $20M. (Pump still takes a cut: 0.93% before bonding curve is reached, then a flat 0.05% after, plus a 0.2% fee for LP swaps).

What does this structure mean? This setup incentivizes token holders to avoid dumping early stakes in favor of monetizing via upsized fees that can be used to promote their coin, fund new features, or cover their own costs.

This new economic foundation makes live-streaming with tokens viable. Before, creators monetized by dumping, a dynamic sealing the fate of any “live-streamed token.” Now they can have sustainable revenue, redeemable in SOL and tied to volume — all generated by the excitement they can drum up on-stream.

New Creator Model

The potential of Pump’s new economic structure becomes even more noteworthy when you stack it up against traditional streaming platforms.

Unlike traditional platforms like Twitch, which take 50% cuts on subs and 50-70% on ads – Pump.fun flips the script with a more direct payment model that skips the audience grind and hands early creators up to 80% of fees.

For example, on Sunday Pump paid out $4M in Creator Rewards, mostly to first-time creators. Everywhere we look right now on the timeline, “Pump as the future of streaming” is being championed. With early traction a resounding success, the spectrum of future possibilities looks like this:

- At minimum? Success stories like Bagwork's expand the platform's notoriety, drawing attention from streamers who see peers earning 30x more with smaller audiences

- Beyond that? Pump actually emerges as the streaming platform of choice for creators who understand that ownership and trading volume beats ad revenue every time

To be clear, it's not all smooth sailing. Pump streamers must keep the viral fire burning to develop any sort of “consistency” with fees, since fans aren't locked into recurring fees like subscriptions. In other words, there's zero predictability and, given the mercenary nature of attention in crypto, you can never just coast on past momentum.

Retention Through Trust

While Pump’s updated economics can create new value for live-streaming overall, the greater promise lies in how live-streaming can help Pump cultivate the essential currency of every successful token launch in crypto: trust.

Users are eating up live video. Many attribute the growth in live-streaming and success of shows like TPBN to their satisfying a cultural hunger for unfiltered authenticity in the era of AI-generated content. This dynamic may prove particularly potent in crypto, where the default expectation on platforms like Pump is rugging and every token requires a profound leap of faith.

We saw this power of trust play out over the summer when BONK captured market share from Pump precisely because it understood this dynamic. While Pump did things that were good for Pump alone, BONK built trust through visible community buy-in from its top leaders and influencers.

We broke down this shift back in August:

Now, already having made up the difference, Pump’s reintroduction of live-streaming stands poised to provide the platform with new ammo here. When the “devs” show their faces, interact in real-time with holders, and demonstrate follow-through on their coin's mission, they transform tokens into communities with real people behind them — a necessary backbone which provides them a stronger chance of holder retention.

Creator fees provide the financial base, allowing developers to sustain themselves without dumping while live-streaming lets them build credibility and drive momentum through presence rather than promises.

This trust infrastructure doesn't just benefit individual tokens — it reinforces Pump's position as the platform where projects have all the tools they need to thrive, creating a virtuous cycle that strengthens the entire ecosystem.

Discover. Analyze. Execute. All in one place. Surf is the first crypto AI platform built for serious traders — combining institution-grade research with seamless onchain execution. From uncovering opportunities to putting together sourced back content, Surf delivers:

- Comprehensive onchain data

- Real-time social sentiment

- Pro-grade technical analysis & insights

Stop wasting time juggling tools. Try Crypto AI that actually works.

👉 Sign up today and use code BANKLESS for a 7-day free trial!

What if payment chains are the “AWS moment" for money?

Simon Taylor – fintech veteran, ex-Barclays crypto lead, and author of FinTech Brainfood – joins Bankless to map the convergence of fintech and crypto. From stablecoins serving as the Trojan horse for tokenization to Tempo’s push for a payments chain, Simon explains why finance is on the brink of its biggest infrastructure shift since Visa.

We cover the rise of payments L1s, the regulatory roulette of stablecoins, and whether neutrality and permissionlessness can survive in corporate-led networks. Plus, Simon breaks down the differences between stablecoins, tokenized deposits, and CBDCs — and explains why the future of finance is already being rebuilt on-chain.

Listen to the full episode👇

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.