Prices aren't going up, the dollar is going down

Dear Bankless Nation,

Inflation is running rampant in the U.S.

Not just the asset price inflation everyone has seemed to ignore over the past decade—now it’s hitting the prices of our basic goods….food, energy, cars, shelter.

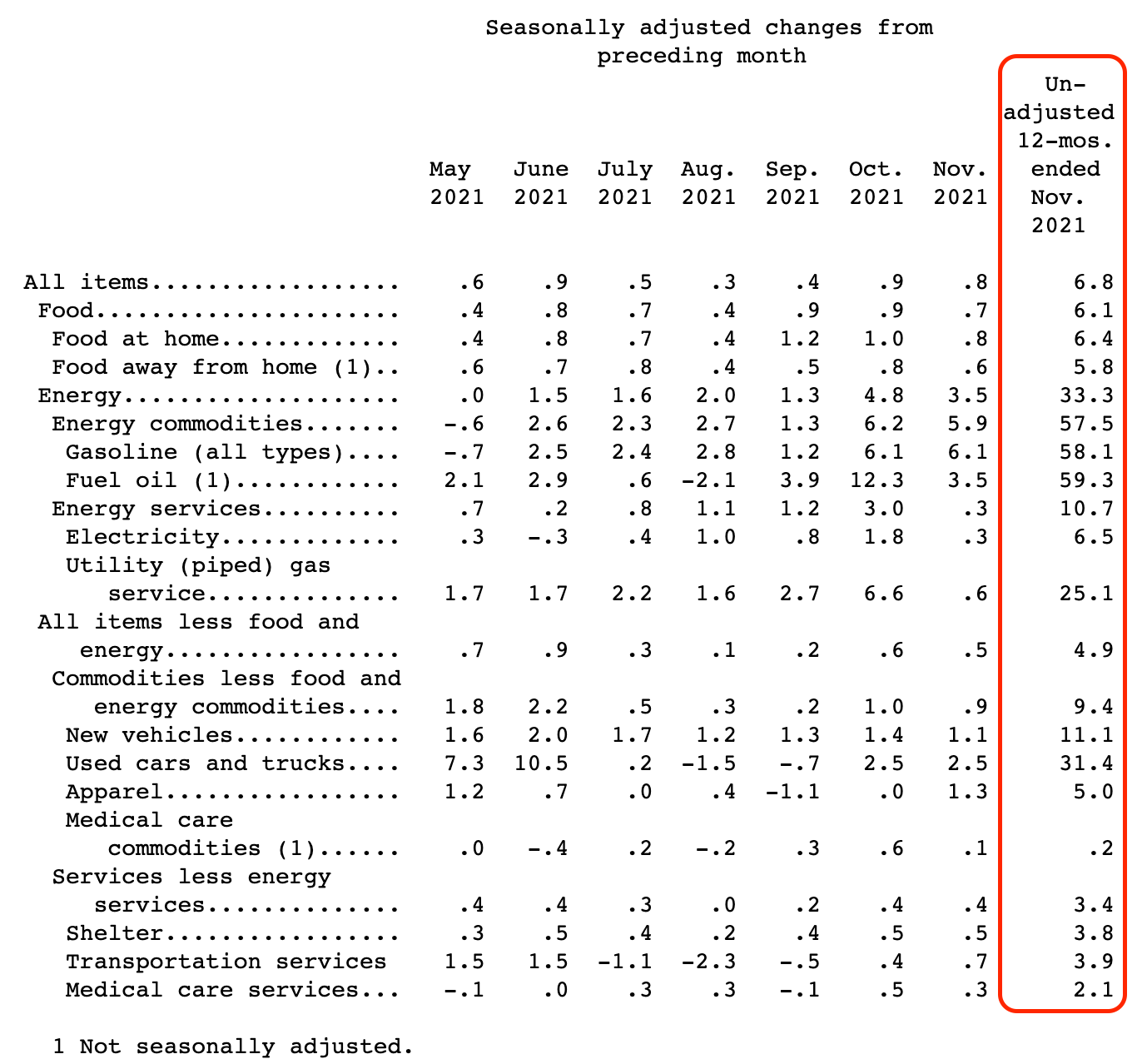

According to the most recent report from the U.S. Bureau of Labor on Friday, the Consumer Price Index (CPI)—an index used to measure price inflation on household items—rose to a 39-year high of 6.8%.

The energy sector was hit hardest, with oil and gasoline prices rising over 58% in the last year. Adding to the chaos, both new and used vehicles soared by double digital percentages (in part due to supply chain issues) while the price of groceries and food increased by 6.4%.

Even though CPI rising at the fastest rate in nearly four decades is news, high inflation shouldn’t be a surprise to anyone—at least not anymore. The M2 money supply has increased by 47% since 2019 as a result of central bank actions.

No matter how you want to cut it, this rapid expansion in the money supply was going to have an effect on the economy.

Fed Chair Jerome Powell tried to dam the coming inflationary flood, claiming that inflation was transitory—fancy talk for “not permanent.” But with the amount of money being printed, that narrative quickly ran dry.

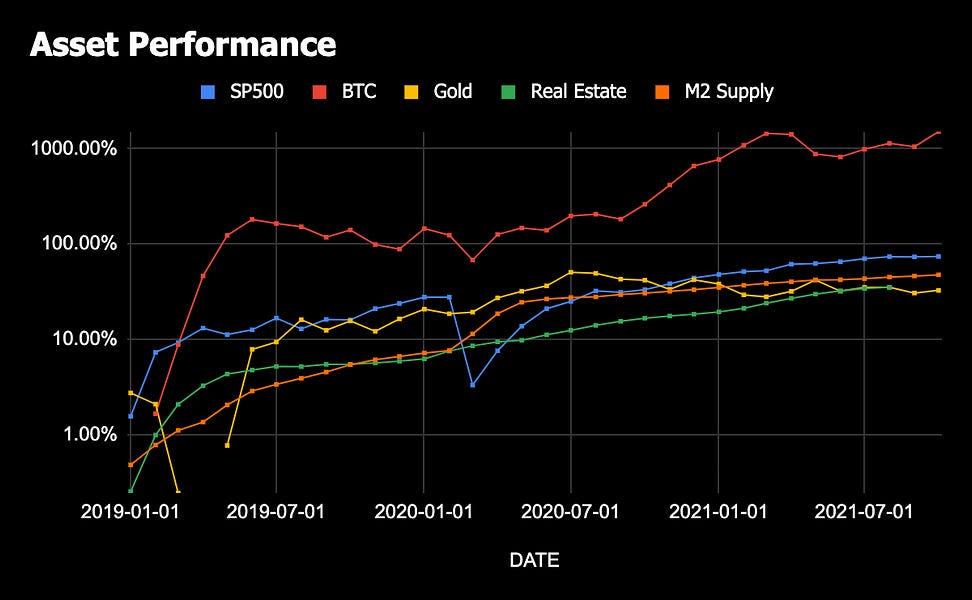

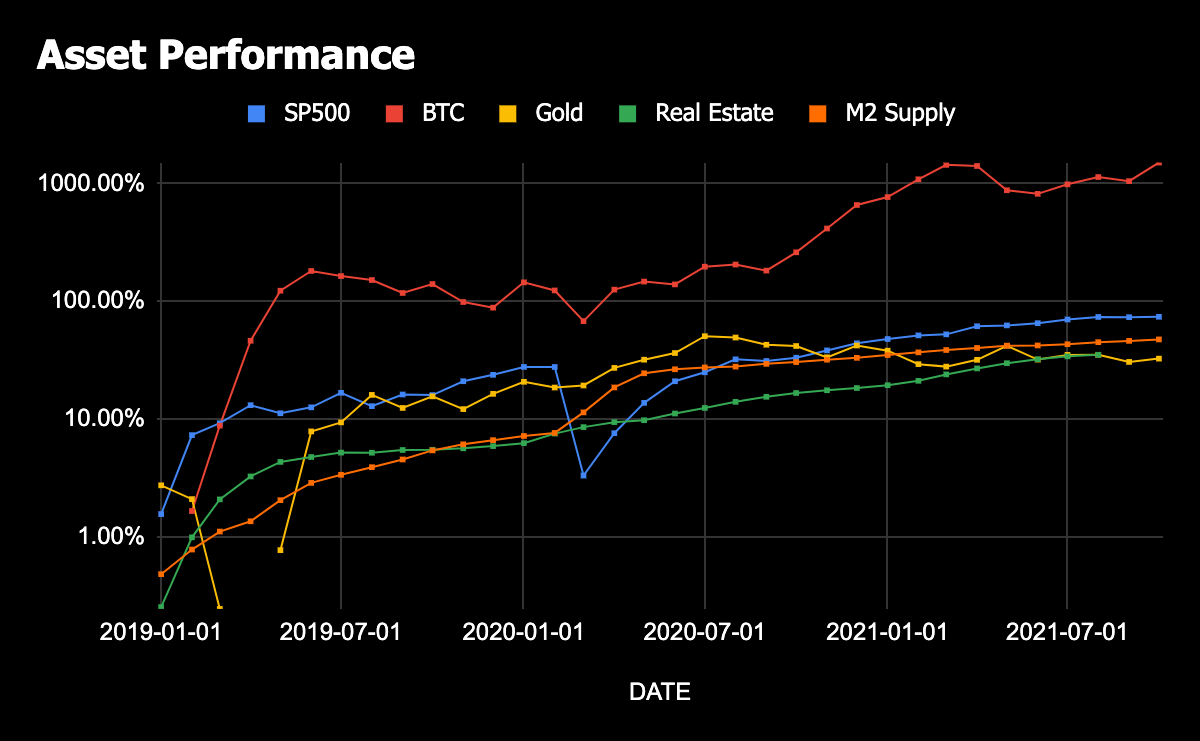

We’ve seen this trend with asset prices going crazy. The S&P 500 has increased by 77% since 2019, home prices have soared by 32%, and Bitcoin has gone parabolic with a 1500% increase while the crypto market as a whole has ballooned to a multi-trillion dollar asset class.

What’s funny is that when plotting these gains on a chart, none of these assets (outside of crypto) have really outperformed Jerome Powell and his money printer by a material amount.

Everything is in line with the rate of growth in M2.

This brings us to our point: prices haven’t gone up, but the dollar has gone down.

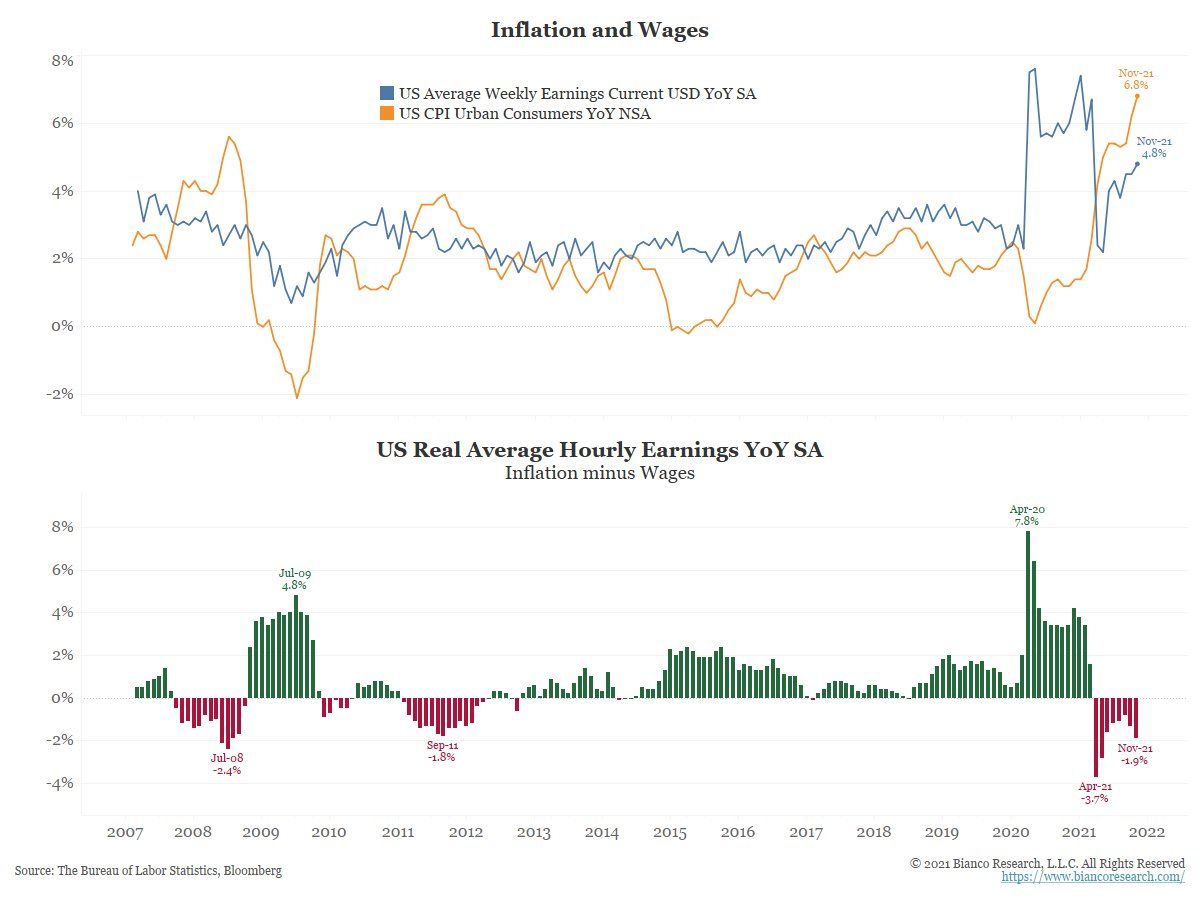

The worst part is that this inflation is exacerbating wealth inequality in the United States. If your wealth is primarily denominated in assets (stocks, real estate, commodities, crypto, etc.), you’re probably doing fine.

The problem is that an estimated 45% of Americans don’t hold any stocks and live paycheck to paycheck. This is where inflation is hitting people hardest as wage growth is negative against the CPI, making it more and more expensive for the average American to live.

Making Things Worse

The Fed has no good options

The Federal Reserve has two options:

- Raise interest rates

- Let inflation run its course

The first option feels like the most natural: raise rates. In macroeconomic theory, increased interest rates would incentivize consumers to save. With less disposable income circulating, the economy slows and inflation decreases.

The issue here is that the world has been living in a low-interest-rate environment for a decade. The economy is addicted to “free money” and raising rates will simply bring on withdrawal symptoms—not going to be good when the economy gets sick.

The second option is to let inflation run its course. The result here is widening wealth inequality, where the rich will continue to get richer off asset appreciation and the poor will get poorer off a decrease in purchasing power and stagnating wages.

Neither option is going to turn out well and the outcome will likely be swayed by politics in the end. No one said this inflation thing would be easy.

Regulators are limiting our options

The cherry on top is that regulators are constraining American investors.

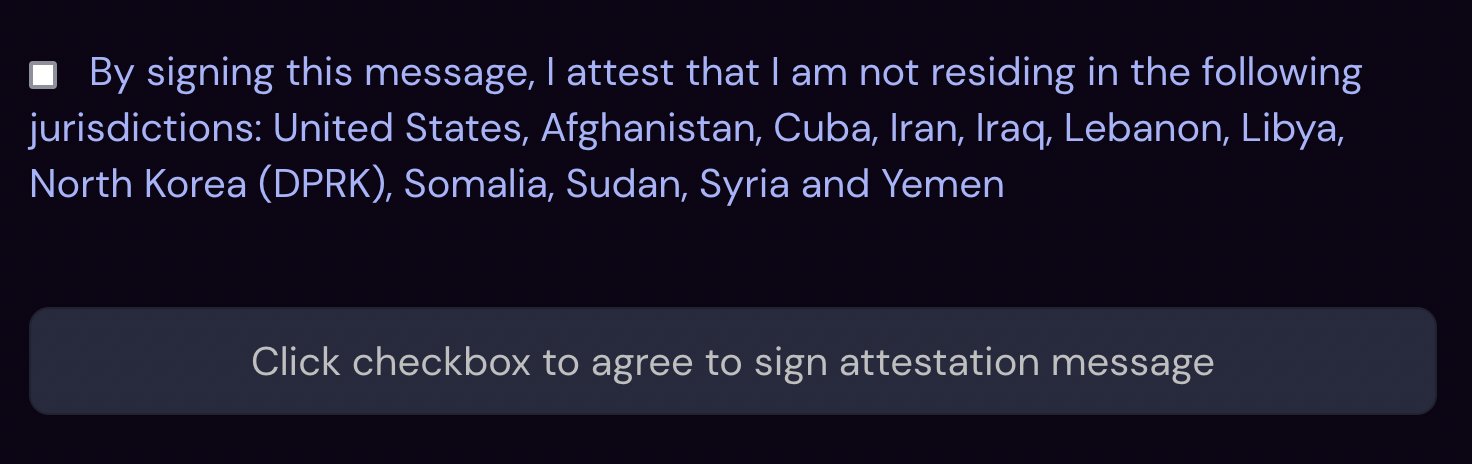

Look at this list of countries that are banned from using a prominent DeFi protocol.

Does something seem out of place?

Another one—Coinbase recently announced they’ll be launching a high-yield lending option for users by leveraging Compound. Interest rates upwards of 5%!

But it’s not available for U.S. citizens. 🥴

In the land of the free, a public and regulated U.S. company is banned from providing its U.S. users with a product built on global, permissionless, open-source software. Instead, we’re forced to rely on savings accounts—the same ones that are averaging 0.06% APR on deposits.

Now, the regulators still focused on serving the people are speaking out. Earlier this year former CFTC commissioner Brian Quintez said on our podcast that the current regime is chilling innovation. Today SEC Commissioner Hester Peirce came out and said Gensler’s newly released SEC agenda would further constrain investors.

The U.S. government is putting up roadblocks to crypto in the name of protectionism.

But we don’t need protection from crypto.

We need protection from the inflation they’ve unleashed on us.

“We live in a financial prison.”

I used to say it as a joke but it’s scary that it’s actually becoming more true.

Eroding dollar values, broken savings accounts, restricted capital formation. This is the system they want to trap us in.

Maybe they should stop worrying about crypto and focus on the dollar.

Fortunately, while they’re figuring all this out, there’s a lot of smart people heads-down building an open, accessible, credibly neutral system for the new world.

This is why we go bankless.

- Lucas

P.S. If crypto in real life isn’t absurd enough, try some crypto satire. (Mint it here!)

Action steps

- Execute any good market opportunities you saw

- Listen to our episode on Web3 Gaming with Amy Wu

- Join us on Twitter spaces for our call with Ledger