Pre-IPO Markets Don't Work

View in Browser

gm Bankless Nation. Today Arnav from BVC takes a critical look at pre-IPO markets, examining why these highly speculative assets remain broken and what needs to fix before crypto can help.

Today's Issue ⬇️

- ☀️ Need to Know: MON Arrives

Monad's token claims go live until Nov. 3rd. - 🗣️ Primer: Pre-IPO Markets Don't Work (for now)

But here's how we can begin to fix them.

P.S. Bankless Summit II is coming — powered by M0, the universal platform enabling builders to create application-specific stablecoins

Sponsor: Frax — Fraxtal Ecosystem: Where DeFi Meets AI.

- 🪂 Monad Opens MON Airdrop Claims. Over 230K wallets can now verify allocations ahead of Monad’s mainnet launch, with the high-speed, Ethereum-compatible chain promising 10K TPS and one-second blocks once MON becomes transferable.

- 💳 Stripe Adds Stablecoin Support for Subscriptions. Businesses can now accept recurring payments in USDC on Base and Polygon, with Stripe’s new smart contract removing the need for manual re-signing and integrating crypto and fiat billing in one dashboard.

- 🧨 Binance Faces Backlash Over Alleged Listing Demands. Limitless CEO CJ Hetherington claimed Binance sought 9% of the project’s token plus $2.25M in deposits for a listing, prompting denials from Binance and sparking public criticism from Coinbase’s Jesse Pollak and other industry figures.

| Prices as of 5pm ET | 24hr | 7d |

|

Crypto $3.95T | ↘ 2.7% | ↘ 8.4% |

|

BTC $112,996 | ↘ 2.4% | ↘ 7.2% |

|

ETH $4,121 | ↘ 3.7% | ↘ 8.1% |

The pre-IPO market has always been stacked against retail investors.

Six-figure minimums, inflated valuations, year-long lockups, hefty fees, and opaque pricing make it one of the most inaccessible corners of finance. Now, with Circle, Figma, and Bullish recently going public, crypto builders are racing to "democratize" private markets through tokenization and perpetual futures. But there's a problem: they're building derivatives on top of a market that barely functions.

Without a liquid, real-time spot market, these solutions won't just fall short, they'll eviscerate retail investors in the process. The allure is obvious: turn illiquid shares into tradeable tokens, use the DEX as an oracle for perps, and suddenly retail has access.

The real opportunity isn't in financial engineering. It's in solving the single hardest problem no one's cracked in over a decade: building a functional spot market for pre-IPO shares. Everything else is just noise.

Pre-IPO Landscape

The pre-IPO market can be broadly categorized into two segments: institutional-focused and retail-focused platforms. Institutional venues, namely Nasdaq Private Markets (NPM) and Forge, dominate the market with >90% market share.

Institutional Platforms

1. Broker/Marketplace Model (Forge)

How it works: Forge operates through its FINRA-registered broker-dealer subsidiary. Most transactions are intermediated by brokers who source blocks of shares from employees, funds, or early investors. Instead of a live public orderbook, brokers typically match institutional buyers with sellers in large negotiated block trades over 2-6 weeks.

Pros:

- No balance sheet risk – Platforms don’t warehouse inventory

- Direct ownership – Buyers end up with actual company shares, no derivatives

- Minimal counterparty risk – Trades are executed via regulated broker-dealers, with escrow and company transfer approval processes designed to ensure both sides perform.

- Scalability/Access – Because brokers cultivate relationships with funds, banks, and issuers, they can source large blocks and give buyers exclusive access to deals with size

Cons:

- Opaque pricing – Transactions are privately negotiated, often at wide spreads vs fair value

- Slow settlement – Typical deal takes weeks, not days; ill-suited for fast liquidity needs.

- High fees – Broker commissions (2–5%) eat into both buyer and seller proceeds.

- Retail excluded – High minimums (often $100K+) + company transfer restrictions

- Company approval bottleneck – Issuers can block or delay transfers

- Iliquidity persists – Despite “marketplace” branding, actual liquidity is thin and episodic

- Long minimum holding period – Under SEC Rule 144, most resales of private-company stock require a minimum 12-month holding period before shares can be legally sold

2. Company-Sanctioned Liquidity Programs (Nasdaq NPM)

How it works: Platforms like Nasdaq Private Market (NPM) and Carta Liquidity run issuer-approved tender offers, buybacks, or secondary programs. These aren’t continuous markets but structured events, usually once or twice a year, tied to major financings. After board and legal approval, a 2–6 week window opens where eligible shareholders can sell, with the company aggregating bids, setting a clearing price, and executing in bulk.

The pros and cons are nearly identical to the above model, the key difference is that sanctioned programs are structured, time-bound events with guaranteed company participation, lower fees, and cleaner cap table management.

It’s important to note, Institutional platforms dominate pre-IPO markets because virtually all major private companies require transfer approval under their shareholder agreements. Every secondary trade must be manually approved by the issuer, and more than half are typically rejected. Additionally, because each transaction requires broker intermediation, legal review, company coordination, and compliance checks, small trades are simply uneconomical. This structural friction gave rise to retail pre-IPO platforms today built around SPV models to circumvent regular transfer approvals.

Retail Platforms

3. Inventory/Principal Model (Linqto)

How it works: The platform purchases pre-IPO shares (from employees, early investors, or funds), takes inventory risk, then resells fractionalized pieces to retail.

- Pros: Clean access for retail, immediate execution.

- Cons: High balance sheet risk, high markups, potential compliance shortcuts, weaker investor protections, no secondary market

4. SPV Aggregator Model (EquityZen, AngelList-style deals)

How it works: Multiple retail accredited investors are pooled into an SPV, which collectively purchases a secondary block of shares.

- Pros: Lower minimums, risk spread across multiple investors, less balance sheet risk

- Cons: High fees, no secondary market, weaker investor protections

To summarize, we can segment the landscape as:

- Broker/Marketplace (institutional matchmaker)

- Company-Sanctioned (issuer-led)

- Inventory/Principal (retail reseller)

- SPV Aggregator (pooled retail)

So we are left with:

The Institutional route that is fundamentally inaccessible to retail OR the retail route which is littered with poor pricing, high fees, no secondary market, weak investor protections, etc.

But can tokenization or perps solve these issues?

Why pre-IPO perps are wayy to early

Launching a perp DEX is table stakes post HIP 3. The real challenge lies in the oracle, specifically where and how reliable pricing data is sourced.

As we covered above, the pre-IPO spot market is slow, opaque and predominantly broker driven, meaning there are no real-time pre-IPO price feeds in existence.

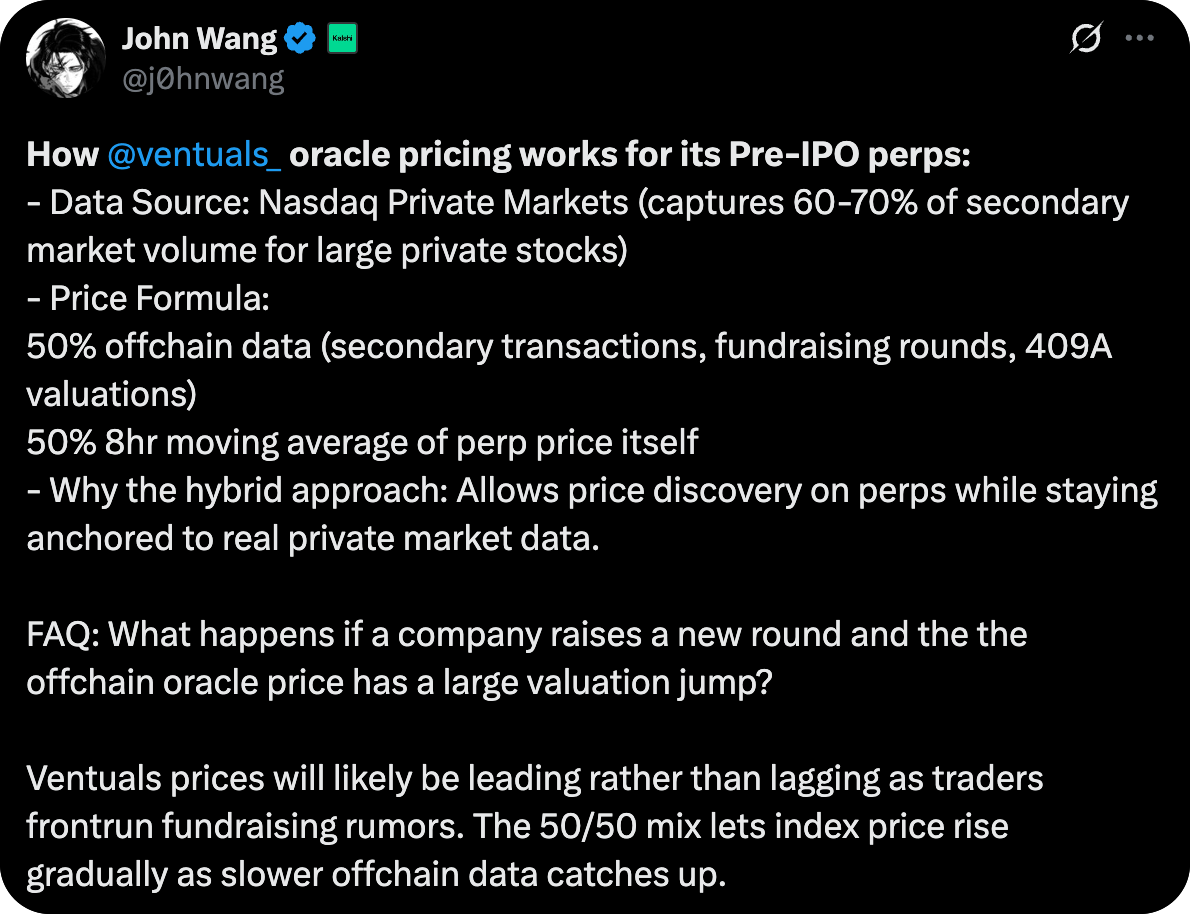

Per John, Ventuals, a new HIP-3 pre-IPO perps platform, is using a combo of offchain data (NPM price feeds, 409As, etc.) + the 8hr moving average of perp price itself.

For reference, 409As can be up to 90 days old by the time they're circulated. More importantly, they are intentionally deflated to provide favorable Fair Market Values (FMV) for employee stock options — companies want lower valuations here to minimize the tax burden on employees receiving equity compensation. Thus, the resulting price isn't a fair value of the stock price in the open market, and 409As can often be as low as 1/4th the price of the most recent primary round.

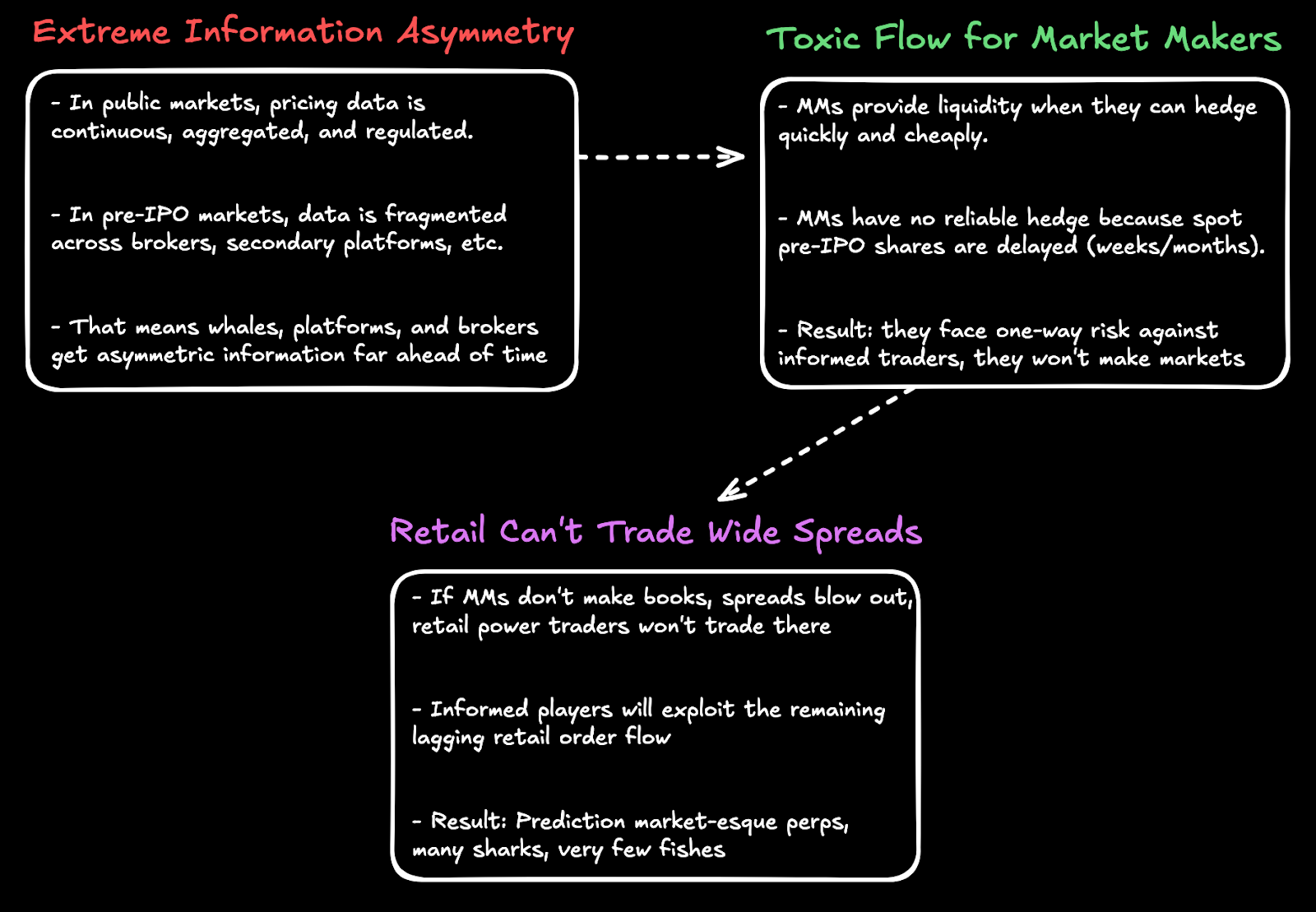

As such, I suspect early pre-IPO perp platforms will behave closer to prediction markets where toxic flow is a feature not a bug. Here’s why:

Put simply, pre-IPO markets attract a high concentration of informed traders: brokers, secondary funds, and platform operators at a minimum. For market makers, this creates a toxic-flow problem with no offsetting hedge, since no real-time spot market exists. The outcome is predictable: market makers don’t quote, spreads widen, and retail loses interest in trading altogether.

Given these oracle and toxic flow problems with perps, the natural next question is: what if we skip the derivatives layer entirely? What if we tokenize pre-IPO shares directly — putting them onchain where the DEX price serves as a real-time oracle and market makers can actually hedge their positions. Problem solved, right?

Why pre-IPO tokenization doesn’t work (for now)

Tokenization does not fundamentally fix any of the core issues around the pre-IPO market. The high fees, slow execution, high minimums, etc. are a function of poor design heavily constrained by regulatory measures. Simply tokenizing shares wouldn’t solve any of those issues.

Before tokenizing, here are some key problems to solve as a platform:

- How do I scalably source pre-IPO shares? (Without taking on inventory risk)

- Related, how do I get market markers to provide liquidity and make these books?

- Investor protections are a must: What do investors actually have a claim to? Are the SPVs bankruptcy remote? Is the platform compliant?

- Etc.

The pre-IPO spot market is the single hardest problem no one’s solved in over a decade.

Tokenization can however add real value once the underlying spot market structure is fixed. But right now it just amplifies bad market structure.

Social Alignment

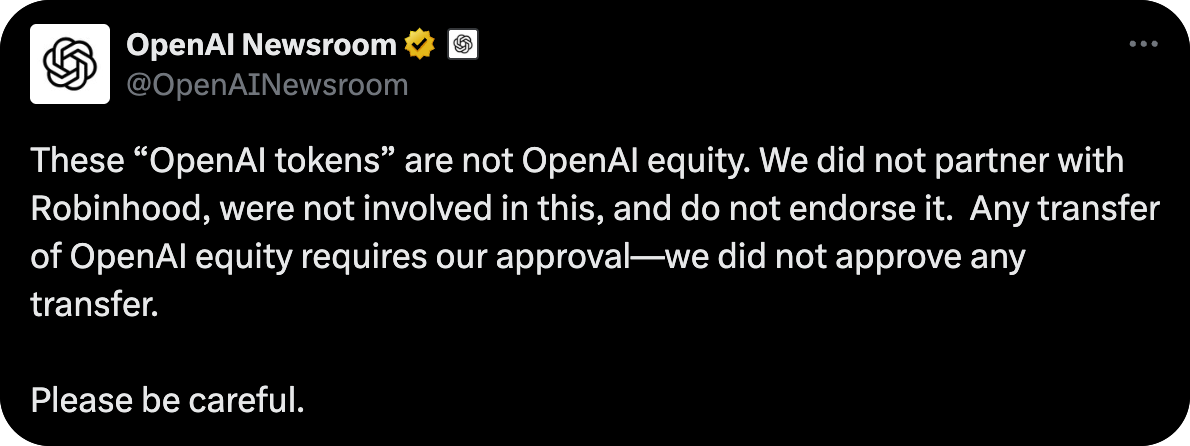

Further, underlying companies would need to be comfortable with tokenization for the asset class to scale; And right now that seems unlikely.

Tokenizing pre-IPO equities can result in the underlying stock units being voided if it's perceived by the underlying company to be particularly bad to their interests. It's likely that the end retail purchaser of such tokens would be the last person to know that their capital is at risk in this way.

Regulators are also very weary of tokenized securities. Just recently, ESMA and the World Federation of Exchanges have already urged the SEC to tighten oversight of tokenized equities, which are an order of magnitude simpler than pre-IPO shares. From a social consensus perspective, we are just too early.

What is the endgame?

The path to winning starts with building a liquid, real-time spot market. One with low fees, short holding periods, and bankruptcy-remote structures as the foundation. Once daily volumes reach levels that can support meaningful perp open interest across the top 5–10 companies, low-leverage perps can be introduced. At that stage, the platform’s own spot market doubles as the live price feed and, more importantly, unlocks real-time liquidity for market makers, laying the groundwork for the deepest and most efficient markets.

Looking ahead, tokenization of private shares could eventually move the spot market fully onchain, enabling the full composability and accessibility of DeFi. But that vision remains at least a few years out, held back by regulatory, structural, and market-driven hurdles.

For too long, retail investors have been locked out of private markets. As companies stay private longer and treat public markets as mere exit liquidity, unlocking liquid access to these assets will stand as one of the most important innovations in personal finance.

The Fraxtal ecosystem is expanding at lightning speed—this month’s biggest highlight is IQAI.com, the newest Agent Tokenization platform from IQ and Frax. IQ is building autonomous, intelligent, tokenized agents launching on Fraxtal in Q1. Empower on-chain agents with built-in wallets, tokenized ownership, and decentralized governance—all within a fast-growing Fraxtal ecosystem.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.