Polymarket Gets Green Light from CFTC to Reenter U.S. Market

Polymarket received formal approval from the CFTC to operate again in the United States, marking its full return after being barred in 2022. The decision followed the firm’s acquisition of a regulated exchange and capped a breakout year of major licensing deals, accelerating volume, and rising investor interest.

What’s the Scoop?

- Regulatory approval: The CFTC issued an Amended Order of Designation permitting Polymarket to operate an intermediated trading platform under the full set of rules applied to federally regulated U.S. exchanges.

- Background: Polymarket had been barred from U.S. operations after a 2022 enforcement action for running an unregistered derivatives exchange. Its acquisition of QCX, a designated contract market and clearinghouse, laid the foundation for its regulated return.

- Valuation: The startup, founded in NYC in 2020, was reported to be seeking a valuation between $12 billion and $15 billion. It last raised at a $9 billion valuation in October and has hinted at launching a POLY token.

- Leadership Statement: CEO Shayne Coplan said the approval enables Polymarket to operate with the transparency the U.S. regulatory framework requires while continuing to deliver clarity and accountability.

Bankless Take:

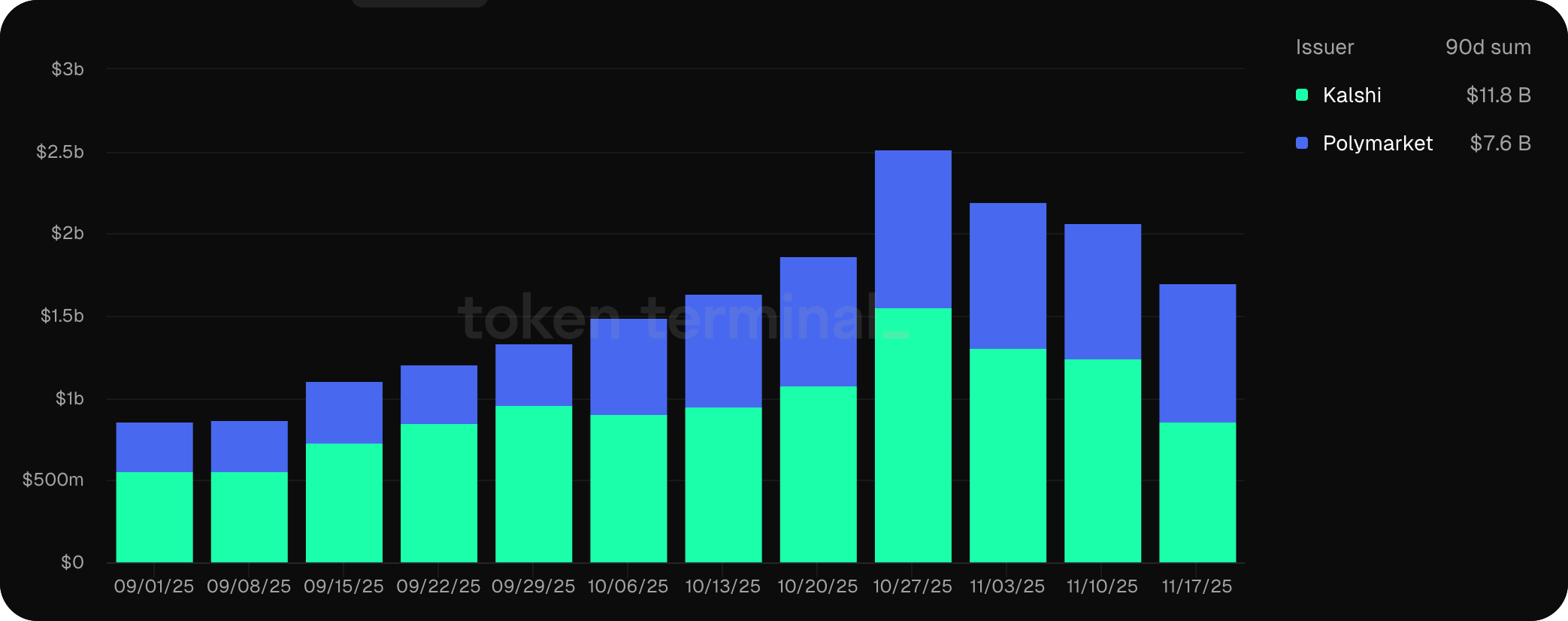

After years of operating offshore and settling with the CFTC in 2022, Polymarket’s return to the U.S. as a fully regulated entity now positions it on the same ground as Kalshi. Prediction markets are already in the spotlight, and the timing of this announcement lands as Galaxy Digital and Jump move into market making on both exchanges. The leading platforms are signaling they’re tightening operations ahead of real competition. With Kalshi leading Polymarket in total volume traded over the past month, and generally since the beginning of September, we’ll see if this approval helps level the playing field for the crypto-native favorite.