Perp DEXs That Stay True to Ethereum

Perpetual exchanges, or “perp DEXs,” have become the hottest sector in crypto as traders seek leveraged exposure to markets and airdrop hunters churn out volumes in the pursuit of receiving free money distributions.

Players like Hyperliquid and Aster currently control the vertical, but their performance-focused edge comes at the cost of security. Now, a new wave of perpetual exchanges is attempting to optimize for both speed and security by prioritizing Ethereum alignment.

Today, we’re breaking down the two platforms leading the charge here: Synthetix and Lighter.

💱 Synthetix

One of the oldest decentralized trading platforms in existence, Synthetix has taken a back seat throughout 2025; notional trading volumes were down over 90% during the first three quarters of 2025 compared to the same period in 2024.

Although leverage remains popular among crypto traders, Synthetix has experienced mounting pressures from all angles amid the rise of flashy new perp competitors and regulated TradFi alternatives.

In an attempt to regain its dominant perps position, Synthetix will soon redeploy to the Ethereum Layer 1 with a refreshed vision for the future that combines centralized exchange-like performance with the benefits of Ethereum’s world-class security.

"There is no perp DEX on Ethereum. We need a perp DEX on Ethereum." @kaiynne explains why Synthetix is returning to Ethereum Mainnet on @BanklessHQ pic.twitter.com/z6z6uUnr7N

— Synthetix ⚔️ (@synthetix_io) September 23, 2025

Such a deployment had long been considered impractical, as quality exchanges require sub-second responsiveness and Ethereum only produces blocks every 12 seconds, but Synthetix’s new architecture decouples offchain orders from onchain settlement.

Like a rollup that bundles multiple transactions and settles them together on Ethereum after a short delay, the new Synthetix will batch offchain orders and settle them every Ethereum block, while keeping position margins on L1 throughout the process.

This structure eliminates centralized chokepoints for operations besides order placing, providing centralized exchange-like confirmations with the benefits of Ethereum’s robust security.

While an offchain order book will unfortunately make traders reliant on the exchange operator to behave correctly until settlement, trustlessness could be achieved through the utilization of trusted execution environments (TEEs).

The next generation of Synthetix is expected to launch to the public sometime this November following an invite-only trading competition that begins on October 20.

🕯️ Lighter

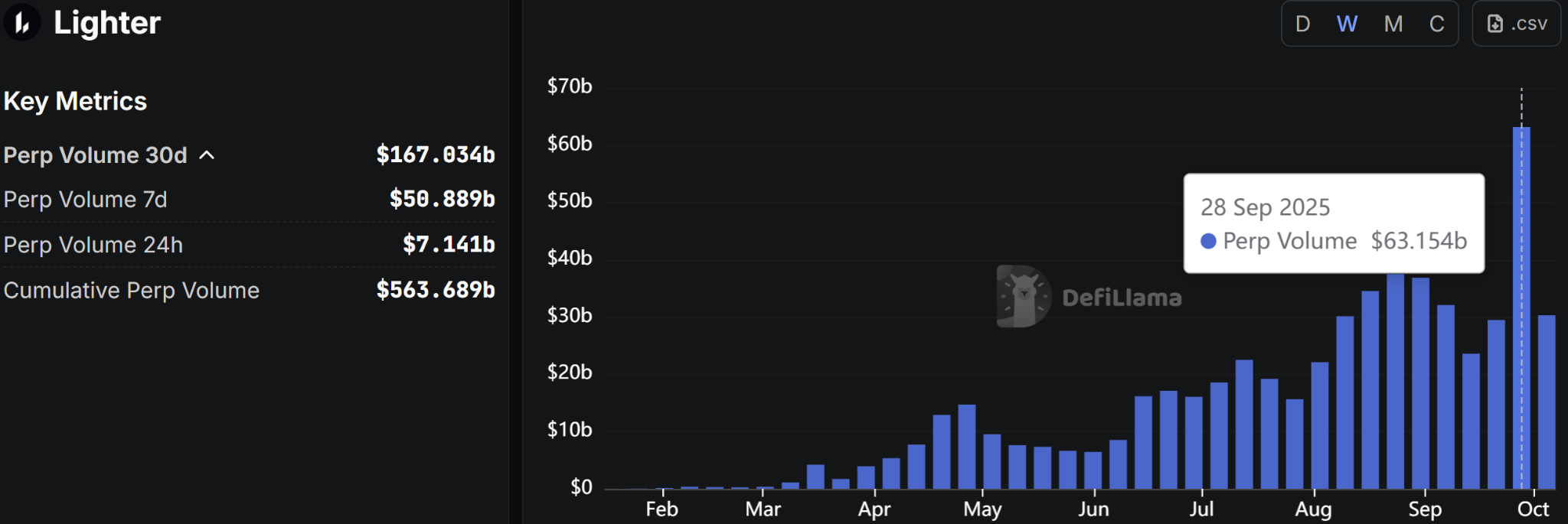

Lighter is a decentralized trading platform that aims to provide unmatched security and scale. Though a relative newcomer among perp DEXs, Lighter has seen its popularity surge in recent months, fueled largely by its high airdrop potential.

The first season of Lighter points concluded on September 30 along with the release of the network's public mainnet. Further details on a second points season have been promised in the coming days, and while unconfirmed at this time, it's likely that Lighter will conduct an airdrop at a future date given the presence of this points program.

Lighter’s momentum culminated towards the tail end of September, with the platform processing more than $63B of volume in one calendar week to become the third most active onchain perpetuals exchange behind Hyperliquid and Aster.

The exchange provides verifiable matching and liquidations using zero-knowledge (ZK) proofs, while operating at traditional exchange performance levels.

Due to its Ethereum Layer 2 design, deposited assets and the canonical Lighter state root are stored on Ethereum, allowing users to freely enter/exit directly through the L1 and enjoy the benefits of the world’s leading settlement layer.

In the event of a Lighter sequencer failure, the system automatically triggers Escape Hatch mode. Users can then leverage Ethereum-posted data blobs to generate proofs of ownership and withdraw the full value of their assets directly to Ethereum, with no reliance on offchain coordination.

Despite their ability to withdraw assets to Ethereum at any time once a proof is generated, Lighter users depend on the sequencer to correctly order transactions and a prover to generate timely transaction proofs.

🧐 Conclusion

Synthetix and Lighter are competing to offer the best high-performance, blockchain-based trading experience.

Both emulate Ethereum L2 design principles by combining the speed of offchain orders with the security of onchain settlement, which mitigates user centralization concerns by tapping Ethereum L1 for asset custody.

Although these two different takes on an Ethereum-aligned exchange afford traders with similar settlement guarantees, their race for millisecond performance and their resulting reliance on offchain orders undesirably centralizes the transaction process.

Compared to a spot DEXs where the worst case scenario is that user transactions can no longer be processed in the event of order book difficulties, perp DEX users typically close open trades before withdrawing from the exchange – an impossibility when orders cannot be submitted that may lead to position liquidations and loss of funds.

Synthetix attempts to deal with this issue through promises of a trusted execution environment, which could reduce the risks of exchange operator tampering, though it would also leave users vulnerable to an exchange outage.

Alternatively, Lighter’s exit hatch will halt the network state once triggered. While users can always withdraw their account balance as registered by the last posted state root, the lack of state updates effectively freezes user balances in time, potentially resulting in erroneous profits and losses on a mark-to-market basis.

These two parallel approaches and their respective drawbacks highlight the core trade-offs perpetual platforms must wrestle with as they attempt to achieve centralized-exchange performance without eroding trustlessness.

At this stage, neither design is perfect, and although technological breakthroughs like decentralized sequencing and forced transaction inclusion could bolster trustless guarantees, there remains plenty of room for innovation in the race to create the best Ethereum-aligned perp DEX.