The Rise of PEPE

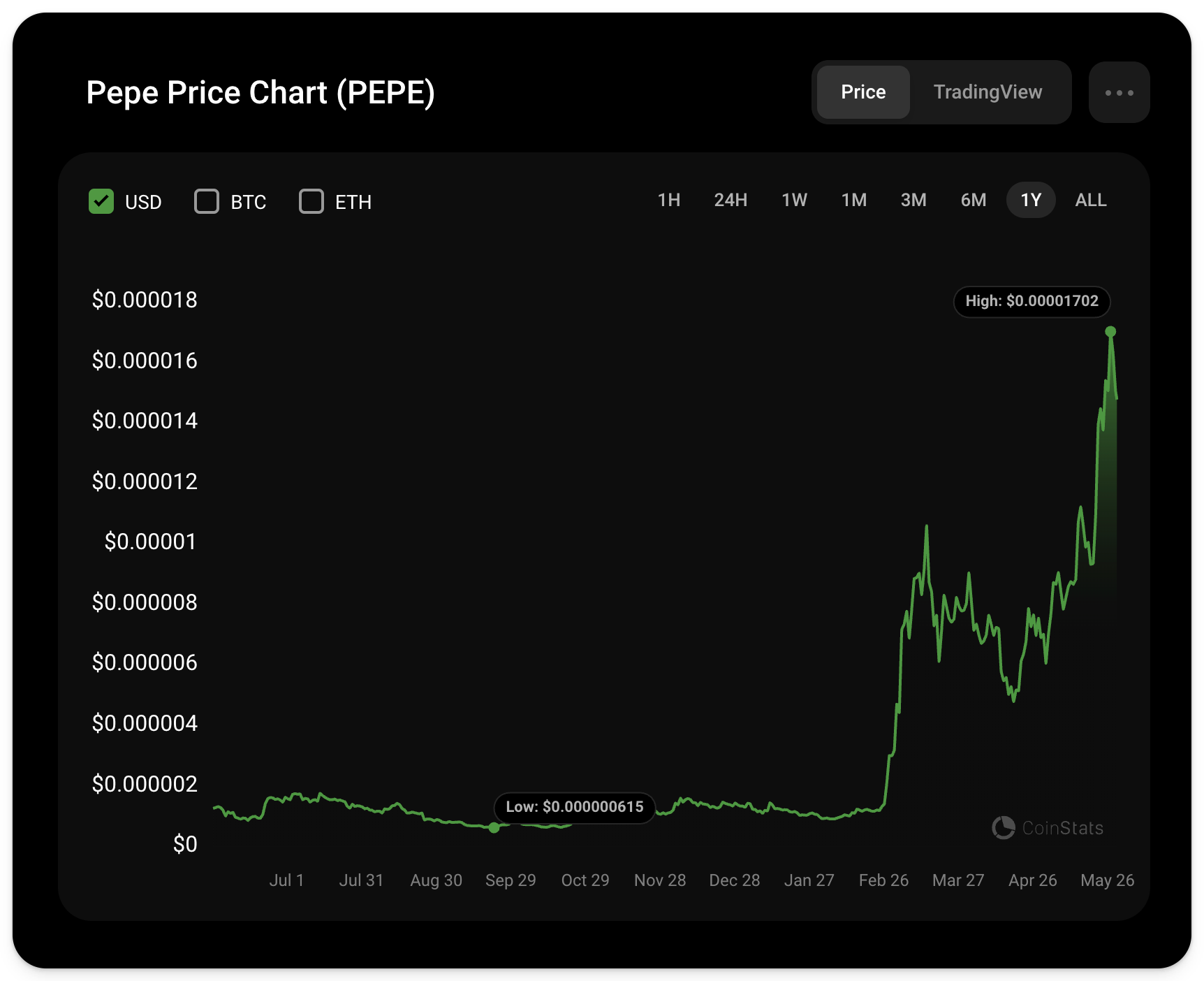

Up over 100% this month and over 1100% year-to-date, PEPE has rocketed into the slot of the third-largest memecoin with a whopping $6.2B market cap.

The infamous frog has made a significant impact on the Ethereum memecoin ecosystem since its launch in April 2023, rising to become one of the highest consensus plays of this cycle so far.

In this article, let's take a look at the memecoin's initial journey and then dive into its recent rise and related offshoots, all to get a sense of where the token is at and where it may be going. 👀

PEPE’s Journey

PEPE came onto the scene last April with a mission to dethrone DOGE, boasting a maximum supply of 420.69T tokens.

A nod to one of the web's most well-known memes, PEPE's rise can be traced to cultural significance first and foremost. While originally created as an apolitical character by cartoonist Matt Furie, Pepe was co-opted as a right-wing meme that at times showcased a darker side of web culture. Fast forward nearly a decade, and Pepe the Frog has mostly receded from controversy and remains a consistent fixture of Crypto Twitter.

All the while, PEPE boasts an explicit connection to MAGA culture, something the PEPE team has often nodded to on social and on its website. As presumptive GOP Presidential nominee Donald Trump has more recently sought to align himself with crypto circles via dedicated events and policy promises, PEPE's team has sought to turn this development into narrative fuel for the token's growth.

https://t.co/q6CLq85QrS pic.twitter.com/sBWuCrXXAT

— Pepe (@pepecoineth) May 9, 2024

Likely more significant to this recent pump is the very significant political development of Ethereum's ETF approval which has lifted related networks and coins. As ETH's standout memecoin of this cycle, PEPE has continued winning big.

Many questioned whether PEPE could build higher than its previous heights.

In early May 2023, it had achieved a market cap of $1.5B. By Aug. 24, 2023, a multi-sig wallet from the team unexpectedly transferred 16 trillion PEPE tokens to exchanges, spooking holders and leading to a sell-off. Initially attributed to a hack, PEPE’s Twitter revealed that the change was due to internal team turmoil, not theft. The token felt the effects of this through the rest of the year, bleeding until its run-up started again in February.

With its most recent pump, the token has climbed into the memecoin stratosphere, currently repping a market cap over $6 billion.

Much as a rising doggy coin lifts all pups, PEPE's pump has lifted up an assortment of Pepe-related offshoots or competitors.

While most derivatives fade, some have managed to stand out, as in the case of APU, a community token that already survived a developer rug and is currently repping a $215M market cap.

Perhaps more interesting is competitor PepeCoin, which pre-dates PEPE and launched as a custom L1 blockchain in Mar 2016 that migrated to ETH in Apr 2023. Unlike PEPE, PepeCoin has aimed to build out a nascent tech ecosystem, with dApps like Pepe Paint, an MS-Paint style NFT creator, and Pepe Messenger, a wallet-to-wallet messenger.

PEPE's continued growth is a testament to the power of memecoins in this most recent cycle, as well as the continued strength of ETH-based assets.

This cycle has already seen multiple groundswells of memecoin activity, but the most-publicized wins have often been Solana-based tokens like WIF or BONK. Traction around ETH L2-based memecoins has attracted attention to the memecoin arenas on networks like Base, but amid all of that traction, it's still hard to compete with the L1

Where to Next?

The rise of PEPE has been marked by dramatic highs and challenging lows.

From a meme coin with no utility to... still a meme coin with no utility, but also now a top 20 token, PEPE’s cultural significance, political tie-ins, and designation as the Ethereum meme have solidified its place as not only a leading memecoin but a leading token this cycle.

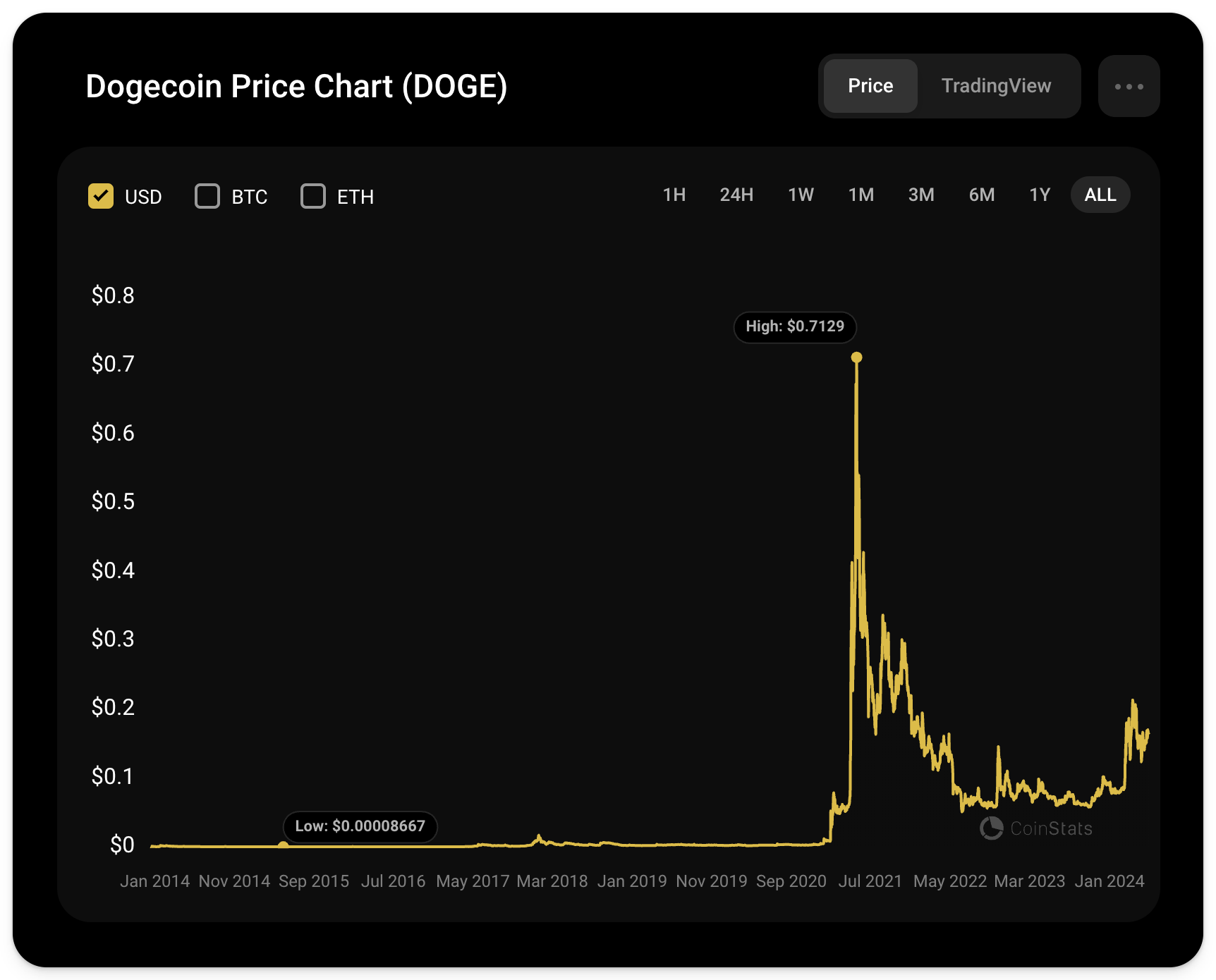

However, there are few up-only tokens in crypto, as we’ve seen time and time again, even with leading memes like DOGE, which fell from a market cap high of $75.26B to one of $7B last cycle.

Given PEPE’s current size, achieving “incredible” returns from here could be hard. And while derivatives may provide higher room for growth, they also carry higher risk due to their lower market caps.

While its largest gains may be behind it, its size, ever-increasing activity, and strong consensus standing make it wise to think twice before fading the frog.

always take time to smell the flowers along the way $PEPE pic.twitter.com/kD1YzqF11u

— Pepe (@pepecoineth) May 20, 2023