OpenSea Drying Up?

View in Browser

Sponsor: Kraken — Sign up for an account and see what crypto can be.

📈 Wall Street rebounds. Crypto stocks pushed higher during Wall Street's best week of the year, spurred by hopes that the Fed is done hiking rates. Coinbase up 19%, Block up 21%, and MicroStrategy approaching 18mo highs.

| Prices as of 10am ET | 24hr | 7d |

|

Crypto $1.30T | ↗ 1.5% | ↗ 1.7% |

|

BTC $34,719 | ↗ 0.4% | ↗ 1.8% |

|

ETH $1,836 | ↗ 1.5% | ↗ 2.8% |

Notable movers

SOL 7d

↗ 30.7% |

TIA 7d

↗ 16.2% |

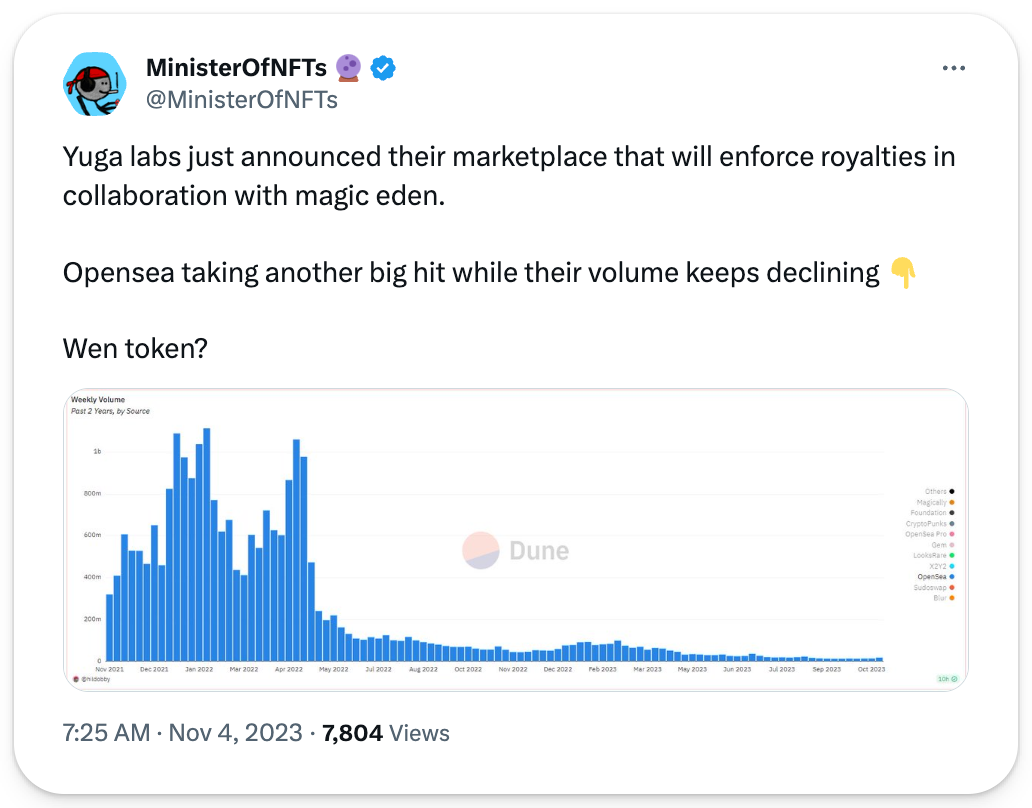

1️⃣ OpenSea takes drastic steps.

As the NFT market slowdown continues, OpenSea is looking to take things in a different direction. They're taking some drastic measures, announcing Friday that they're laying off half of their staff.

The layoffs were announced by OpenSea CEO Devin Finzer in a thread that charted the platform’s plans to reimagine its “operating culture, product, and tech from the ground up.”

OpenSea struggled to maintain dominance this past year while its chief competitor, Blur, leveraged its airdrop to drive substantial volumes. It's also dealt with pushback from massive players like Yuga over its royalty policies.

But as floor prices of top collections crater and liquidity thins, there's less open ocean out there right now for OpenSea, which at the bull run's heights raised at a $13.3 billion valuation.

2️⃣ SBF guilty on all counts.

It's official: Sam Bankman-Fried is guilty of fraud.

The jurors in SBF's trial returned their final verdict, which found the disgraced FTX founder guilty on 7 different counts tied to the self-inflicted collapse of the FTX exchange last year.

The main question now is how much time will SBF face. There's a technical max sentence of 115 years, but he will likely be sentenced far less than that. The case's presiding, Judge Kaplan has tentatively set sentencing for March 2024, so mark your calendars.

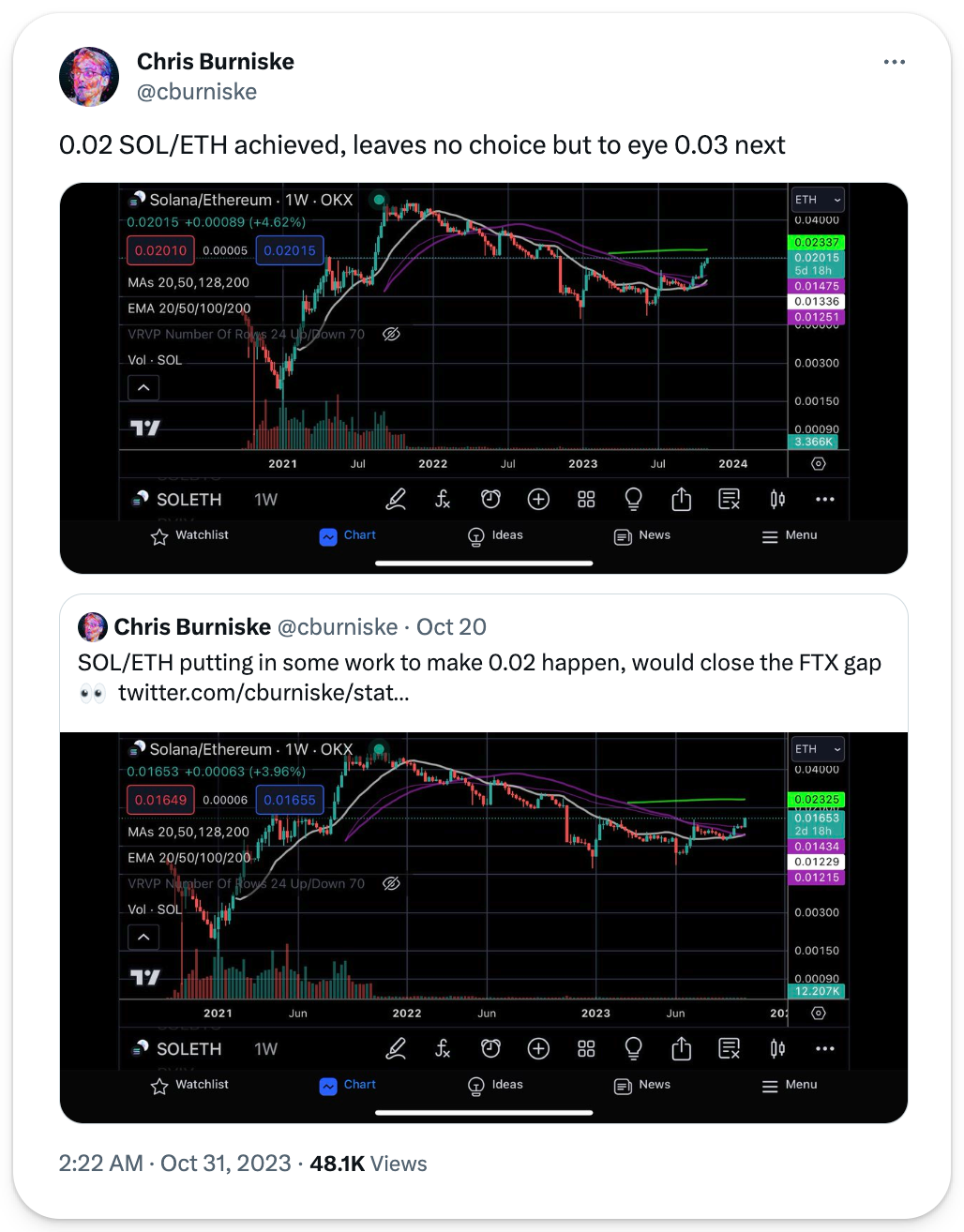

3️⃣ SOL catches fire.

In this latest week of the Game of Coins, Solana was the big winner among the majors. That's because SOL rallied double-digit percentage points to $40+ on the week, outpacing BTC, ETH, and other top projects in the same span.

The catalyst? No singular reason, though vibes are on the up and up. Solana's Breakpoint conference was this week, which rallied excitement, and VanEck just posited a potential $3k+ price point for SOL by 2030, which rallied hope.

4️⃣ Vitalik talks L2 diversity.

Ethereum creator Vitalik Buterin published his latest blog post, this time on the different types of L2s.

His conclusions? The L2 scene will become increasingly varied as the range of approaches here widens and deepens, and the "connectedness" of networks to Ethereum works along two main dimensions: the security of withdrawing to Ethereum and the security of reading Ethereum data.

5️⃣ Celestia mainnet arrives.

Celestia arrived on mainnet this week with a much-hyped airdrop. Things were a little rocky at first, but supporters have big expectations for the modular crypto infra.

Celestia is a data availability (DA) layer built on Cosmos. In other words, it's an L1 optimized to store and supply data for other chains in a trust-minimized fashion. The big idea? L2s can now opt to manage their transaction data on Celestia rather than Ethereum and save money from the lower costs in the process.

Kraken is one of the largest and most secure crypto platforms in the world. They've been in the crypto game for over a decade, and now they're inviting us all on a journey to see what crypto can be.

This is our first time ever covering a TradFi stock! However, Coinbase is a different beast… it's a behemoth.

Today, we’re bringing on two analysts–independent researcher Jay (0xJaypeg) and Delphi Digital analyst Michael Rinko.

Today’s episode is all about $COIN, the asset. Down from its ATH of $342/share in Nov. 2021 to $85 today—and with a current market cap of $17.8B— are you bullish $COIN? Why or why not?

Bankless Citizens get Early Access to our Monday podcast, as a free member you're missing out! 👇

📰 Articles:

📺 Shows:

You're on the free version. Unlock the benefits of Bankless Citizenship.

Thousands of crypto's sharpest investors trust Bankless to bring the alpha via exclusive articles, ad-free podcasts, and tools like our Claimables wallet tracker and Airdrop Hunter app.

Not financial or tax advice. This newsletter is strictly educational and is not investment advice or a solicitation to buy or sell any assets or to make any financial decisions. This newsletter is not tax advice. Talk to your accountant. Do your own research.

Disclosure. From time-to-time I may add links in this newsletter to products I use. I may receive commission if you make a purchase through one of these links. Additionally, the Bankless writers hold crypto assets. See our investment disclosures here.