Onchain Money Games on Solana

Onchain money games. These are crypto games that center around, instead of shy away from, financial elements. Liquidity, payments, trading, yield, and etc. make up the field of play in this niche.

These sorts of titles aren't unprecedented in crypto. But I've seen a spurt of these games ramping up lately, and all are building toward new kinds of onchain recreation. Here are 4 recent examples from the Solana ecosystem you can explore for yourself.

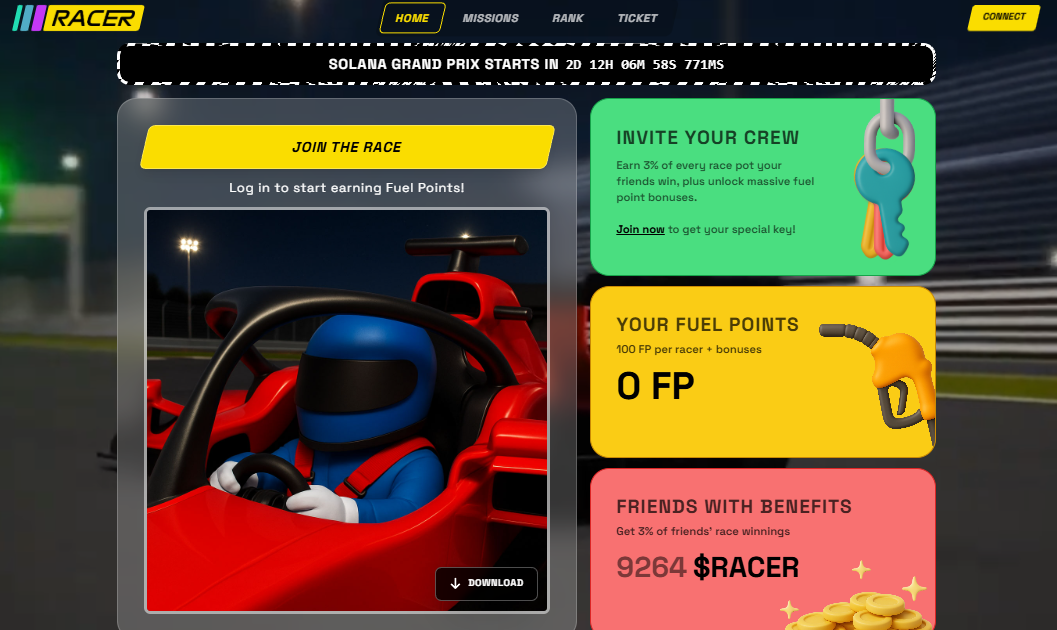

🏁 Racer

- "Every team is a token, every swap burns RACER." That sentence sums up dotfun's new liquid game, Racer.

- Built atop the Meteora DEX, the title will pit multiple teams against each other, and every team will have a live token market paired with the RACER token. The price action of these coins comprises the game's scoreboard, i.e. liquidity = the racetrack.

- All trading here feeds back into a burn-and-prize loop. 100% of team coin fees will be sent to the game's ensuing prize pool, while half of RACER swap fees will be put toward RACER buy-and-burns.

- The game's 1st week-long season, the Solana Grand Prix, starts this Thursday, Nov. 13th. Minting an SGP ticket grants you the "driver" role, offering you the ability to launch a team and earn a 10% cut of your team's winnings per race. With +117,000 mints already, there's plenty of early interest.

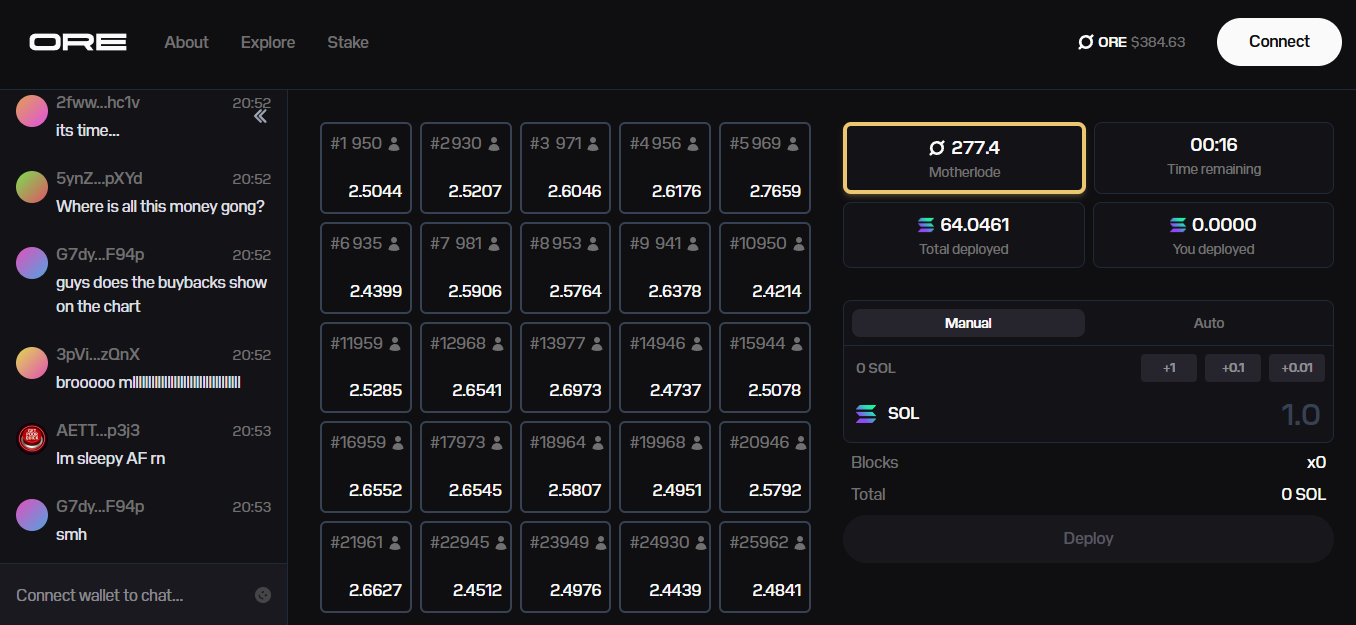

⛏️ ORE

- ORE isn't a game per se. Instead, it's a gamified mining protocol that is designed to support the ORE token as a digital store of value, and it was recently rebuilt from the ground up and reintroduced.

- Here, each minute-long round unfolds on a 5×5 grid where users deploy SOL to claim space.

- When a block in this grid is randomly chosen as the winner, miners on that square split the losers' pooled SOL proportionally to their deposits, plus one of the miners earns a 1 ORE reward. This ORE reward gets split by all winning miners every handful of rounds, too.

- Additionally, a rare "motherlode" event can drop extra ORE rewards to all of a round's winners, while every round also channels 10% of SOL volume into automatic buybacks and burying (i.e. burning) ORE, creating deflationary pressure.

🔮 Mystic

- A staking protocol underpinned by a DeFi card game, Mystic is rolling out soon on Solana.

- Once the title is live, players here will stake MYSTIC tokens to earn daily yield (DPY) and collect NFT cards that can raise or lower their returns, with rare cards offering the biggest boosts.

- Every day will bring a free card draw, while booster packs can be purchased or earned through engagement. 3 cards can be equipped at a time for stacked modifiers, and cards can also be sacrificed to mint new packs.

- Altogether, you can think about the project as a community-driven yield farming game. Players will be able to collaborate, strategize, and stack together in a transparent arena. I haven't seen a launch date yet, but you can join the waitlist now.

🗺️ Spots.fun

- Launched last week, Spots turns real-world locations into tradable onchain assets.

- The gist is that players mint “Spots” using Google Maps links, becoming "Mayors" and launching live token markets tied to each place. In the debut season, players build Headquarters (HQs) and attach their Spots to earn hourly rewards in the ecosystem token, CREDITS.

- Power is determined by each Spot’s rarity and level, meaning the rarer and more active your holdings, the higher your yield. Plus as trading volume rises, Spots level up, multiplying their power and value. Half of all swap fees automatically buy back CREDITS, too.

- Blending memecoins and IRL locations makes for an interesting, if not quirky, approach. We'll see if Spots can gain serious traction, though it's an experiment worth tracking either way.