Dear Bankless Nation,

After weeks of regulators bringing down the hammer, the top news in the crypto industry this week was actually about stuff being built.

For our weekly recap, we dig into:

- Is everything a security now?

- Coinbase announces its Layer-2 rollup Base

- Spotify going Web3

- Ethereum news

- DeFi launches

- Bankless Team

📅 Weekly Recap

1. Is everything a security now?

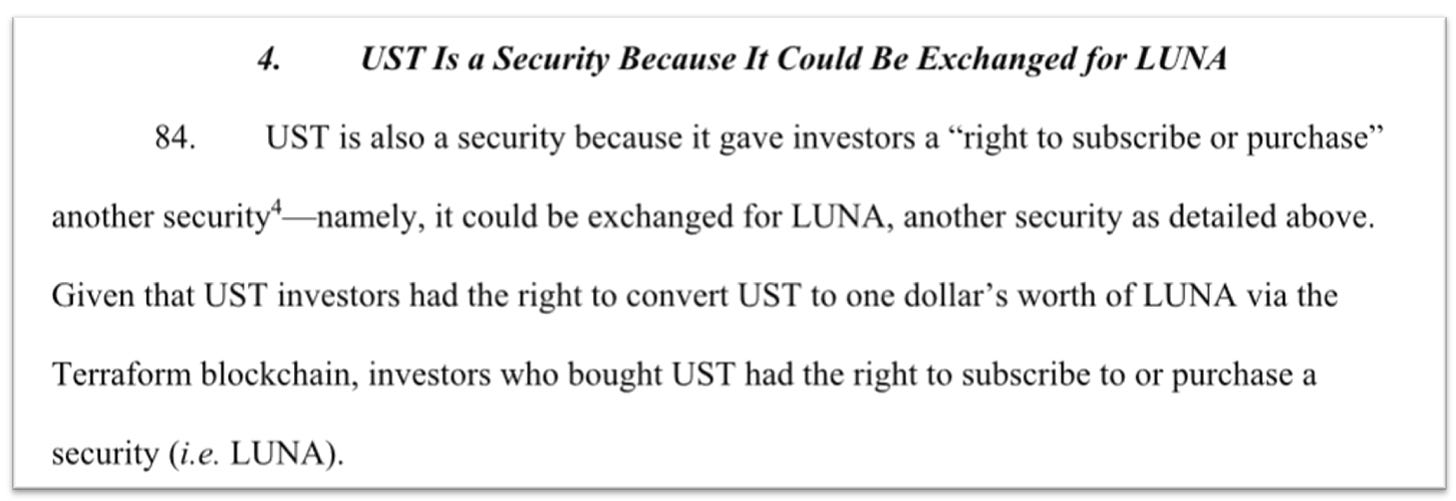

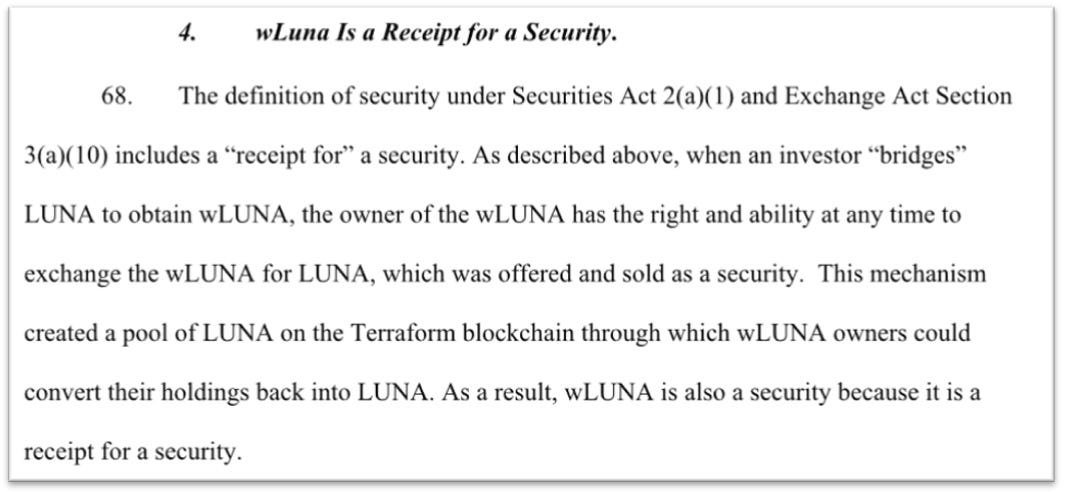

The SEC’s lawsuit against Do Kwon and Terraform Labs last week alleges that the UST stablecoin is a security because it was a “right to subscribe or purchase” another security i.e., it was convertible to LUNA.

In addition, the SEC argues wLUNA, a wrapped asset, would count as a security in itself because it is a “receipt” for a security in turn.

The case against Terra is filled with broad proclamations that could make life miserable for more reputable crypto entities if the government is successful in every facet of their prosecution.

Gensler's next strategy is to go after Do Kwon and UST because he knows no one will defend them and if he wins he'll establish broad precedent for more control over crypto.

— RYAN SΞAN ADAMS - rsa.eth 🏴🦇🔊 (@RyanSAdams) February 16, 2023

It's evil genius. https://t.co/FDLoeVcTLb

NFTs didn’t come out of the week unscathed either.

A federal judge of the Southern District of New York ruled this week in a class-action lawsuit against Dapper Labs that its NBA Top Shot NFTs “might be securities”.

The judge ruled that “purchasers’ fortunes were tied to the overall success of Dapper Labs” due to the fact that the underlying Flow blockchain and NFT marketplace where Top Shots were traded was controlled by the company.

Other elements of the underlying reasoning were a little… questionable.

A federal court judge ruled that these emojis 🚀📈💰objectively mean "one thing: a financial return on investment." Users of these emojis are hereby warned of the legal consequence of their use. #emojis #rocketshipemoji #DapperLabs https://t.co/4yRfWBH96R

— Former SEC Branch Chief Lisa Braganca (@LisaBraganca) February 23, 2023

Don’t get caught using the wrong emojis, kids.

Here it is: pic.twitter.com/7WJjXdNiwN

— Former SEC Branch Chief Lisa Braganca (@LisaBraganca) February 23, 2023

Caitlin Long, founder and CEO of Custodia bank published a blog post this week which points to the regulatory failures of American financial regulators to act, despite evidence of crypto fraud:

Today, I’m publicly disclosing for the first time that (1) I handed over evidence to law enforcement of probable crimes committed by a big crypto fraud, starting months before that company imploded and stuck its millions of customers with losses, and (2) I warned bank regulators of the mounting bank-run risk inside the banks serving the crypto industry before the bank runs ultimately hit… I’ve been calling out the worst of crypto while trying to build a lawful, compliant alternative that relegates scams to the trash heap. But, while FDR invited Paul Cabot to the Oval Office to work out how to fix the problem, most of today’s policymakers seem intent on killing the high-integrity innovators.

I can't tell you how infuriating it is to have pointed out massive red flags and obviously illegal activity to regulators only to have them ignore the issues for years. "They're offshore. It's complicated. We're looking at everybody." FOR YEARS. Then to be used as their example. https://t.co/YHdNazM2UE

— Jesse Powell (@jespow) February 18, 2023

To be continued…

2. Coinbase announces its Layer-2 rollup Base

In case you’ve been living under a rock in crypto world, Coinbase announced this week it is launching its own blockchain: Base.

This could be seen as the equivalent of BNB Chain to Binance, except that it is an L2 optimistic rollup, rather than a whole new L1. And no, (for the time-being) there is no forthcoming Base token.

Base is built on OP Stack, Optimism’s developer toolkit for creating modular L2s. For all the details, see a full breakdown on the Bankless newsletter here, or our interview with Senior Director of Engineering at Coinbase Jesse Pollock below.

Coinbase Announces Base🔵, an Ethereum L2 Network Powered by Optimism

Expect dozens of builders to be deploying on Base.

6/ Base is for Everyone.

— Base (@BuildOnBase) February 23, 2023

We’re excited to launch Base with an incredible group of builders from across the crypto ecosystem, with more joining in every day.

The best products are built in community and Base will be an open ecosystem where anyone, anywhere can build. pic.twitter.com/TD1UqY9WRv

Will Base succeed in a time where L2s are red-hot flipping mainnet and zkEVMs by Polygon and zkSync are just around the corner? Already, dozens of DeFi projects have signaled their desire to deploy on Base in a bid to court Coinbase’s massive user audience. Join the discussion on the Bankless open thread here.

The chain is off to a turbulent start as some transactions weren’t being processed correctly at launch.

base's bridge is off to a rough start, every single transaction reverting and the bridge contract is unverified so nobody can figure out what's going on pic.twitter.com/2MiFZrMNfj

— foobar (@0xfoobar) February 23, 2023

3. Spotify going Web3

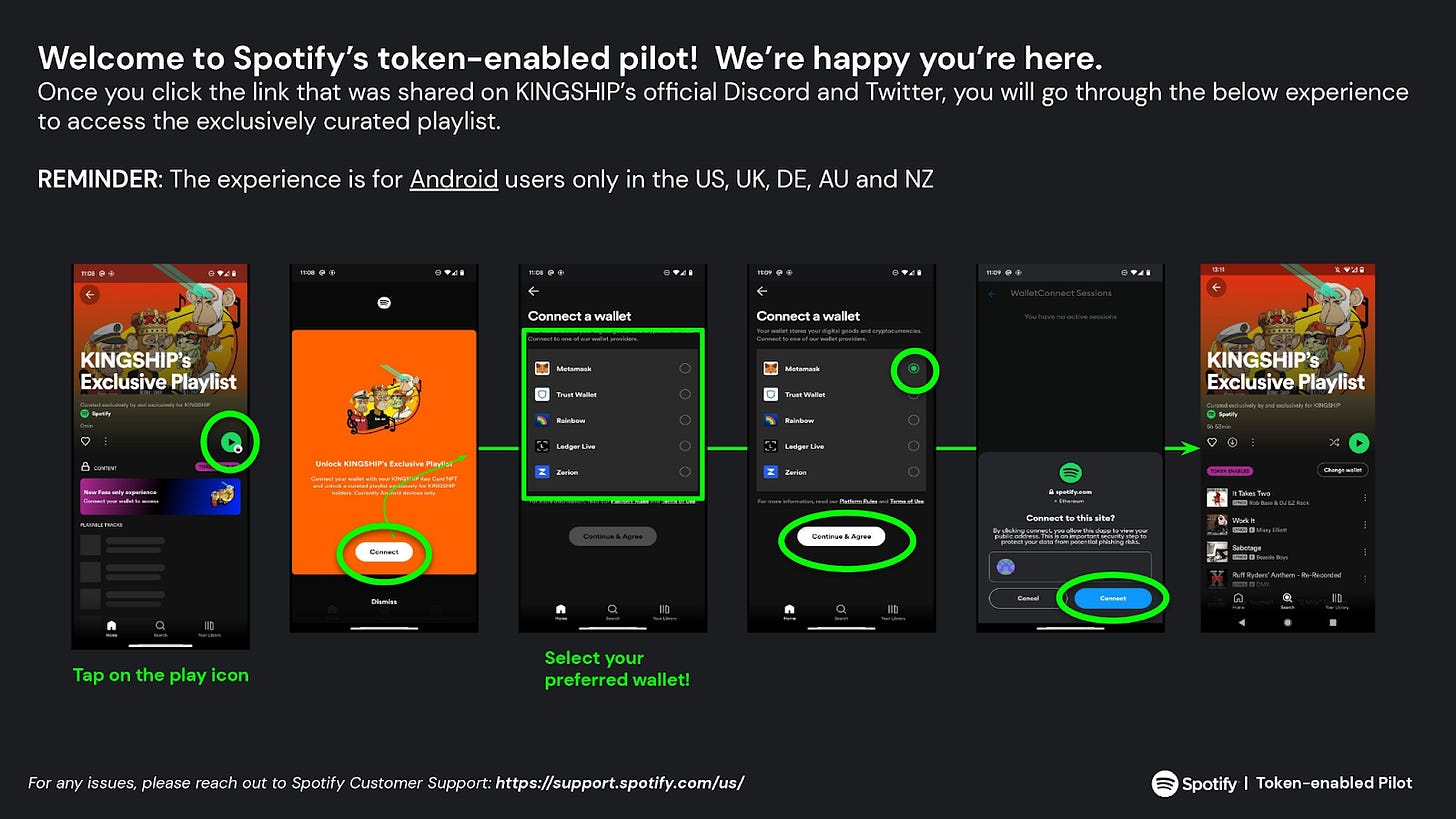

Spotify is experimenting with token-gated playlists by letting users connect their crypto wallets on the platform.

Are music NFTs on the horizon?

At present, the 3-month pilot service is accessible to Moonbirds, Kingship, Overlord, and Fluf communities for Android users in the U.S., U.K., Australia, Germany and New Zealand.

Overlord x @Spotify 🎶

— Overlord (@Overlord_xyz) February 22, 2023

We’ve been selected as one of Spotify’s partners in a new pilot.

🦎 Exclusive pilot of their token-enabled playlists

🎧 Launching with a holder-curated playlist

Details below ⤵️ pic.twitter.com/MDTjPRCXS5

4. Ethereum news

ETH withdrawals are coming.

The Shapella (Shanghai + Capella) network upgrade is officially scheduled for Feb 28 2023 on the Sepolia testnet at 4AM UTC.

After the Sepolia testnet deployment comes the Goerli testnet and finally Ethereum mainnet deployments, which will finally enable validators staking ETH on the Beacon chain to withdraw their ETH stake onto the execution layer of the blockchain.

Sepolia Shapella scheduled for Feb 28, 4AM UTC 🌃

— timbeiko.eth (@TimBeiko) February 21, 2023

Read about the upgrade, and find links to the specs, client releases and withdrawals FAQ here: https://t.co/cRh4UWvl8J 😄

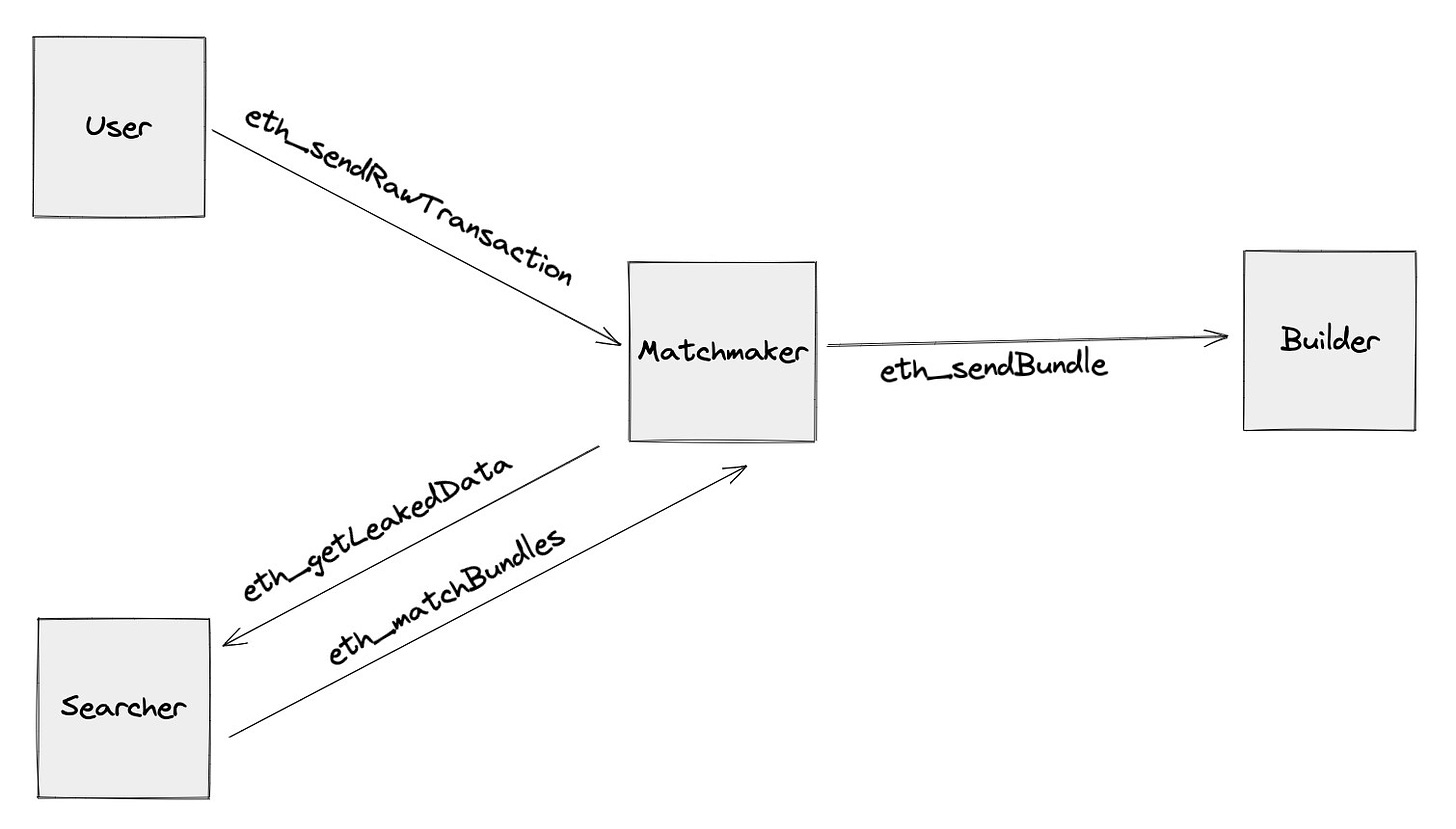

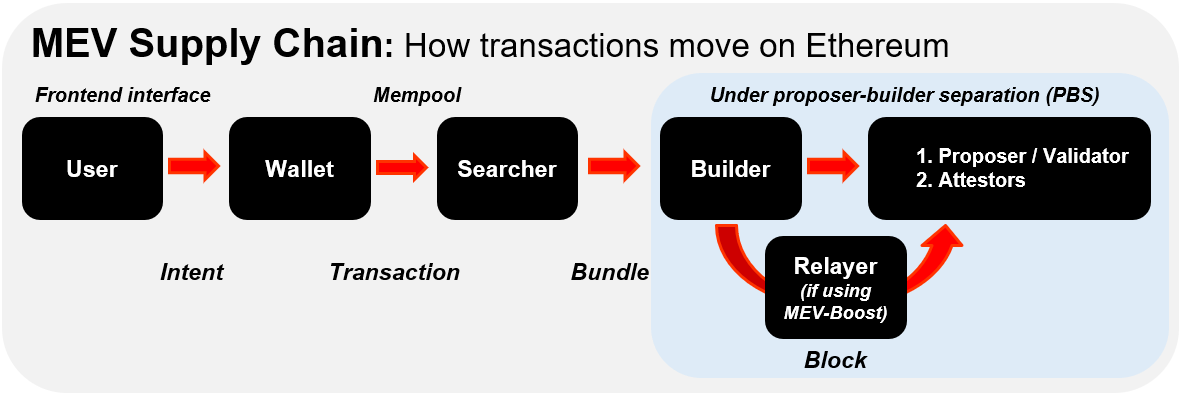

Flashbots is also announcing a new product MEV-Share.

MEV-Share introduces a permissionless protocol that empowers users to recapture some MEV value, by choosing what transaction data to hide or reveal. Searchers then bid in a competitive auction for the right to execute against user’s transactions.

Introducing MEV-Share: programmably private orderflow that empowers users, redistributes MEV, and takes a step towards decentralized block building

— @bertcmiller ⚡️🤖 (@bertcmiller) February 15, 2023

MEV-Share is where transactions and bundles find their perfect matchhttps://t.co/AUCsC1pHSP pic.twitter.com/u4IgZmThYR

Finally, Obol announces its first Ethereum mainnet distributed validator.

We're thrilled to share that we've been running the first DV cluster on Mainnet Ethereum since Dec 30 with a 🔥 98.6% eff. rating!

— Obol Labs (@ObolNetwork) February 22, 2023

As this is the first phase of our Road to Mainnet 🛣 it's time to discuss our design philosophy and approach. 👀🧵#RunDVThttps://t.co/T49ZBPeBAd

5. DeFi launches

Base wasn’t the only big launch of the week, a handful of projects and protocols launched new features or found themselves in the news. We’ve collected a few below:

- Synthetix V3 is live on mainnet and Optimism.

Synthetix V3 is on Mainnet. https://t.co/NbWNaBYKEx

— noah (@noahlitvin) February 22, 2023

- Buy NFTs on Uniswap with any ERC-20 token without converting to ETH.

1/ Buy NFTs with ANY single ERC-20 token—starting today! ✨

— Uniswap Labs 🦄 (@Uniswap) February 22, 2023

Don’t have enough $ETH? No problem. Use any ERC20 token in your wallet to complete your transaction without swapping to ETH first. pic.twitter.com/vJ9UtYnWtP

- Stader Labs is forking Rocketpool and cloned quite a bit.

Forking repos is good. It's why open source is great, cuz we can iterate and improve on work. But prolly best to say "hey, we're a clone of this other protocol, & here's where we improved" rather than wait for the community to start recognizing vestigial code you forgot to remove pic.twitter.com/Wd7aK14jgx

— nixo 🦇🔊 (@nixorokish) February 23, 2023

- Yearn Finance is launching a liquid staking derivative of its own.

Introducing yETH, an LSD of LSDs.

— yearn (@iearnfinance) February 21, 2023

💊 Get exposure to a basket of LSDs in one token.

🌈 Spread your risk.

🍄 Boosted yields.

Get ready to expand your mind anon.

- Liquid staking protocol Swell Network has big things coming in April 2023.

Mark your calendars stakers, the new and improved Swell is coming April 2023! 🌊

— Swell (@swellnetworkio) February 22, 2023

- Reward bearing LST

- Built for composability

- Fully fungible

- Vetted node operators

- Integrations with top DeFi protocols https://t.co/7XmVwcJ1xQ

Other news:

- Arbitrum flips mainnet in daily transactions

- EigenLayer releases its whitepaper

- Polygon cuts 20% staff, Immutable cuts 11% staff

- Galois Capital winds down after $40M loss to FTX

- Helium is migrating to Solana March 27th

- Collab.land DAO launches COLLAB governance token

- Superfluid launches liquid, composable vesting tool

- Phi raises $2M seed round

- Ingonyama launches Ingopedia V2, a resource for zk-proof