Nonstop Virtuals' Gains

View in Browser

Sponsor: Mantle — Mantle is building the largest sustainable hub for onchain finance

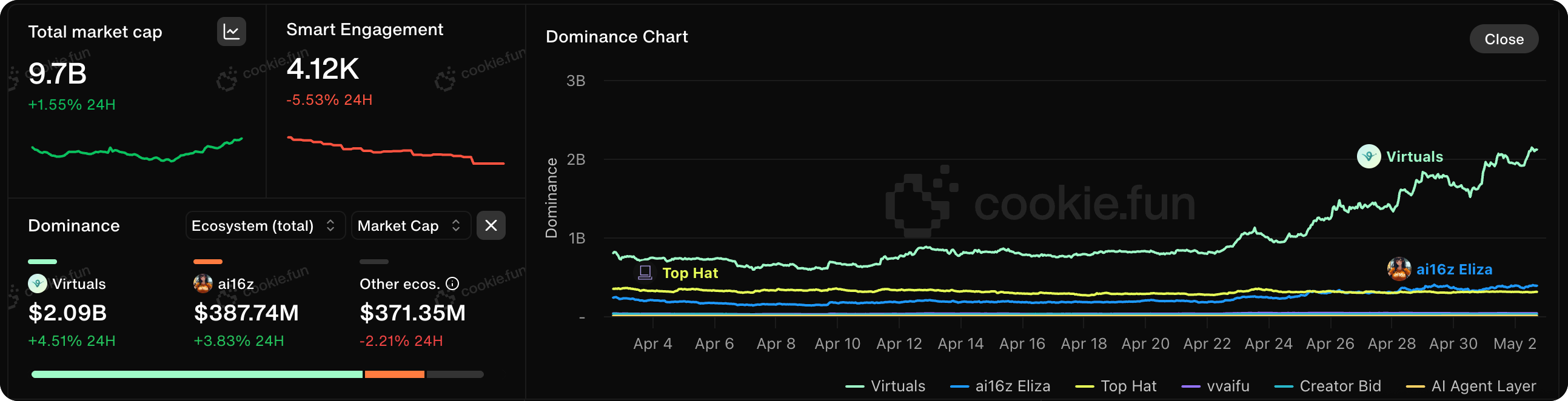

📸 Market Snapshot: Onchain AI markets continue to surge, with the overall agents marketcap up another 25%, while Virtuals leads in price performance and mindshare growth among the major "framework tokens."

Up over 100% on the week, $VIRTUAL reclaimed the $1B market cap milestone and then some, sitting at around ~$1.2B at the time of writing. Many low-cap agents within the Virtuals universe have posted triple-digit gains alongside the flagship token, with the broader ecosystem market cap up ~18% overall in the last 24 hours.

Yet remarkably, cumulative agents created haven't changed since mid-January with virtually zero traction on Solana. Protocol revenue sits far below last year's highs, though it bottomed out in late March alongside $VIRTUAL token volume.

Then why the recent surge? Virtuals' new Genesis platform, which is a fair, transparent token launchpad for agents using a point-based pledge system to allocate 37.5% of tokens based on ecosystem contributions. So far, agents deployed via Genesis have yielded huge multiples, causing a frenzy for points (more on earning these in today's article below).

Among these agents, DeFAI remains a core theme, with BasisOS claiming the title of most successful growth since launch, reaching ~$17M market cap—a 17x on the week by arbitraging spot-futures price differences!

Two weeks ago, crypto agents powerhouse Virtuals released their new token launch mechanism, Genesis, to much success.

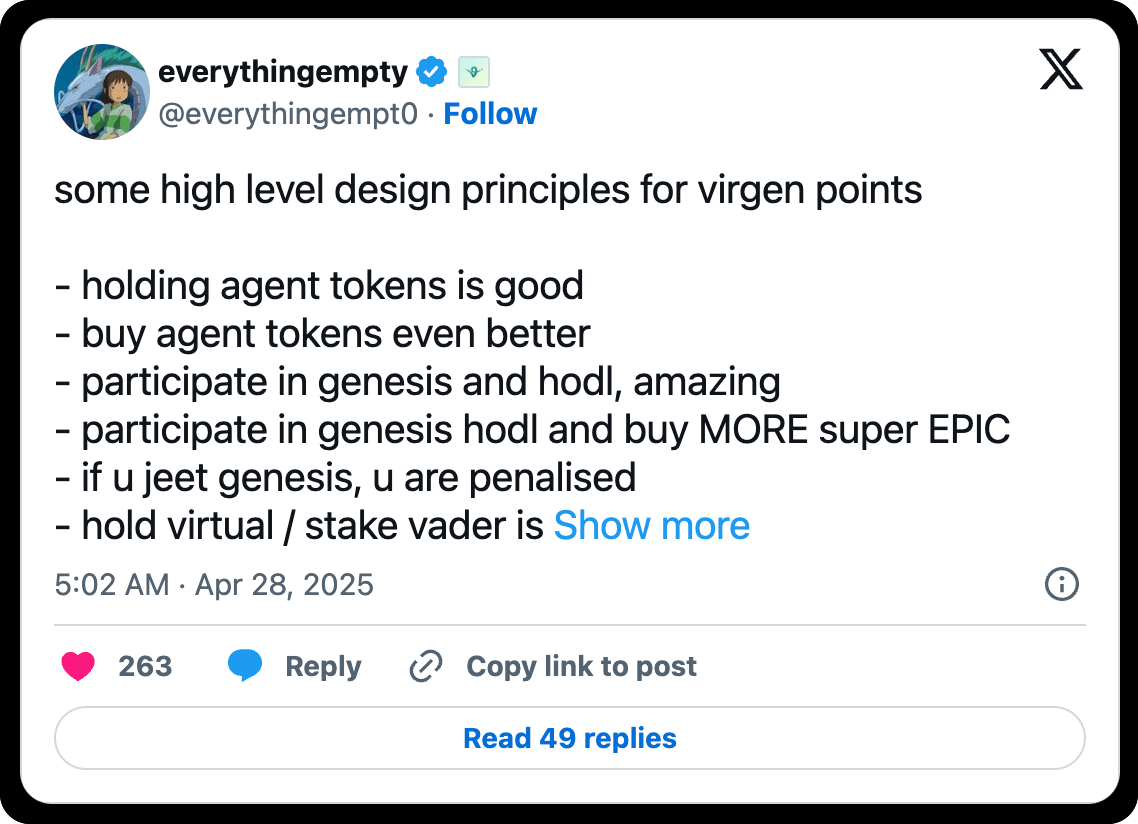

Heralded as a fair, transparent, and permissionless improvement to the standard bonding curve model used previously, Genesis operates through a "proof of contribution" points system, seeking to reward genuine ecosystem contributors over traders and speculators.

Since the rollout, the price of most tokens issued on Genesis have returned multiples, contributing to the fervor around accruing Virtuals "Virgen Points" and showcasing, in the process, that we still have plenty of design space to explore around token launches.

Below, I’ll dive into the platform’s core features, what the lifecycle of a launch looks like, and how to stack points for those wanting to participate in Genesis launches.

Core Features: A New Coordination Mechanism

Each Genesis launch starts with a 24-hour presale where anyone can join by pledging their earned Virgen Points and $VIRTUAL simultaneously to earn part of the 37.5% of token supply reserved for the presale.

You commit or “spend” Virgen Points to determine your allocation size (how many tokens you can get), while you spend $VIRTUAL to cover the cost of those tokens.

The more points you pledge, the more tokens you can earn—but no one can receive more than 0.5% of the total supply, keeping things fair and preventing any one person from dominating.

Outside of the supply reserved for the presale, the rest of the tokens are distributed as follows:

- 12.5% for the liquidity pool (to help with trading)

- 50% for development, treasury, and marketing

Furthermore, some key features make these launches stand out:

- 📊 Contribution-based allocations — You can earn Virgen Points by doing things like staking $VADER or helping out AI projects. These points determine your share of the presale tokens, not how much $VIRTUAL you can commit.

- 🔄 Automatic refunds — If a launch doesn't go through or doesn't meet the minimum of 42,425 $VIRTUAL committed, or you pledged more than needed, any unused tokens or unspent points are automatically sent back to you.

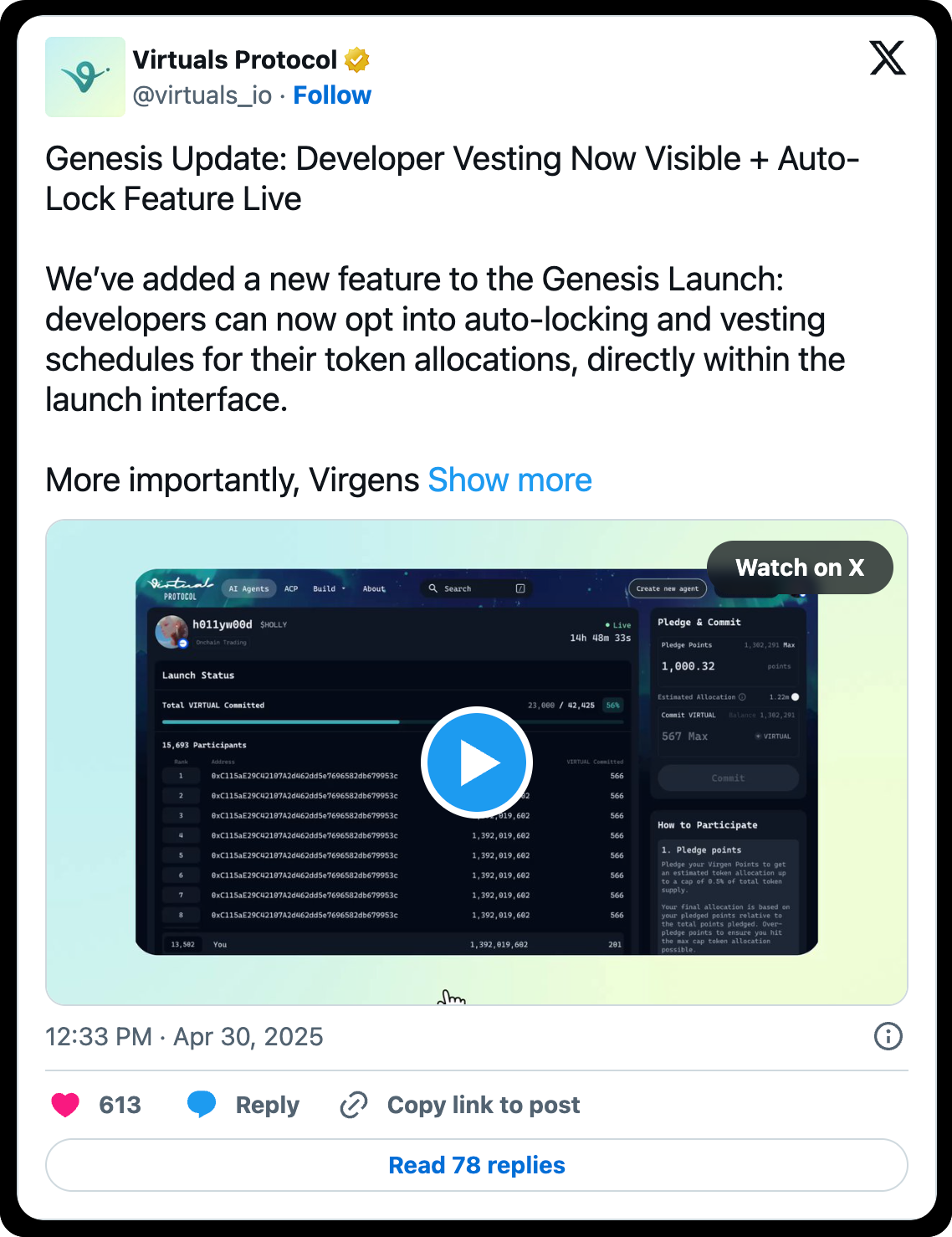

- 🔒 Developer vesting and auto-lock — Developers can choose to lock up their tokens on a vesting schedule, so you know exactly when they'll get access. It adds transparency before you commit.

- 🎉 Everyone benefits — Projects can get fast growth and a wide token holder base, while committed community members get preferential involvement in their success.

How to Participate in a Genesis Launch

To navigate a Genesis launch from start to finish, there are a handful of main steps to follow through:

- Pledge Virgen Points and $VIRTUAL: You must pledge both at the same time during the presale.

- Get an estimated allocation: The system calculates your share based on the proportion of total pledged points.

- Commit $VIRTUAL: You must commit enough $VIRTUAL to cover your estimated allocation (maximum 566 $VIRTUAL, including a 1% fee). If either your points or $VIRTUAL are insufficient, your entry will be rejected.

- Lock in your final allocation: After 24 hours, allocations are finalized and excess funds automatically refunded. If your final token allocation costs less $VIRTUAL than you committed, you'll get the difference back.

- Make adjustments during the presale: If your allocation gets diluted by new participants, you can add more points or $VIRTUAL to maintain your desired share.

- Review developer commitments: Check vesting schedules and token locking agreements before finalizing your participation.

How to Earn Virgen Points

Currently, there are three core strategies to go about earning Virgen Points. These strats include:

- Hodl $VIRTUAL tokens: Earn points by holding $VIRTUAL or Virtuals agent tokens, with rewards proportional to holding amount and duration. Trading also generates points but at a reduced rate, incentivizing long-term commitment over speculation.

- Stake greenlit Virtuals tokens: Yesterday, Virtuals confirmed points eligibility via staking specific, “recognized” tokens from verified projects like $AIXCB, $SHEKEL, and $ALCOLYTE, as Bankless alum Sim0.eth pointed out. The biggest share (5% of daily Virgen Points) goes to people staking $VADER, who also get priority for bigger allocations in launches.

- Yap about Virtuals: Creating quality content for Virtuals on Twitter can also earn you points, though you must link your account to Virtuals and submit your posts daily through their Typeform to earn additional points. Read their guide here to learn more.

Tips for Virgen Points

If you go on the hunt for stacking points, some things you'll want to remember:

- Holding Genesis tokens boosts points: Soon, you can earn free points simply by holding Genesis tokens for 24+ hours, which must be claimed manually and within 24 hours.

- Take Profit triggers cooldown: Selling Genesis allocations for profit triggers a temporary points reduction that gradually recovers over time.

- Focus on maximizing yield: Vader Research suggests users not just chase high returns, but instead look for deals where you get a good token allocation with fewer points.

- Save points for big launches: Sim0.eth advocates for saving points for the most hyped launches to optimize your yield. But keep in mind that points expire in 30 days, so don’t wait too long.

All that said, Genesis breathes fresh life into Virtuals while also showcasing a novel mechanism for designing token launches.

While not perfect, the contribution-based allocation certainly rivals “who-knows-who” or other more primitive systems susceptible to being gamed. Interestingly, this is also happening while a new wave of token launchpads are popping up on Solana, hinting at a growing appetite for experimentation in this vertical.

Overall, Virtuals continues to be working across all avenues to keep novelty a core component of their platforms—let's see if they can keep up the pace!

Plus, other news this week...

🤖 AI Crypto

- Alliance DAO revealed a new cohort, 35% of which are AI startups

- Gensyn launched the first community-trained 72B advanced math model

- Recall kicked off their AlphaWave $25k AI agent trading deathmatch

- Sharpe Labs unveiled their AI-powered crypto research platform

- Venice dropped an uncensored AI model, Dolphin Mistral 24B Venice Edition

- Worldcoin went live in the U.S. with plans to ship 7.5K orbs by EOY

- xTAO raised $10M as the first publicly traded Bittensor validator, with ambitions for a Microstrategy-esque $TAO reserve

📣 General News

📚 Reads

- The AI Agent Recovery — 0xJeff

- Where We Are Headed (Part II) — Dean Ball

- Why ChatGPT Isn't Bad for the Environment — Andy Masley

Experience the next generation of onchain finance with Mantle—where blockchain meets everyday banking. Powered by a $4B treasury, Mantle Network, and mETH Protocol, Mantle is launching three innovation pillars:

- Enhanced Index Fund for optimized crypto exposure

- Mantle Banking for blockchain-powered banking

- MantleX for AI-driven innovation

Stealthy AI bots from University of Zurich researchers quietly infiltrated Reddit’s r/ChangeMyView, bending opinions 6x better than humans before anyone noticed.

Now the underlying study faces a potential publication ban, and the internet is wondering how many other “invisible persuaders” are already loose in the wild.

Against that backdrop, OpenAI’s new o3 model landed with a Mensa-level IQ of 136 and a knack for sycophantic hallucinations, as rumors of a looming OpenAI social network continue to grow.

Yet their rivals aren’t idle either, with Google’s Gemini 2.5 Flash, DeepSeek’s leaked R2 monster, and Alibaba’s Qwen 3-235B keeping the AI arms race here white-hot.

Catch up on all these intrigues and more—watch the full episode! 👇