Nonstop Regulatory Wins

View in Browser

Sponsor: Mantle — Mantle is building the largest sustainable hub for onchain finance.

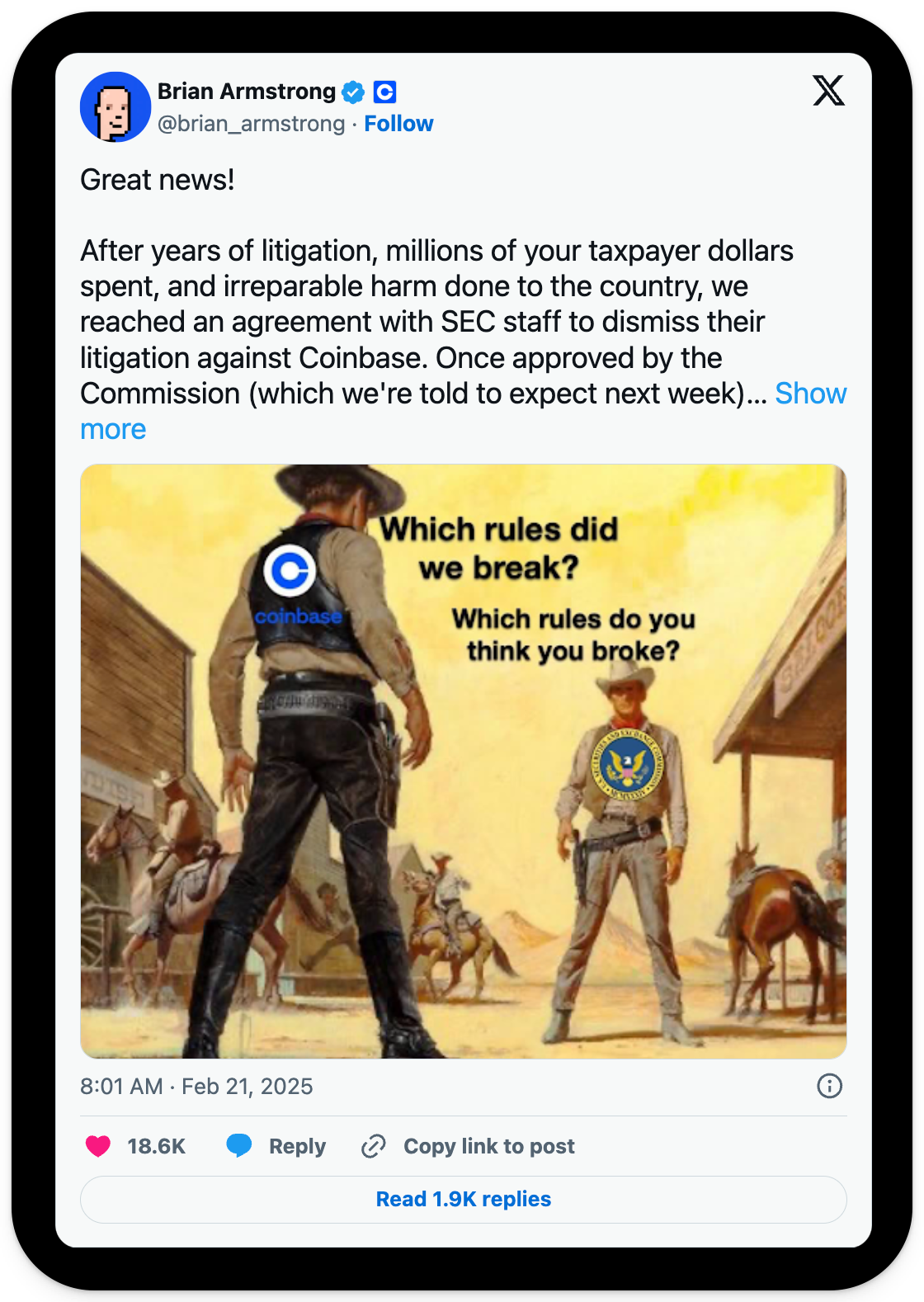

1️⃣ SEC Continues to Drop Cases

It has been a great week (in regulation) for crypto, as SEC staff have begun dropping cases left and right against crypto firms. The first major development occurred last Friday when Brian Armstrong announced that Coinbase had agreed with SEC staff to drop its case, pending approval from SEC commissioners.

This case had been ongoing for nearly two and a half years, with the SEC alleging that Coinbase violated federal law by operating as an unregistered exchange. That was just the first domino. SEC staff have also begun dropping cases against companies like Uniswap, Gemini, OpenSea, Consensys, and Robinhood over similar allegations. However, these dismissals are still awaiting commissioner approval.

2️⃣ Safe to Blame for Bybit Hack

Following the $1.5 billion Bybit hack last Friday, an investigation was launched to determine how the Lazarus Group pulled off the biggest crypto heist of all time. On Wednesday morning, Bybit CEO Ben Zhou released a tweet containing reports from Sygnia Labs and Verichains, which indicated that the exploit stemmed from Safe’s infrastructure rather than Bybit’s systems. Sygnia Labs’ report stated that "the root cause of the attack is malicious code originating from Safe’s infrastructure."

Safe later confirmed the attack in a tweet, stating that "a compromised machine belonging to a Safe developer" was the entry point for the Lazarus Group. This discovery sent CT into a frenzy, as major DeFi protocols like Aave, Balancer, and Uniswap also rely on Safe, with billions in total value locked (TVL). While the ByBit hack was a devastating loss for the crypto space, the damage could have been far worse if other projects had fallen victim to a similar attack.

3️⃣ Bank of America CEO Excited for Stables

Bank of America CEO, Brian Moynihan, spoke at an Economic Club meeting in Washington, D.C., where he was asked about the outlook for stablecoins if comprehensive legislation is passed. He responded, "If they make that legal, we will go into the business," suggesting that Bank of America may already be preparing to enter the stablecoin market. He also hinted at the possibility of the bank offering dollar-backed tokens linked to customers' accounts.

With the Bank of America CEO signaling interest in launching a stablecoin, we may soon see more banks and financial institutions following suit. Last year, BlackRock began working with Ethena, and in 2023, PayPal introduced its own stablecoin. It’s becoming clear that traditional finance is increasingly integrating with crypto—a trend that could provide the boost the industry has been waiting for.

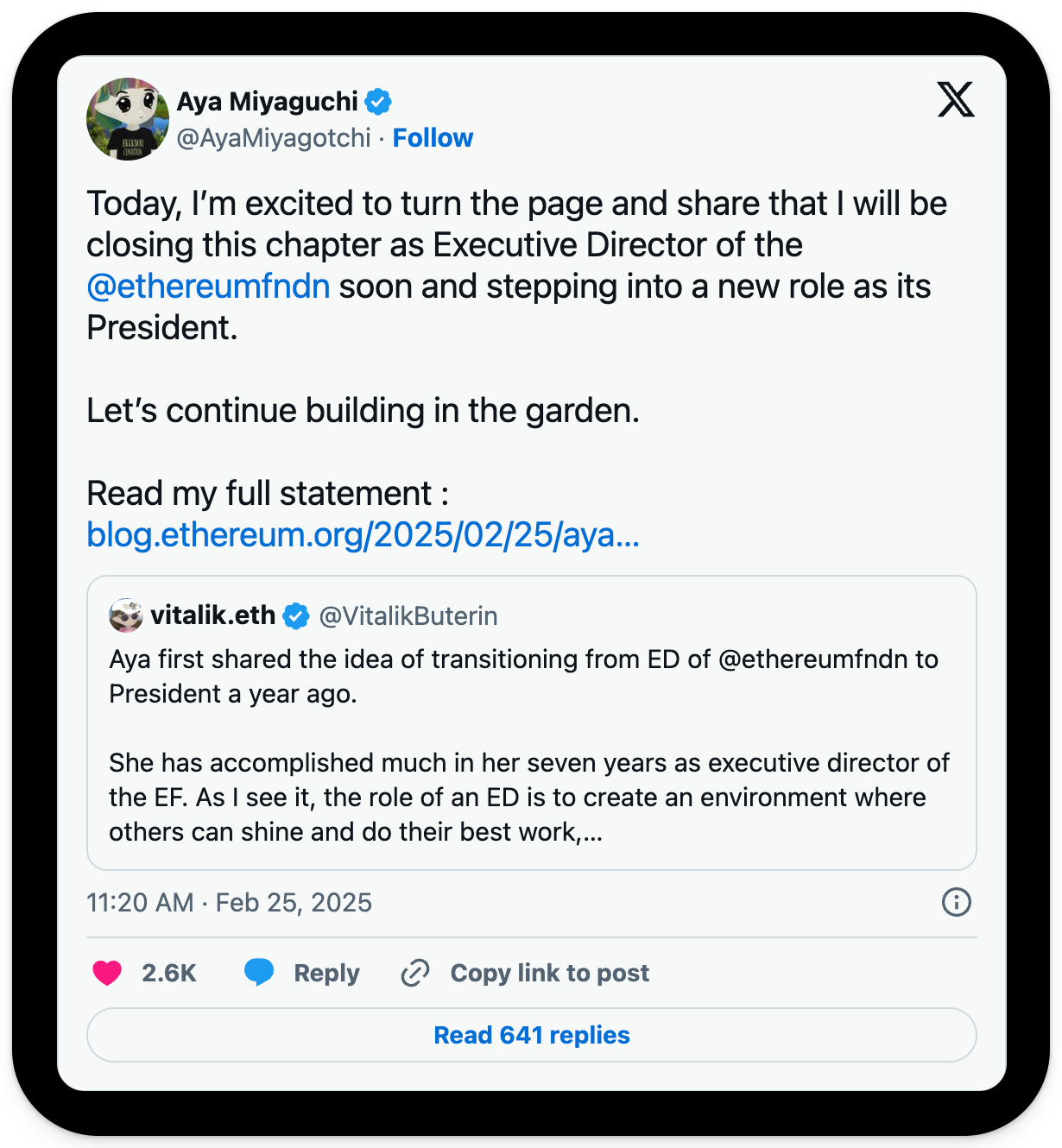

4️⃣ Aya Miyaguchi Named President of the Ethereum Foundation

On Tuesday, Aya Miyaguchi was promoted from Executive Director to President of the Ethereum Foundation following community calls for leadership changes. Aya has played a key role in the foundation since joining in 2018, helping oversee The Merge, which transitioned Ethereum from a proof-of-work to a proof-of-stake consensus mechanism.

Following the announcement, Aya published a blog post outlining her vision for the Ethereum Foundation. She first addressed recent concerns raised by the Ethereum community, emphasizing the need for the foundation to realign with its core mission. She also highlighted key principles that she has urged the foundation to keep in focus as it moves forward.

5️⃣ House Democrats Propose MEME Act

House Democrats are preparing to introduce the Modern Emoluments and Malfeasance Enforcement (MEME) Act, which would ban public officials and their relatives from launching and profiting from memecoins. The bill comes in response to the launch of TRUMP and MELANIA coins, and their subsequent plummets.

California Representative Sam Liccardo, a Democrat, introduced the act, stating that it has support from dozens of Democratic sponsors. Explaining his motivation, Liccardo said, “The Trumps’ issuance of memecoins financially exploits the public for personal gain and raises the specter of insider trading and foreign influence over the executive branch.” All this comes as Pump.fun activity continues to dwindle, maybe marking an end to memecoins... for now.

Experience the next generation of onchain finance with Mantle—where blockchain meets everyday banking. Powered by a $4B treasury, Mantle Network and mETH Protocol, Mantle is launching three innovation pillars: Enhanced Index Fund for optimized crypto exposure, Mantle Banking for blockchain-powered banking, and MantleX for AI-driven innovation. Stay tuned and enter the future of on-chain finance with Mantle.

Joining us this week is Alex Thorn to break down why crypto markets are taking a hit. Major hacks, bearish macro signals, and fresh tariffs from the U.S. all played a role.

But it’s not all bad news: the SEC is backing off from lawsuits against Coinbase, OpenSea, and Uniswap, signaling a potential shift in regulatory pressure. Plus, Bybit suffered the biggest crypto hack ever, losing $1.5B—how did it happen, and who’s behind it?

Check out this week's weekly rollup for the latest insights into the crypto space and what the future could hold!

📰 Articles:

📺 Shows:

Thoughts on how to make Bankless even better? Tweet me!

🧑💻 Lucas Matney, Bankless Editor