Dear Bankless nation,

This week, justice came for SBF who was arrested by police in The Bahamas and is facing extradition after a laundry list of charges were filed by U.S. authorities.

It’s about time. Crypto supporters were skeptical Sam would get his comeuppance due to his political connections, but it appears the government is ready to throw the book at the FTX founder.

What charges, if any, await his FTX co-conspirators might be a different story.

Read along for more details, and other news highlights from the week.

- Bankless team

p.s. Premium Subscribers can listen to our interview with Vitalik on the future of Ethereum in Early Access now.

📅 Weekly Recap

Here’s a recap of the biggest crypto news from this past week.

1. Steal Customer Funds? Right to Jail

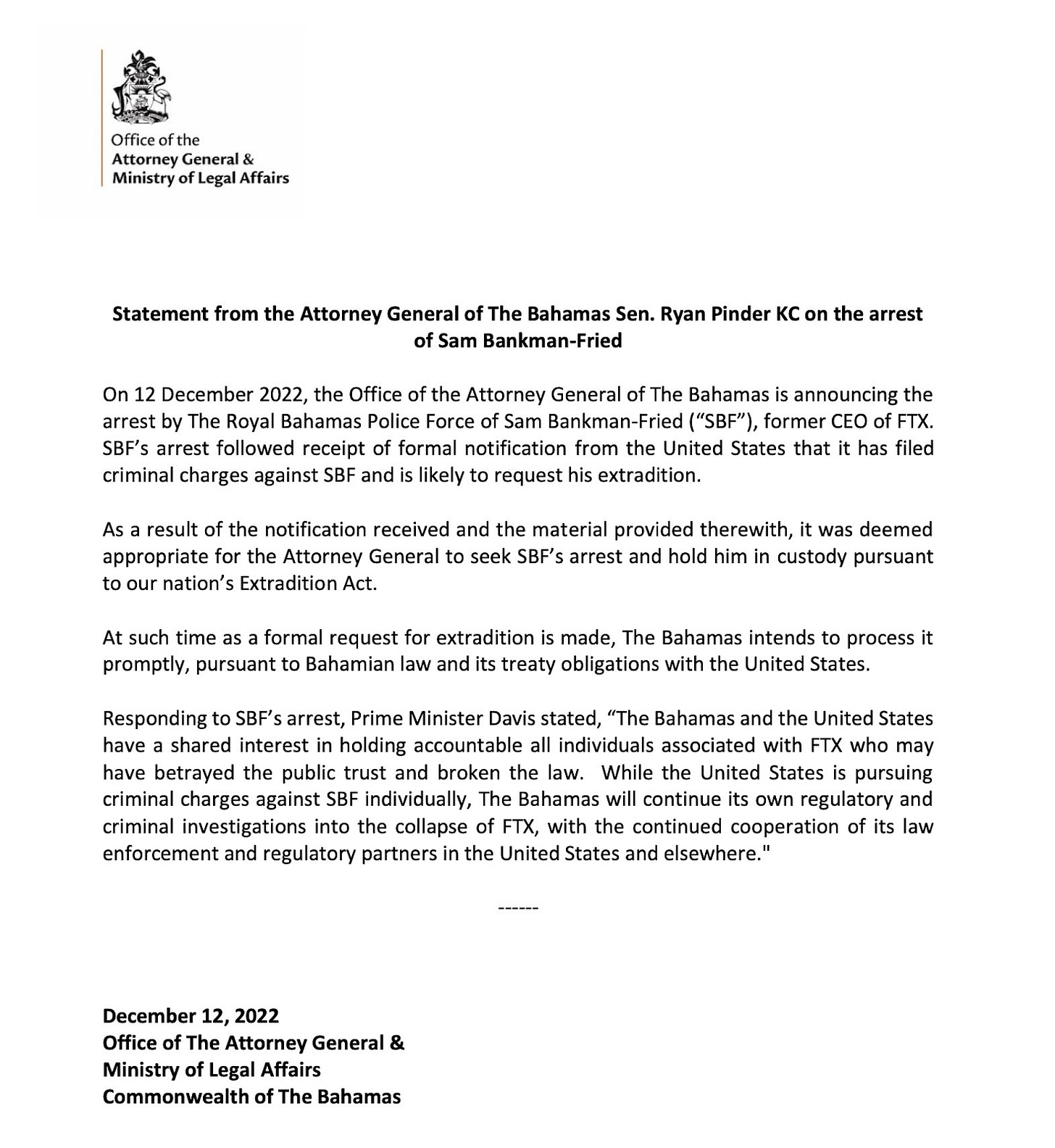

The U.S. is filing formal criminal charges of wire fraud and securities conspiracy against Sam this week, so the Bahamas Police Force arrested Sam this Tuesday in anticipation of a formal extradition request.

Here’s the footage of police escorting a suited-up Sam.

BREAKING: Footage of SBF arrest in the Bahamas. pic.twitter.com/gc5uvUbc2y

— Magus Wazir || The One Who Rings 🔔 (@MagusWazir) December 16, 2022

Sam has been denied bail as the “risk of flight is so great… [and Sam] ought to be remanded in custody”, said Bahamian chief magistrate Joyann Ferguson-Pratt.

The Commodity Futures Trading Commission (CFTC) is also charging Sam, FTX and Alameda on eight separate charges including wire fraud, commodities fraud, money laundering and campaign finance violation. A choice quote:

At Bankman-Fried’s direction, FTX executives created features in the underlying code for FTX that allowed Alameda to maintain an essentially unlimited line of credit on FTX. FTX Trading executives also created other exceptions to FTX’s standard processes that allowed Alameda to have an unfair advantage when transacting on the platform, including quicker execution times and an exemption from the platform's distinctive auto-liquidation risk management process…

Alameda used FTX funds, including customer funds, to trade on other digital asset exchanges and to fund a variety of high-risk digital asset industry investments… also took hundreds of millions of dollars in poorly-documented “loans” from Alameda that they used to purchase luxury real estate and property, make political donations, and for other unauthorized uses.

In a hearing with FTX CEO John Ray, Congressman Tom Emmer beseeches the public to understand the FTX debacle as fundamentally a “failure of centralization and business ethics” that decentralized, immutable blockchain technology seeks to solve. He also comes with some tough questions around the relationship between FTX and the SEC:

@GaryGensler are you scared yet? pic.twitter.com/9bfURn9rK6

— LitBit (@bittybitbit86) December 13, 2022

On the other side of the coin, Kevin O’Leary of Shark Tank fame is arguing in a formal testimony that FTX’s failure stemmed from Binance “intentionally” putting it out of business. Make of this what you will.

JUST IN: Kevin O’Leary testifies at Senate hearing and says #Binance intentionally put FTX out of business. pic.twitter.com/90pYPYrU5J

— Watcher.Guru (@WatcherGuru) December 14, 2022

2. Binance Raises Eyebrows

While crypto tries to mentally move past the FTX blow-up, people have been putting a more skeptical eye on another massive central exchange.

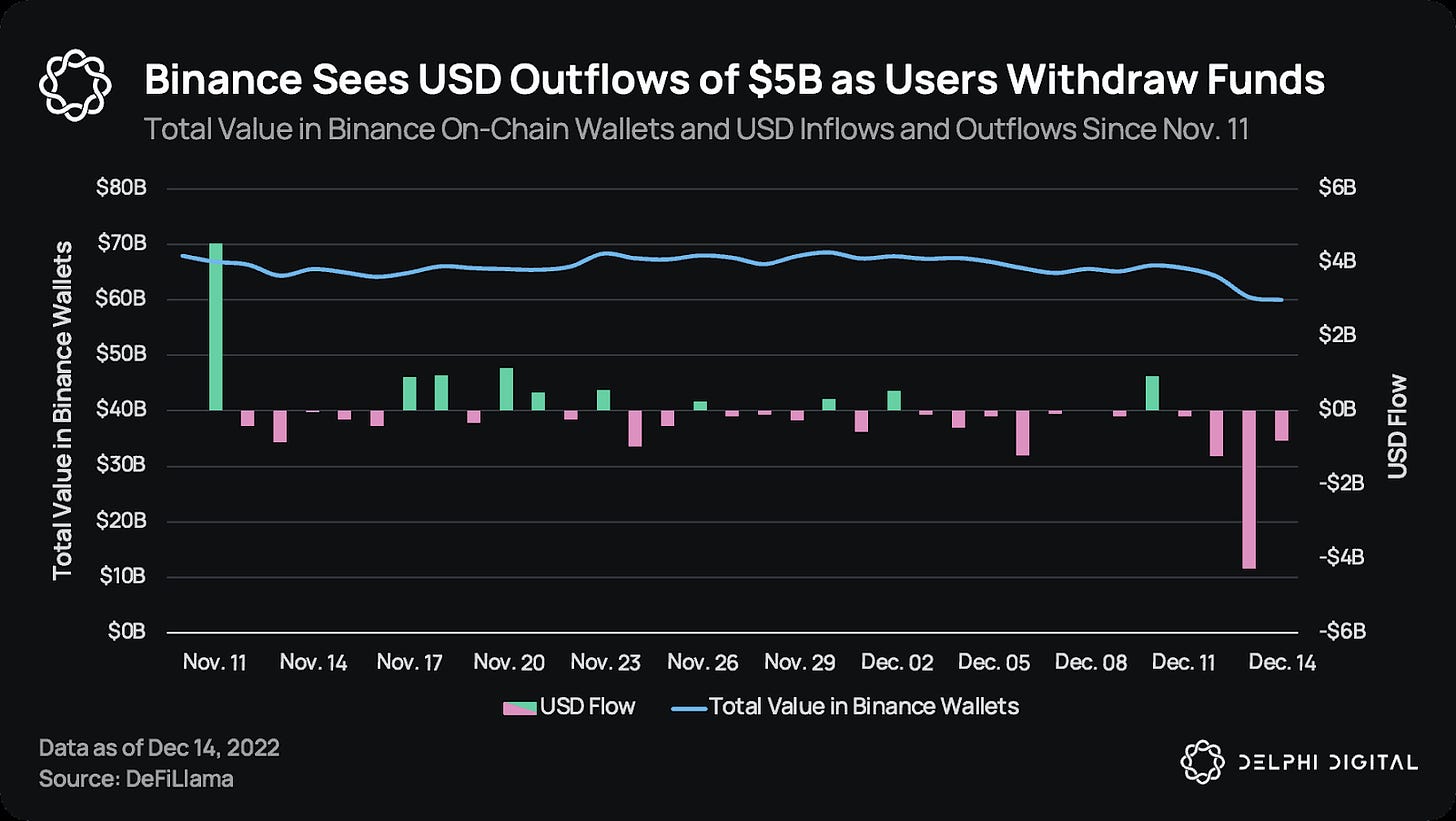

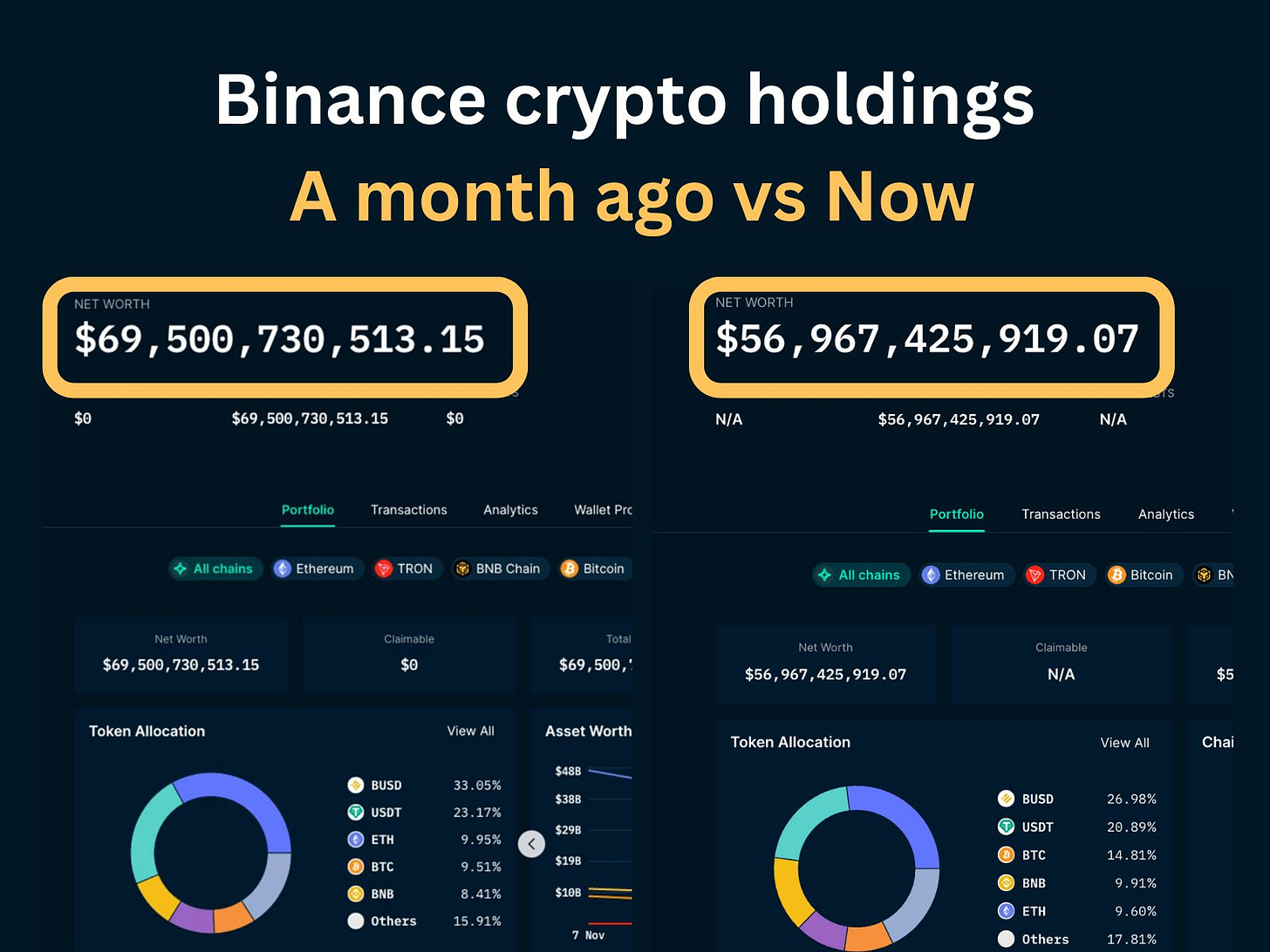

Binance saw a significant outflow of ~$5-6B in funds earlier this week. What’s the reasoning this time around?

Binance released a half-baked 5-page “proof-of-reserves” audit from auditing firm Mazars earlier this week that set off Crypto Twitter’s bullshit meter. The “audit” excluded all other cryptoassets and looked only at Binance’s Bitcoin assets and liabilities. Even Mazars themselves issued strong disclaimers around the methodology of the audit in the report:

This AUP (Agreed-Upon Procedures) engagement is not an assurance engagement. Accordingly, we (Mazars) do not express an opinion or an assurance conclusion. Had we performed additional procedures, other matters might have come to our attention that would have been reported.

As of Friday, Mazars has reportedly stopped all work with crypto companies for proof-of-reserves.

But even though the words “bank run” are being thrown around a lot, Binance’s solvency situation may be less grim than you think. Binance’s proof-of-reserves as captured on a Nansen dashboard 24 hours ago still showcases a war-chest of $57B, down from $70B a month ago.

More on this on our Monday newsletter next week.

this is the 'bank run' at Binance you're all hyperventilating about

— happy nic year (@nic__carter) December 14, 2022

(data @cryptoquant_com @ki_young_ju) pic.twitter.com/hX9yULWeNy

Finally, the U.S. Justice Department is also reportedly closing in on charging Binance for “possible money laundering and criminal sanctions violations” as part of a multiyear-long investigation since 2018, according to Reuters.

3. Spicy NFT Happenings

A class-action lawsuit is being launched against Yuga Labs.

The charge? Celebrities that were scooping up Bored Apes in the past year didn’t really buy it on their own accord, but were secretly paid by Yuga as part of an orchestrated scheme through the crypto payment firm MoonPay to inflate its price, create ApeCoins “out of thin air” and “mislead” retail buyers into buying “losing investments at drastically inflated prices.”

The Bored Apes floor price is down ~56% to 69 ETH from an all-time-high of 158 ETH in April 2022.

Some of the celebrities in the lawsuit include Jimmy Fallon, Justin Bieber, Madonna, Paris Hilton, Kevin Hart, Snoop Dogg, Post Malone and more.

Elsewhere, the 45th President of the United States of America Donald J. Trump is dropping his own NFT collection on Polygon. All for the price of $99 per card.

The collection has a larger than ordinary supply of 45,000 images of Trump wielding boxing gloves, cowboy hats, rugby balls, semi automatic rifles… you get the idea. And — of course — the collection sold out in hours.

SOLD OUT IN HOURS. WE MADE HISTORY! Thank you! @realDonaldTrump #MajorAnnouncement #TrumpCard pic.twitter.com/i1h0wSTp47

— CollectTrumpCards (@CollectTrump) December 17, 2022

4. Politicians Gonna Politick

Elizabeth Warren is trying to introduce a bill – Digital Asset Anti-Money Laundering Act – that would effectively create AML/KYC rules around wallet providers, block validators/miners, MEV searchers and more. Jake Chervinsky seems to think the bill is more of a political stunt than anything, so there’s that.

This bill by @SenWarren and @RogerMarshallMD is the most significant attack on digital freedom i've ever seen.

— RYAN SΞAN ADAMS - rsa.eth 🏴🦇🔊 (@RyanSAdams) December 14, 2022

It turns validators into money services businesses

It bans financial privacy

It turns America into a full on surveillance state

This is how western democracies die pic.twitter.com/XM1JjM0uL0

5. PayPal x MetaMask

ConsenSys is announcing a huge collaboration with PayPal this week that lets retail buy crypto directly via MetaMask.

Our US users will now be able to fund their wallet with ETH via @PayPal! 🦊

— MetaMask 🦊💙 (@MetaMask) December 14, 2022

Rolling out in the next weeks in the US, excl. Hawaii, through our mobile app (make sure to update to v5.13.0)🧵👇https://t.co/392JwFYF3m

If you’re thinking that this isn’t decentralized at all – you’d be right. PayPal still controls who has access to its payment rails, so it’s not a DeFi product.

The second way to look at this is: it’s still an improvement on the status quo. With everything that’s been going on around crypto this past year, centralized exchanges have been increasingly treated as a vehicle merely meant for on and off-ramping from TradFi into the trustless rails of DeFi.

In that CeDeFi layer of the crypto world, more competition in centralized onramping is a huge plus, particularly for one of the largest and efficient payment processors of the world. And what better way but to ramp directly onto crypto’s biggest non-custodial wallet?

More on crypto on/off-ramps in one of next week’s newsletters. 👀

Other news:

- Maker votes to return DAI saving rate with a 1% fixed yield

- Phi launches its web3 social world that visualizes on-chain identity on Polygon

- EIP-4844 (proto-danksharding) is coming in May after March’s Shanghai fork

- Ethereum blocks censoring Tornado Cash transactions have dropped to 65%

- Aztec Network raises $100M in a Series B round for Ethereum encryption tools

- Blocknative raises $15M for Ethereum infrastructure