The 5,000 ETH Mystery Hack

Dear Bankless Nation,

After some post-Shapella ecstasy, prices slumped back to earth this week. But there was way more going down in the space beyond the price action.

For our weekly recap, we dig into:

- A mystery wallet hack

- Tornado Cash developer out on bail

- Gary Gensler in the spotlight

- An SEC rampage

- Shapella withdrawals update

- Bankless Team

📅 Weekly Recap

1. A mystery wallet hack

There’s a mystery hack going on and nobody knows who is behind it.

MyCrypto founder Taylor Monahan tweeted this week about a “massive wallet draining operation” that has drained 5000+ ETH and NFTs across 11+ chains since December.

Afaik, no one has determined the source of their compromise.

— Tay 💖 (@tayvano_) April 18, 2023

Multiple devices have been forensic'd. Nothing.

The only known commonalities are:

- Keys were created btwn 2014-2022

- Folks are those who are more crypto native than most (e.g. multiple addresses, work in space, etc)

Long-time crypto users are finding their wallets drained by the mystery attacker, the thread notes, and despite significant research it's still unclear what the link between victims is. Monahan notes that some of the drained wallets had never signed transactions, suggesting hackers somehow gained access to the private keys themselves. MetaMask has issued a statement saying that this is not a MetaMask-specific exploit.

What's going on?!?

There is precious little information on how this attack is being executed. According to Monahan, the only known factors are that the private keys in question were created between 2014-2022 and that folks “who are more crypto native than most” are being targeted.

With so few details regarding potential causes or solutions, Crypto Twitter has understandably been freaking out this past week.

2. Tornado Cash developer out on bail

Tornado Cash developer Alex Pertsev is finally being released on bail to await trial, a Dutch court ordered this week.

The 29-year-old Russian was arrested by Dutch police on August 10, 2022 under suspicion of conducting money laundering via privacy mixer protocol Tornado Cash. He has since spent nine months in detention without trial.

His arrest came two days after the U.S. Treasury issued sanctions against Tornado Cash. At least 50 supporters of Pertsev came together in Amsterdam last August to protest his arrest.

He will be under surveillance as he awaits trial on the 24th of May.

🕊️ @Free__Alexey IS FREE TO GO HOME 🕊️

— Eléonore Blanc 🔜 #ETHDam (@blockblanc) April 20, 2023

Next Wednesday 26th, he can await his trial at home with electronic monitoring.

The most important thing is that he can walk around and work on his defense, something that was virtually impossible while detained.

🔐 Learn more and build on core.safe.global

3. Gary Gensler in the spotlight

In an open letter to SEC Chair Gary Gensler, U.S. Republican lawmakers slammed the SEC’s approach for impairing the digital asset ecosystem and failing to provide a regulatory path for crypto firms to register.

The letter followed a highly-publicized hearing with Gensler by the House Financial Services Committee this week, which focused on the SEC’s regulatory approach to crypto.

Here are some choice highlights from the 4-hour long hearing:

- When asked if ETH qualified as a security or commodity, Gensler equivocated and did not give a specific answer.

Watch @PatrickMcHenry drop 🔥🔥 on Gary

— Bankless (@BanklessHQ) April 18, 2023

"Is Ether a commodity or a security"

Gary will happily speak to Bitcoin, but not to Ether...

Why not??... pic.twitter.com/9QJblYQVSv

- Gensler blamed crypto for the cause of Silicon Valley Bank’s failure.

🚨 BREAKING 🚨

— Bankless (@BanklessHQ) April 18, 2023

Gary Gensler, the Chairman of the U.S. SEC, blames crypto as the cause of Silicon Valley Bank's failure pic.twitter.com/eAeTCC4JQW

- GOP Majority Whip Tom Emmer questioned the SEC’s failure to detect the collapse of FTX and Terra, calling him an “incompetent cop on the beat” who is “doing nothing to protect everyday Americans.” Meanwhile, Congressman Warren Davidson called for the firing of Gensler and a restructuring of the SEC to “correct for a long series of abuses.”

- On the other side of the aisle, Congressman Brad Sherman referenced the “rampant non-compliance” of crypto companies with American securities laws and implored for Gensler to “please shut them down as quickly as you possibly can.”

4. An SEC rampage

While Gensler got put on a blast, the SEC’s regulatory rampage continued.

- The SEC issued a new enforcement charge against crypto exchange Bittrex on Monday for “operating an unregistered national securities exchange, broker, and clearing agency.”

- A proposed law by the SEC last month wants to redefine “exchange” in a way that would bring open source protocols, namely decentralized exchanges, under the SEC's regulatory regime.

- SEC Commissioner Hester Peirce is calling this redefinition “so expansive as to drain the word of any meaning and therefore of any limitation on its scope… [that] may include anybody who has even a purely ministerial role with respect to defi activity.” Coin Center calls it an unconstitutional violation of the First Amendment.

- At a fintech conference in London, Coinbase CEO Brian Armstrong mentioned that US regulatory hostility to crypto means relocating Coinbase was a possible option for the company and that “anything is on the table.” The exchange also just received a license to operate in Bermuda, Fortune reports.

MetaMask Learn is an educational resource to help people understand what web3 is, why it matters, and how to get started. Consider adding MetaMask Learn to your onboarding guides if you’re a dapp developer or NFT creator to give your community the welcome they deserve.

5. Shapella withdrawals update

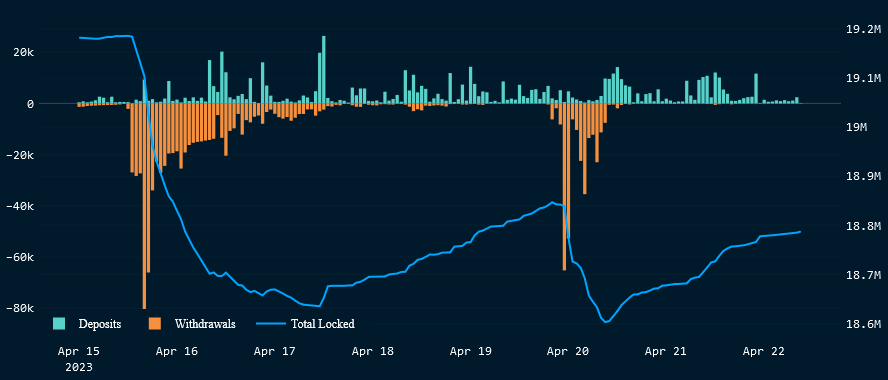

It’s been ten days since the Ethereum Shapella hard fork.

A total of 18.7 million ETH is still locked on Ethereum, while 1.36 million ETH has been withdrawn since. The biggest withdrawals came from Kraken which was ordered by U.S. regulators to shut down their U.S. staking service as part of a settlement.

Despite massive withdrawals, ETH deposits are continuing at a steady rate. In the last 24 hours, ETH deposited was a net 74K.

See our Bankless story ETH Withdrawals One Week Later for a full update on all things Shapella.

Weekly Rollup

Other news:

- Introducing Permissionless II

- 1inch launches on zkSync Era

- EU passes comprehensive MiCA Crypto Law

- A stablecoin legislation draft that would ban decentralized stablecoins is dead on arrival

- Donald Trump drops second NFT collection

- Mattel launches peer-to-peer NFT marketplace

- PUBG game studio to launch NFT Metaverse game

- Societe Generale launches a Euro stablecoin on Ethereum for institutional clients