Mining is Hot Again

Dear Bankless Nation,

After a brutal 2022, crypto mining companies have quite a few favorable tailwinds working for them. Today, we take a look at the state of mining and the future outlook.

- Bankless team

Hot Miner Summer

Bankless Writer: Jack Inabinet | disclosures

Undeniably, it has become an excellent time to own Bitcoin mining companies, with many tickers in this category of crypto equities seeing their valuations expand by multiples since the beginning of the year.

Yes, 2022 was a brutal beatdown of the category, but in 2023, top performers have handily outperformed the impressive rally we’ve witnessed from BTC and have held their weight with TradFi’s current darling: AI stonks.

We can easily attribute the outperformance of miners over BTC to their levered financing structures, but doing so fails to acknowledge a newfound perception of value in the sector and shifting fundamentals bettering the investment case. Today, we’re uncovering the 4 narratives redefining investors’ outlooks on Bitcoin miners. 👇👇👇

🤖 AI Bull Case

Many Bitcoin miners have transitioned from crypto specialists into high-performance computing (HPC) generalists in an attempt to shore up falling revenues as they struggle to combat the economic realities of the bear market. Unsurprisingly, many of these generalist miners are now flocking to where the cash is and have begun servicing the AI corner of the HPC market!

Applied Digital Corporation (APLD) has been a clear leader among miners attempting to establish a presence in the AI universe, landing major AI deals worth up to a combined $640M in May and June, and partnering with Hewlett Packard Enterprise and Supermicro to help deliver its AI Cloud service.

Unfortunately, diversifying into the AI industry is no easy task! Construction of an AI-compliant facility by APLD reportedly cost the company 10 times more than building an equivalent one for crypto mining – and existing hardware (i.e.; mining GPUs and ASICs) must be replaced as they are largely incompatible with AI applications.

Mining GPUs are optimized for mining PoW crypto assets and sacrifice versatility and vRAM storage for energy efficiency and hash rate, making them a third-tier choice for AI applications. Meanwhile, ASICs are purpose-built hardware for mining, lacking any of the flexibility required for the diverse and evolving nature of AI HPC workloads.

Hive Blockchain (HIVE) is attempting to repurpose some of its GPUs originally purchased to mine Ethereum to train large language models by selling excess capacity to clients in a “GPU as a Service” model, however, early revenues have been dismal. There’s limited demand for low-quality AI compute, and Hive only expects to earn ~$1M per year from this service (far from a sufficient amount of revenue to put a dent in the $236M loss the firm has recorded for fiscal year 2023).

While it will certainly be an expensive leap to make, Bitcoin miners that can successfully establish a presence in AI HPC will be rewarded with a diversified revenue stream and customer relations in an industry set to revolutionize the future of global productivity.

Even with our limited understanding of how pervasive AI may become over the next few years, we can be nearly certain that demand for AI HPC will persist and strengthen over time. According to one estimate, the annual budget for dedicated AI HPC stood at $6.3B in 2022 and is projected to increase by 56% over the next four years, reaching $9.8B by 2027.

🚀 Cambrian Transaction Explosion

Bitcoin has recently witnessed a surge in unforeseen functionality and usage of the network, thanks to primitives built using the Taproot upgrade.

Ordinals came first, breaking onto the main stage of the crypto world in early February. This innovation brought NFTs to Bitcoin and drove up transaction fees to levels previously unseen throughout the bear market.

Then came BRC-20s, which used ordinal theory to replicate Ethereum’s ERC-20 fungible token standard on the Bitcoin blockchain, the rise of which coincided with the most recent bout of memecoin mania on Ethereum in May. Fees on Bitcoin went hyperbolic as rampant speculation engulfed BRC-20 marketplaces, forcing average users to pay over $30 per transaction.

Long run Bitcoin miner viability depends on higher transaction fees and increased demand for Bitcoin blockspace. With successive halvings, the next of which is slated for April 2024, block incentives (the network inflation of BTC) decrease, making miners increasingly dependent on transaction fee revenues to subsidize the cost of their operations.

Unexpectedly high transaction fees have temporarily boosted miner profitability, but it is essential to consider the long-term implication of recent Taproot-fueled emergent use cases on Bitcoin: devs have discovered a portal to bring a new kind of life into the network.

Early adoption of Ordinals and BRC-20s indicates some promise of staying power, but these primitives don't have to be the ultimate instantiation of Bitcoin innovation. In the ever-evolving landscape of blockchain technology, it is only a matter of time before new use cases emerge, triggering a fresh wave of blockspace consumption that increases transaction fees and reduces miner dependence on BTC inflation.

✅ SEC Endorsement

At the start of June, the SEC came out with two rebukes against crypto’s major centralized exchanges. In the agency’s enforcement actions against Binance and Coinbase, it labeled numerous tokens as securities.

The SEC was keen to target many tokens using Proof of Stake (PoS) consensus mechanisms in its complaints, including Solana (SOL) and Cardano (ADA), but gave an apparent pass to tokens issued by Layer 1 blockchains using Proof of Work (PoW) consensus, like Litecoin (LTC) and Dogecoin (DOGE).

While it is unknown what line of reasoning underlies this decision, it would appear that much of the PoW market may not fall under the SEC’s designation of what it considers to be a security. It is almost as if Gary Gensler himself has blessed the business of crypto miners!

Kraken, the secure, transparent, reliable digital asset platform, makes it easy to instantly buy 200+ cryptocurrencies with fast, flexible funding options. For the advanced traders, look no further then Kraken Pro, a highly customizable, all in one trading experience and our most powerful tool yet.

🇺🇲 Political Realignment

The environmental concerns surrounding crypto mining have hindered support from many on the left side of American politics, but BlackRock's application for a spot Bitcoin ETF has instilled hope within many in the crypto industry that this resistance may soon diminish.

Larry Fink, the CEO of BlackRock, is a notable Democratic Party donor, and his company has a strong track record of upholding ESG values. By aligning BlackRock with Bitcoin, it is likely that Fink sees the opportunity outweighing the energy consumption concern, which seem increasingly less likely to become a major hot button issue in the near term given deepening political division elsewhere.

A political muting of the progressive focus on the environmental impact of crypto could lead to fewer anti-crypto policies in the United States, while fostering a comparably favorable environment for the adoption of proof-of-work (PoW) crypto assets, benefiting miners in the process.

Additionally, with America already pursuing a policy of rapid decarbonization, with fiscal spending programs like the Inflation Reduction Act subsidizing the deployment of clean electricity resources, the carbon output of US-based crypto mining will likely tamper down. Perhaps BlackRock and other see an opportunity to frontrun this future shift to green energy?

Takeaways

Buying stock in publicly traded Bitcoin mining companies can be an excellent way to get exposure to both the crypto and AI sectors, but keep in mind that Bitcoin’s next halving event is just around the corner. It is only a matter of time before miners' Bitcoin-derived profits shrivel and inevitable industry consolidation occurs.

To enjoy the tailwinds presented by emergent use cases of Bitcoin, an SEC more friendly to crypto mining, and a potential realignment of progressive opposition to PoW, you must place your bets on the miners with the best probability of surviving the halving. One way that you can do this is by investing in miners who diversify their underlying business strategy to reduce their dependence on BTC emissions.

Firms that can successfully expand into other forms of high-performance computing, especially those that can tailor their offerings to meet the stringent standards of the AI market, stand to benefit from such a diversification in their revenue streams, a factor which may give them a better shot of surviving the post-halving miner cull. As always, seeking out companies with healthy balance sheets and low costs of production gives you a better chance of backing those that will eventually eat their mining competitors as opposed to winding up on the menu!🍴

MARKET MONDAY:

Scan this section and dig into anything interesting

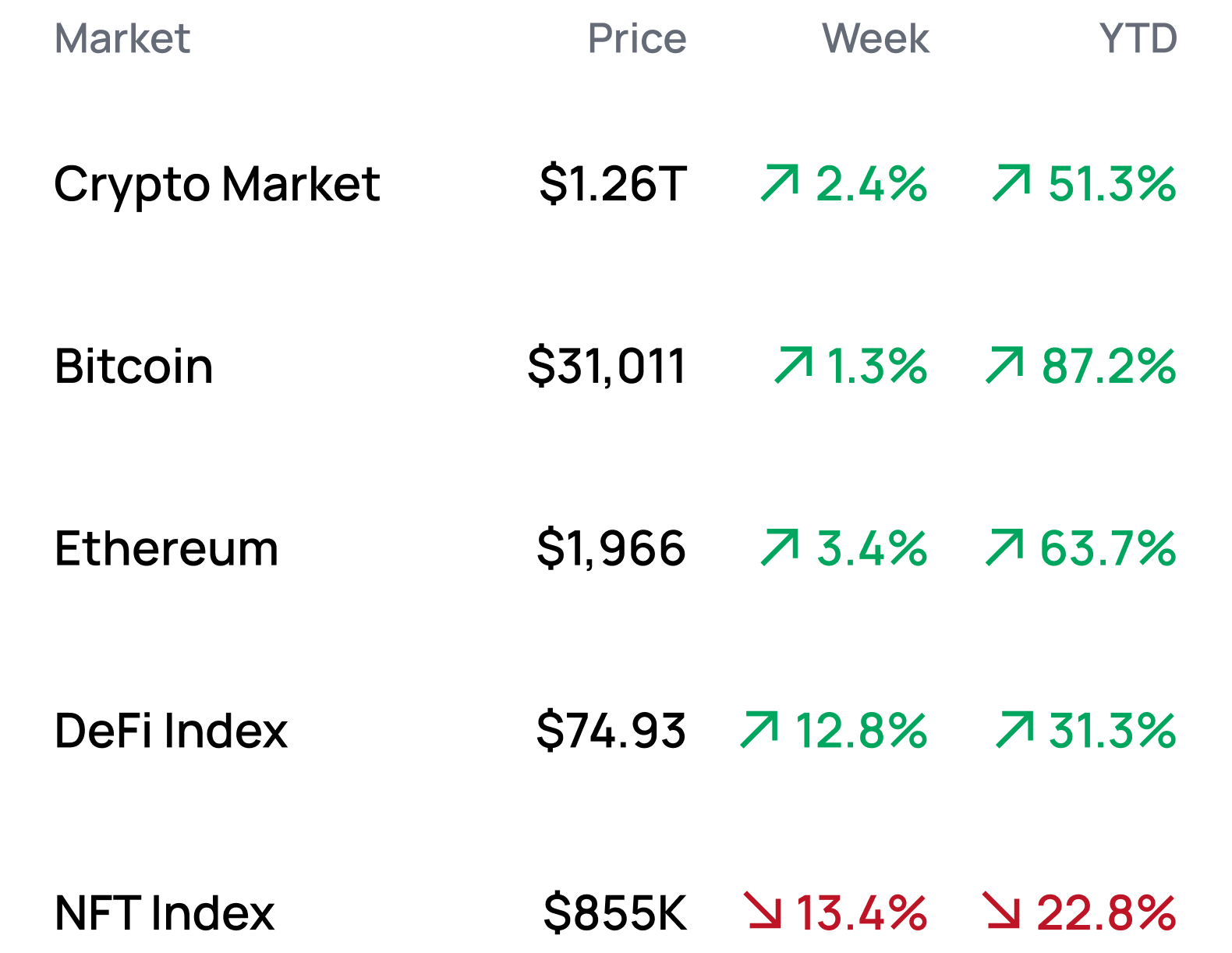

*Data from 7/3 1:00 pm EST (DeFi Index = $DPI, NFT Index = $Blue-Chip-10)

Market Opportunities 💰

- Mint Mirror’s new Writing NFTs 2.0

- Maximize your eligibility for a potential zkSync airdrop

- Deposit LSDs into EigenLayer (again) starting July 10

- Swap on Polygon zkEVM using PancakeSwap

- Trade on dYdX’s testnet V4 deployment, going live Wednesday

Yield Opportunities 🌾

- BTC: Earn 8.3% APY by depositing BTC with O3 Swap on Arbitrum

- ETH: Earn 7.5% APY with Beefy’s wstETH-ETH vault on Optimism

- ETH: Earn 7.3% APR with Aura’s wstETH-WETH pool on Arbitrum

- USD: Earn 13.5% APR with Maverick’s LUSD-USDC boosted pool on Ethereum

- USD: Earn 17.7% APY by depositing crvUSD with Conic Finance on Ethereum

What’s Hot 🔥

- Coinbase files motion to dismiss SEC lawsuit

- Celsius can convert alts to BTC, ETH starting July 1

- Creditors seek liquidation of BlockFi, accuse CEO of fraud and extortion

- UK passes bill recognizing crypto as regulated financial activity

- Sharia-compliant Islamic coin secures $200M in funding

- Azuki issues public apology

- KuCoin to introduce mandatory KYC for all users starting July 15

- zkSync introduces zkStack

- Regulators say BlackRock, Fidelity applications inadequate

- Institutions refile spot BTC ETF applications

- NFT floors suffer across the board

- Prime Trust lost access to wallets back in 2021

- What is BlackRock?

Money reads 📚

- Reviewing the Second FTX Report - Birb Bernanke

- Crypto Litigation Update - MetaLawMan

- Insights on EigenLayer - YQ

- LSDFi Catalysts - The DeFi Investor

Governance Alpha 🚨

- Camelot requests ARB grant from ArbitrumDAO to fund incentive program

- 1inch DAO considers using ARB airdrop to provide liquidity

- Uniswap takes temperature check for how to distribute ARB allocation

- Radiant Capital votes to deploy to Ethereum

- Yearn Finance looks to activate veYFI rewards

Trending Project: Render Network (RNDR) 📈

We’re initiating coverage on Render Network with a rating of bearish.

Catalyst Overview:

Render Network has received renewed attention with AI becoming a dominant investment narrative in TradFi markets. Speculators are now dreaming up “new” use cases for Render Network. For example, one of the unfounded rumors currently circulating is that Apple may outsource graphics rendering of Vision Pro to Render Network 👀

Such outlandish visions are unlikely to come to fruition and we doubt that Apple will give priority access over control of key product functions to a decentralized network. Additionally, while the project is certainly a cool experimentation in decentralizing compute, the performance offered by the network is inadequate for many of the most cutting edge and promising AI applications.

Price Impact:

RNDR is one of the only clear routes to gain exposure to a real AI-related product in crypto, making the token a magnet for blind capital inflows throughout 2023.

While RNDR has outperformed ETH throughout 2023, we question how much longer this will continue and believe the RNDR trade may be oversaturated, especially considering how outlandish the circulating narratives appear. Additionally, altcoins face a hostile US regulatory environment; this will serve as an additional headwind against RNDR’s continued outperformance. For these reasons, we anticipate that RNDR/ETH will continue to trend lower, as it has since late May.

See more ratings in the Token Hub.

Meme of the Week 😂

Is this a safe space? pic.twitter.com/73uvfhQr6u

— Bankless (@BanklessHQ) July 2, 2023